Fact vs. feeling: Retirement confidence is at an all-time high. Should it be?

A close colleague of mine, financial author Tim Noonan, likes to say, “Financial security is a fact, not a feeling.”Based on a recent study about financial security in retirement, Tim’s saying is truer than ever.

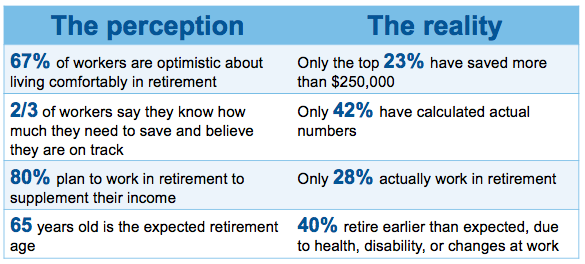

According to the 2019 Employee Benefit Research Institute’s annual report, 67% of workers are optimistic about their ability to live comfortably in retirement. According to Craig Copeland, a senior research associate at EBRI, that’s close to an all-time high.

This optimistic trend is no surprise, given our current bull-market run. But is it good news that workers feel so confident? Or is it proof that Nate Silver is right—that the gap between what we actually know—how prepared we really are—and what we think we know—how prepared we think we are—is widening?

Let’s crunch some numbers. And in the midst of our concerns, let’s offer some positive solutions that advisors can bring to the situation.

Source: EBRI/Greenwald Retirement Confidence Survey ©2019

According to the EBRI study, the top quartile of savers—23%—said they’ve saved $250,000 or more. As an advisor who knows how expensive retirement really is, does this sound like good news? Even if it does, consider this: The bottom 40% of the workers reported that the total value of their savings, excluding home equity, is below $25,000.

Other findings paint a similarly troubling picture. According to a 2019 Transamerica study, the median Generation X worker—born between 1965 and 1980—has saved a total of $66,000 in all household retirement accounts.

The EBRI also points toward a concerning knowledge gap: While two in three workers are confident they are doing a good job saving for retirement and know how much they will need to have saved to live comfortably, only 42% have actually tried to calculate how much money they will need.

One of the likely reasons for this overconfidence is that many future retirees plan on supplementing their retirement income with a paycheck. The EBRI study says that eight in 10 workers think they will work for pay in retirement. But, based on retiree experiences, only 28% actually do. Workers are also three times as likely to say they expect working for pay to be a source of income in retirement, compared with just one in four retirees who receive income from this.

What about simply working longer? EBRI tells us that many workers expect to retire fully at 65 years old, but in reality, more than four in 10 retired earlier than they expected—most often because of a health problem or disability or changes within their organization. Workers may not be anticipating circumstances out of their control that can cause early retirement.

None of this is a surprise to us and is likely not a surprise to experienced advisors, either. One of the behavioral investing biases that we see investors struggle with is the bias of overconfidence. Investors tend to over-estimate or exaggerate their ability and expertise. In other words, they tend to believe they are experts when they are not. When it comes to managing their portfolios, their belief in their ability to time the market, for example, may cause them to trade too often or at the precisely wrong time. And when it comes to funding their retirement, this research shows that many investors are dangerously overconfident there as well.

Three simple ways advisors can make a difference

For skilled advisors, the enthusiasm shown in this study can be put to good use. When your clients and prospects are enthusiastic and engaged, it’s your job to leverage that enthusiasm to ensure their actions are aligned with their desired outcomes. Here are three strategies that can help:

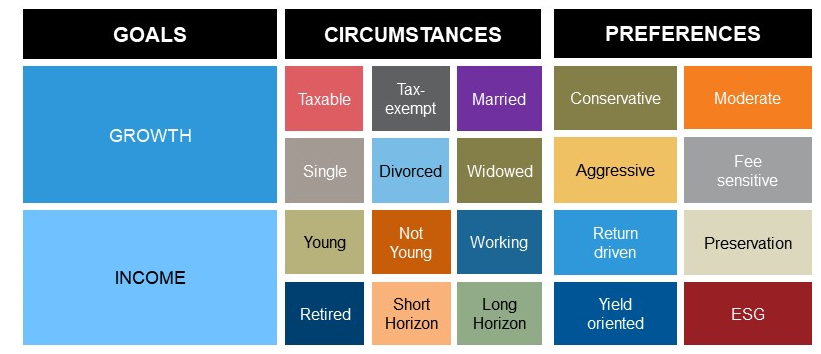

- Nail down the Goals, Circumstances and Preferences. Retirement planning is more than just a number. Make sure you and your client are both crystal clear on their Goals, Circumstances and Preferences (GCP). While their goal may be reaching a well-funded retirement by age 60, with a preference for low-risk, the circumstance of a recent divorce and two kids in college may complicate matters. Using the chart below, take some time to explain briefly what GCP are. Give some examples and explain how they form the basis of an outcome-oriented portfolio that is tailored to your client. Without knowledge of your client’s GCP details, how can you claim to be structuring an outcome-oriented solution for their needs?

Click to enlarge - Have the tough conversations. Some of your clients are NOT on track. Many investors, as the EBRI stats show, simply don’t know. Your first—and arguably most powerful—value-add is in giving your clients clarity on where they stand. Your job is to be clear with them. This is about more than simply listening and engaging. This is a clear, direct, numbers-driven conversation: “Susan, based on your current portfolio, your current contribution rate, and your retirement goals, we have a problem and it’s time to make some tough decisions. You’re either going to need to contribute more now, retire later, take on more risk, or spend less in retirement.” There are really only a few levers that you, as an advisor, can provide to your clients. But the longer you wait, the harder the conversations will be. Don’t wait. They might not thank you for it now—but they sure will when they’ve had time to digest the alternatives. They’ll thank you again in the future, when they’ve reached their goals under your careful guidance.

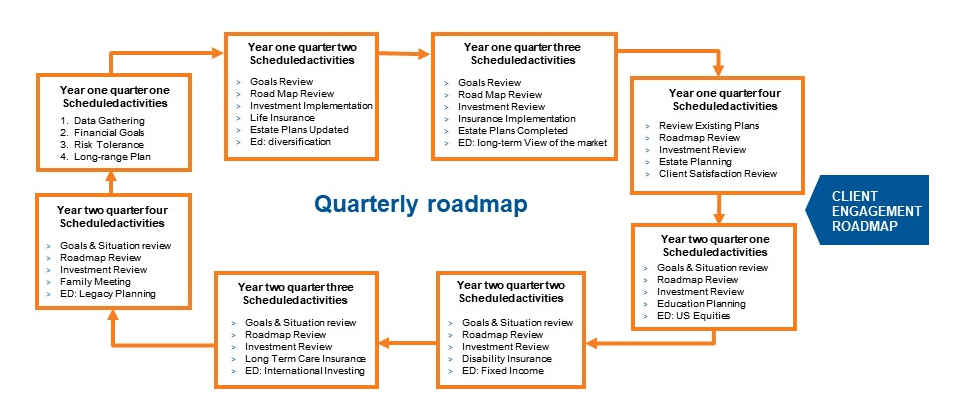

- Map your engagement. We’ve talked about this before and I’m sure we’ll talk about it again. Because it’s one thing to know your desired outcome. And it’s great that you’ve had the tough conversation with your clients that need to make serious adjustments. But one of your biggest challenges as a financial professional is to help your clients stay focused and on course. This is why we advocate a Client Engagement Road Map. The Client Engagement Road Map positions you as the coordinator of your clients' multi-faceted financial affairs. It helps you articulate and illustrate the value you deliver. It provides an ongoing reality check, hopefully making those tough conversations a thing of the past. Ask your Russell Investments representative for access to this easy-to-use tool.

Click to enlarge

The bottom line

Always remember the point Tim Noonan made with his quote. Instead of feeling good about financial security, it’s vastly better if your clients are actually and factually financially secure. It’s your job, as their advisor, to help them get there.