Multi-manager for DC plans: How to hit the sweet spot, even in volatile markets

For the first time in years, the cycle of investor sentiment has turned decisively toward fear. The halting of economic activity precipitated by the COVID-19 global pandemic is the perfect storm for fear. It threatens both accumulated retirement savings and human capital at once and comes with so much uncertainty around the severity and duration of impact, that fear is a perfectly reasonable response. Consider this: The historic standard range for the CBOE Volatility Index (the VIX) is between 12.23 and 27.31. The VIX recently spiked to over 80 in March—just one of many manifestations of this fear. As I write this on June 30, it has settled down to just over 30, but that’s still outside of the top end of its standard range.

In the face of this fear, how can investment options in defined contribution plans support good decisions and great investment outcomes? After all, plans need to find the right balance of several goals which are not always well aligned:

- Give participants a smooth ride while achieving investment outcomes

- Deliver great returns through superior investment management

- Avoid choice overload for plan participants

The tension between these goals is easy to understand. For an approach with a single strategy per investment option, it is impossible to deliver all three. On one hand, a smooth ride may require sticking to relatively simple low-risk strategies that lack the best of active management. On the other hand, an approach that relies on the specialization of investor skills to narrow styles or investment habitats that characterizes the best investors may yield excessive volatility, when delivered as discrete options.

Multi-manager investing hits the sweet spot that balances all three of these objectives—a smooth ride, returns and avoiding choice overload. Though originally conceived as the best approach for large institutional investors to get a diversified mix of the best investment strategies in all asset categories, we believe it is also well suited to deliver a high-confidence set of DC investment options without excessive complexity or behavioral traps.

Let’s take a closer look at how multi-manager can help deliver on each of the goals above, without sacrificing the others.

Smooth ride

In markets like these, the value of a smooth ride of investment returns is easy to understand. Sticking to an investment strategy through volatile markets is hard enough for most DC plan participants. Extreme results lead to regret and may drive poorly timed knee-jerk de-risking. In extreme market environments, when asset class returns may plunge, the tracking error of single strategy approaches can compound this risk, even if they are complemented by other equity investment strategies.

Single strategy portfolios often hinge on single risk factor payoffs that can cause returns to vary widely from the asset allocation benchmark. For example, an allocation to a technology-heavy U.S. growth equity strategy may deliver returns much worse than the U.S. equity index in a downturn. Right now, value strategies with a pro-cyclical or finance industry bias are getting punished. The risk of participants cutting a strategy at the wrong time and missing any rebound is significant.

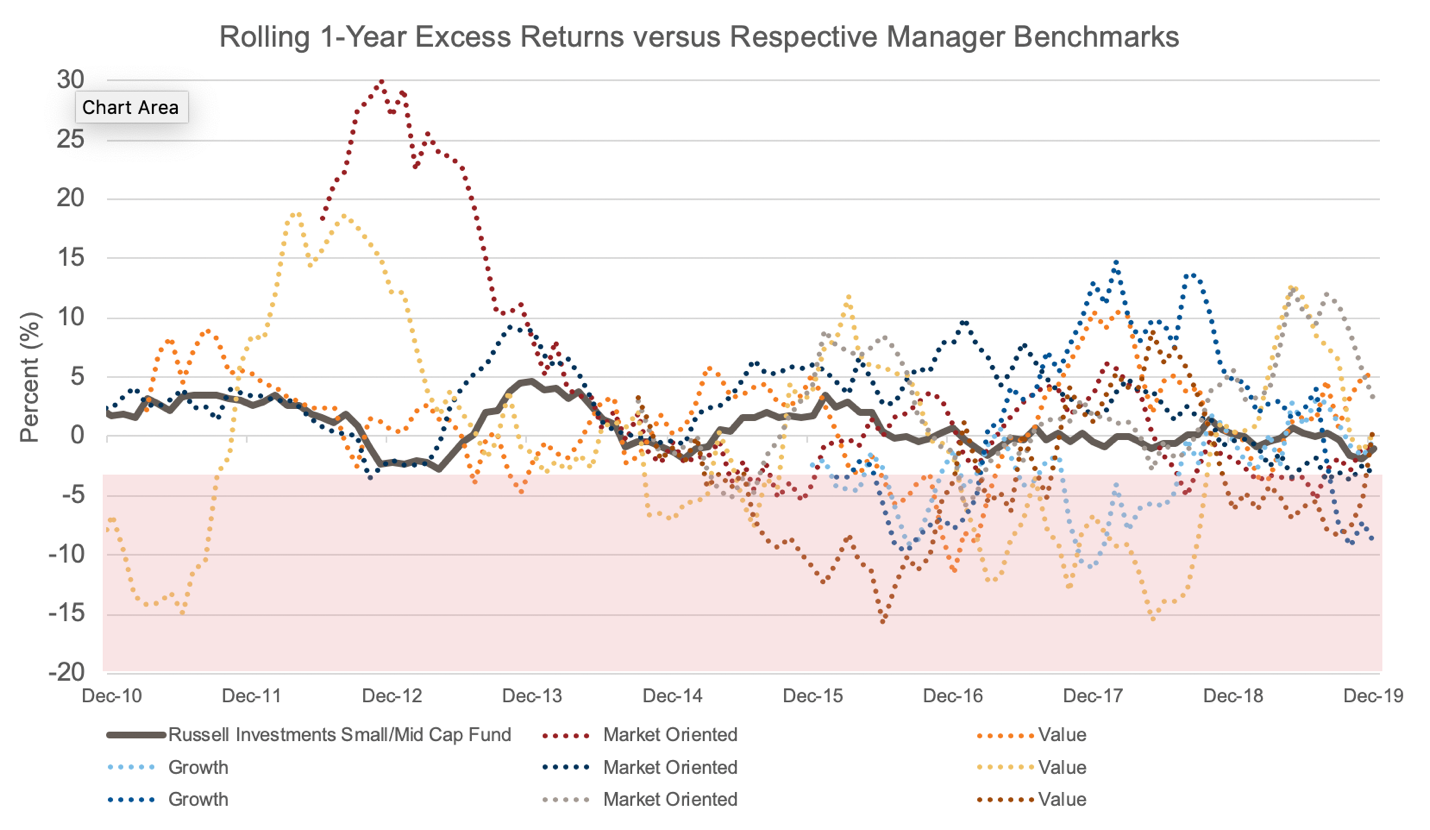

A multi-manager, multi-strategy investment option can provide a smooth ride with a diversified mix of active strategies blunting the extreme results any one strategy might deliver. A skilled multi-manager investor will look to create an optimal risk-return trade-off by mixing these strategies to construct a portfolio where risk is focused on security selection as opposed to large risk tilts.

Click image to enlarge

Source: Russell Investments as of December 19, 2019

Deliver superior returns

Some might argue that a low tracking error can deliver a smooth ride, but there is a cost to using low risk single strategy funds: sacrificing the ability to generate strong returns. Best-in-class active managers tend to specialize in a particular habitat, investment category, region or style. Creating a balanced combination of discrete strategies, with differing risk loadings, scenario risks and drivers of success can deliver the best of both worlds: potent return in a modest tracking error. At Russell Investments, we never forget where the free lunch of investing comes from: diversification. And tracking error diversifies down, excess returns do not.

Click image to enlarge

Source: Russell Investments as of December 19, 2019.

This is equally true in equity as in fixed income. A mix of multiple distinct style strategies in a multi-manager equity portfolio (value, growth, and market-oriented, for example) will blunt the deepest drawdowns of each. In fixed income, the value of this approach is more about diversifying investment habitat than style, as the high return approaches—which access a broad universe of fixed income sectors and security types—can be pulled together into a diverse whole.1

Avoid choice overload

Long lists of investment options are a trap for DC plan participants. They create unnecessary allocation challenges, which invite confusion and often result in opting for a reductive 1/n approach to mixing diverse strategies. We believe the plan options should be limited to just the levers required to make the portfolio appropriate to the goals, preferences and circumstances of each person.

As already pointed out, a multi-manager approach allows for a limited set of investment options stocked with high quality and diverse strategies. That intentionally limited choice does not imply limitations on the ambition of the plan to provide superior investment products because a multi-manager approach, by its very nature, is designed toward finding and combining best-in-class investment options. Those are the decisions made by the asset manager. This frees up the plan participants to focus on the most important allocation decisions they make—aligning overall risk-taking with their goals and risk tolerances. When one considers that the more micro choices of how to mix individual styles and strategies within a broad equity or fixed income fund are being taken by portfolio managers like those at Russell Investments—with state-of-the-art analytics and real-time updates on the efficacy and power of each investment manager’s approach—the picture is completed.

The bottom line

The greatest responsibility of plan sponsors is to support the achievement of great investment outcomes. We believe the best way to meet this responsibility is through an array of options that make top-quality investment management available to power each participant’s investment goals. When considering the value of a relatively smooth ride and intentionally limited choice in the quest to avoid unproductive behavioral traps and biases, we believe multi-manager investing hits the sweet spot of DC plans.

1 Source: Russell Investments, The Right Fit—Case for Multi-Manager Funds in DC