Why downside protection may matter more than upside growth

Senior Portfolio Manager of the Multi-Asset Growth Strategy discusses the key concepts behind downside protection. A multi-asset approach to investing can efficiently employ downside protection in order to smooth the path towards securing an investor’s financial objectives.

The power of capital preservation

The global macroeconomics and geopolitical outlook remains uncertain, suggesting that an environment of low rate, low growth, and high valuations may linger. This uncertainty presents a challenge for investors who are looking to generate attractive returns while preserving capital during market volatilities.

Against this backdrop, preserving capital may be more important than seeking the growth of capital, i.e. downside protection. It matters, because, in the investing world, losing less means requiring less to bounce back.

In fact, avoiding losses appears to be more important than achieving gains.

Grow the upside and protect the downside

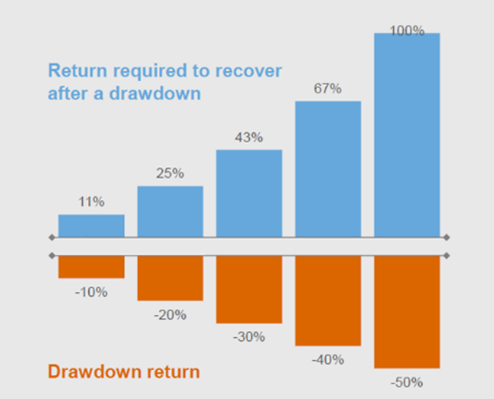

The following chart shows the historical returns required to recover after a drawdown. The returns investors need significantly increase as losses go deeper after a period of underperformance. A drawdown of 20% would need 25% to recover, whereas a drawdown of 50% would need 100% to regain ground. This example demonstrates that a dollar of excess return in a down market is worth more than a dollar of excess return in an up market. To achieve long-term growth, it is inherently important to not only grow the upside, but it is arguably even more important to protect the downside.

The value of outperforming in down markets

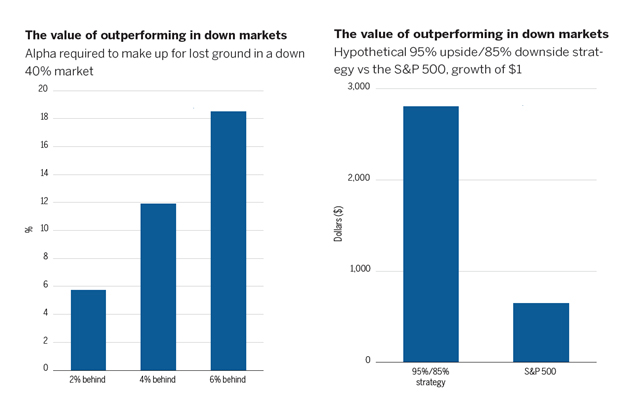

We are not alone in this belief. Many industry peers have reached similar conclusions. The following charts are from a paper published by Wellington Management1 to show the value of outperforming in down markets. The chart on the left-hand side illustrates the amount of excess return required to break even in a down 40% market. The chart on the right-hand side shows the cumulative returns of a hypothetical 95% upside and 85% downside strategy versus S&P 500 during 1 January 1930 to 30 June 2016.

As the data shows, strategies that provide both potential upside and downside protection can enable investors to weather through market changes and stand better chances of outperforming benchmarks. With valuations inching higher, how can investors identify such opportunities? The key is through diversification.

Securing financial objectives

At Russell Investments, we advocate the multi-asset approach to investing for a variety of reasons. The central reason being that it can smooth the path towards securing an investor’s financial objectives. We believe a globally diversified multi-asset approach is the best way to provide investors with the growth they require, with a keen focus on reducing the magnitude of drawdowns. Or rather, in plainspeak, it can provide equity-like returns, but with far less downside risk.

Here’s how:

Design

In the design phase of a portfolio, when asset allocations are established, a nuanced asset allocation may help to capture the things in-between core equity and bonds – such as bank loans, high yield debt, emerging-market local and hard currency debt, mortgage-backed securities, and other alternative strategies — that are not modeled in a traditional 60/40 fixed income and equity allocation. This differentiated approach to diversification is designed to deliver growth, and, perhaps more importantly, to minimise the big downward dips.

Construct

When the portfolio is actually built, we believe a true multi-asset approach applies a wide network of skilled, active money managers who specialise in each asset class. This may be complemented by passive exposures and specific positioning strategies that seek to effectively manage the total portfolio. The broad net of manager expertise acts as additional layer of diversification against the downside.

Manage

After the portfolio is built, it is important to dynamically manage it across asset classes. Intended to help manage downside risk, this dynamism can gain exposure to a diversified set of high-conviction investment opportunities. It can include managing a portfolio of physical securities — such as stocks or bonds — or implementing overlay-based strategies such as options, currency forwards and futures.

Combining all these levers, a multi-asset approach may help investors with downside protection.

Downside protection: Take a multi-asset approach

It’s understandable that so much of the world is chasing growth. We, however, choose to focus on what the data tells us. And the data shows that protection against downside risk will pay off in the long run. By exploiting the benefits and power of downside protection, a savvy multi-asset investor can capture multiple return sources with less risk, in any environment.

1“Is downside risk management still important? An update seven years later”, September 2016, Wellington Management