New private markets strategies to support your total portfolio

Asset owners are increasingly using private markets to help address some of the key challenges they face in managing portfolios, such as generating returns, reducing volatility and diversifying overall risk at the total-portfolio level.

However, private assets are not a one-size-fits-all solution and an effective private markets strategy will depend on a variety of factors, such as risk/return objectives, liquidity and investment beliefs. In addition, private assets are dynamic, and the universe of investment choices continues to evolve. Therefore, one of the key factors to success when building a private markets program is to have a surgical focus on desired exposures across the universe of opportunities, including private equity, private credit, private real estate and private infrastructure. In doing so, private markets investors can optimize performance, manage risk and capture the ever-evolving opportunity set.

The spectrum of private markets investments: Characteristics for success

Private equity

Investors are attracted to private equity for different reasons, including access to the significant investable opportunity set that exists across the universe of private companies, along with lower volatility when compared to public equities. One of the most attractive benefits is the potential for greater returns relative to public markets. For example, buyout returns have outperformed global equities on a public market equivalent basis in every one of the past 20 vintage years.1

So, when investing in private equity today, what are some of the key exposures we believe investors need to achieve successful outcomes?

The first is the use of specialist managers. We believe those managers who specialize in certain sectors (i.e., industrial, technology, consumer) or market segments, such as small-mid buyouts, are more likely to have clear areas of expertise relative to generalist managers. This specialist expertise directly translates to sustainable value creation opportunities across acquisition, business transformation and exit. Examples of these include proprietary networks to generate investment opportunities, operational and strategic initiatives to drive EBITDA growth and maximizing value upon the sale of portfolio company investments.

Another key exposure is secondaries. Secondaries are a rapidly growing market, with global transaction volume in 2021 reaching US$132 billion—representing a 120% increase relative to 2020. At the same time, secondary-market growth is being driven by an increase in general partner(GP)-led secondaries deals, which accounted for around 50% of 2021 transaction volume.2 High-quality secondary investments make sense in the current environment, as a key benefit of secondaries is reducing blind pool risk. Given that secondary funds invest in existing interests, it is possible to conduct due diligence on these assets prior to investing. With this greater transparency into the underlying assets comes greater visibility into potential future performance, including potential exits, pending valuation increases and positive business results. These all contribute to improving near-term performance outcomes for investors. Should the global economy experience a downturn in the coming years, secondary investors would likely benefit from being able to purchase interests at greater discounts to net asset value than is the case today, therefore improving expected future returns.

Regardless of the access point, whether it be primary or secondary, private equity investments support desired investment outcomes, including expanding the investable opportunity set and generating higher returns relative to public equities.

Private credit

Since the 2008 global financial crisis, private credit as an asset class has expanded significantly. Given regulations that were put in place following 2008, such as Dodd-Frank in the United States and Basel III in Europe, banks significantly curtailed their lending to small- and medium-sized enterprises. As that source of financing became less available, private credit investors stepped in to fill the void left behind by banks. Over the last 10-plus years, private credit has grown significantly and today represents a US$1.2 trillion opportunity set that has increasingly garnered attention from investors.3

Given the growing and diverse nature of the private credit asset class, what are some of the key factors investors should consider when constructing their portfolios?

First, we believe a focus on sponsor-backed loans is crucial. Sponsor-backed private credit investments are simply loans made to companies that are owned by private equity sponsors. The significance of this relationship manifests itself in different ways. For instance, within private-equity-owned companies, there is greater alignment between company owners and company management, which provides better governance and oversight. Access to management teams and information also provides an advantage in that potential problems can be identified sooner, and remedial action—such as bringing in the expertise of operating partners—taken faster to protect the interests of lenders.

Other considerations include:

- Experienced management teams that have invested through multiple business and credit cycles.

- A demonstrated ability to avoid losses with low default and loss rates over time. This includes having in-house expertise to maximize the recovery value of investments experiencing distress

- The ability to opportunistically position into technically dislocated tradeable credits where the risk reward may justify inclusion, should heightened levels of volatility occur during the investment period of a private credit fund.

Private credit can support income generation from privately originated loans, backed by cash flows of company operations or hard assets. In addition, loans are typically floating rate, which benefits investors in periods of rising interest rates.

Private real estate

While private real estate has been a staple of private markets portfolios for decades, the investable opportunity set has rapidly evolved particularly over the last five years. Today, real estate is much more than offices and shopping malls, and investors have an opportunity to access the 21st-century real estate ecosystem. This includes alternative real estate sectors such as student housing, life sciences, data centers, medical offices, healthcare and self-storage—all of which currently play an increasingly strategic role in investors’ portfolios than in years gone by. The secular growth trends associated with these sectors include:

- Increased demand for healthcare services as the baby boomer population ages, which positively impacts medical office and life sciences.

- Underlying demand for self-storage because of factors including household mobility and people downsizing their homes.

- Increased enrollment in post-secondary schools, given the importance of earning a college degree in a technologically advanced economy.

In addition to the secular growth trends outlined above, these sectors also benefit from strong operating fundamentals, which consequently provided a benefit to investors during the pandemic as traditional sectors such as office and retail faced existential questions about their future viability. Further, they typically have low correlation with the global economy, which has often proven to be valuable during periods of market volatility.

Given its low correlation to equities and fixed income, private real estate supports portfolio risk reduction It also provides inflation protection based on:

- Cash flows derived from periodically resetting contractual rent payments adjusted to rising price levels.

- An increase in the value of buildings. In an inflationary environment, replacement costs increase, therefore boosting the value of existing buildings.

Private infrastructure

Private infrastructure has been a hallmark of Canadian and Australian institutional investor portfolios for 10-plus years, and in recent years has been gaining increased acceptance from investors in the United States, Europe and Asia.

Infrastructure assets are fundamental building blocks in a functioning modern society and operate in monopoly-like competitive positions with long-term sustainable cash flows. These assets include toll-roads, utilities, airports, sea-ports, communications and social infrastructure.

One of the key reasons that investors are driven to the infrastructure asset class is access to a tremendous global growth opportunity. Indeed, upgrading the world’s infrastructure stock will be a dominant theme over the coming decades. In fact, it’s estimated that a staggering US$69 trillion will be spent on infrastructure by the year 2035.4 In addition, private capital will increasingly be relied upon to finance infrastructure spending, given the fiscal constraints of many governments.

The investable opportunity set spans a range of different infrastructure strategies that can support various investment outcomes, including:

- Super-core: accessing income via contracted and / or regulated revenue

- Core: provides diversification with low correlation and inflation protection

- Core-plus: growth by exposure to repeatable capital appreciation

The metrics that matter

When reviewing the value of the opportunities outlined above, it is important to focus on the risk/return profile, correlation and drawdown characteristics to demonstrate the benefits to the total portfolio.

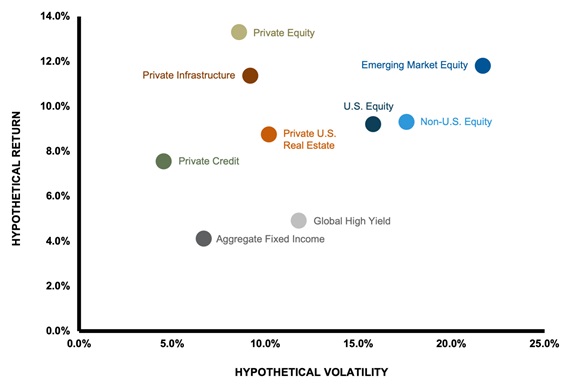

Return and risk

These are the primary building blocks used in developing a strategic asset mix. Investors need to generate returns, whether it’s to fund a pension plan’s liabilities in order to deliver on the pension promise—i.e., providing benefits to participants—to meet a foundation’s desired real spending rate, or to achieve a desired return above the cost of capital for a hospital or healthcare system. While investors allocate to private markets for the higher return potential relative to public markets, there is also the added benefit of managing downside risk given their lower volatility relative to public markets.

As Exhibit 1 below highlights5, expected future return and volatility for a range of private markets strategies including equity, credit, real estate and infrastructure are highly attractive relative to traditional assets such as equity and fixed income. For example, private equity has an expected return that is 44% higher than U.S. equities, but with 45% less risk as measured by the standard deviation of return. Similarly, private credit has an expected return that is 54% higher than high yield—with 61% less risk. Given these metrics, it is not surprising that investors are increasingly looking to utilize private markets in their strategic asset allocation.

Exhibit 1: Comparing forecasted risk and return across asset classes. Click to enlarge.

Another key metric in the portfolio construction process is correlation. By combining strategies that have lower correlations to other assets in a portfolio, the end result is a reduction in volatility at the total portfolio level. As Exhibit 2 below highlights6, correlations of private equity, private credit, private real estate and private infrastructure are all lower, and in most cases significantly lower, relative to traditional asset classes. Given these attractive characteristics, private markets provide a key tool for investors to manage risk at the total portfolio level.

Exhibit 2: Correlation matrix. Click image to enlarge.

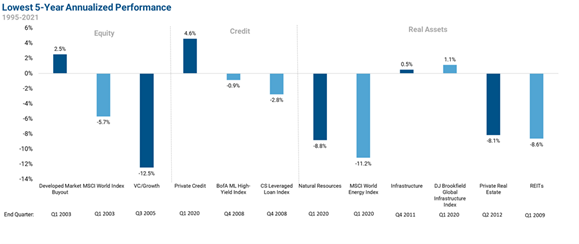

When managing total portfolio risk, avoiding material drawdowns is paramount, as negative returns have a significant impact on the positive effect compounding has on returns over time. Exhibit 3 below7 highlights that in their worst five-year period, developed market buyouts, private credit and private infrastructure all delivered positive returns. The key takeaway: private markets have generally experienced lower drawdowns relative to their public market counterparts.

Exhibit 3: Drawdowns Click image to enlarge.

Infrastructure from 2006-2021, Natural Resources from 1998-2021

Source : Hamilton Lane Data via Cobalt, Bloomberg (January 2022)

The bottom line

It is not surprising that as investors seek to address the challenges of generating returns, reducing volatility and diversifying overall risk, they are increasingly turning to the private markets to improve their investment outcomes. As we have discussed, understanding the underlying exposures that private markets can offer will help investors surgically position portfolios to fully benefit from the range of strategies available to them. In addition, investors can also leverage the powerful combination of superior risk/return characteristics, reduced correlation to other asset classes and the avoidance of material drawdowns to also help achieve their desired outcomes

1 Hamilton Lane Market Overview 2022, February 2022

2Deal Volume Topped US$130bn last year, says Jefferies, Greenhill www.secondariesinvestor.com/deal-volume-topped-130bn-last-year-say-jefferies-greenhill/ January 2022

3 Blackstone, Private Credit’s Rapid Growth: A Secular Trend, April 2022

4 McKinsey Global Institute, Bridging Global Infrastructure Gaps, October 2017

5 Russell Investments Strategic Planning Forecasts, March 2022

6 Russell Investments strategic Planning Forecasts, March 2022

7 Hamilton Lane Data via Cobalt, Bloomberg, January 2022