The perils of passive investing amid a highly concentrated S&P 500

The S&P 500® Index set seven record highs last month1 and now, at the start of September, stands roughly 3% above its pre-pandemic peak. That’s an absolutely startling rebound, coming only five months after the coronavirus pandemic sent the index reeling to a March 23 low of 2,237. We have, of course, talked a lot about the important role that we thought fiscal and monetary stimulus would play in supporting a healthy market outlook. And we remain encouraged that the U.S. and global economy have transitioned into the recovery phase of a new business cycle.

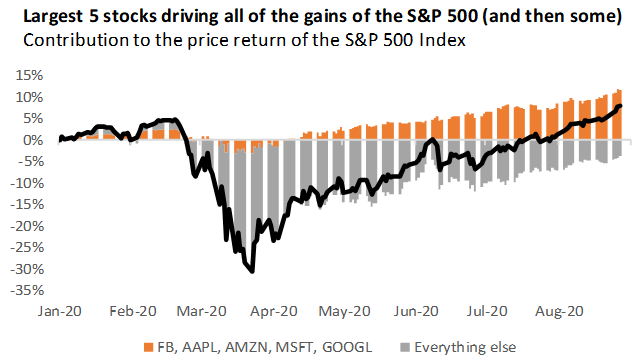

But the gains are still impressive, nonetheless. And at a headline level they mask an even more remarkable explosion in the concentration of performance. Apple, Microsoft, Amazon, Facebook and Alphabet (aka Google) have contributed 12 percentage points of the 8% year-to-date total return on the S&P 500® Index. Put differently, the other 495 companies in the index are still negative on the year (chart).

Source: Thomson Reuters Datastream, Russell Investments calculations. Data as of Aug. 27, 2020.

5 companies responsible for S&P 500’s positive yearly return

These superstar firms were already delivering record profit margins in recent years and were fortunate enough to be uniquely positioned for how COVID-19 impacted our daily lives. The big five grew their earnings in the second quarter during an economic recession when most companies experienced a severe earnings contraction. Stay-at-home orders, online shopping, virtual meeting, cloud computing—you name it, our lives have changed.

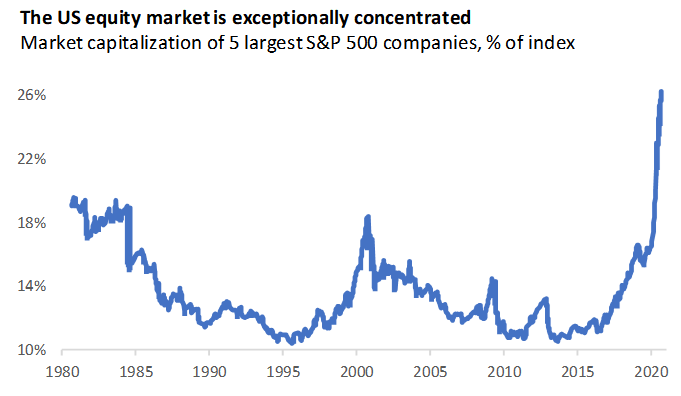

But this has also meant that passive investments in broad diversified indices may actually be a concentrated technology investment in sheep’s clothing. Apple, Microsoft, Amazon, Facebook and Google now comprise 26% of the market capitalization of the S&P 500 Index. That’s considerably larger than the 18% weighting that Microsoft, Cisco, General Electric, Intel and Exxon held in 2000—and far and away the most concentrated market in the data we have spanning the last 40 years.

Click image to enlarge

Source: Goldman Sachs and Compustat from 1980 through April 2020. Thomson Reuters Datastream and Russell Investments calculations through Aug. 27, 2020.

This concentration risk also partly explains regional equity market dynamics in 2020. For instance, emerging markets have also performed well over the past several months. You can copy-paste Alibaba, Tencent, Taiwan Semiconductors, Samsung and Meituan Dianping in for the U.S. companies and the story above holds true: Superstar technology companies are driving more than all of the gains on the MSCI Emerging Markets Index this year. Meanwhile, continental Europe and the United Kingdom, which do not have as much representation in the way of mega cap technology companies, have notably lagged.

Impact on retirement plans

The concentration that now exists within the S&P means returns are being driven by a very small pool of names. Consequently, we can expect the volatility of returns to be positively related to these concentration levels. This has important ramifications for institutional investors, many of whom have cashflow-negative pension plans and require periodic disinvestments from their portfolios to meet ongoing benefit payments. A highly volatile return profile, coupled with a need to disinvest regularly, inevitably increases the likelihood of a plan being a forced seller, should the fortunes of equity markets reverse. We believe that plan sponsors should carefully consider their ability to weather this sort of risk when considering their beta exposure in the equity space. It may be helpful to partner with a skilled OCIO provider to determine an appropriate risk appetite.

Not surprisingly, much has also been made of the earnings growth among these mega-cap tech names. However, it is important to contextualise these figures by noting that almost all of these firms either are in the infancy of their lives as corporations or derive much of their growth from fledgling areas of their respective markets. This is important, as such areas are characterised by little-to-no regulatory burden—something which may be about to change, given the current socio-economic climate and the looming U.S. presidential election.

In addition, unprecedented levels of fiscal stimulus in the U.S. and across the globe will begin to feed more into the economic data in the coming months. Historically, such high levels of stimulus have favored over technology.

The bottom line

While structural issues like these are faced by investors in all sectors on a daily basis, today’s highly concentrated levels are rare. As a consequence, we believe that it’s now just as important—if not even more so—to focus on sector exposures, rather than regional diversification, when constructing equity portfolios. Because in today’s market, index exposure should not be conflated with diversification.