Q1 2022 Fixed Income Survey: Inflation’s grip tighter than expected

What happens to interest rates and asset class preference in a changing policy environment?

In this latest survey, 60 leading bond and currency managers considered valuations, expectations and outlooks for the coming months

In the previous survey, markets expected the U.S. Federal Reserve (Fed) to raise interest rates in the second half of 2022. The European Central Bank (ECB) remained more dovish in regard to inflation, maintaining that higher prices were transient, despite supply side issues. This resonated with investors who preferred EU over U.S. credit. Managers also expressed less enthusiasm about returns within the U.S. high yield market. Another aspect that managers contended with was the potential impact of the Chinese property market debt turmoil on the wider emerging market debt universe.

Since then, persistently high inflation and a faster-than-expected path for U.S. monetary policy tightening drove the worst month (January) for wider financial markets since the March 2020 coronavirus selloff. The Bank of England (BoE) raised interest rates from 0.25% to 0.5% in February, the first back-to-back hike since 2004, while ECB chief Christine Lagarde refused to strictly rule out raising rates this year. Meanwhile, continued Chinese property market debt problems failed to turn more volatile for global markets. However, since the results of the survey, geopolitical tensions between Russia, Ukraine and North Atlantic Treaty Organization (NATO) countries have escalated, as Russia invaded Ukraine on Feb. 24.

With this in mind, we are keen to see how views have therefore changed in regard to the impact of inflation, monetary policy tightening and rising risk levels.

Higher inflation downs the dove

Views from interest rate managers

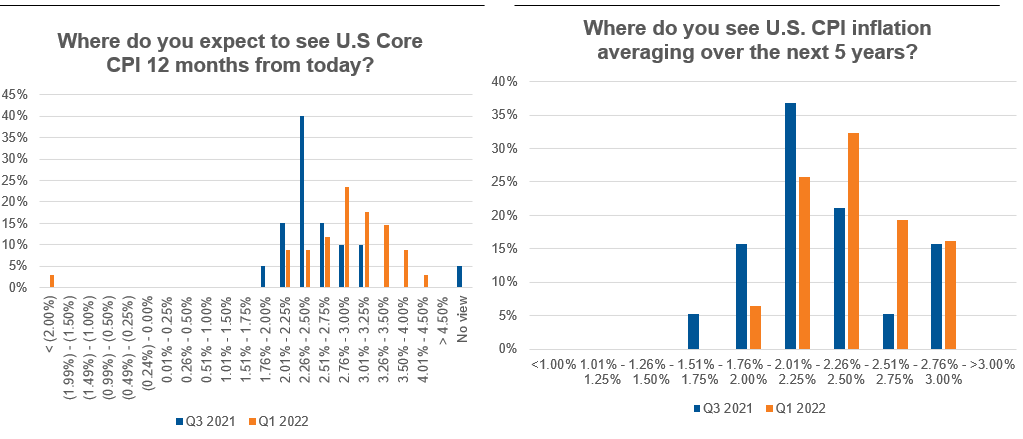

- Following the persistence of inflation in the US, managers updated their expectations for the next 12 months. Now, more than two-thirds of managers expect core inflation to stand between 2.5% and 3.5%. Moreover, none of the managers expect inflation to fall below 2.0%, with only 9% of correspondents expecting it to stand between 2.0% and 2.25%.

- As such, 91% of managers became extremely confident that the Fed will start raising interest rates in March. Afterwards, most investors (52%) expect the Fed to hike the interest rate four times through the year. Beyond 2022, investors expect the cash rate to be hiked another three to four times. However, as the information set continues to evolve and incorporate new data, investors’ expectations will likely remain volatile.

- Most managers (59%) expect the supply-demand balance of U.S. Treasuries to become less favorable due to the Fed’s tapering. Additionally, 47% of managers expected fiscal stimulus to continue supporting the economic recovery and partially offsetting negative impacts from tighter monetary policies.

- In terms of risks, most managers (61%) identified policy mistakes by either governments or central banks to be the main source of risk. In the meantime, medium-term concerns about stagflation subdued, with only 26% of respondents indicating concerns, versus the 53% in the prior survey. Contrastingly, the number of respondents that indicated a major repricing in riskier assets to be the main medium-term concern increased from 32% to 50%.

Click image to enlarge

Views from IG credit managers: Sentiment changing

- Managers sense the end of the deleveraging trend that was observed in 2021. Half of respondents affirmed that they expect U.S. BBB-rated companies to remain leverage-levels constant. Equally, there is little expectation that companies’ leverage levels will increase leverage significantly. Moreover, investors also expect European BBB-rated companies to maintain stable leverage, with 61% of respondents responding so.

- In the meantime, the share of managers that believe that current spreads compensate for potential risks of deteriorating credit quality remained stable. However, the share of managers that believe that caution should be warranted due to current spreads and leverage expectations continued its downwards momentum—falling from 40% in May 2021 to 30% in September 2021 to 21% in January 2022.

- Interestingly, the attractiveness of the investment grade (IG) segment versus cash decreased further for managers. It decreased to a low that was only observed in mid-2018, a time when investors were shifting their attention to the Fed’s restrictive monetary policies. This is a sign that investors are more concerned with the impact of rising rates rather than corporate fundamentals.

- Moreover, managers continue to prefer high yield (HY) issuers, with the overall score attributed to the market segment marginally increasing since the previous survey. Managers’ fondness of other securitized debt has also been increasing, surpassing the interest in IG issuers. Nonetheless, despite a sharp increase in managers’ interest in holding cash, they still prefer other asset classes.

Global leveraged credit

- Global leveraged managers believe that the upside remains limited, with no expectation of spread tightening. Meanwhile, the percentage of managers that expect spreads to widen moderately increased from 20% to 47%. At the same time, the percentage of investors that expect spreads to remain stable decreased from 80% to 53%.

- Managers still remain broadly positive on issuers’ credit stance, but with a lower degree of confidence. The number of managers that expect corporate fundamentals to improve decreased from 85% in September 2021 to 65% in January 2022. At the same time, the number of correspondents that expect credit metrics to remain relatively stable increased from 10% to 30%.

- Within this space, managers favored U.S. leveraged loans, with 40% of respondents indicating a clear preference, up from 24%. On the other side, interest in emerging markets debt (EMD) decreased from the same level to 10%.

- Confidence in fallen angels remains considerably positive, as half of the survey respondents classified them as rising stars, while the other half classified them as potentially attractive opportunities.

- Investors significantly decreased their return expectations, from between 4.0% and 4.9% (48% of the respondents in Q3 2021) to between 0.0% and 2.9% (50% in the present survey). However, managers do not expect a negative performance over the next 12 months.

- Investors’ attention shifted solely toward inflation (30% of respondents) and its impact on central bank monetary policy tightening (40%). This led to concerns regarding elevated geopolitical risks and a slowdown in GDP growth becoming more secondary. Meanwhile, as COVID-19 continues a shift from being a pandemic to an endemic concern, it is no longer serves as a significant worry.

Risk across the globe

Emerging markets

- Within local currency emerging market debt (LC EMD), managers remain constructive in regard to the performance of EM currencies, with almost 63% expecting a positive performance of EM currencies in the next 12 months and 59% expecting this over the next three years.

- 70% of managers indicated that they favor local currency over hard currency for the next 12 months, up from 57%. However, the longer-term attractiveness was subdued, as only 58% of respondents indicated a preference for local currency instruments—down from 77% in the last survey.

- On a regional basis, most investors continued to favor Latin America (54%). 40% of managers reported that they expect the Turkish lira to be the worst performing EM currency in 2022, up from 32% in the prior survey.

- Interest in the Russian rouble dwindled, as only 19% of managers (down from 37%) indicated that they expected it to outperform the most among EM currencies. This is especially the case as Russia’s invasion of Ukraine brought with it strong, far-reaching sanctions on Russia by Western nations.

- Within the hard currency emerging market debt (HC EMD) space, 38% of the managers expect spreads to tighten in the next 12 months, versus 29% in the third quarter of 2021. Meanwhile, 8% of managers expect spreads to widen. Weighted average expected return stands at 3.0% over the next 12 months—circa 0.72% down when compared to our 3Q21 survey.

- Similar to the previous survey, managers expressed their preference for Egypt, Ukraine and Mexico as the countries with the highest expected return over the next 12 months. China and the Philippines remain the top-two underweight (least preferred) countries.

Europe & Asia-Pac currencies

- Two-thirds of managers expect the euro to trade (versus the U.S. dollar) between 1.11EUR/USD and 1.20EUR/USD. However, most managers expect some bouts of weakness and believe the floor to be between 1.01EUR/USD to 1.10EUR/USD. However, such risk profile is asymmetric, as 78% of managers do not see the euro trading above the 1.20EUR/USD level.

- Regarding the British pound, two-thirds of respondents believe that the currency will trade between 1.31GBP/USD and 1.40GBP/USD. Similarly to the euro, managers find any upside limited, as 69% of respondents do not see the GBP trading above 1.40GBP/USD at any given time in the current year.

- 22% of managers expect the Japanese yen to post the worst performance among G10 currencies. However, there seems to be no concrete consensus about the performance of the U.S. dollar. A mere 28% of managers indicated that they expect the greenback to be the best performing currency, alongside the Australian dollar.

Securitized sectors

- Less conservative views in the securitized segment: 43% of managers expressed they will be adding risks in return-oriented securitized portfolios in the next 12 months—up from the 19% registered in our 3Q21 survey. Similarly, 43% said they will maintain risks—down from 75% in the last survey.

- When asked about taking a meaningful beta position, 67% of managers expressed already having a long basis in their portfolios, up from the 27% in our Q121 survey. Meanwhile, only 14% already have a short position, and 21% expect to further add short positions.

- The number of investors indicating that they expect non-agency spreads to tighten decreased from 50% in September 2021 to 14% in January 2022. On the other hand, the percentage of managers that indicated they expect spreads to remain range-bound increased from 31% to 43%. The number of managers that indicated they expect spreads to widen increased from 19% to 43%.

- Managers expressed balanced views regarding risks for the CLO market, with 57% mentioning a broad risk-off environment as the main risk, followed by underlying loan collateral credit deterioration.

The bottom line

Inflation persisted in 2021, and both the Fed and BoE indicated that they would step in more aggressively, which surprised market participants. The market and the Fed now see eye-to-eye as to when rates will increase this year, which moderated some of the market volatility we experienced in January. This also caused the attractiveness of IG credit to decline somewhat, while demand for high yield increased

Meanwhile, ECB president Christine Lagarde remains quick to warn that higher interest rates could dent the economic recovery. As such, managers remain more confident in mainland Europe regarding IG credit—slightly ahead of the U.S.. However, the ECB refused to rule out interest rate hikes this year, which adds a little policy uncertainty and could alter investor sentiment.

Within emerging markets, sentiment recovered slightly as the detrimental fallout of the Chinese property market on the broader Chinese economy has failed to materialize. Managers’ preference for Latin America in detriment of Turkey can be explained by the unorthodox monetary policy undertaken by the country’s central bank. Despite a level of concern regarding tensions between Russia and Ukraine, investors have a favorable view on the latter country. In our opinion, this poses questions as to whether managers underestimate the risks engendered by geo-political events.

Another subject which received less concern was COVID-19. This makes sense, as vaccination programs continue to be rolled out and are evolving to tackle variants. COVID-19 is also shifting from a pandemic to an endemic. Nevertheless, when markets felt confident at the end of 2021, the emergence of the omicron variant sparked significant market volatility. Could another, more vicious variant appear and dent the economic recovery?