June FOMC preview: What to expect when you’re expecting … aggressive Fed rate hikes

I will get to our outlook for the June meeting in a moment. But let’s start big picture. We’ve just gone through an important and fundamental change in central bank strategy. A year ago, the U.S. Federal Reserve (Fed) set an extremely accommodative monetary policy to support a full and inclusive recovery coming out of the pandemic. And it said that it was willing to tolerate an inflation overshoot to ensure that happened.

You can probably guess where this is heading … we now have that inflation overshoot—and one that has become so large and problematic that the Fed is now engineering an economic slowdown to get it back under control again. I’m not going to throw stones at the Fed for that—it’s not entirely their fault, and some of the smartest people I know still work there. But the change is still profound, and it is responsible for driving a lot of the volatility investors faced in 2022.

So, what’s next? I’ll start with the central bank outlook—which is relatively straightforward—and then transition to the market outlook—which is not.

High inflation, overheating labor market fuel aggressive rate hikes

In terms of first principles, the Federal Reserve has two congressionally-mandated goals: to promote full employment and price stability. Sometimes there is a tension between these goals. Right now there is not. The labor market is overheating: the unemployment rate is hovering near its lowest levels since the 1960s, companies are struggling to find workers to fill their job openings and wage inflation for nonsupervisory employees is running north of 6%—its fastest pace since 1982.

Switching over to the price stability side, consumer price inflation is sharply overshooting the Fed’s 2% inflation target—with the drivers of that inflation broadening to stickier categories like shelter and service prices this year. That’s a clear recipe for higher interest rates. How high?

Could the Fed hike rates above 3%?

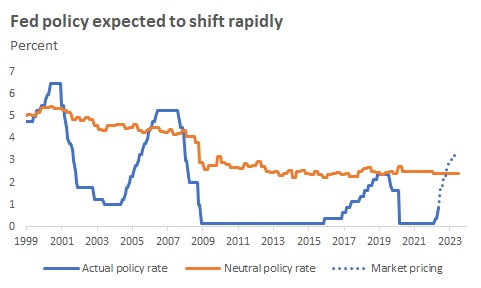

Almost any policy rule would suggest rates that are high enough to slow the economy down and bring demand and supply back into balance again. On TV, that’s a Fed that needs to take the punch bowl away. At an economist’s dinner table, that’s a Fed that needs to hike interest rates above neutral. Without getting too deep into the weeds about a) how we estimate a neutral interest rate and b) how far above that neutral setting the central bank needs to go in the current environment, the bottom line is the U.S. economy will probably require overnight interest rates north of 3%.

Is a September pause in the rate-hiking cycle possible?

The target range for the federal funds rate is currently 0.75% to 1%. So the central bank has a job to do here. Fed Chair Jerome Powell has already offered strong guidance that large 50-basis-point (bps) hikes are likely to continue into June and July. That’s our expectation as well. Markets know this too and, rather than the decision itself, will likely key off of any guidance Chair Powell offers about the likely path for September and beyond. The Fed hasn’t broken the back of inflation yet, and so of the three options for September—pause, slow down to 25 bps hikes, or continue with supersized hikes—a pause in September seems like the least probable outcome here, from our vantage point.

Before we dig into markets, a quick interlude on the economy. The Fed pivot matters. A restrictive Federal Reserve is a hallmark of the late cycle. It’s possible the central bank will engineer a perfect soft landing—cooling the economy without breaking the economy—but its track record is not comforting, particularly when the labor market is overheating as it is right now. Our 12-month-ahead recession probabilities are moving up accordingly, from 10% last November to 30% today. And those risks will continue to grow if/when expected rate hikes turn into realized rate hikes.

Source: Russell Investments

Market outlook

Earlier I wrote that the market outlook is not straightforward. And I say that for two reasons. First, even though the economic backdrop is concerning, going risk off in a portfolio strategy is a hard call to get right. It requires impeccable timing on both when to get out of AND back into the market. Remember: the equity risk premium is one of the strongest forces in finance. De-risking means you’re swimming against the tide.

Second, the economy isn’t everything. You need to assess your view on the economy and fundamentals against what is priced. At Russell Investments we look at asset classes through the lens of three building blocks: cycle, valuation and sentiment. Yes, we’ve downgraded the cycle meaningfully in recent months. But the S&P 500 is down 14% on the year through June 8, 2022. And when we measure sentiment, or the psychology of other investors in the marketplace, we see significant signs of pessimism—which is a strong, positive signal in our tactical investment framework.

The chart below shows an example of one (of many) indicators we look at. It’s a survey of professional investors asking if they are bullish or bearish on the market outlook. Note that it’s below 1 right now (i.e., there are more bears than bulls)—something that does not happen very often. Similarly pessimistic readings in 2015, 2016, 2018, and 2020 occurred near market bottoms.

What about the outlook for bonds? U.S government bonds have not played their role as a diversifier to-date, but a 10-year Treasury yield of 3% looks a lot more attractive to us now than the 1.5% that was offered at the start of the year. And if a recession hits, we do expect government bonds to do their job in portfolios (again).

The bottom line

Against a backdrop of elevated macroeconomic uncertainty, we think current portfolio positioning should be aligned to an institution’s strategic asset allocation. We spend a lot of time building customized asset allocations to help our clients meet their specific goals and needs. Now is not the time to deviate from that plan and take more risk than you need to. It is arguably a ripe environment for active management—skilled security selectors should be able to differentiate those companies who have pricing power from those who don’t. At Russell Investments, we have a long history in manager research, helping our clients to identify the best of the best in the industry. Let us know how we can help.