Asia's Economic Tightrope: Balancing Rising Oil Prices Amidst Geopolitical Uncertainty

In a world rocked by geopolitical turmoil, Asia finds itself on an economic tightrope. The looming shadow of the Israel-Gaza conflict has intensified concerns about rising oil prices, and the Asia-Pacific region, heavily dependent on oil imports, must carefully navigate these uncertain waters.

We recently discussed the potential implications of the Israel-Gaza conflict, with a focus on the US economy and major financial markets. However, the Asia-Pacific region is in a more difficult position should the conflict escalate.

Economic implications for Asia-Pacific and regional financial markets

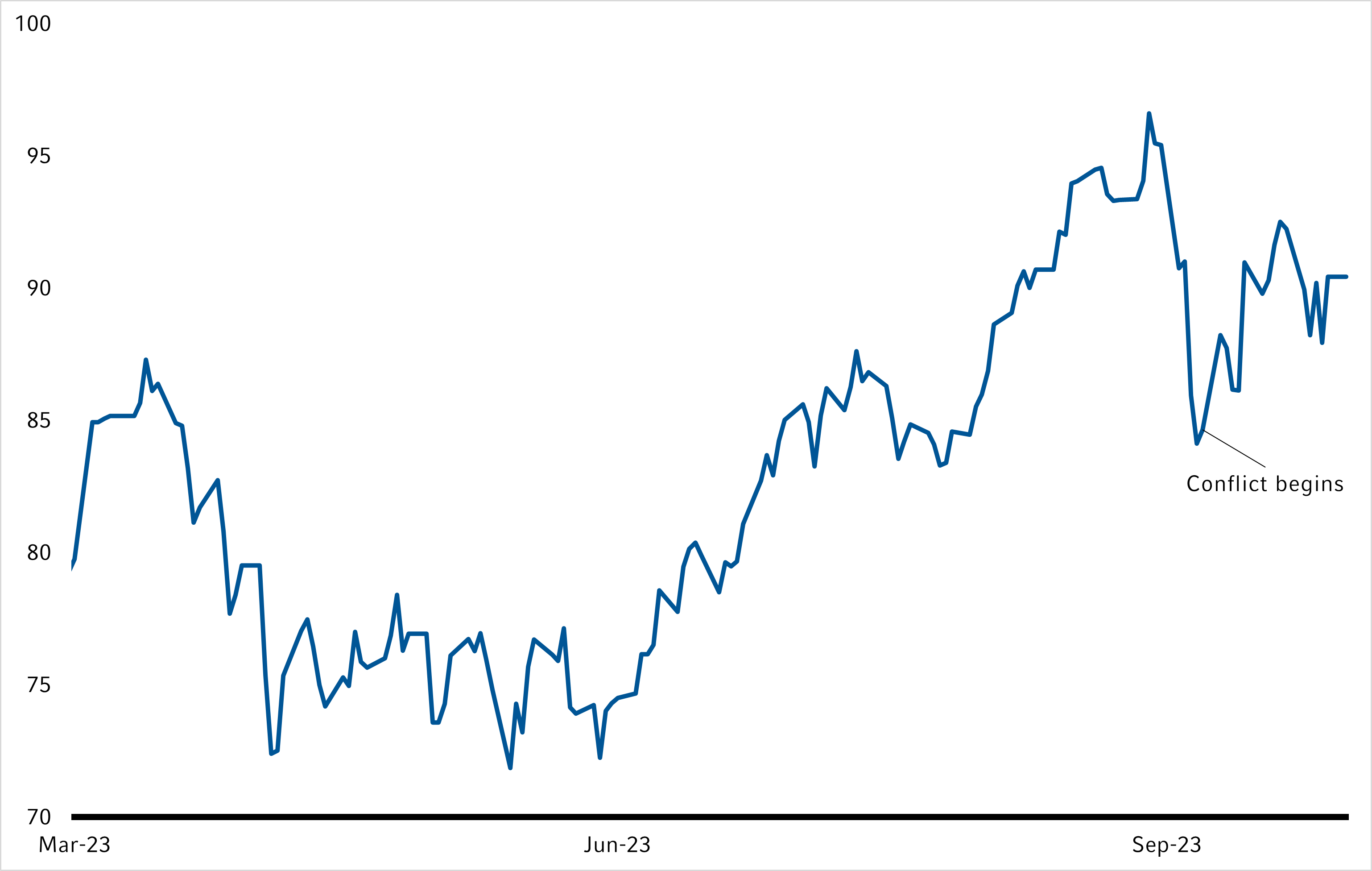

The oil market is the main risk channel from the conflict to the broader economy. Indeed, we have seen oil prices move higher since the conflict began, as shown in the chart below. We continue to think that a widening of the engagement into Lebanon or, much more significantly Iran, would be the key escalation as this would likely lead to a further spike in the oil price.

(Click image to enlarge)

Source: LSEG Datastream, 31 October 2023

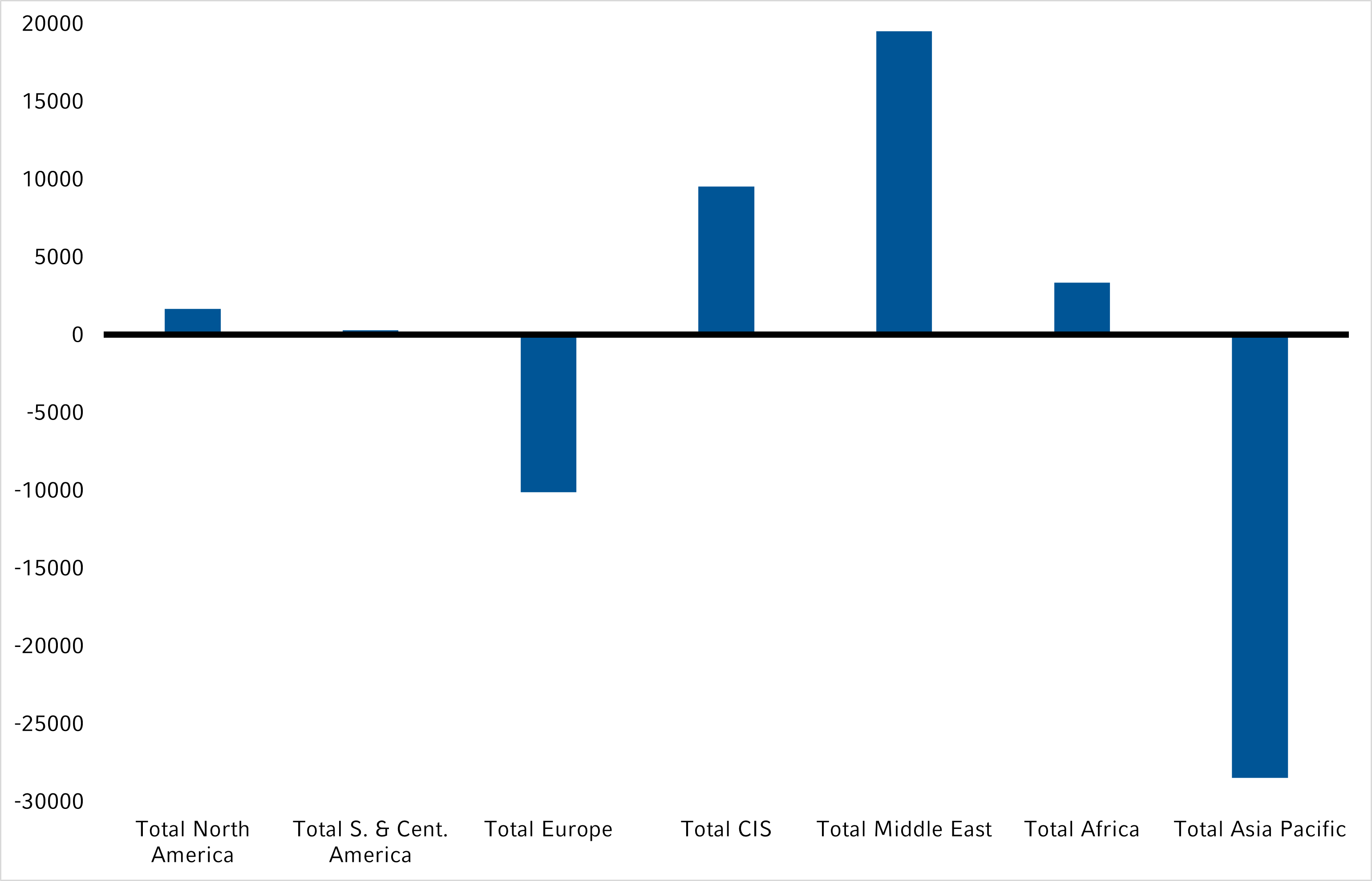

Asia generally is more sensitive to oil prices than other regions, given it is a net oil. The chart below shows the net production of different regions, with Asia Pacific standing out as a big net consumer of oil prices. Indeed, oil accounts for the largest portion of imports for Japan, India, China and South Korea. Further volatility in prices from here would lead to a worsening of the trade balance for each country and would act as a tax on growth.

(Click image to enlarge)

Source: BP Statistical Review of World Energy 2022

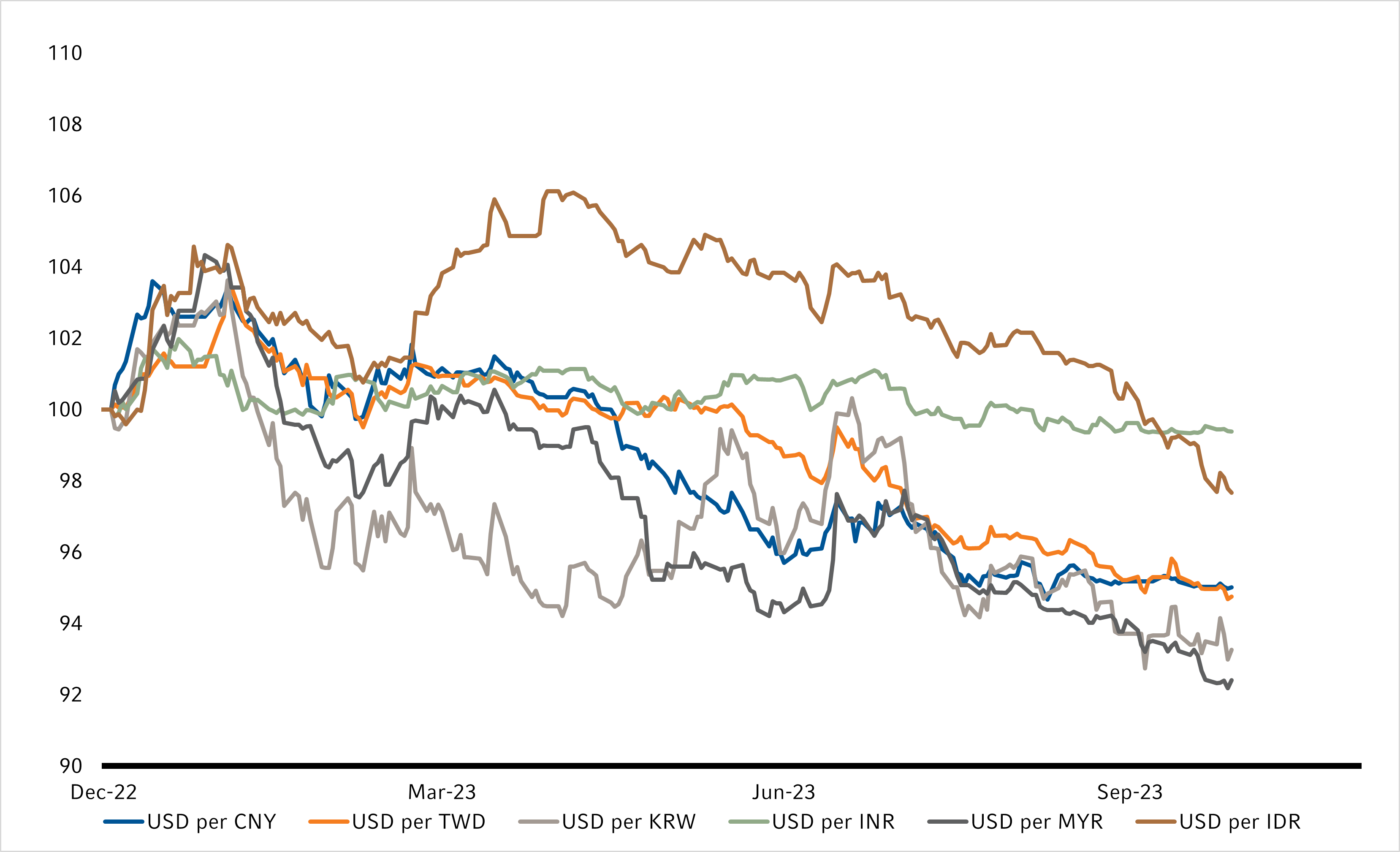

This impact is exacerbated by the fact that many Asian currencies have been falling, thus making the cost of those imports more expensive in local currency terms. For example, the South Korean won has depreciated by roughly 7% against the US Dollar over the course of 2023.

(Click image to enlarge)

Source: LSEG Datastream, Russell Investments, 30 October 2023

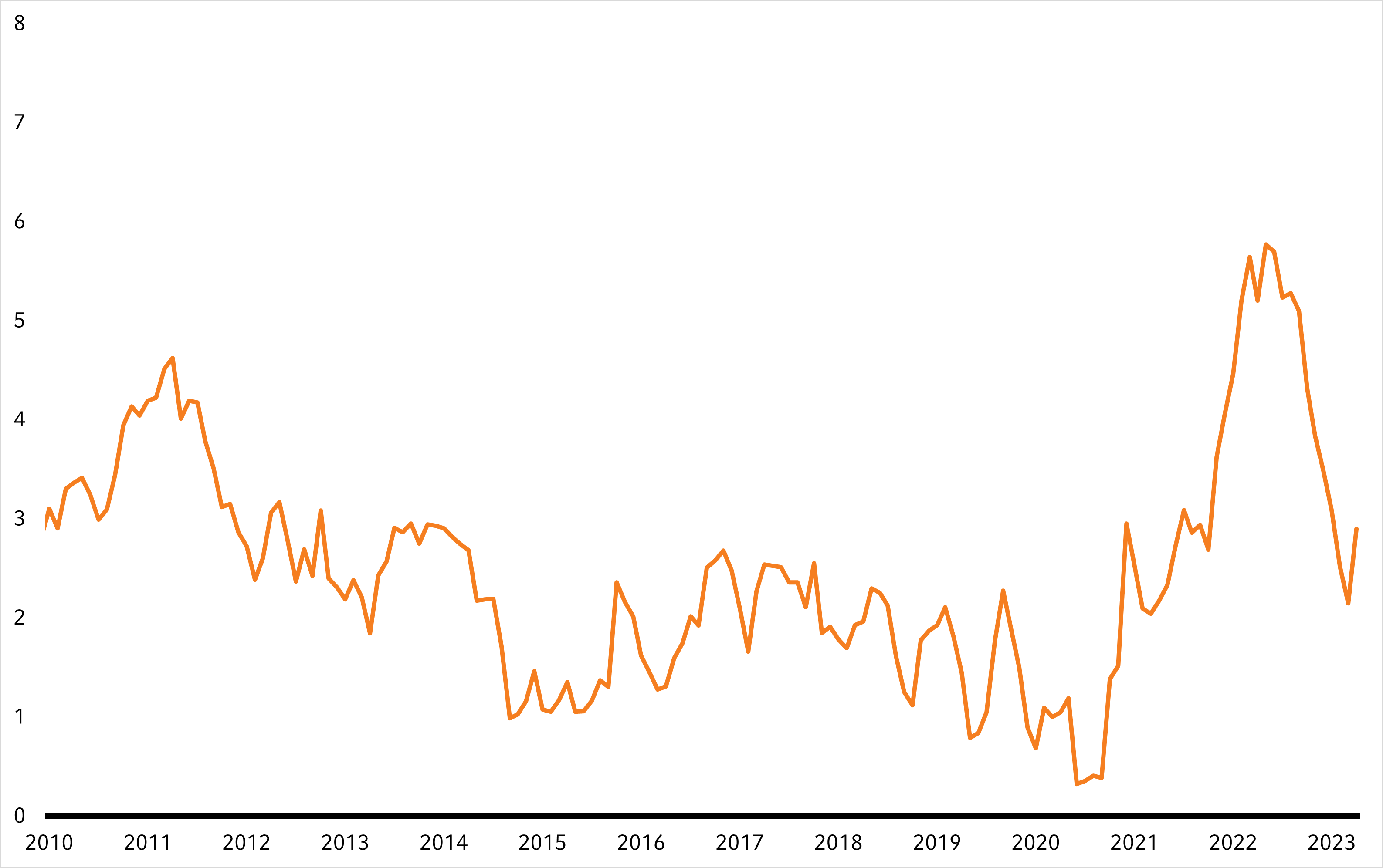

At this stage, we do not think there is a meaningful risk that Asian central banks will need to raise rates further in response to this increase in costs. Indeed, even in the more severe scenario, where the conflict broadens and puts more pressure on the oil price, central banks may look through the increase in the oil price. The rationale for this is that the increase in oil prices would act as a drag on the broader consumption profile of the economy.

(Click image to enlarge)

Source: LSEG Datastream, Russell Investments, 30 October 2023

Outside of these potential impacts on the region, we think there are some positive stories amongst Asian economies.

The Japanese economy is growing at a decent rate, as the consumer has reengaged with the economy post the lockdowns. Services spending is still recovering back to pre-COVID levels, so there is still some room for catch-up growth.

The Chinese economy has been struggling given the headwinds of the property market and depressed consumer confidence. However, the Chinese government recently announced that more fiscal stimulus will be provided by both the local and central government through the rest of this year and into next year. This should provide a boost to the economic outlook, and we think that the Chinese government are likely going to target 4.5-5% GDP growth for 2024.

South Korea and Taiwan should benefit from any bottoming in the semiconductor cycle, while the growth outlook for India continues to look quite healthy.

Moving to Australia and New Zealand, both countries have lower proportions of oil imports compared to broader Asia Pacific. Australia is going to continue to see growth slow but avoid recession while we are more concerned about recession risk in New Zealand.

The Australian economy is being supported by a very strong immigration profile, although this is exacerbating pressure on rent prices and the Reserve Bank of Australia to increase interest rates again.

The Reserve Bank of New Zealand is holding rates at very restrictive levels, and this is likely to lead to a more meaningful slowdown through next year. At this stage, we do not see any meaningful shift in fiscal policy following the victory of the National party at the general election in October.