Falling UK inflation: What are the implications for pension savings?

Executive summary:

- While the fall in inflation is welcome, the impact of higher interest rates on mortgage borrowers still has some way to play out

- The reduction in inflation will help DB members that are drawing on their pension

- Pension trustees should consider their investment strategy and support members with their retirement planning

On Wednesday, 15 November, UK Prime Minister Rishi Sunak celebrated achieving one of his five pledges – to halve inflation by the end of the year.

This commitment was made in January 2023 when inflation stood in excess of 10%, and it was fulfilled last week when the registered UK consumer price inflation for October fell to 4.6%.

Yet, for many consumers, mortgage borrowers, and renters, it feels like a hollow victory – UK inflation is still among the highest among major economies. The drop in inflation last month was largely attributable to the huge increase in household energy bills last October now passing out of the calculations.

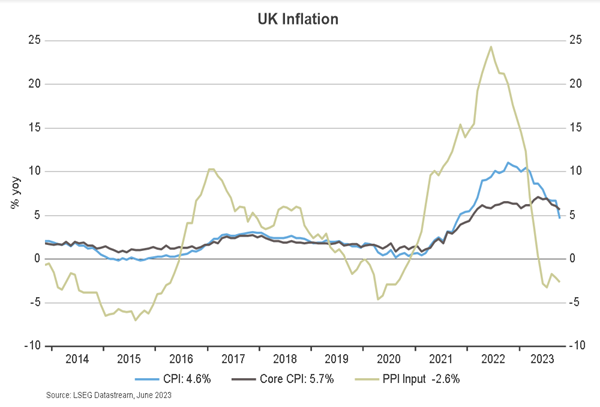

Wage growth has not compensated households for the surge in the price level and mortgage rates have risen fourfold since late 2021.The Bank of England were clear to stress that there is still a lot of work to do to control inflation as the core rate (stripping out the more volatile food and energy components) is at an elevated level of 5.7%. Annual producer price inflation, which often leads developments in consumer prices, is in negative terrain and raises the hope that the recent fall could carry on for a few months.

Chart: UK inflation developments

While the fall in inflation is welcome, the impact of higher interest rates on mortgage borrowers still has some way to play out. The majority of mortgages (about 60% of mortgages outstanding) will reset to higher levels, which will be a significant burden on household budgets. This has serious potential implications for house prices, pushing more borrowers into negative home equity, and credit card defaults. It remains a challenging environment for savers and investors.

This week, there is the possibility that Jeremy Hunt uses the Autumn Statement to offer tax cuts or save them for the spring to have a greater election impact. Either way, the monetary policy decisions will be the bigger driver of steering the UK economy through the challenges of reducing inflation without triggering a deep recession.

From the perspective of Defined Benefit (DB) pension funds, most don't have a lot of residual interest rate and inflation expectations risk. The rise in long-term bond yields over the last two years has improved the funding position of many pension funds. Those that did have some unhedged exposures have taken the opportunity to close it out over the last 12 months.

However, the reduction in inflation will help DB members that are drawing on their pension and have largely been protected from inflation rises; this protection comes from DB Schemes often increasing benefits in line with inflation, albeit often with a cap between 3-5%.

Spot inflation rates feed into the pensions in payment much more than into long-term inflation expectations (which impact DB funding levels). Lower spot inflation does make it easier to meet near term pensions in payment.

Effective solutions to meet ongoing cashflow requirements are of greatest importance to DB pension schemes and the biggest focus of our current work with DB clients.

Members of Defined Contribution (DC) pension schemes have seen the real purchasing power of their pension pots eroded by the inflation surge. As salaries have not kept pace with prices, employees and employers may need to consider increasing their contributions to achieve the same real retirement income, a difficult ask during a cost-of-living crisis.

A gradual return of inflation to the Bank of England’s target of 2% would be very welcome to members of DC schemes. There is a silver lining though. The sharp rise in long-term bond yields that accompanied the inflation surge has significantly raised annuity rates, making them a potentially appealing choice to retirees and those approaching retirement.

The bottom line

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.