Who cares about taxes? Investors do!

Editor's note: Unlike most of our other articles, this one is aimed at end investors. If you’re an advisor, consider sharing this one with them.

I want to start this blog post with the thought of retraining our brains, challenging the status quo or just better understanding the whole picture. In so many aspects of life, we need to take a step back and retrain or better understand what we are trying to do. In sports, this may mean breaking a bad habit with your golf swing, following through on your free throws or entering a turn too early on a mountain bike or in a race car. We must retrain our brain, challenge our perception and understand why what we are doing isn’t providing us with the outcome we had hoped for.

Sometimes we need a coach, a trainer or an instructor to help us see the larger picture. We may not even know we’re doing something wrong—and that’s OK. What’s not OK is not knowing there are simple changes we can make that can have a dramatic impact on the outcome we intended to have in the first place. For instance, a small adjustment of your grip can dramatically improve your golf swing, snapping your wrist and creating follow-through will increase your free throw percentage and waiting until your appropriate braking marker will help you get around the racetrack that much quicker.

Investing can be the same. There is an incredible amount of information, and misinformation, on the internet that can both help and harm the average investor. How does one start to wade through the information and find the adjustments they need to make to dramatically impact the outcome?

Why work with a financial advisor?

At Russell Investments, we recommend working with a competent financial advisor who seeks to deliver value beyond picking product. This means someone who understands the nuances of the industry, can help you control your investing behavior, plan for the future and make sure your entire portfolio is tax-efficient. Here’s where we come back to challenging the status quo of the average investor: Taxes.

Managing your taxes

There are certain types of accounts that allow special tax treatment. You may already know many of these. At work, you may invest in a 401(k) or 403(b) plan, you and your spouse may have an Individual Retirement Account (IRA) or Roth IRA outside of this plan to supplement your retirement investing, and you may take advantage of a Health Savings Account (HSA) or Flexible Savings Account (FSA) through your employer for medical expenses. We even think about taxes when it comes to our children, by investing in a 529 plan for college savings.

We open all of these types of accounts for one reason: Tax savings. Why is it then, when it comes down to our extra savings, our rainy-day funds, the money we can’t seem to find a tax-sheltered home for, we default back to death and taxes?

Strategies for keeping more of what you make

Wait a second—we likely have way more control than you know. We believe there are ways to maximize your after-tax return and keep more of what you make, even outside a tax-sheltered account. These include strategies such as investing in municipal bonds, tax-loss harvesting, minimizing wash sales, managing holding periods and managing a fund’s yield, to name a few. Again, it’s OK if you don’t know what these strategies involve or how they work, but it’s not OK to not know they are available to you and that we believe they can have a dramatic impact on your investing outcomes.

T is for tax-smart investing

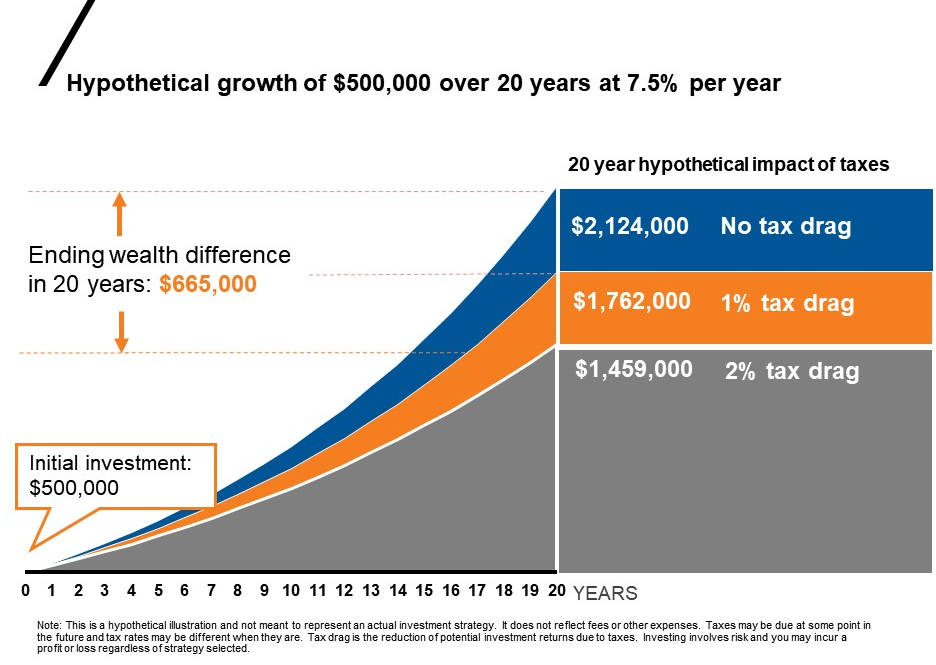

Let’s take a look at a hypothetical example of an investor with $500,000 in investable assets. In the illustration below, we assume the ending wealth difference under three scenarios:

Click image to enlarge

Just as you may seek advice on adjustments you can make from a golf pro, a basketball coach or a professional driving instructor, so too should you seek advice from your advisor beyond what your annual portfolio performance is.

Asking your advisor this one additional question may have a huge difference on your investing future and outcomes:

How do we invest our taxable dollars differently than our tax-sheltered dollars?

The bottom line

An advisor can help you navigate the complex world of tax implications of your investments—asset location across taxable and non-taxable accounts, tax-smart withdrawal strategies, taxable trusts and more. A successful relationship with your trusted financial advisor requires engagement—on both sides. Here are some considerations to be an engaged client:

- Be open with your advisor about your current situation, goals, circumstances, preferences, values, asset location and other relevant wealth management information—including insurance payouts and inheritance.

- Engage in proactive, two-way communication with your advisor as your family’s situation changes. This may include the sale of real estate, the sale of a business or other assets due to downsizing.

- Share with your advisor your annual state/federal tax return to optimize the tax implications of your investments.

Because when it comes to investing, it’s not what you make that counts. It’s what you get to keep.