Real assets: Today’s Mag 7 diversifiers?

Executive summary:

- Real assets are comprised of two main asset classes—real estate and infrastructure—and offer a mix of equity-like and bond-like return characteristics.

- We believe the inclusion of listed real assets in a total portfolio provides a key diversification benefit. This is especially important during today's highly concentrated markets.

- We see today's environment—marked by falling interest rates as well as economic uncertainty—as particularly favorable for skilled listed real asset managers.

Here on the real assets team, we like to make the case for listed real assets in a total portfolio, as you’d expect from subject-matter experts. We’re always happy to remind investors of this, but we can’t always say that now may be an opportune time to add exposure. Well, now we believe we can.

In this article, we’ll remind you what listed real assets are, explain how they fit into an asset allocation, and help you understand why we believe now is an attractive time to invest in the asset class.

Real assets – What are they?

Let’s start with a quick review. What exactly are listed real assets? You don’t need any sense of imagination to get started—they’re simply physical assets that trade on public markets. The majority of assets fall into two categories: real estate and infrastructure. However, commodities and natural resources are also real assets. For the sake of simplicity, in this article when we refer to real assets, we are referring to a 50/50 split of global real estate and global infrastructure. Here is a brief description of each.

- Real Estate – Investment companies that own assets related to real estate, such as buildings, land, and real estate securities.

- Infrastructure – Assets that provide essential services that are vital for the effective functioning of societies—think highways, ports, and power.

These tangible assets trade like equities on public markets, and benefit from many of the same dynamics, such as strong GDP (gross domestic product) growth, low interest rates, and strong earnings growth at the company level. What’s unique about real assets, though, is their mix of bond-like and equity-like return characteristics, which is derived from the tangible nature of the underlying assets. Let’s take a deeper dive.

Return composition: Dividend yields and capital appreciation

Real assets have two main return components, the first being stable, bond-like, income yield that comes from resilient cash flows tied to long-term contracts, concessions, or leases. The second is equity-like, capital appreciation that is linked to increased utilization, heightened demand, or limited supply. The combination of these two return sources offers a unique makeup compared to either stocks or bonds, offering opportunities for competitive total returns, diversification, and a non-traditional source of income.

Dividend yields often get swept under the rug in broad equities, but it’s hard to ignore the differentiated benefits of dividend yields in listed real assets. Investors often like to highlight the downside management offered through these yields, but the truth is these yields provide a relevant source of returns in both positive and negative markets. Seen below, dividend yields in listed real assets are more than double that of global equities and even greater than global bond yields. This is because they’re driven by consistent revenue streams from long-term leases and concessions, which lend real assets to having more stable and predictable earnings.

Source: Bloomberg, as of September 30, 2024. Global Infrastructure: S&P Global Infrastructure Index, Global Real Estate: FTSE EPRA Nareit Developed Index, Global Equities: MSCI World Index, Global Bonds: Bloomberg Global Aggregate Bond Index.

While a 3.8% return may not jump off the page, there are many advantages in having a stable source of income of this magnitude. In the short-term, this yield provides either downside management—helping preserve capital during periods with negative price returns—or, as mentioned, an additional source of return on top of positive price appreciation. Over the long-term, an additional 3.8% in returns provides compelling and stable value-add, whether you prefer to take dividends in cash, or reinvest.

Capital appreciation occurs much like it does in equities, particularly since these assets trade like equities on public platforms. Just as broad equities do, these securities generate returns through earnings growth, valuation movements, and market sentiment. The results from this portion of return are often of a higher magnitude than the average dividend yield, but this volatility presents opportunities for active managers to generate alpha. And even though this portion of return behaves like broad equities, real assets tend to perform better in down-markets, providing better downside management relative to broad equities, as seen below.

10-year down-market capture ratio, relative to global equities

Source: Bloomberg, as of September 30, 2024. Global Infrastructure: S&P Global Infrastructure Index, Global Real Estate: FTSE EPRA Nareit Developed Index, Global Equities: MSCI World.

Diversification: A key benefit to a total portfolio

For all this talk about a return profile that differs from other asset classes, what we really need to dive into is the potential benefits that listed real estate brings to a total portfolio. The simplest way to do this is by examining the benefits of adding listed real assets to a traditional 60/40 portfolio. From an implementation perspective, listed real assets and broad equities are almost interchangeable, considering listed real assets are stocks. Not only that, but real assets sectors, such as real estate, industrials, utilities, midstream energy, etc. are already in the broad equity indexes, —albeit at small weights that often get neglected by active managers investing in broad equities. Synergies in implementation make this a reasonable solution, which then leads us to the investment case: diversification.

For long-term investors, diversification is the main potential benefit of including listed real assets in a total portfolio—derived from their ability to perform differently than either stocks or bonds across various market cycles. From our vantage point, the introduction of listed real assets creates a more sophisticated strategic asset allocation that ultimately allows portfolio managers to achieve desired outcomes in a smoother fashion, requiring less tactical decision-making and reducing the difficulty of implementation relative to a traditional 60/40 portfolio.

Additionally, a broader, more diverse opportunity set opens the door to a more favorable environment for active managers. In this case, expanding the universe to include listed real assets introduces the benefit of allocating capital to sectors that are under-represented in broad equity indices, while allowing real asset specialists to identify compelling bottom-up ideas in these sectors. It’s a specialist approach as opposed to a generalist approach, which we believe adds value to end investors. This dynamic looks even better when addressing the active management case in broad equities and global real estate, which shows us that adding global real estate to a total portfolio expands the opportunity set into an area that has a more compelling active management case relative to broad equities.

The active opportunity

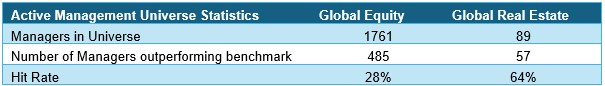

As seen below, eVestment’s listed global real estate universe is much smaller than the global equity universe, but even more important is the excess return hit rate in this universe. When measuring 3-year excess returns, 64% of the Global REIT universe outperformed the benchmark, compared to 28% in the global equity universe. That is over double the success rate in the listed global real estate universe relative to the global equity universe. Unfortunately, due to differences in benchmark composition, we aren’t able to create the same measures for the listed infrastructure universe, but performance within this universe has shown to have notable sub-sector return dispersions and stock-specific volatility, both of which provide compelling opportunities for active managers.

Source: eVestment defined Global Equity and Global Real Estate universe returns, returns as of Aug. 31, 2024. Global Equity returns relative to the MSCI World index. Global Real Estate relative to the FTSE EPRA NAREIT Developed index. These are results of 3-year returns.

In today’s environment, with tailwinds from falling interest rates as well as economic uncertainty, we are particularly optimistic that best-in-class active managers can leverage their ability to generate returns through bottom-up stock selection in an area of the market that’s generally underrepresented and underallocated to in broad equities.

Why now?

Even though diversification is always at the center of portfolio construction, it’s become increasingly relevant in recent years due to the Magnificent Seven group of stocks driving a disproportionate amount of returns in the equity index. Investors want to participate in the upside, but doing so in a risk-controlled manner is becoming harder to implement at the total portfolio level. We believe introducing real assets to a total portfolio can help solve this issue over the long-term, but we also believe both top-down and bottom-up dynamics support this in the short-term.

The third quarter highlighted how powerful macroeconomic dynamics can be in the listed real assets space, as listed real assets outperformed broad equities. We believe the combination of lower rates, paired with economic uncertainty, provides a favorable market environment for active managers in listed real assets going into 2025.

Not only do we see a favorable backdrop from a macroeconomic level, but we believe bottom-up fundamentals also offer a compelling opportunity in listed real assets. Third-quarter earnings generally outpaced expectations and relative to broad equities, listed real assets are trading near a 15-year low on a price-to-earnings (P/E) basis. Even though they’ve since rebounded modestly, there is still ample opportunity to take advantage of a valuation re-rating, which provides an additional source of excess returns on top of the usual drivers in earnings growth and dividend yields.

Source: Bloomberg, as of September 30, 2024. Global Real Assets: equal weight S&P Global Infrastructure Index and FTSE EPRA Nareit Developed Index; Global Equities: MSCI World Index.

The bottom line

Even though we believe including listed real assets in a strategic asset allocation has been a prudent step for investors to take these past few years, we see the opportunity as especially attractive now. In our view, the current interest rate environment, combined with economic uncertainty and stock-specific volatility, provides a compelling landscape for listed real assets managers to add value in more ways than one.

As investors look for ways to participate—in a risk-controlled manner—in a market dominated by the Magnificent Seven, we believe that broadening the opportunity set through listed real assets may be key. Ultimately, doing so creates more opportunities for active stock-pickers to generate alpha through bottom-up stock selection, while diversifying portfolio risk at the same time.