Q4 2020 Fixed Income Survey: With the dust settling, is demand for riskier assets heating up?

In this latest survey, 64 leading bond and currency managers considered valuations, expectations and outlooks for the coming months.

In the previous Q2 survey, the environment showed a clear divergence in economic and financial markets performance. Financial markets rose on the back of unprecedented levels of government and central bank stimulus around the globe, whilst hopes for a COVID-19 treatment also improved sentiment among investors. However, managers expressed notable concerns for the speed of the recovery, a second wave of infections and the depth of the global recession.

With lockdown restrictions easing from the end of the second quarter, risk appetite continued to build up strongly in July and August. However, rising coronavirus cases in September and October pointed towards a second wave of infections. Brexit uncertainties and volatility in the run-up to U.S. presidential elections, further moderated investors’ risk sentiment. G7 central banks remained accommodative during this period. For example, the Federal Reserve (Fed) adopted an average target rate for inflation – allowing inflation to trend higher for longer before interest rates positioning are reevaluated. Meanwhile, governments around the world are tasked with figuring out how to continue to financially support their respective countries.

For the latest survey, therefore, we seek an updated consensus from managers on the speed of the recovery - in particular, when the global economy could rebound to the peak levels seen in December 2019. We also ask what their inflation expectations are and whether new investment opportunities are appearing?

Is the dust settling?

Views from interest rate managers

- Managers showed more consensus in regard to U.S. inflation versus our previous survey, with 63% of managers expecting U.S. inflation to be within the 1.50%-2.10% range in the next 12 months. 21% of managers still expect U.S. inflation to be negative in the next 12 months. When asked about inflation targets in the U.S., 54% of respondents are confident the Fed will achieve its 2% inflation target.

- 96% of managers believe the Fed will not move interest rates to negative territory.

- Just over half of the managers (54%) believe the Fed will not engage in yield curve control, versus 70% that expected the Fed to do this in the previous 2Q20 survey. 21% of respondents, however, believe that yield curve control is already happening.

- 56% of managers expect to see a bear steepened move in the U.S. yield curve, in contrast to the 37% in the 2Q20 survey. More managers are convinced duration offers muted effectiveness to hedge credit today - with almost 60% of respondents expressing such a view versus 50% in our 2Q20 survey.

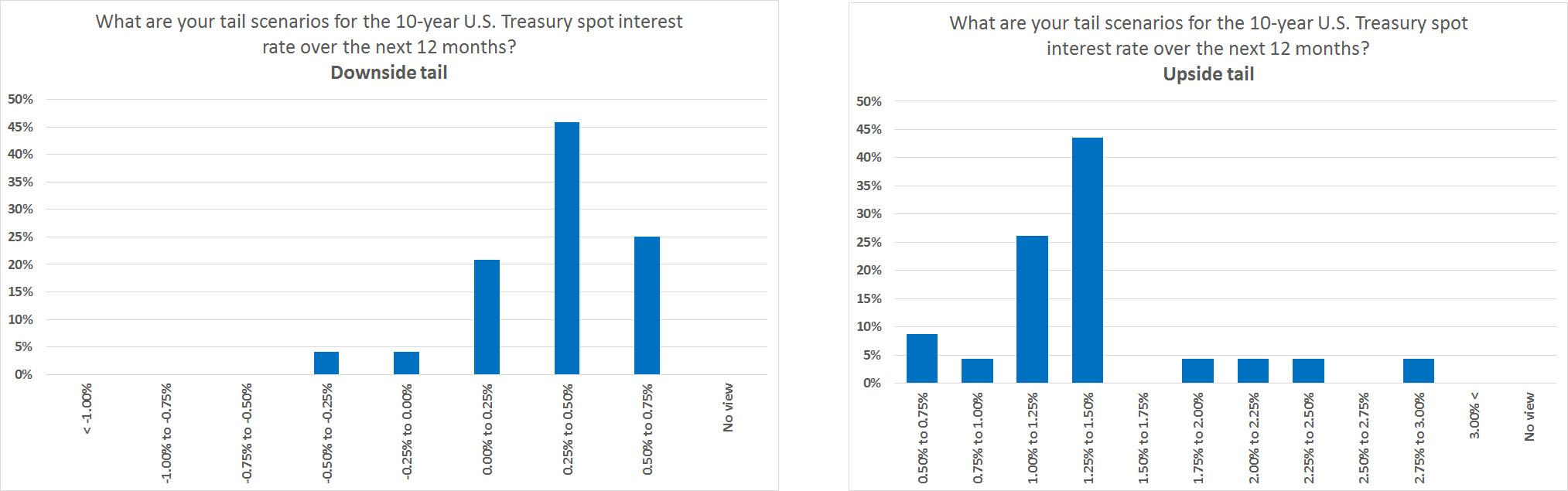

- When asked about downside/upside tails for U.S. Treasury spot interest rates for the next 12 months, managers expect rates to stay within the 0.25% (downside tail) and 1.5% (upside tail) range.

Click to enlarge the image

Investment-grade (IG) credit managers are still bullish but less aggressive managers

- Almost 67% of respondents still expect spreads to tighten in the next 12 months, in contrast to the 73% that responded so in our 2Q20 survey. 30% of managers expect spreads to be range bound - up from 10% in the previous survey.

- Panic signs dissipate. Expectations of managers increasing leverage of IG companies declined to ~50% versus 87% in our previous survey. Nonetheless, more managers now consider that leverage of IG corporates will decline or at least will remain stable in the next 6-18 months.

- Most of the managers still favour the U.S. as the region with the most attractive returns, followed by Europe (excluding UK). Regarding sectors, financials is still expected to post the best returns on a 12-month basis, while expectations about performance of non-cyclicals slightly declined versus the 2Q20 survey.

- When asked about energy allocation, 47% seem to be comfortable maintaining risk exposures in the sector. Only 3% of respondents mentioned they are willing to add risks in the sector versus 10% in our previous survey.

Global leveraged credit (still bullish but less aggressive managers)

- 54% of managers expect spread tightening over the next 12- months versus 70% in our previous survey. 33% of managers expect spreads to be range bound – which is 20% higher than in the 2Q20 survey.

- In our 2Q20 survey, 100% of the managers believed that fundamentals of high yield corporates would deteriorate. Currently, 45% of managers expect fundamentals to deteriorate while 45% of them now expect fundamentals to improve!

- 58% of managers expect total return of the U.S. high yield market to be in the 5%-6% range for the next 12 months, down from the +7% total return expectation managers expressed in our 2Q20 survey.

- Managers expressed most concerns for mismatched pricing for credit risk within the energy, retail and healthcare sectors.

- 80% of the managers still consider Fallen Angels to be potentially good opportunities - down only 8% versus the 2Q20 survey.

- Less ‘panic’ among managers. In the 2Q20 survey, 50% of managers expected default rates to be in the 8%-10% range over the next 12 months. This time around, 67% of the managers established a consensus for a 5%-8% default rate.

Risk across the globe

Emerging Markets (EM)

- Managers remain bullish but less aggressive within the hard currency emerging market debt (HC EMD) space. 79% of the managers expect spreads in the HC EMD index to tighten in the next 12 months. Weighted average expected return stands at ~6% over the next 12 months - 1% down compared to our 2Q20 survey.

- For managers, sovereign spread change and Fed policy are the most significant risk factors for HC EMD performance in the next 12 months.

- 42% of the managers expressed having more than 15% exposure to HC EMD corporates - the highest level since the start of the survey.

- Managers prefer Ukraine and Mexico as the countries with the highest expected returns in hard currency, followed by Argentina and Egypt. China and The Philippines remain as the top two underweight countries.

- Managers shift their view in regard to local currency EMD (LC EMD). Managers express a more constructive view regarding performance of developing currencies versus the 2Q20 survey - with almost 60% expecting a slight positive performance of EM currencies in the next 12 months. In our last survey, 32% of managers expected foreign exchange to be a detractor in the next 12 months - the highest number since we started the survey.

- In terms of local rates, the consensus view is that rates are at fair value (57% of responses). In the last survey, 50% of managers considered local rates were cheap.

- As the dust settles, managers unveil a more bullish view for the LC EMD. Total return for the GBI-EM GD index is expected to be at ~6.0% over the next 12 months versus +0.5% from our previous survey.

- In our 2Q20 survey, managers expected rates to drive the positive returns in the asset class. This time around, 61% consider positive returns will come from a combination of FX and rates. Meanwhile, 51% of managers still think currency depreciation is the release valve for countries at risk of debt restructuring. In the last survey, 76% made the same statement.

- Managers expressed their preference for the Mexican peso as the most attractive currency in the next 12 months followed by the Russian rouble. They still consider the Turkish lira to register the worst performance during the same period.

Europe and UK

- There are narrower and higher expectations for the euro. 73% of managers expect the euro to trade in the 1.21-1.30 range. In our 2Q20 survey, 75% of managers expected the euro to be in the 0.96-1.10 range.

- The consensus for the UK was not great, with only modest expectations of an appreciation of the British pound: Circa 66% of managers expect the British pound to be in the 1.26-1.40 range in the next 12 months.

Securitised Sectors

- 38% of managers stated they will be adding risk to their return-oriented securitised portfolios in the next 12 months - down from the 50% registered in our 2Q20 survey.

- 67% of managers expect non-agency spreads to tighten in the next 12-months the second highest level since the start of the survey.

- Top three preferred segments in securitised: i. CRTs ii. Prepayment (IO, IIO, PO) iii. Legacy Non-Agency.

- 48% of managers consider the BBB-tranche to be the highest rank in which to expect losses into the structure of the CMBS 2.0 securities as a result of COVID-19. During our 2Q20 survey, managers considered even the single-A tranche could experience significant losses into the structure of CMBS 2.0 securities.

Conclusion:

Central banks remained accommodative throughout the period, in the face of technical recessions, and signalled continued support until the major adverse effects of the pandemic have finally disappeared. In fact, some loosening of lockdown restrictions did engender greenshoots of positive economic performance. Governments also promised support, but political events such as November’s U.S. presidential elections, can often delay further fiscal commitment.

Judging from the previous survey, a lot of the current headwinds, however, were already on managers’ minds. Notably the speed of the recovery, a second wave of infections and the depth of the global recession.

In the latest survey, managers seem to be less concerned about the depth of the global recession. Additionally, as the dust settles, managers are cautiously willing to explore opportunities in more riskier asset classes such as high yield (perceived better fundamentals) and LC EMD (positive returns expectations). There is also a more robust consensus in regard to rates, U.S. inflation expectations and the direction of both developed market and emerging market currencies. Managers are also less negative in regard to fundamentals for both governments and corporates – which contrasts to more negative sentiment in the previous survey.

Nevertheless, the speed of the recovery still remains a top concern for managers. Half of the managers still expect global nominal GDP not to revert to pre-Covid levels before the second half of 2021. 48% of the managers consider it will not revert before 2022. Additionally, a second wave of infections certainly is a major concern among managers.

In the absence of a vaccine, will renewed lockdown measures to combat new coronavirus cases dent any economic recovery and engender a ‘double dip’ recession? Will it moderate inflation expectations? And will political developments such as Brexit and the U.S. presidential election results affect fiscal support measures? Slow fiscal support and a stunted economic recovery may impact managers’ positive sentiment toward high yield assets and LC EMD. This year has already been one of the most bizarre in modern post-war history. Clearly, however, it is still far from over and we will watch closely what the next few weeks and months will bring.

This year has already been one of the most bizarre years in modern post-war history. Clearly however, it is still far from over and we watch closely what the next few weeks will bring.