Private Markets Outlook: Rapid intensification

In 2024 and beyond, investors will continue to confront rapid change. While change can create challenges, we see opportunities, many of which will be accessible via private equity, venture capital, real assets (e.g., real estate and infrastructure), and private credit strategies.

The result? Clients structurally positioned to fund decisive1 and committed long-term partners with strategic playbooks that recognise we're not going back to a pre-2020 world – can thrive.

What trends are impacting private markets?

While factors being tackled today in private markets are not unique, they are historic. The distinction is not the omnipresence of disruptive factors, it is the speed and global nature at which they will advance. In our view, addressing this rate of change will require a truly long-term mindset as well as a structural ability to take advantage of the interconnected forces shaping both the strategic and tactical investing environments.

These dynamics can, in-part, be seen by comparison of a mid-1950's U.S. short film, The Future is Now, which goes inside government research labs to showcase how society is responding to rapid change from industrial automation to new forms of power generation. The film reinforces the idea of a new revolution in how humans will interact with technology, creating productivity surges and use cases far beyond intended industries. Fast forward ~70 years, advancements are intensifying across the board in areas including artificial intelligence ("AI"), synthetic biology, quantum computing, and energy transition.2 Much of this, especially the earlier phases of growth, will be funded and accessed via private markets.

In this context, resilient asset owners and investors prepared to confront a wide range of investment scenarios and opportunities will be better positioned to help ensure financial security for beneficiaries.

Saver capacity for illiquidity: In scenarios where system-wide liquidity trends down, the advantages of both time horizon and ability to harbor illiquidity clearly go up. A confluence of factors, however, including demographics, dependency ratios, and benefit plan shifts (e.g., employee-directed plans, liability-driven investing, pension risk transfer, etc.) have lowered the savers' capacity to take on illiquidity. While beyond the scope of this outlook, more innovative and structurally sound solutions are in development to address this. In the interim, anything eroding these advantages, such as sell-side expectations, debt maturities, lease rolls, expiry of extension options, political dysfunction, etc., serves up tactical opportunities.

"We can't realize our potential as people or as companies unless we plan (and invest) for the long-term."

Jeff Bezos,

AMAZON AND BLUE ORIGIN FOUNDER

New growth models and the political economy: In comparison to the mid-20th century, investors need to be acutely aware of secular and shared challenges (economic crisis, pandemics, inclusion, climate change, etc.) which are motivating new models of growth alongside hyperawareness of the reserves and location of resources required to fuel this growth.

In tandem, a sustained period appears underway wherein politics drive economics versus the other way around. In the U.S., one look at the growing influence of the Commerce Department supports this statement. While building long-term businesses heavily influenced by any Congressional appropriations process or re-contracting risk is fraught, a legislative mindset shift from government being viewed as a 'provider' to a true 'partner,' may very well be on the horizon. Irrespective, we would argue these shifts are incredibly important to strategy development in terms of what, where and how projects are funded. General partners ("GPs") who are highly skilled in navigating these dynamics and determining where policy results in things being built, should thrive.

At the end of the day, especially in an overtly politicised atmosphere, having trusted partners with an investment-driven non-negotiable fiduciary-first approach will matter more than ever.

A confluence of factors including demographics, dependency ratios, benefit plan shifts, have served to lower the capacity of savers to take on illiquidity.

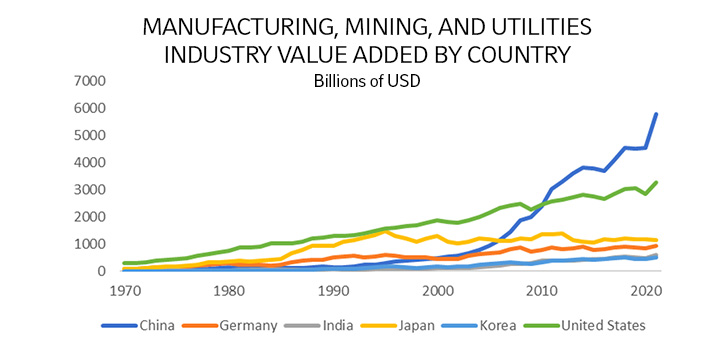

Cooperation and competition: Investors will need to establish long-term strategic goals amidst a historic period in which the world desperately needs cooperation around shared challenges. A reality is that incompatible global systems have developed, which we believe will secularly increase business cycle volatility. Furthermore, if future businesses and services (and growth) are built on digital, energy, and computing power, differing ideologies, governance approaches, and national security issues will only hinder progress. In parallel, efforts are underway to substitute or reshuffle trillions of dollars of manufacturing and processing capacity installed over the past 30+ years, effectively moving production closer to consumption. These forces are at work while civilisation attempts to cooperatively 'reimagine' and decarbonise most every industrial workflow of the past century.

By definition, a growth mindset will view every challenge as an opportunity. While the challenges with cooperation and competition will not be easy to address, the stakes are incredibly high, and private markets can serve as solutions.

The inflationary impulse: In our prior 2019 and 2021 outlooks, we highlighted how high growth and low inflation are much easier to achieve in a world where the dominant theme driving corporate activity is producing where it's the cheapest and selling where it's the most expensive (i.e., globalisation), with little regard to externalities. We're now experiencing a reversal of these trends, which, even on the margin, can produce mixed growth and be inflationary.

While the world desperately needs cooperation around shared challenges, incompatible global systems have developed, which we believe will secularly increase business cycle volatility.

In concert, Western governments will be focused on large deficits combined with competing needs to address contemporary industrial policies, entitlement reform, and defense spending. Global conflicts or the regional expansion of existing conflicts can also impose large costs on countries. Governments are increasingly crowding out funding markets, and the interest rate response should all, in theory, be inflationary as well.

This inflationary undercurrent, along with increased regulatory focus on the stability of banking systems, is likely to lead to much tighter financial conditions than those experienced during past cycles. Amidst this pressure, we anticipate more common sense 'whole-of-government' and public-private sector solutions emerging to meet capital needs.

'De-risking' and internationalisation: Irrespective of any trends around 'de-risking' or 'de-globalisation,' as most private markets strategies are very much the domain of the local market, we see the opportunity set internationalising. For example, the rise of more powerful 'swing' nations, many of which are middle-income countries, will emerge to build the capacity and capability to absorb growth and capital flows in this new world. We see this happening, or at least attempts, alongside new forms of international cooperation, innovative financing schemes, and real potential reforms to multilateral development institutions (e.g., IMF, World Bank, etc.).

It's not unreasonable to expect more capital rotation out of traditional private markets and East Asia, seeking to fund sustainable growth in regions such as the Indo-Pacific, Latin America, the Middle East, and Africa, especially alongside government support.

These regions historically represent less than 5-10% of combined global deal activity; therefore, even a marginal shift would prove meaningful. There are also active efforts to create interoperability amongst future technologies, such as public and private blockchain networks, which could have a huge impact on the transfer and settlement of private assets around the world.3

Politics will be everywhere: By the end of 2024, public policy, both opportunities and risks, for much of the remainder of this decade will start to be priced. The year begins with elections in Taiwan, E.U. parliamentary elections in June, and U.S. elections in November. From AI regulation to the path of contemporary industrial policies, most factors relevant to investment strategy are at play, creating a murky environment for corporate activity.

On this journey, global investors, public and private alike, will need to navigate erratic monetary policy, tax changes, export controls, sanctions, tariffs, investment screening, and more anti-trust scrutiny. Many examples exist, including but not limited to U.S. technology restrictions which should benefit ASEAN countries4; as an export-driven economy, the European Union's ("E.U.") response to China's electronic vehicle ("E.V.") industrial strategy will start to have ripple effects around the globe, and more anti-trust scrutiny on larger private equity transactions and 'roll-up' strategies from the U.S.' Federal Trade Commission ("FTC") and U.K.'s Competition & Markets Authority ("CMA") will influence corporate activity as well.

Regarding monetary policy, while the days of central bank independence5 may or may not be waning, strategy development incorporating 'higher for longer' rates and market conditions devoid of any 'central bank put'6 is justified. Any near-term central bank rate cuts could relieve emerging economies, while any pullback can provide better entry points to capture growth unavailable to public market investors. Latin America is an example. Mexico will be a big beneficiary of supply chain reconfiguration. However, much of the funding has involved Chinese surplus recycling, a feature we see changing in upcoming vintage years and supplanted with institutional private capital.

In our view, these dynamics only enhance the value of general partners ("GPs") with a nuanced understanding of the interconnected forces that lead to good domestic and cross-border investment decisions.

Countries supporting the rule of law and ushering in permitting reform to produce the cheapest and cleanest power supporting manufacturing and the energy transition will attract investment.

Energy security paired with energy transition: One bright spot is advancements in science and technology, which are on track to discovering and commercialising some of the most important new alternative materials, molecules, and production techniques. These, including AI and other emergent technologies, will require affordable energy. While most of this will still involve fossil fuels, there is a growing awareness it does not need to be coal-fired. Shipping raw materials worldwide for processing is carbon-intensive and increases supply chain complexity. As such, most commercially available renewable energy sources are heavily exposed to hardware, materials, and critical minerals susceptible to supply chain disruptions and manufacturing inputs still underpinned by fossil fuels.

This highlights that energy security will accompany any energy transition. Countries that support the rule of law, have effective ESG characteristics, and usher in permitting reform to produce the cheapest and cleanest power supporting manufacturing and the energy transition will attract investment. In the long term, more international coalitions to support transportation assets and power development via ammonia, hydrogen, fusion, small modular nuclear, and space-based solar will provide additional opportunities for public-private investment.

Cyber resilience: A perpetual theme and critical need will be cyber resilience. In connection with a historic number of general/parliamentary elections in 2024 and elevated geopolitical tensions, cybersecurity, and national security will be front and center. Associated demand and funding support for cyber-resilience will only grow and evolve. With the latter, 'quantum preparedness' will become more visible, progressively drawing more attention and investment activity, particularly with standards for 'quantum-resistant algorithms' being released in the U.S. in 2024 for full-scale enterprise implementation by, at the latest, 2030.

What about private markets in 2024 and beyond?

A key takeaway is that winners and losers begin to shake loose materially, driving partner selection spreads across all strategies. Strategically, in this new world under development, the concurrent value of active ownership in private markets, trading strategies in semi-liquid vehicles, and insight from global multi-asset relative value views will grow meaningfully.

In the tactical realm, portfolio company exit activity will be highly geared to the path of interest rates in 2024 and beyond. While most of the market will focus on central bank-driven 'soft' or 'hard landing' scenarios, we see outside shocks or what economists call exogenous factors, with as much or more risk of knocking economies off track. For example, early signals have already emerged via conflicts around key shipping chokepoints, notably the Suez Canal and the Bab el-Mandeb Strait. Events here and in other parts of the maritime domain could have material impact on inventory availability as well as durable goods inflation. Even within the U.S., threats from labour could surface and have transitory impact as the current contract for East and Gulf coast dockworkers is set to expire in October 2024, conveniently before federal and state elections take place.

So, irrespective of whether consumer spending outperforms, outsized allocations to more flexible and opportunistic / solution-oriented strategies still make a lot of sense. We also see a resurgence of trading strategies offered by sponsors (i.e., not hedge funds) with an advantaged view on enterprise values coming to market in semi-liquid vehicles, delivering more ways to harvest tactical volatility.

A key takeaway is we see winners and losers beginning to shake loose in a material way, driving partner selection spreads wider across all strategies.

Strategy breakdown

We still believe private investments should be viewed as long-term strategies focused on building, buying, and using ownership rights to manage outcomes actively. As highlighted in our 2023 outlook, while an elongated period of low-interest rates and allowance for financial engineering (e.g., dividend recapitalizations, etc.) have served capital owners well, different tactics will be required to drive high growth this cycle. Again, high CapEx and development will be needed to future-proof assets, create resiliency, and carry on building what is needed in the latter half of this decade. Private markets can answer the call; although, in a more supply-constrained secular environment, M&A activity and consolidation or 'roll-up' strategies do not necessarily create new supply. These strategies can also measurably concentrate the benefits of ownership throughout an economy. With these considerations in mind, below are comments by key segments of private capital to help keep discussions going:

Venture capital: Venture investors will continue to find opportunities and improved entry points into category-leading technology and life sciences companies, notably at earlier stages and selectively in later stages. We also expect venture funding to continue to expand throughout middle-income countries, especially in fintech.

Following the "SaaSacre,"7 of 2022 and 2023, revenue durability and technology longevity expectations have already reset. In tandem, every business and industry group is figuring out what A.I. means to them. So, while I.T. budgets may not expand, they are expected to be redirected, offering exposure to more revenue growth outside of dominant publicly traded peers.

The breakout growers in 2023 were hardware-related and involved raw computing (e.g., Nvidia, data centers, hyperscalers). The enduring businesses in the 'picks-and-shovels' application layer or software development have yet to be determined. For some, architecting software around these new use cases in data will be easier and very hard for others. This is the opportunity. Our partners see revenue and multiple expansions coming from those companies aligning generative models with massively productive workflows for the enterprise ("B2B"), which will then be extended into consumers ("B2C").

Going forward, we anticipate tighter fundraising markets will offer more opportunities for committed long-term asset owners to partner with some of the world's smartest investors and entrepreneurs. Given the technical complexity of what is coming, this reinforces the need for allocators to be focused on making bets on highly aligned partners with clear succession plans and well-funded business models focused on excellence.

Private equity: In private equity, reindustrialisation, energy transition, supply chain resilience, and strategies at the intersection of government-private sectors and the food value chain remain attractive to us. Any pullback in capital markets will increase opportunity across private market strategies, including taking public companies private and funding corporate carveouts. In scenarios where M&A and corporate activity remain muted, we could see heightened intra-activity within the sponsor market or what the industry often calls 'secondary buyouts.' So, where portfolios are positioned within what we call the 'P.E. value chain' will likely matter more in upcoming vintages.

For control-equity strategies (e.g., buyout transactions), higher-for-longer rates bear weight on traditional buyout models, reducing return expectations and driving future restructuring demand over time. With two foundational contributors to buyout transaction volume in flux (cost of financing and multiple expansion), taking a rifle shot approach, funding specialist managers who can develop a point of view on areas that matter will be in a strong position to win. It's worth noting buyout strategies as a percentage of total private market investing have declined from over 50% at the time of the Global Financial Crisis ("GFC") to under 35% today, reflecting the breadth of opportunity in play and the benefits of multi-strategy private markets investing.

Irrespective of whether consumer spending outperforms, outsized allocations to more flexible and opportunistic / solutions-oriented strategies still make a lot of sense.

Real estate: Three years removed from the onset of the COVID pandemic, the property sector and broader built environment offer one of the more strategically rich periods for investors in quite some time. The unique characteristics of local markets in developing and developed economies are spawning more situations to address debt, bank balance sheets, obsolescence, reshoring activity, and sector-specific development responsibly. In the near term, the balance between any financial and asset management challenges within existing portfolios will continue to be a central area of focus in 2024 and beyond, all serving up opportunities, with the main exception being China.

Despite recent financial easing, private portfolios with any concentrated near-term catalysts are being tested. Commercial real estate values have yet to bottom out, and gridlock between buyers and sellers will be addressed, in part, via debt maturities. For example, while pricing in European property markets has adjusted much faster than in the U.S., opportunistic returns may be available as values remain weak and credit conditions are tight. European property markets are much more heavily banked, with no real CMBS market. If banks retrench further and leverage declines, European equity values may still disproportionately suffer, creating opportunities for those with ample dry powder.

Within the U.S., the spread between capitalisation rates and 10-year Treasuries remains historically low, with many dependent on near-term dovish interest rate policies to help unlock transaction volume. Tight bank credit, however, paired with resilient fundamentals in leasing and income growth across markets ex-office, will give rise to the benefits of real estate debt solutions, including distressed debt and opportunistic CMBS strategies.

Infrastructure: Most of the cash flows associated with private infrastructure-oriented strategies have inflation linkages, a feature we see continuing to drive secular investor attention. Specific categories continue to need private capital, including secure data themes (secular rise in traffic via mobile, IoT, AI, and cloud), defensible energy transition (global policy priorities), and transportation innovation (modes disrupted but not displaced). There is an ongoing need for quality upgrades and more supply in all these spheres, and governments and corporates will need to seek financial solutions as debt costs rise.

Concerning energy transition, this theme encompasses one of the most important secular areas for private capital mobilisation. As the base material for the bulk of the world's industry and petrochemicals, energy impacts every economic sector and region. However, the U.S. is only one of a handful of countries even positioned to be able to substitute mass fossil fuel usage at scale. Australia is another. As noted earlier, this environment imposes a more pragmatic debate, pairing energy transition with energy security. We believe this will add momentum for countries to take a more realistic approach to accelerate the movement toward a more stable and hopefully cleaner energy future.

Private credit: Being first in line to access free cash flow to the firm ("FCFF") remains attractive. Since much of the private credit market is floating rate, higher base rates mean lenders will continue to absorb more cash flow. High funding levels in the non-bank lending market and competition suggest more of a floor behind transaction volumes this cycle but at a higher cost, benefitting direct originators.

While our prior year views still apply, strategies focused on originating facilities backed by assets (e.g., asset-backed and asset-based) continue to be as or more attractive relative to those supported by broader enterprise operating income or EBITDA (e.g., cash flow lending). Tighter financing conditions and bank consolidation will sustain origination opportunities in non-sponsored lending as well, notably as demand for capital to expand manufacturing capacity and fund critical rolling stock increases. We are leery of certain strategies' uses and productive capacity, including NAV-based financing, which currently represents a small minority of lending volume but could become more pervasive. Conversely, the investment proposition of opportunistic credit strategies with the ability to toggle relative value between cheaper public securities and direct origination continues to be high.

On the heels of large bank failures in 2023 and in an election year, concerns over the size of the non-bank lending market and calls for increased regulatory scrutiny will loom larger. It's worth appreciating much of the funding for private credit is via unleveraged balance sheets with locked-up capital as opposed to levered bank balance sheets backed by on-demand commercial deposits.8 The private credit market, though, in its current form, has not been tested through an extended period of defaults. In addition, we would not be surprised for the market to wrestle with prospects of tax policy change, particularly any impacting incentives around originating debt versus equity.

The result is that the value in partner selection and the potential for outperformance tied to strategic decision-making goes up from here.

Secondary strategies: Given dry powder levels, the 'secondary market' for private funds and assets will be available to provide investors with liquidity solutions at better pricing. For existing investors, selectively selling less strategic legacy positions, specifically to increase flexibility and capital availability for fresh commitments, can still make a lot of sense. Following a historic move in interest rates, more programmatic selling of private market portfolios due to liability management exercises and pension risk transfer, can also present opportunities to buy, especially in real assets.

It's worth noting that the rapid advent of GP-led continuation vehicles is enabling sponsors to spin out individual assets into fresh long-term entities and reset incentive economics, which continues to be an opportunity and an area to pay close attention to. The GP-led continuation market is as large as the entire private equity secondary market coming out of the GFC. Increased GP-led transaction activity may hollow out value drivers in legacy portfolios, particularly with any looming 'PE maturity wall.'9 While an extreme example, this could be analogous to a mall investor targeting value creation in B-rated assets in secondary or tertiary markets. This is not easy even with heavily discounted pricing, especially with lower availability and higher leverage costs. Investors indiscriminately using secondary markets simply to mute 'j-curves'10 could run into some challenges.

Summary

In 2024 and beyond, asset owners and investors will continue to confront a dynamic landscape shaped by rapid technological advancements, geopolitical shifts, and often erratic market environments. Those prepared for a range of scenarios, attuned to interconnected market forces, and able to navigate a complex terrain alongside trusted, long-term partners are not only positioned to help beneficiaries thrive, they can contribute meaningfully to funding the future. As finance is a key instrument of growth, it is imperative to get this right. Let's get after it.

1 Decisiveness, by definition, involves making decisions quickly and confidently. In theory, the larger and/or more bureaucratic the entity, the harder it can be to make fast decisions. As uncertainty goes up, the harder it is to make high confidence long-term decisions. In recent media, Jeff Bezos identified 'decisiveness' as the key driver of future success across the enterprise. He categorises decisions into two types, one-way door and two-way door decisions. One-way door decisions are consequential, difficult to reverse, and should be made methodically. Two-way door decisions can be reversed and should be made quickly by highly skilled individuals or small groups.

2 A worthwhile treatise detailing related trends here is Mustafa Suleyman's recent book, The Coming Wave.

3 For example, the Society for Worldwide Interbank Financial Settlements ("SWIFT") announced in 2023 plans to explore using existing Swift infrastructure to make interoperable with public and private blockchains around the world.

4 Association of Southeast Asian Nations ("ASEAN"). A collection of ten member nations for which Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam are the most influential. https://en.wikipedia.org/wiki/ASEAN

5 Central Bank Independence ("CBI"): The degree of autonomy and freedom from political influence a central bank has to conduct monetary policy and manage the financial system. The concept emerged in the late 20th century with the core idea that central banks should be free to make monetary policy decisions unobstructed by shorter-term political considerations. https://en.wikipedia.org/wiki/Central_bank_independence

6 A 'central bank put' is a practice where a central bank sets up an effective floor under prices of assets by offering to buy them from the private sector with no obligation from the seller to share in losses. A 'central bank put' is one tool monetary authorities can use to calm an unstable financial market. The 'put' can be effective as long as this does not destroy confidence or disrupt the value of currency (i.e., debasement). https://en.wikipedia.org/wiki/Central_bank_put

7 "SaaSacre" attribution credit to Bessemer Ventures.

8 A less obvious area taking shape is regulatory scrutiny for private equity owned insurers and the impact of private credit allocations on claims-paying abilities. Reference AG 53 adopted in 2022. As or more important, the Financial Stability Task Force and its Macroprudential Working Group in the U.S. is actively reviewing regulatory considerations for private equity owned insurers, the role of asset managers more generally in insurance, and the increase in private investments in insurers' portfolios.

9 As funds launched during 2013 to 2018+ vintages approach their full fund term and if the amount of unrealized NAV in portfolios continues to increase, GP's will increasingly demand more solutions.

10 J-curve is a concept illustrating negative cash flows which can occur in the early years of a closed end fund partnership as the upfront costs related to acquiring portfolio companies or assets and other expenses are incurred. As the partnership assets increase in value, the cash flows and net asset value ("NAV") profile of partnership improves. 'J-curve' comes from the graphical representation of a closed ended partnership cash flow profile which resembles a "J" when plotted.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.