Healthcare and hospital systems

Decades of institutional leadership drive every product and service.

Hospitals and healthcare systems have trusted us for almost 40 years to ensure their investment programs are aligned with their financial objectives.

We offer comprehensive investment solutions for long-term or operating pools, defined benefit and contribution plans, foundation, and insurance assets.

Our services include outsourced CIO (OCIO) solutions and custom investment solutions such as consulting, dynamic, multi-asset class investment management, and implementation services for healthcare organizations of all sizes and levels of complexity.

Solutions and capabilities for healthcare systems

You can count on these guiding principles that underline our investment approach

Investment discipline

We use a research-driven investing approach free from emotional and behavioral biases. Our investment strategy involves:

- Evaluating a wide range of investment opportunities.

- Identifying areas where potential returns are greatest.

- Maintaining strict investment disciplines to ensure your portfolio remains stable and balanced.

Open architecture

No single asset manager can do it all. We leverage our industry manager research to find the asset managers we believe to be among the best in the world. Then, we incorporate them into a portfolio designed to meet your risk and return requirements.

Outcome-oriented investing

It's not enough to beat benchmark returns. We start with understanding your objectives and then design an investment solution tailored to meet your goals.

Dynamic portfolio management

Our investment capabilities empower us to respond quickly to market changes. Timing and efficient implementation are crucial, and every basis point matters.

Cost-efficient approach

Our investment solutions are designed to help you increase returns and reduce risk, all while staying within your fee budget. We utilize our scale, purchasing power, and access to help you achieve your goals.

Effective risk management

It's critical to "know what you own" before making changes to your investment portfolio. We leverage our advanced software and tools to help manage risk and reduce unexpected outcomes.

We are proud to be globally recognized for excellence in the investment industry

Russell Investments was ranked as the largest global manager of Healthcare outsourced assets, out of 26 firms, in CIO Magazine’s “2024 Outsourced-Chief Investments Officer (OCIO) Survey,” based on the AUM from its fully discretionary clients (as of December 31, 2023).1

Russell Investments' multi-asset approach is core to what we deliver to our OCIO clients.

Multi-asset investing is the process of incorporating exposures to a globally diverse mix of asset classes and dynamically managing those exposures to capture short-term market opportunities and mitigate risks. We integrate this approach into every outsourced CIO solution we build for our clients.

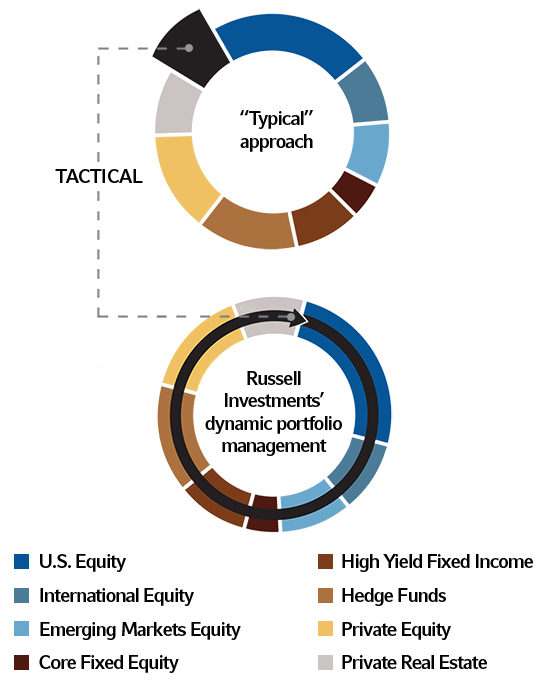

Below illustrates a typical approach and Russell Investments' multi-asset approach. We believe this is what makes us a best-in-class solution, a cut above the rest.

The "typical" portfolio shown is constructed using sleeves for individual asset classes combined with an additional tactical sleeve bolted onto the portfolio. In this type of portfolio construction, each sleeve is managed separately, and the tactical sleeve is applied without considering the managers' current position and risk budget in each asset class sleeve.

In Russell Investments' multi-asset approach shown, the decision about what tactical shifts to make is informed by the underlying holdings of the managers and strategies, plus the risk budget of the total portfolio and the shifts in the market. This approach gives our portfolio managers greater flexibility to adapt the portfolio to short-term market shifts to help retain long-term return potential.

This approach requires the skills of a team of full-time, dedicated and experienced investment professionals, and this capability is built into every OCIO solution we offer to our clients.

Webinar recording

A conversation with Alfred Salvato, SVP and CIO

Alfred Salvato, SVP and CIO at Thomas Jefferson University Hospitals (Jefferson Health) joined us to discuss how Al implemented an integrated risk framework across TJU’s balance sheet assets to align the investment risk positioning with expected capital needs over the short, medium, and long term.

A Guidebook for Healthcare Systems

We created the Healthcare Fiduciary's Guidebook as a step-by-step guide for non-profit hospitals and healthcare systems to provide a fiduciary roadmap to help you simplify your complex investment programs.

Partner with us

Get in touch with us through this form, and we'll reach out to you.

Lisa Schneider, CFA

Managing Director,

Market Leadership

855-771-2966