How is China’s crackdown on big tech impacting emerging markets?

The current wave of regulatory intervention by the Chinese government has been far reaching, addressing matters including anti-trust, data protection, property speculation, climate change and various interventions in relation to social abuses. In the internet platform space, financial technology (Ant Group), ecommerce (Alibaba, JD.com, PDD, etc.), gaming (Tencent, NetEase etc), food delivery (Meituan, etc.), education technology (Tal/Oriental Education etc) and ride-hailing (Didi) have all been targeted.

The objective behind all these policies can be traced to China’s stated long-term aspirations, which includes creating a more sustainable economy—with less pollution—that benefits the broader Chinese population instead of just the elite. On the issue of education reform specifically, there is a clear intention by the government to improve incentives for families to raise more children, in order to alleviate demographic headwinds. The latest moves are also targeting companies not fully aligned with the overall strategy of the government and serve as another clear indication that China is strongly motivated by self-sufficiency—and is willing to sacrifice short-term growth in the pursuit of same.

From a timing perspective, Chinese President Xi Jinping is evidently craving legitimacy of rule ahead of China’s 20th Party Congress in 2022, where he is expected to extend his leadership beyond 10 years, disturbing the established order. China remains, at least by name, a socialist state, and in a country with extreme income disparity, the public perception concerning the contrast between the billionaire owners and gig-economy workers at China’s internet platforms makes them a very easy target politically.

The internet platforms have arguably become a victim of their own success. In addition to bad press about income disparity and worker practices, the monopolistic behaviour and increasing power accumulated through harvesting data on Chinese consumers make them an obvious target for anti-trust and data protection legislation. The government is legislating to improve consumers’ data protection against private companies, and particularly tightening private companies’ ability to transfer sensitive data abroad. Only the government is allowed unfettered access to such data.

China’s top strategic priority is arguably to become self-sufficient, especially in regards to key technologies of the future like semiconductors, medical devices, AI (artificial intelligence), green technology and various forms of automation. The ample war chest of the internet platforms puts them in pole position to invest in the development of these new technologies, and the Chinese government is, amongst other things, using anti-trust legislation as leverage to force these companies to reinvest in areas aligned with the overall strategic direction of the country, instead of harvesting monopoly rents for their owners. This type of industrial policy obviously undermines property rights, which has knock-on effects for the incentives of entrepreneurs and investors alike.

Amid this backdrop, we believe it’s crucial for those investing in China to understand the strategic direction of the country, where the government would like capital to be allocated to, and which business models are perceived to work in the interest of the nation’s unfolding strategic plan—and, conversely, which ones are in the bad books.

The crackdown’s impact on Chinese tech stocks

Before the Ant Group’s initial public offering (IPO) late last year, Chinese internet companies had been the darlings of the stock market for a while. This was especially true during the height of government-mandated lockdowns in early 2020 as the coronavirus pandemic took hold, with these business models perceived as havens in the storm. In a world under lockdown, the appeal of services like meal delivery, ecommerce and online entertainment received a boost, while most other areas of the economy were suffering.

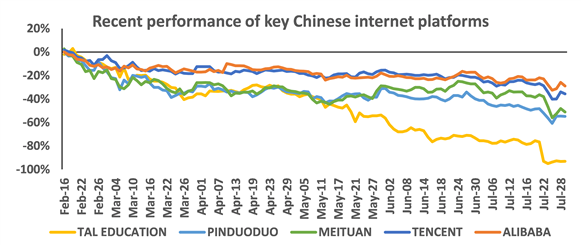

Chinese regulators’ decision to suspend Ant Group’s IPO in November 2020 negatively impacted sentiment in some of these internet names, including Alibaba, given the affiliation between the two companies. However, it was not until February of this year that we saw a peak in valuations more broadly across this space. Since then, there have been a flurry of regulatory interventions and, as illustrated in the chart below, these have resulted in a rapid decline in share prices for the largest players in this space.

Click image to enlarge

Source: Russell Investments / MSCI, cumulative total returns in USD from Feb. 16, 2021 through Jul y31, 2021.

Notably, the combined destruction of market capitalization in these five names alone from mid-February 2021 through the end of July 2021 was nearly $700 billion, with a long list of second-tier players in this space—many of whom were equally or harder hit.

The impact on emerging markets

We have seen a very rapid transformation of the opportunity set across emerging markets as the crackdown has intensified. As noted in a blog post from earlier this year, the MSCI Emerging Markets Index is dominated by large tech names—roughly to the same degree as the S&P 500 Index. The top five tech names made up roughly 24.5% of the MSCI EM index, compared to 22% in the S&P 500, in December 2020.

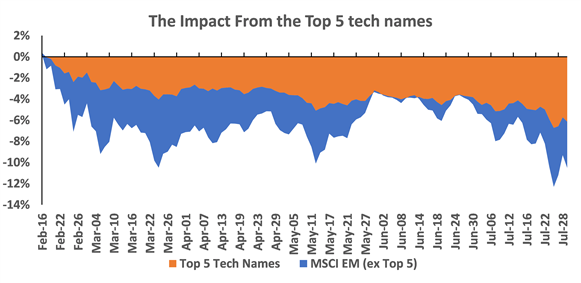

As illustrated in the chart below, the five largest tech names alone have contributed more than -6% to the -10.5% aggregate MSCI EM index decline since the peak in mid-February (through the end of July 2021). In addition, their weight in the index has shrunk to about 21% as of this writing. We have seen even more aggressive declines in some of the next-tier internet platforms, such as PDD, Baidu, Tal Education and New Oriental Education.

Click image to enlarge

Source: Russell Investments / MSCI, cumulative total return contribution in USD from Feb. 16, 2021, through July 31, 2021, of the 5 largest technology names (TSMC, Tencent, Alibaba, Samsung and Meituan) vs. the MSCI Emerging Markets Index net.

Notably, as a result of the rapid market cap erosion amongst ecommerce names, the weight of the internet and direct marketing retail industry has shrunk from roughly 12% in mid-February to below 9% of the MSCI EM index now.

The outlook for emerging markets going forward

We have held the view for a while now that the valuation spread within emerging markets was extraordinarily wide and would eventually need to reverse. We have equally observed for a few years that the small and mid cap section had struggled to keep up with the wider market for the longest period in recent memory, which again raised the probability of an eventual reversal in this dynamic and for the small and mid cap premium to reassert itself. We are now seeing reversals on both fronts, but we believe this dynamic continues to have legs to it.

It is always difficult to predict the exact timing and trigger for such reversals. in this case, the Chinese regulatory drive has certainly played a large role, along with the future expectations around vaccines and other positive drivers behind the eventual reopening trade elsewhere in EM. Valuations have also played a role in the magnitude of the selloff, given the elevated valuations many of these names were trading at.

Focusing in on the motivations of the Chinese regulators responsible for the clampdown, the recent flurry of activity seems to indicate that they perceive the rectification of the core issues the reforms are targeting to be urgent. Therefore, in our opinion, it is very plausible that the reform drive will continue for a while as China once again seeks to coerce its corporate champions to align behind the country’s strategic goals.

Ultimately, we believe that dislocations like this may provide ample opportunity for disciplined active stock pickers to establish positions that could contribute to performance in years to come. With this in mind, we remain excited about the opportunity set in EM.