2022 Annual ESG Manager Survey: The ESG journey accelerates

Our annual ESG manager survey of active managers assesses the integration of ESG considerations in investment processes among equity, fixed income and private markets managers, and spotlights firmwide policies, use of data, engagement and integration.

Top survey findings

This year marks our eighth annual ESG manager survey. The survey has evolved over the years, enabling deeper insights into trends and how attitudes toward responsible investing have shifted since it was first launched in 2015.

The survey participants have a broad representation by asset size, region and investment strategy offerings. Of the 236 participants, 184 offer equity strategies, 147 offer fixed income strategies, 77 offer private markets strategies and 66 offer real assets strategies. 58% of the respondents are headquartered in the U.S., 16% are based in the United Kingdom and 9% are based in continental Europe, with the rest located in other regions. 28% of the respondents have assets under management (AUM) of less than $10 billion, while 33% of the participants have over $100 billion in AUM.

In this short summary of the 2022 survey, we take a look at the following key findings:

- Biggest ESG issue: Climate risk dominates client concerns

- Top growing ESG product sector: ESG integration

- Biggest challenge of incorporating ESG for asset managers – Varying client needs

- Data concerns: ESG data and reporting continue to be a challenge

- DEI: Roughly half of the asset managers have gender or ethnic-minority representation of <20% on their investment staff

Biggest ESG issues among clients – Climate risk dominates

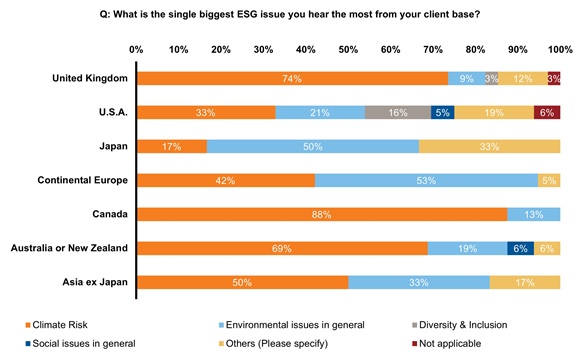

Given that ESG considerations cover a wide range of topics, we asked survey participants to select the single largest ESG issue they tend to hear from their client base. In a sign of increasing awareness of the climate crisis, 45% of respondents selected climate risk, versus 39% from the previous year. In addition, 23% of respondents chose environmental issues in general, versus 21% in 2021. Climate risk was identified as the biggest issue among managers’ client bases in Canada, continental Europe, Australia and New Zealand, followed by the United Kingdom. When combining climate risk and environmental issues, the client base in continental Europe, Australia and Canada had the largest weight in environmental-related topics.

Interestingly, 10% of respondents selected diversity, equity and inclusion (DEI), compared to 15% from the previous year, while 15% of respondents chose “others”, versus 11% in 2021. Of particular note, many in this category cited both climate risk and DEI as equally large issues. In fact, the number of firms that cited DEI in the comments under “others” was larger than the previous year.

DEI concerns were most prominent in the U.S., where 16% of U.S.-based firms cited it as the biggest ESG issue they hear from their client base. While the number declined from 31% last year to 23% this year, factoring in the respondents that flagged DEI as a big issue in the “others” section leads to an overall level of concern that is similar to last year’s.

Click image to enlarge

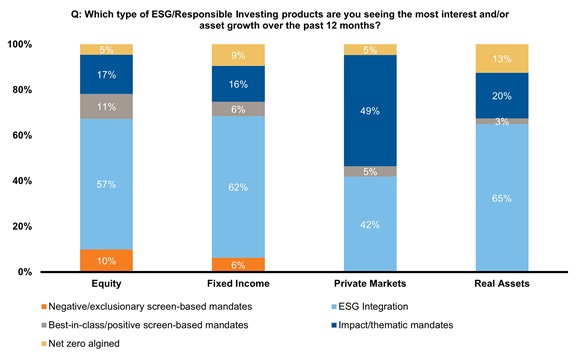

Growth in ESG product offerings – ESG integration leads the way

In order to gain a deeper understanding of ESG-related strategy offerings, we asked firms to classify the types of products they currently offer, including exclusionary screen-based mandates, ESG integration, best-in-class/positive tilt-based mandates and impact/thematic strategies. Across all asset classes, the strategies that provide ESG integration make up the largest proportion of strategies offered to date. Additionally, we asked asset managers which type of strategies saw the most interest and asset growth over the past 12 months. The results show proportionally more demand in ESG-integrated strategies, which are often mainstream strategies that are benchmarked against traditional public indices, such as the MSCI EAFE Index and the Bloomberg Barclays Global Aggregate Index.

These findings align with our discussions with asset managers, which suggest that investors may be looking to substitute existing core allocations for sustainable strategies with ESG outcomes. Ultimately, investors’ desire to align investments that are contributing toward positive environmental or social objectives with impact/thematic strategies has resulted in an uptick in momentum for this category across all asset classes.

We believe it’s important to distinguish between ESG integration and sustainable investing. ESG integration is about incorporating ESG factors into an investment process in order to enhance the portfolio analysis. Sustainable investing is about seeking certain sustainability outcomes within a portfolio. If an investor were to limit their investment universe based on certain exclusion criteria, then their portfolio outcome would also likely change. This is because if an investor constrains their investment universe materially, performance outcome will naturally be impacted, especially in a shorter time period. Therefore, we believe it’s important for clients to understand the potential performance implications of sustainable investing.

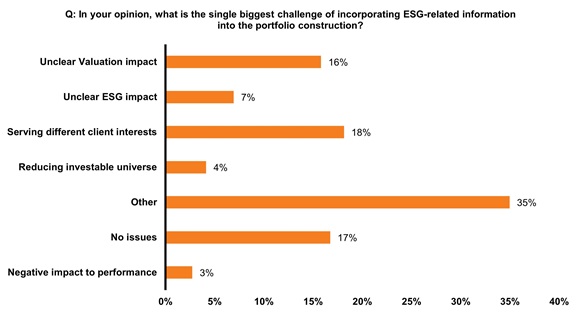

Biggest challenge of incorporating ESG for asset managers – Varying client needs

While ESG integration has reached universal recognition among the asset management community, there is still a wide range of views on how asset managers treat ESG considerations. To better understand the various views, we asked participants to identify the single biggest challenge of incorporating ESG-related information intoa portfolio’s construction.

18% of respondents cited the challenge of serving different client needs as the largest issue - and that is understandable since specific ESG preferences vary depending on the client. For instance, some clients may prefer to focus on portfolios that are centred around tackling climate risk, while others might prefer to focus on social issues. Also of significance, 16% of respondents cited the challenge of unclear ESG pricing impact. It’s also worth highlighting that 35% of respondents selected the “other” category, with the majority stating that data transparency and consistency were the key issues. This aligns with the data challenges highlighted earlier.

Regulations and sustainability – ESG data continues to be a challenge

Regulators, particularly in the European Union (EU), are stepping in to provide guidance for what qualifies as sustainable investments. Under the EU Sustainable Finance Disclosure Regulation (SFDR), a sustainable investment is defined as (under section 2(17) of SFDR) “an investment in an economic activity that contributes to an environmental or social objective, provided that such investments do not significantly harm any of those objectives and that the investee companies follow good governance practices, in particular with respect to sound management structures, employee, relations and remuneration of staff and tax compliance.”

The regulatory disclosure requirements bring greater transparency to sustainable investing. However, where to go from here remains unclear. In addition to the challenge of ESG data quality and how it actually contributes to the financial impacts of corporations, different regulators appear to be heading in different directions. The EU, for instance, is expanding further regulations to encourage incorporation of non-financial aspects with Article 8 and Article 9 products - both popular demands in the region. On the other hand, the U.S. Securities and Exchange Commission (SEC) has expressed caution around incorporating ESG factors, likely to divest from a fiduciary-duty standpoint. At the same time, regulators across the globe appear to be united in acknowledging the many issues around the practice of greenwashing. Ultimately, we believe that acknowledging both the data disclosure challenges and establishing industry-disclosure frameworks are important steps for building greater transparency in sustainable investing.

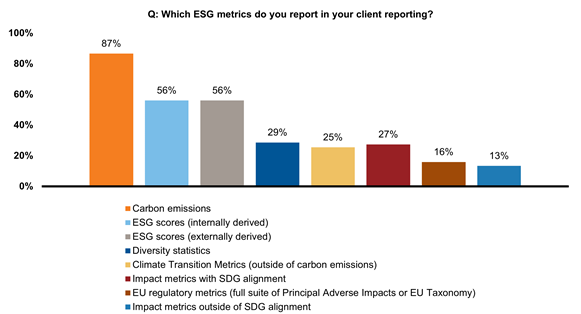

ESG reporting – Standardisation begins to increase

While ESG-related reporting guidance continues to grow in prominence - one chief example being the TCFD framework - the reporting contents still vary widely. Our survey indicates that carbon emissions data is currently the most popular of the reporting items.

For ESG profile reporting, the results showed an equal level of respondents who disclose their internally derived ESG metrics versus those who rely on and report to third-party ESG data vendors’ outputs. ESG factors involve non-financial metric-driven considerations, which are often harder to quantify and can be highly subjective. That’s why ESG data providers’ outputs can vary for the same company, unlike credit rating agencies, where outputs have less dispersions. The results seem to indicate a slight shift in the reporting content source for ESG profiles. Last year’s survey results suggested that an increasing number of asset managers were utilising their internally derived ESG characteristics or metrics, as opposed to third-party ESG data providers’ metrics. This year, however, asset managers were evenly split when it came to using third-party ESG data or their own metrics. This result aligns with our market observations. During our discussions with asset managers, we often hear about the challenges of third-party ESG data providers’ outputs and how they try to augment it with their in-house ESG analysis. However, we are hearing more market participants reporting both internally derived and externally derived ESG data in their reporting. This suggests that investors want a standardisation of disclosures in key ESG metrics, and that asset managers are increasingly responding to this request.

In addition to carbon emissions and ESG-profile metrics, managers identified diversity statistics, climate-transition metrics and UN SDGs (sustainable development goals) alignment as other popular ESG metrics included in reports.

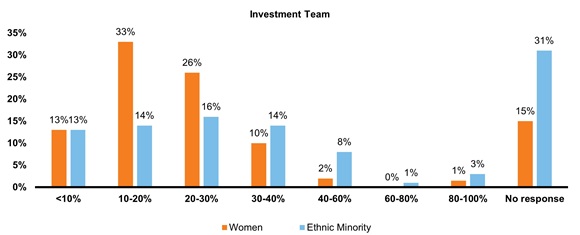

Diversity, equity and inclusion – Disclosures greater for gender than for ethnicity

There continues to be a growing effort to promote DEI practices in the asset management community, in order to recruit and retain a more diverse talent pool, increase employee engagement through diverse representation and empower broader perspectives and thinking. We have observed that many asset managers are taking DEI issues seriously, with a key focus on tackling the societal challenges of inequality in the workplace, as well as recognising the importance of having diverse talent and investment ideas. The application of supportive DEI efforts is necessarily multi-faceted, as diversity issues pertaining to gender, ethnicity, sexual orientation, disabilities and social backgrounds.

The investment industry has a lack of diversity. We asked participants what the female representation is at the following levels: total firm, investment team, senior investment team and board membership. We also asked the same set of questions about ethnic minority representation. Generally speaking, we have observed that disclosures are greater for gender than for ethnicity - likely due to the fact that some firms only have data on the gender of their employees (often due to legal prohibitions or other difficulties in gathering information about ethnicity). For instance, 85% of respondents disclosed the percentage of their total female employees, while only 69% did so for ethnic minorities.

For the ethnic minority disclosure, disclosure was greatest in the U.S., where 85% of U.S.-based respondents disclosed their DEI statistics around ethnic minorities, and 90% disclosed their gender demographics. The ethnic minority disclosure was lowest among firms based in continental Europe, which is understandable, given the regulatory differences. In particular, it’s illegal for companies to collect and/or disseminate diversity-related information in some European countries.

Of the firms that disclosed their DEI statistics, most (54%) have investment teams comprised of less than 20% women, and 40% have investment teams where less than 20% of the members are ethnic minorities. In other words, roughly half of the asset managers we surveyed have gender or ethnic-minority representation of less than 20% on their investment staff. Perhaps this provides a reference point of the general demographics of the industry.

The bottom line

Ultimately, the 2022 Russell Investments ESG Manager Survey shows that the ESG journey is continuing, and at a markedly escalated pace, with regulators across the globe aggressively stepping in as the investment community tries to digest and accommodate new ideas and practices at an incredible rate of speed.

The results indicate that client demand and risk mitigation are among the key reasons that asset managers are integrating ESG factors into investment processes. The survey also shows that investors increasingly are desiring a standardisation of disclosures in key ESG metrics, and that asset managers are responding to these types of requests. In regard to carbon emissions data, while it captures a snapshot of an entity, our survey reveals that there is a growing trend to evaluate the energy transition with forward-looking views.

The survey also shows that efforts around climate risk management continue to rapidly expand, and that this is reflected in resourcing, reporting and engagement activities. While roughly half of asset managers think that ESG-related risks aren’t priced in much today, a majority expect that to change within the next few years.

At Russell Investments, we continue to take a holistic approach to portfolio construction and management. Our goal is to achieve best-practice ESG integration to effectively capture ESG materiality. We believe that ESG topics, including DEI and climate change, can have material impacts on capital flows, which can influence asset prices. An integrated ESG process allows ESG issues to be understood and managed holistically. We believe that this approach not only allows for the best outcomes for our clients, but for our society and planet as well.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.