Annual private markets outlook: Assessing today’s high-growth and high-income opportunities

Where do investors go to seek sources of high growth and income?

At Russell Investments, our key mission is to help clients prudently fund more liability expense through investment earnings. We do this through our unique open-architecture approach and deep strategic partnerships. As fiduciaries, we have a duty to seek out markets and risk-adjusted returns to help fulfil the promises our clients make. In our view, private ownership as well as the ability to control or influence the performance of assets, remain incredibly powerful tools for introducing sources of high growth and income into portfolios. In a world seemingly in flux, having partners who enable improved access to both assets and general partners (GPs) in a sustainable way, will be as or more important than ever.

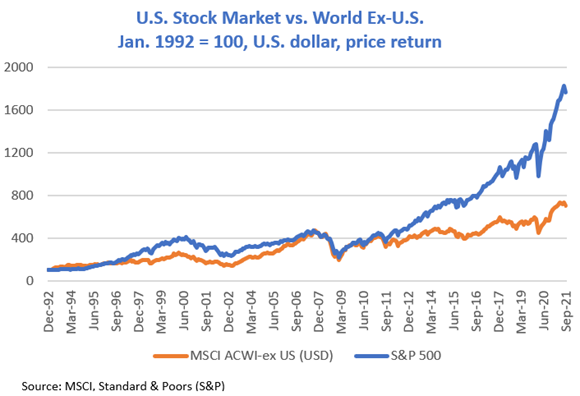

In terms of where to go, we believe we’re entering an environment where investors increasingly need to be considering return sources outside of more traditional markets and well-known centres of private capital formation. With modern interest rates near 40-year lows and valuations of U.S. stocks and bonds in the top decile relative to history, investors should be considering how to add dimensions of diversity. Whether this includes funding future technology champions in Europe, developing growth opportunities in Japan, or supporting energy transition in key markets, there are many ways to be allocating marginal funds.

In concert, we see increased opportunity for small and medium enterprises around the world to grow and scale in markets supportive of private ownership, potentially at the expense of larger multinational peers. For example, throughout recent history, a dominant theme driving high growth simply involved producing where it’s the cheapest and selling where it’s the most expensive (e.g., globalisation), with low regard to externalities. Underpinning this strategy was an idea of the global consumer and the global value chain transcending borders and sovereignty. Whether cyclical or secular, this is changing. One byproduct will be more asynchronous markets based on the competitive arrangement of individual countries, enabling clients to benefit even more from global multi-asset relative value views. A related but latent fact worth noting here, only practising professionals near or well beyond retirement age have set strategies during periods when high inflation did not necessarily correlate to higher growth among OECD countries. So, while perspective is important, it should not be at the expense of a durable business model with aligned partners positioned to take risk over the long-term.

In terms of private markets, in our view, they are as much an arena of strategies versus a collection of asset classes. Where you compete and your sources of advantage, are how you win. While some strategies such as core infrastructure may be conducive to larger GPs, many strategies, particularly those where a rifle-shot approach can be taken to navigate both cycle and value, are also highly attractive. These often involve specialists who have enduring advantages in increasingly localised markets.

More broadly, private markets can also be considered strategies focused on building, buying and using ownership rights to actively manage outcomes (e.g., active ownership). Therefore, an assessment of what should be bought and what should be built is continually relevant. In terms of buying opportunities, significant growth potential still exists in U.S. and non-U.S. developed markets, as well as in places conducive to implementing a sustainable private markets strategy - in other words, places supporting or progressing the advantages of private ownership and strong governance. As a result, we believe existing or new investors to private markets who are working with elite partners and who have the flexibility to pursue varied opportunities across the globe, are in a strong position to win across cycle. In this regard, below is a summary by various segments to help get discussions started:

Private equity

Emergent technologies are impacting every sector and service. A multi-decade trend line has already been established vis-a-vis larger companies outsourcing innovation to private markets including the venture capital community. As compared to prior cycles, the amount of growth captured in private markets is becoming disproportionately higher and only tempered by expanded routes to liquidity. This is due, in-part to companies staying private longer. In addition, as regional and global pressure around competitive dynamics and governance grows, we believe private markets and small / medium sized enterprises are in a position to be key beneficiaries. Whether through increased digitisation of manufacturing or adoption of conversational artificial intelligence (AI), many categories of investment have enormous power to unleash new waves of productivity and help smaller firms scale more profitably.

Private infrastructure

Within unlisted infrastructure, we are focused on building future growth assets or pursuing develop-to-core strategies as compared to buying core assets across many sectors. In less developed markets, there is an acute need to fund critical infrastructure in parallel with a shortage of institutionally viable projects to fund. We believe this will change rapidly in upcoming vintage years. Furthermore, listed infrastructure benchmarks are often highly concentrated in select sectors including utility, power generation as well as oil/gas equipment and services. Expanding the opportunity set to unlisted infrastructure can bring improved diversification as well as more varied exposure to attractive sectors, particularly specific segments of renewables, social infrastructure as well as data infrastructure. Through the benefits of private and active ownership, we believe the ability to take advantage of opportunities related to ESG done correctly, will also improve meaningfully.

Private real estate

Real estate is fundamentally about building or buying. Most real estate is owned in the private market. So, there is a need to understand what is going on in the private market to understand public market real estate. In private markets, investors can improve their ability to tailor real estate exposure based on leverage, development and property type. You have little to no control over leverage when investing in listed assets, a feature which can only be partially compensated through enhanced liquidity. This is important because individual REITs can be structurally incentivised to use higher levels of debt, potentially exposing investors to more financial risk during volatile periods.

Furthermore, a key risk to any strategy involved in building is oversupply. If worried about oversupply in broad segments such as residential, then it’s worth being very worried about other property segments. While there are opportunities to build in residential, particularly in the U.S., investors need to be mindful of the concentration of institutional for-rent capital by market and changing demographics which may lead to dormant supply.

In the non-core arena, developing or building industrial assets in target markets, remains attractive. Buying fully developed and fully leased industrial or multi-family assets at current capitalisation rates with low-cost leverage and marginal rent growth assumptions, is not. Investors do not need to lock up capital for this. In upcoming vintage years, a sector of interest to buy in non-core space includes office. It would not be surprising to see more signs of distress in the office sector once leases start to roll.

Private credit

With few places in the world to seek positive real yields, the drive for high income will continue to support private debt formation and M&A activity.1 The flexibility non-bank lenders extend to a sponsor or borrower to engage a buy-and-build strategy or to fund a complex carveout remains an enduring competitive differentiator. This said, as return is mostly subject to capped upside and unlimited downside (e.g., asymmetric), getting paid for risks taken and achieving requisite diversification is fundamental. With general fixed income markets today harbouring some of the most expensive assets globally, this is not a trivial exercise.

In terms of compensation for risk, relative value analysis should not eclipse absolute value in this environment. Moreover, the chase for yield should not replace a well-developed strategy to fund aligned partners able to selectively source and thoroughly underwrite assets across cycle. Generalist partners with a distinct sourcing advantage or specialists capable of navigating both the momentum and the self-correcting nature of functioning markets are attractive. The latter includes, but is not limited to, GPs focused on technology, agriculture (e.g., food value chain), and other real assets including mineral development.

We also have a belief that attractive high credit or illiquidity premia can be bought in traditional fixed income markets. The perennial challenge is these periods are highly cyclical and can be very difficult for daily or even quarterly liquid vehicles to invest with conviction when it matters. Closed-end vehicles with strong GPs able to directly originate and asset manage credit as well as cyclically supply liquidity during dislocated markets, will have high investment proposition in upcoming vintage years. We also believe there will be select opportunities in an emerging private credit secondary market over time. These features all create an opportunity to enable clients to secularly and tactically harvest credit risk premia.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.

1 In the wake of the Global Financial Crisis (“GFC”), a key threat to executing many private market strategies was availability of debt finance. This is not the case today. Following widespread regulation and the cleansing of traditional deposit-based bank balance sheets, private credit markets and non-bank lenders have grown rapidly over the past ten years. The capacity of non-bank lenders has only expanded via regulated banks extending fund level leverage facilities, which many limited partners (“LPs”) have preferred to help offset higher management fees