5 steps for managing your practice through volatility

The current market volatility and unprecedented global health pandemic have many investors reeling. Normal operating procedures don’t seem to apply anymore in communicating with clients and running your practice.

In moments like this, I call on my pilot training: Rely on checklists you’ve distilled and memorised to effectively pilot through emergency procedures. Missing a step can be the difference between a successful and an unsuccessful flight. As a pilot, my checklist is G.U.M.P.S.: Gas, Undercarriage, Mixer, Props, Seat belts. And above all else, Fly The Airplane, no matter how turbulent it gets.

As an adviser, I recognised that checklists could help me manage my clients, my team, my practice and myself through turbulent times, too. Here is what I have used. Try it - and I encourage you to share it with your whole team so you are all working smoothly as a crew.

The effective adviser’s market volatility checklist

G.U.M.P.S

- Gather your thoughts: Have a thoughtful and consistent core message for clients to help them focus on what matters most. When fear is at its highest, consistency can instill reassurance and confidence.

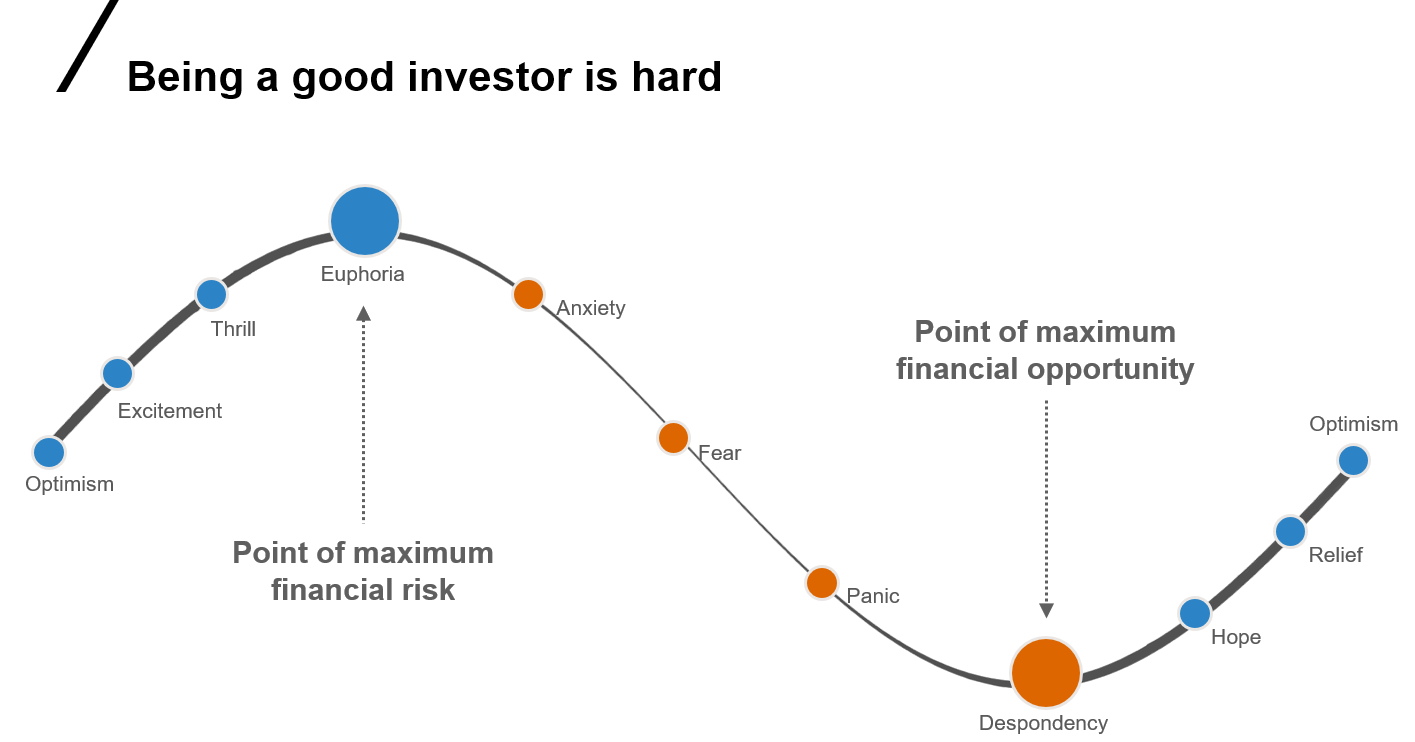

- Understand your clients’ concerns. Reach out to your clients proactively. Consider starting with your retired clients, then those who are approaching retirement, and last, those who have more time before retirement. Ask open-ended questions, listen and empathise. Knowing where they stand on the roller coaster of emotions (as shown below) will help you better predict and manage their biases and prevent decisions that may negatively impact the long-term health of their wealth.

Click image to enlarge

Source: Russell Investments. For illustrative purposes only.

- Measure your words. When addressing clients’ market-related questions, drop the jargon and resist being too technical. Most will simply want to know: How is this market environment likely to impact my ability to live the rest of my life with dignity? Will I be able to cover my bills? Will I be able to take care of Mum and Dad? What will change for my children?

- Protect the plan, review client portfolios. Ensure that clients’ portfolios are still in line with their long-term plans. Portfolio allocations have likely shifted in the recent market volatility. Evaluate if any changes are needed.

- Stay focused on what you and your team can control. Schedule a 15-minute meeting with your team to focus on each person’s daily next best action: Determine what must be achieved today and what can wait. Encourage your team to be realistic about their goals - and not to forget to also take care of themselves and their families.

The bottom line

In the current environment, your typical workflows may not apply very smoothly. Managing your clients, your team, your business and yourself may require emergency procedures. That’s OK. Focus your team on executing your GUMPS Checklist: Gather your thoughts, Understand your clients, Measure your words, Protect the plan, Stay focused.

And reach out to your dedicated Russell Investments regional team for additional resources and support. You’ve got your clients’ and team’s back. We’ve got yours. Stay safe and healthy.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.