The 2022 List Issue, Part 1: Global markets - Top 9 investment watchpoints

Editor’s note: As the world continues to navigate through the uncertainty of the coronavirus pandemic and its far-reaching impacts, we’re following in last year’s footsteps and releasing our key market insights for the year ahead in a series of lists. That’s right, our annual list issue is back for 2022. This year’s edition consists of investment insights for four specific areas: global markets, defined contribution plans, defined benefit plans and healthcare and non-profits. So, without further ado, we present the first in a four-blog-post installment: The top nine investment watchpoints for 2022.

***

With 2021 almost finished, it’s a good time to look ahead to the key questions and themes for 2022. Overall, we believe economic growth, inflation and investment returns should moderate through 2022, but expect growth to remain above trend, which should support the outperformance of equities over bonds.

Below, we address the most frequently asked questions and share our key watchpoints for investors to focus on through the new year.

1. Inflation: Transitory or here to stay?

Inflation has been one of the bigger surprises in markets this year, with supply chain issues and strong wage growth pushing inflation up above 6% year-over-year, as of September 2021. As we look ahead to 2022, we expect inflation to moderate through the year as demand eases and the supply side catches up. The market is currently pricing a similar situation, with the 5-year, 5-year inflation breakeven rate (that is, the average inflation rate expected five years from today) still consistent with the U.S. Federal Reserve (Fed)’s inflation mandate.

Watchpoints in 2022: Continued normalisation of labour supply and wage growth. Longer run inflation expectations for any signs of unanchored expectations.

2. Can a COVID-19 variant derail the economy?

The world is seeing the latest COVID-19 variant, namedomicron, starting to spread after beginning in South Africa. While it is still early days, it seems unlikely that it will derail the economy - and for that matter, it seems unlikely that any given COVID-19 variant will derail the economy. Why? The global economy, in general, is better prepared for outbreaks than when the initial coronavirus outbreak quickly spread around the world in March 2020, heavily damaging the economy. Vaccination rates are solid, vaccine producers can quickly adapt vaccines to new variants and businesses and consumers have learned to adapt and become more dynamic. While not true for every country, there is also a lower willingness and political appetite among many governments to re-instate lockdowns.

Watchpoints in 2022: Hospitalisations and the severity of new variants are important. Vaccine providers’ ability to adapt for new variants is encouraging at this stage, but we will continue to monitor.

3. Will China face a hard landing?

The Chinese economy faces a slowing property market and the maintenance of the zero tolerance approach to COVID-19 outbreaks. Starting with the latter risk, we expect that the Chinese government will not drop the strict approach until at least the conclusion of the Beijing Olympics in February. Through 2021, government authorities have been reasonably successful at containing outbreaks. After encouraging the former risk by forcing property developers to deleverage, the Chinese government has started to ease policy to mitigate the risk of a hard landing.

Watchpoints in 2022: Property market developments, including land sales and home prices. Further signs of fiscal and monetary stimulus from the authorities.

4. How aggressive will the Fed be?

The U.S. Federal Reserve is ending the year on a more hawkish tone and approach to monetary policy, with talk of an accelerated taper (i.e., speeding up the reduction in government bond purchases) and the potential for interest rate raises through 2022. It is important for investors to keep in mind that the U.S. is coming out of an extremely accommodative policy position. One of the key considerations when assessing monetary policy is where U.S. rates are relative to the natural rate of interest (also known as r-star, if you find yourself around a group of economists). This rate is not observed, but instead is estimated using statistical models. There is some uncertainty around this estimate, but we think it is likely around 2-2.5% in nominal terms. In our view, this means that monetary policy won’t become restrictive until the Fed raises rates above that level, which is likely still some time away.

Watchpoints in 2022: Inflation and labour market dynamics, as mentioned above. Any increase in uncertainty driven by COVID-19 or other catalysts would likely slow the Fed.

5. How expensive are U.S. equities?

This is one of the more challenging questions in financial markets. Our view is that U.S. equities are expensive on an absolute basis, but look less so when compared to the low level of interest rates and expected earnings growth over coming years. Therefore, we don’t believe they’re likely to pose a challenge to markets over the next 12 months.

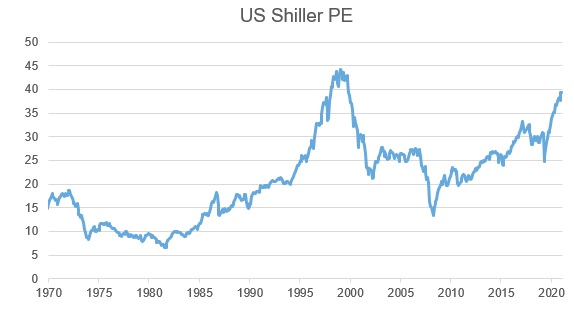

On an absolute basis, one of our preferred measures is the cyclically adjusted price-to-earnings ratio (commonly referred to as the Shiller P20), which continues to look very expensive as shown below. This suggests that U.S. equities have only been as expensive once before, during the tech boom of the late 1990s.

Click image to enlarge

Source: https://www.multpl.com/shiller-pe

Looking at the equity risk premium, however, valuations do not look too strenuous. Another viewpoint is to invert the Shiller PE and compare that to the benchmark 10-year U.S. government bond, which shows that equities provide a reasonable risk premium relative to history.

Watchpoints in 2022: Profit margins will be a key focus given some of the pressures on input costs, as declining margins could pose a challenge to equity market valuations. Regulatory risks around the big tech names in 2022 is also something to keep in mind, given their lofty valuations.

6. Will companies return to the office in 2022?

With the recent news that some large U.S. companies have again delayed their return-to-office dates, it is natural to wonder if future COVID-19 variants may mean that a widespread return-to-office will never occur. Given the tightness in the labour market and the uncertainty around variants, it seems likely that many businesses will offer employees flexibility around returning to the office through a large part of 2022. That said, we think that many businesses will still eventually look to get staff back into the office on a regular basis, given the myriad of benefits that come from having employees in the office together. This is also important for the services sector, given that much of the services economy is built around downtown office settings.

Watchpoints in 2022: Sustained normalisation of mobility and services activity as people return to the office. Corporate announcements around hybrid working arrangements.

7. Will entrepreneurship continue to soar?

One of the dynamics that has come out of the COVID-19 experience has been a significant pick-up in new business registration, with e-commerce attracting plenty of new businesses. Surveys in Europe show that there is a sizeable group of individuals who are considering leaving their jobs to pursue their own businesses. It is challenging to know what the consequences of this will be, as we know that some of those businesses will eventually fold (and those people will come back to the labour market). However, increasing dynamism is generally a positive sign for productivity, which would be a welcome development given the sluggish productivity through the last cycle.

Watchpoints in 2022: New business registrations, as well as surveys around intention of individuals to start/pursue their own business.

8. Will 2022 see the introduction of central bank digital currencies?

With the declining use of cash, central banks have been considering the introduction of digital cash. In fact, nearly 90% of central banks have been researching central bank digital currencies (CBDCs). The People’s Bank of China (PBoC) and the Bank of Canada have already launched small pilot programs, and a number of Caribbean nations (including the Bahamas) have issued live CBDCs. China is likely to continue pushing ahead through 2022, with some suggestions that the PBoC would like to see widespread use by the Beijing Olympics.

Watchpoints in 2022: The further rollout of China’s CBDC. Further research and commentary that comes out of the major central banks, particularly the Fed.

9. Where to find diversifying assets in a low interest rate environment?

With interest rates still near historical lows, investors are raising questions around how valuable government bonds are as a diversifier in the event of an equity market drawdown. We continue to think that government bonds hold diversification benefits at current interest rates. We also think that the Japanese yen holds good diversification benefits, and looks quite attractive on valuation benefits. Options can also be an effective diversifier.

Watchpoints in 2022: Multi-asset solutions allow investors to access a broader range of investment options to fit their needs, so this should be a consideration.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.