Regulation Best Interest, ready or not?

According to a December 2019 survey by the Securities Industry and Financial Markets Association (SIFMA) and Deloitte & Touche LLP designed to gauge advisor readiness for Regulation Best Interest (Reg BI), 77% of survey participants reported feeling moderately to highly confident in their ability to comply with Reg BI’s requirements by June 30, 2020.1 Eighty-three percent (83%) of survey participants expressed a moderate to high level of confidence in being able to sustain compliance with the requirements of the Reg BI rule after June 30, 2020.2

These survey results were encouraging in December 2019.

And then the global pandemic hit, market volatility came back with a vengeance and everyone’s life was turned upside down.

The Reg BI readiness sentiment among advisors today seems to be a little less confident, based on my conversations with advisors in the past six weeks. The prep time many advisors were planning to have in the Winter and the Spring got eaten up by crucial client-reassurance conversations and adapting businesses (and life!) to a work-from-home and virtual setting.

Take for example, the conversation I had with Matt, a seasoned advisor who has been in the business for over two decades and has guided his practice through various market cycles and several regulatory changes. He admitted that while he believes he and his team act in the best interest of their clients, he wasn’t entirely confident that he and his team are rock-solid ready for Reg BI when it comes to other aspects of their operations.

Matt’s feelings of uncertainty are echoed in many other conversations I’ve had. So, if you’re not feeling as ready for Reg BI’s go-live date as you had wanted—rest assured, you’re not alone!

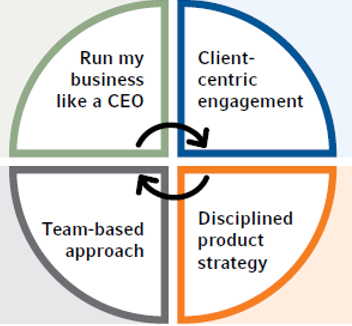

In response, we have developed a 15-question Reg BI Readiness Assessment that can quickly help you identify your practice’s strengths and opportunities along four key drivers of potential future success:

- Running your business like a CEO,

- Client-centric engagement,

- Disciplined product strategy, and

- Team-based approach.

Let’s dig a little deeper into each of these drivers, using Matt and his business as an example.

Four key drivers of potential future success

Think like a CEO

Advisors who adopt a CEO mindset have a strategic plan, they have a branding and marketing strategy, they have a clearly-defined target market, they intentionally allocate their resources and time with an eye to maximizing growth potential and seeking to manage risk, and they continuously build their own competency, skill set and areas of expertise. And that’s just the beginning.

To help Matt, I asked: When was the last time you completed a risk analysis on your practice to understand the relationship between the time you spend on each client relative to each client’s contribution to overall revenue for your practice? He admitted it had been quite some time since lifting the hood on his practice to examine this relationship. We believe great CEOs anticipate challenges before they happen. That means having a plan for market related events vs. reacting to them when they occur. Matt shared that the second quarter of 2020 put his plan to the test and stressed tested their systemized process for how and why they make the recommendations before, during and after market events.

Client-centric engagement

A second key driver for future success—and for Reg BI readiness—is having client-centric engagement. It focuses on delivering the best possible experience for clients—and ensuring you know them well enough to be able to confidently and truly act in their best interest. Client centricity is how great advisors get to the top of their profession and stay there.

After all, this business is about helping people. Offering comprehensive family wealth management services, articulating and tangibly demonstrating your value to clients, conducting thorough discovery and rediscovery of clients to ensure alignment between their goals and their plan and portfolio, having a systematized yet personalized client review process, are all part of a client-centric approach.

Here, Matt admitted he could be doing a better job of defining his value for clients and showing it to them more systematically. He said he intends to use Reg BI as an impetus for him and his team to up their client service game and be more authentic in their interactions with clients. A suggestion I made is to create a deadline for themselves, say by this fall, to execute on a service model based on a client segmentation strategy as well as a new client onboarding process to help them cement their process.

Disciplined product strategy

One of the biggest Reg BI readiness opportunities advisors I’ve spoken with have identified for themselves is managing their product inventory and better documenting and articulating to clients their investment selection and review strategy.

In Matt’s case, he admitted to using over 350 products in his practice. The idea of remaining in compliance with regulatory requirements for all of them seemed daunting to him—especially once he did the math that it can take on average 5 hours per year to do proper due diligence on each product. Combing through his inventory list in greater depth, he realized that 80% of his clients’ assets were concentrated in just 20% of the products in his inventory. On the flipside, 5% of his clients’ assets were invested across 50% of his product inventory! A number of products were used for only a single client, and he only had a few hundred dollars of client assets invested in some other products. Matt quickly realized the inefficiency—and also the risk—inherent in these imbalances in his product inventory. Incidentally, all of these dynamics are quite common across advisor books I have analyzed.

Lastly, Matt reflected on how he had been using his products—the role they played in his clients’ portfolios. He noticed that he didn’t have a distinct solution set for clients’ taxable assets—products designed to help clients keep more of the return they earn in they portfolios, rather than giving up a portion of that return unnecessarily to taxes. He also realized he had built tailored portfolios for many of his clients—the funds and securities on the list were used in different combinations. That increased the operational risks and time investment in monitoring the portfolios one by one and preparing for client reviews.

Matt decided then and there that narrowing his product inventory was going to be a key priority for him. He recognized that having a disciplined product strategy can provide operational leverage, giving back valuable time to spend with existing clients and prospects.

Team-based approach

Throughout my discussion with Matt, he focused a lot on his team, admitting it took him some time to attract and retain good talent. That prompted me to ask him if he felt every team member had complete role clarity and individual accountability. By asking him that, I tried to connect that every team member plays a role not only in the client experience they deliver on, but how that translates in the eyes of regulators. Strong team dynamics and role clarity also show up for clients very authentically. It means every interaction with them feels intentional and customized for their, goals, circumstances and preferences. It reminds them that you are there not only to recommend portfolios and products, but are also as their behavioral coach, guarding them from the very real human emotions that can jeopardize the health of the wealth. For regulators, it shows you have a workflow and a process in place as a team to address client complaints and needs.

The bottom line

Whether it’s Regulation Best Interest or a different set of regulations, advisors who see this as an opportunity to assess the health and growth potential of their business by voluntarily and whole-heartedly delving into the hard questions are likely to set themselves apart in the future. Matt was forced to re-examine his practice to get closer to that answer. He discovered that he and his team were excelling in some areas, and he recognized he needed to dig a little deeper to do more work to shore things up to feel ready.

We believe the time to adapt is now. Reach out to your Russell Investments regional team for access to our Regulation Best Interest Readiness Assessment to begin identifying areas of strength and opportunity for your practice so that you can be optimally positioned for growth into the future. Use our assessment in conjunction with your firm’s Regulation Best Interest guidance to ensure internal compliance is met. We can be your accountability coach throughout your business change process. It’s how we’ve partnered with some of the most successful advisors for the past 20 years. That’s simply how passionate we are about helping advisors build and grow their business. Are you ready?

1 Source: https://www.sifma.org/resources/news/sifma-survey-highlights-industrys-regulation-best-interest-implementation-efforts/

2 Source: https://www.sifma.org/resources/news/sifma-survey-highlights-industrys-regulation-best-interest-implementation-efforts/

https://www.sifma.org/resources/archive/submissions/