30 trillion reasons why we believe advisors should talk to women

I’ve been in the financial services industry for 19 years so I’m well aware of the value an advisor can provide to an investor. My husband and I have advisors we independently work with, but decided we needed a local one we could work with together to guide us on our family’s investment journey.

Since I work in the Milwaukee area, I had a few advisor names come to mind I thought could be a good fit. We picked one and we seemed to click at our initial meeting. Unfortunately, the advisor made one big mistake: he only followed up on our conversation with my husband. I was completely left out.

As Kenny Rogers once sang: “You gotta know when to hold ‘em, know when to fold ‘em. Know when to walk away and know when to run. You never count your money when you’re sitting at the table. There’ll be time enough for countin’ when the deal is done."

Our search for a financial advisor who would incorporate both of our thoughts, priorities and preferences didn’t play out as we hoped, and we walked away. One financial advisor’s misstep is another’s gain, I guess.

As a woman, I’ve felt this inequality in other areas of sales and finance all the time. It happens when you walk onto a car sales lot or when you apply for a home loan. I can’t tell you how much this resonates with other women. We often end up in stitches, laughing after we’ve gotten over the initial sting of the situation itself. Little do those car salespeople know, I can be ruthless when negotiating a car purchase.

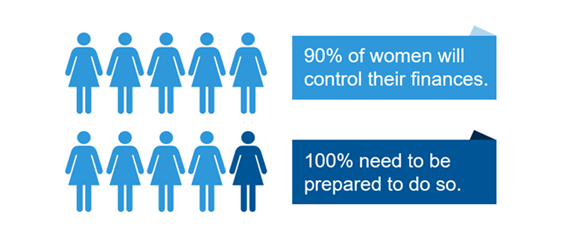

It’s been almost 50 years since the Equal Credit Opportunity Act passed. At this point, it’s become an archaic stereotype to think that the men in the investment conversations would be the ones to make all the finance and investment decisions. Whether women earn the money or inherit it – 90% of women will control their finances at some point in their lives.

Women will manage their investments: Whether they earn, marry, divorce, inherit or outlive it

Source: National Center for Women and Retirement Research, referenced in “Investing Wisely: What Women Need to Know” by Kathleen Williams April 24, 2011. www.womensmedia.com

Moreover, studies show that women will control $30 trillion in wealth by 20301. That’s a lot of money at stake. How are you, as an advisor, positioning yourself to attract female investment clients and build a connection with them?

Word to the wise: Never underestimate any of the players at the table, especially women

Every time you meet with your clients, do you really know who is sitting at the table? How you lead your client discovery process speaks volumes about whose voice you’re really hearing in your client meetings. Couples led through a discovery process together will find their overlapping highest priorities in life, family and finance – but couples who are each led through this same process independently will find their true highest priorities for themselves that should be uncovered and considered.

Which of these priorities overlap? How you as an advisor choose to use the knowledge gained from both sides to forge the path along the investment journey ahead is crucial. Of course, it doesn’t stop there; continuing that discovery along both clients’ investment journeys coupled with the inclusion of the female client in your communications and proactive touches should be a given.

Sounds simplistic, right? However, if you wait until the male voice is absent due to illness, death or divorce to have those discovery conversations with the woman at the table, you’ve missed the bigger picture and the odds are the assets at stake are already gone. Women represent 76% of the widowed population and 70% of widows leave their financial advisor within a year of the spouse’s death2.

The top two reasons women state they’ve left their advisor in these situations include: the advisor didn’t understand the client’s unique goals and priorities; or that the advisor just didn’t listen to them. Both reasons drive us back to an advisor's lack of a solid discovery process and whether they listened to all of the people at the table.

From a personal standpoint, being a female in the finance and investment industry has given me a very different vantage-point than my male counterparts. Even today, men make up a staggering 72.3% of financial advisors.3

There are ways you can build a unique and inclusive approach, regardless of gender, and Russell Investments is ready and willing to help:

- Client discovery – Is your process consistent? Do you have a true process? Your regional representative can walk you through our online discovery tool that’s designed to be a highly interactive process with your clients.

- Effective Client Reviews – Do you feel confident that you’re leading a client through a good experience and connecting at each review in a way that deepens that relationship? We’ve devoted a whole page on our website chock full of tips and resources

- Hosting events focused on women – Have you hosted a women-focused event? Offering some education around investing with a female perspective along with a social opportunity is not only a good way to connect with your clients but can turn into a great referral source if you encourage your guests to bring a friend.

The bottom line

It’s a big gamble if you underestimate any of the “players” at the table. If you want to continue to build your practice in 2023 and beyond – a distinction remains: while you may be creating a strong client experience to maintain your current relationships, you may be failing to ensure you’re providing a strong enough experience to retain those relationships when a wealth transfer, generational or otherwise, takes place. With women set to control two-thirds of personal wealth in the United States by 2030 – now is the time to ensure that you as an advisor will still have a place at the table.1Source: https://www.mckinsey.com/industries/financial-services/our-insights/women-as-the-next-wave-of-growth-in-us-wealth-management, July 2020

2Source: Women as the next wave of growth in US wealth management, McKinsey & Company, July 29, 2020