Selecting good managers is hard. Managing portfolios of good managers is even harder. Completion portfolios can help.

Executive summary:

- Completion portfolios address several key risks, including misalignments between active managers' portfolios and portfolio managers' preferred risk positioning

- Selecting the best managers, managing unintended biases and leaning into opportunities make completion portfolios an extremely important tool

- Completion portfolios provide not only important sources of exposure and risk management, but also contribute positively to fund performance

In a previous article, we highlighted the benefits of completion portfolios, a critical tool for asset owners. When allocating capital to multiple managers, completion portfolios provide customized exposures to help manage unintended risks due to underlying manager bias and align the total portfolio to the investors' preferred positioning.

Specifically, we highlighted four ways to use completion portfolios:

- Better management of factor and portfolio risks

- Gaining efficient access to desirable risk premia

- Unshackling portfolio managers to focus on opportunities for alpha

- Opportunistic allocations

In this blog post, we provide a case study in the form of a real-world completion portfolio used in multiple global equity funds at Russell Investments. Here, we examine how the approach enhances the total portfolio outcome according to each of the four use cases.

The backdrop

Russell Investments' family of global equity funds (the funds) employ a multi-manager, multi-style approach typical among institutional investors and asset owners. Focusing on the three-year period from 2020 to 2022, which includes multiple different market crises with bull and bear market regimes, the funds' portfolio managers (PMs) have made use of two distinct strategies to serve as completion portfolios: quality income and U.S. defensive value.

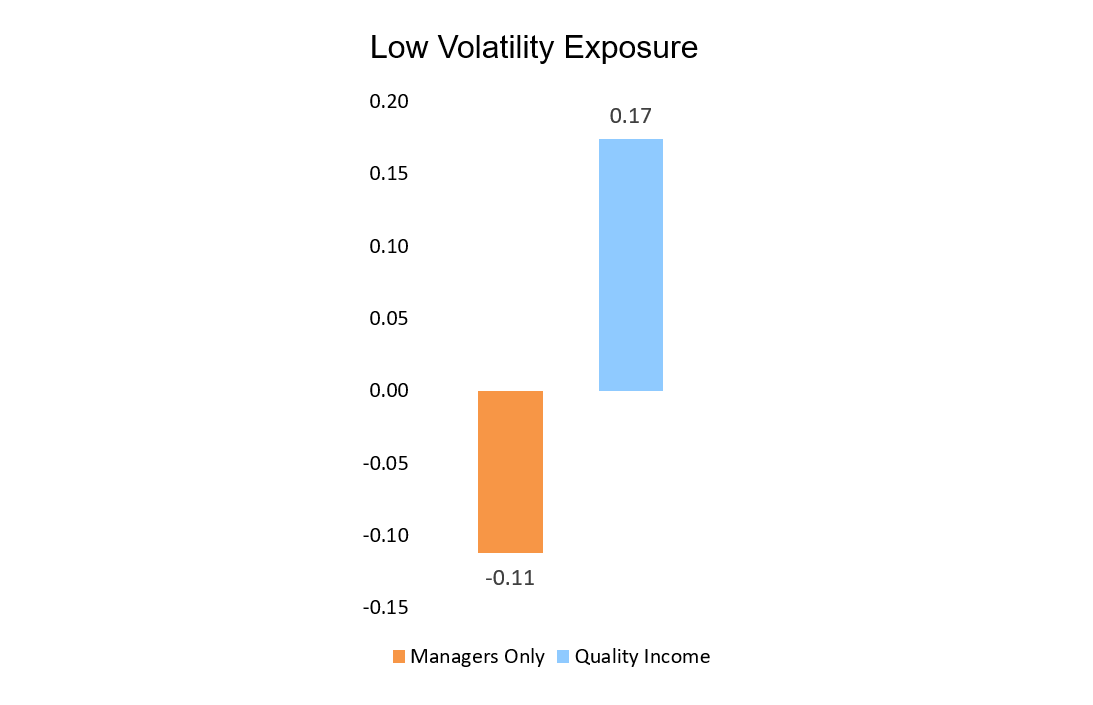

- Quality income: Similar to how a ship uses ballast to steady itself in heavy seas, quality income serves a comparable purpose within the funds. Using a systematic approach, quality income focuses on companies with strong balance sheets, a history of dividends, and lower volatility that provides an important source of yield on an ongoing basis and delivers meaningful defense in periods of high volatility.

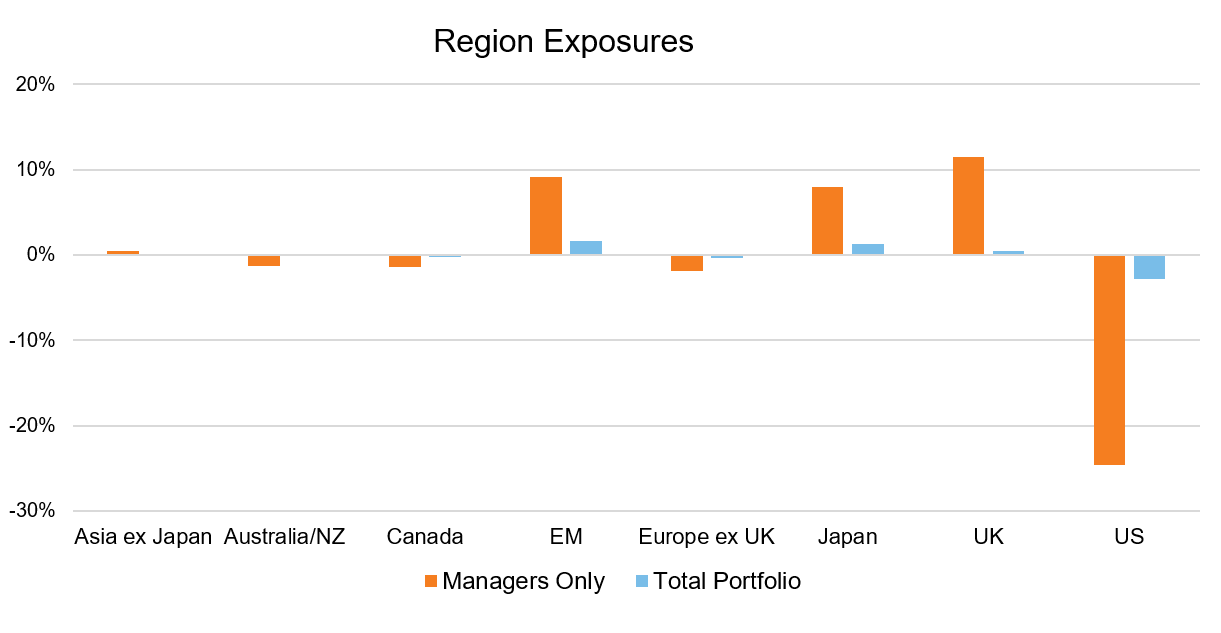

- U.S. defensive value: The funds' underlying managers are meaningfully underweight the U.S., causing an unintended bias at the total portfolio level. To help address this, the portfolio managers sought to offset this underweight with a U.S.-specific portfolio. In addition, value as a factor has been at historically cheap levels relative to growth in the U.S. Finally, a need for lower volatility was expressed to help offset the exposures of the other sub-advisors. A U.S. defensive value factor portfolio was constructed to address this need.

Better management of factor and portfolio risks

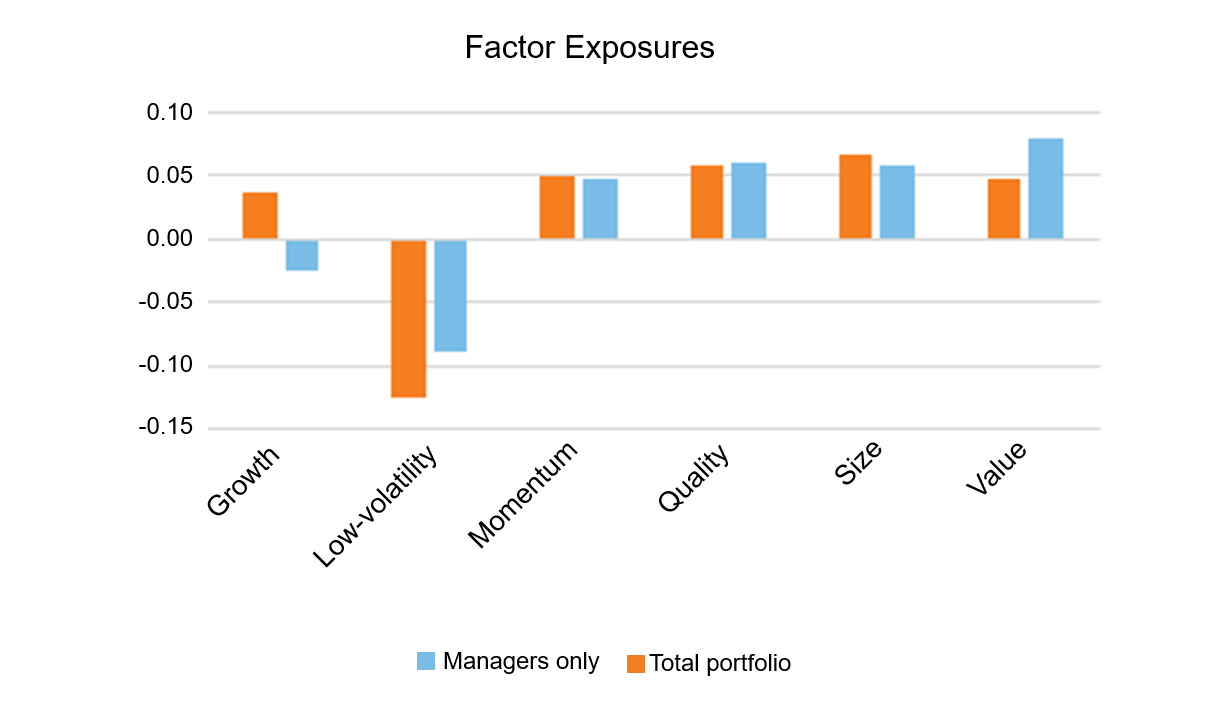

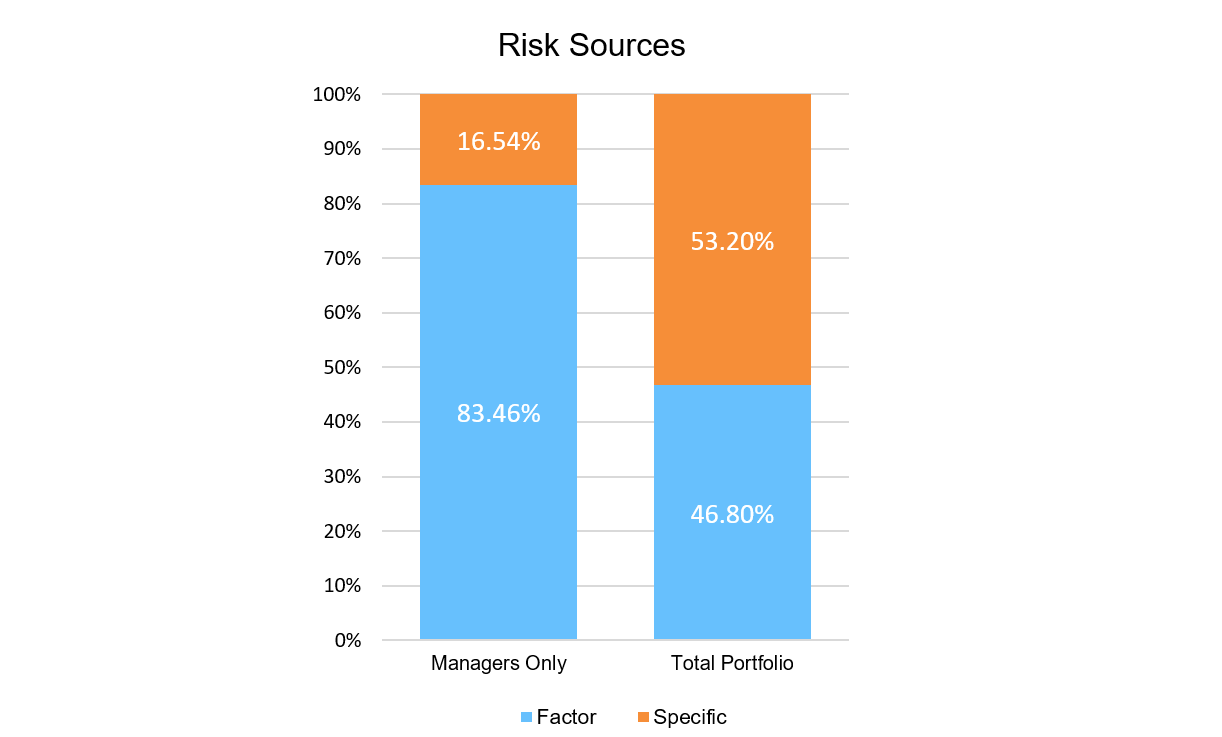

By incorporating both of these strategies, the resulting completion portfolio addresses several key risks, misalignments between the active manager's portfolios, and the PMs' preferred risk positioning. At the total portfolio level, through the completion portfolio, the funds' overall positioning was addressed in three key ways:

- Low-volatility exposure was significantly improved, moving exposure closer to the benchmark.

- Gaps in U.S. regional exposure underweights were addressed.

- Within the U.S., important factor needs desired by the PMs were filled.

Source: Russell Investments

Click image to enlarge

Source: Russell Investments

Click image to enlarge

Click image to enlarge

Source: Russell Investments

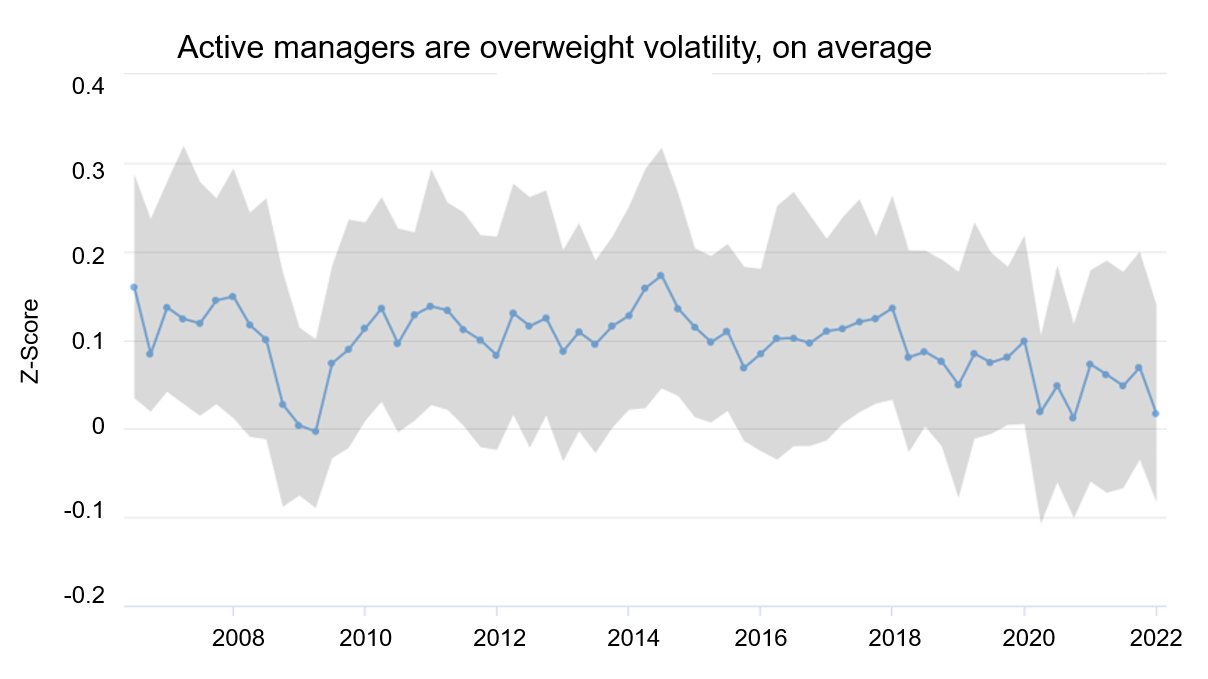

Gaining efficient access to desirable risk premia

Both quality income and U.S. defensive value provide access to risk premia that the funds' PMs desire at the total portfolio level. Active managers have a structural bias toward high-volatility exposures. We identify this bias through our manager research universe datasets dated back to 2001. As discussed in a prior blog post, 75% or more of active managers are overweight this risk factor during many periods. Furthermore, the volatility risk factor has a persistent negative contribution to returns. Because of this, low-volatility exposure has been empirically proven to be an important contributor to improved risk-adjusted returns in a total portfolio by compensating for this risk bias in active managers.

Click image to enlarge

Source: Russell Investments manager research database, March 2022

Click image to enlarge

Source: Axioma Fundamental Risk Model 12/31/2022

As previously noted, quality income provides important levels of defensiveness across multiple dimensions to provide downside protection during periods of market stress. Value is a well-known and documented risk premium. In this case, the funds' PMs sought to increase exposure to value specifically in the U.S., as it had become historically cheap relative to the growth factor and the funds' subadvisors were not allocated here.

Unshackling portfolio managers to focus on opportunities for alpha

The quality income and U.S. defensive value portfolios allow the funds' PMs to deploy capital to high conviction, bottom-up stock pickers without the need to sacrifice alpha potential. In this case, PMs were able to use high tracking error, concentrated strategies, knowing that the completion portfolios would fill the exposure gaps such as low volatility and quality.

Click image to enlarge

Source: Russell Investments

Opportunistic allocations

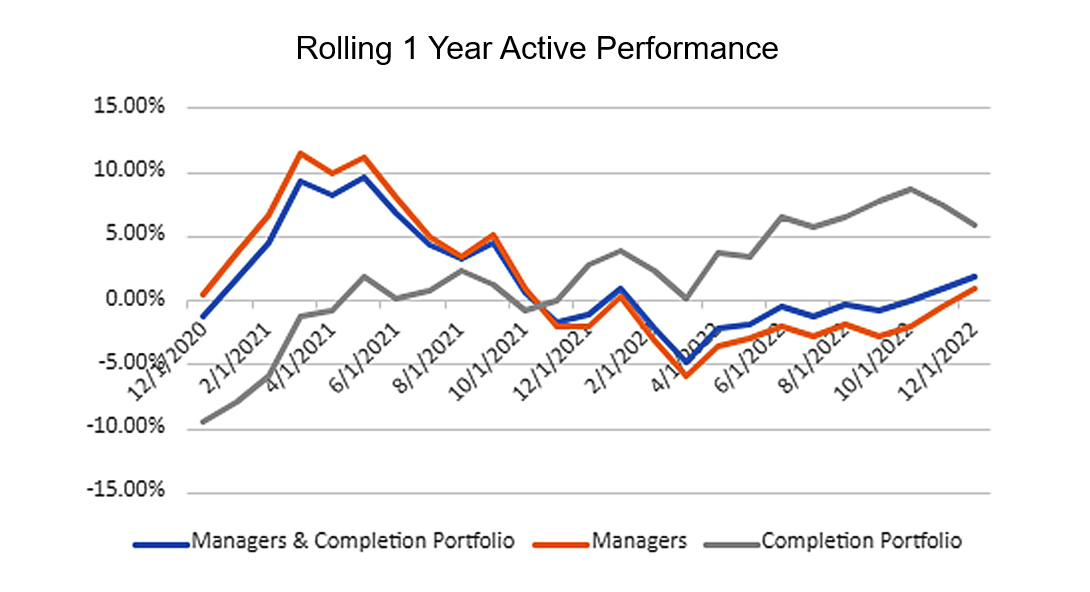

As the COVID-19 pandemic caused historical extremes in the expensiveness of growth stocks relative to the cheapness of value stocks, having access to the U.S. defensive value portfolio allowed the funds' PMs to lean into this exposure as it became more and more attractive. Furthermore, as the rampant speculation that marked 2021 came to a close, and we entered 2022, PMs saw defensiveness as a critically needed exposure. By opportunistically allocating to both strategies, the PMs were able to meaningfully improve risk and return as market dynamics played out.

Putting it all together

The exhibit below tells the story. In the past three years, the completion portfolios have contributed positively to excess return of the fund. Notably, during the selloff that occurred in 2022, the completion portfolio's combined outperformance versus the benchmark was 5.90%. In addition, the funds' tracking error was reduced by 68 basis points (bps), meaningfully improving the fund's risk adjusted excess returns. The information ratio for the fund with a completion portfolio was 0.42 during 2022 (1.89% excess, 4.49% TE), as compared to the managers alone, which was 0.19 (0.96% excess, 5.17% TE).

| 2022 | Managers alone | Managers and Completion Portfolio |

| Excess return | 0.96 | 1.89 |

| Tracking error | 5.17 | 4.49 |

| Information ratio | 0.19 | 0.42 |

During the three-year period of 2020-2022—which saw a pandemic-induced selloff, a reopening and vaccine rally and another market selloff in the face of rising inflation and interest rates—the completion portfolio gave our PMs an important lever to manage the funds' overall risk profile. While the value-oriented exposure of the completion portfolio faced headwinds during 2020, ultimately, amid three years of rapidly changing market dynamics, the completion portfolio contributed positively to the fund's excess return outcomes. Even more importantly, it provided a diversifying exposure to the active managers and helped reduce overall tracking error, ultimately delivering better outcomes to clients with a smoother risk and return pattern.

Click image to enlarge

Source: Russell Investments

At Russell Investments, our long history of quantitative research and funds management has shown the importance of owning the total portfolio outcome. Selecting the best managers, managing unintended biases and leaning into opportunities make completion portfolios an extremely important tool for the investor. Based on this real-world example, we can see that completion portfolios provide not only important sources of exposure and risk management but also contribute positively to fund performance.