Private Markets Survey: How are managers creating value in today’s environment?

Introduction

In this survey, 32 firms representing $1.6 trillion in total assets responded to questions around the following five topics:

- Key investment themes

- Opportunities and risks

- Value creation

- ESG / impact

- Product

Private markets continue to be a more prevalent component of investor portfolios, providing access to an expanded opportunity set and strong diversification beyond traditional stocks and bonds. We expect this trend will continue as investors seek to find new sources of return and portfolio protection in a challenging market environment.

Given the dynamic nature of private markets, we recently conducted a survey of private markets specialists using our distinct relationship with underlying managers to help provide a clear lens through which to view the changing nature of this growing and increasingly important investment landscape.

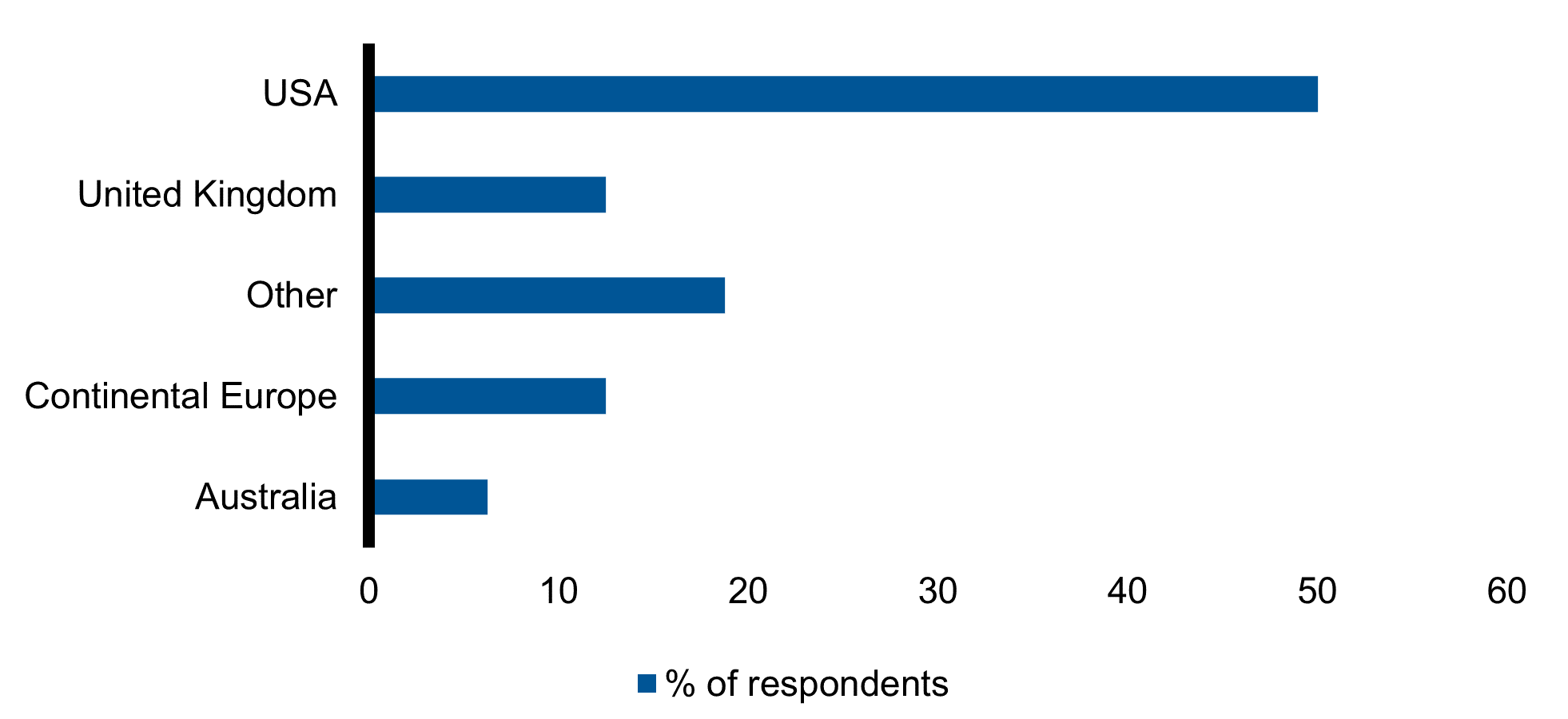

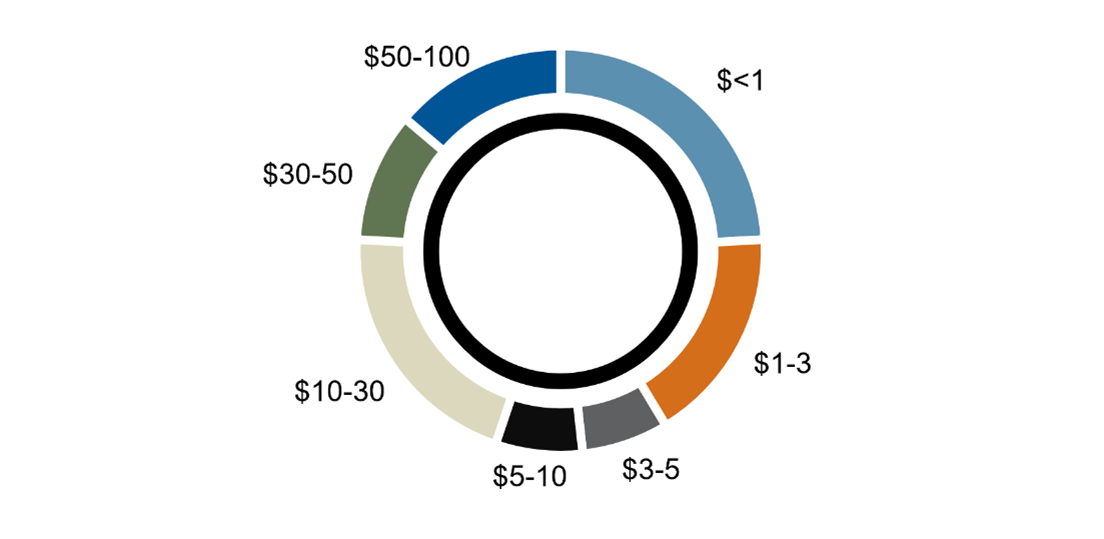

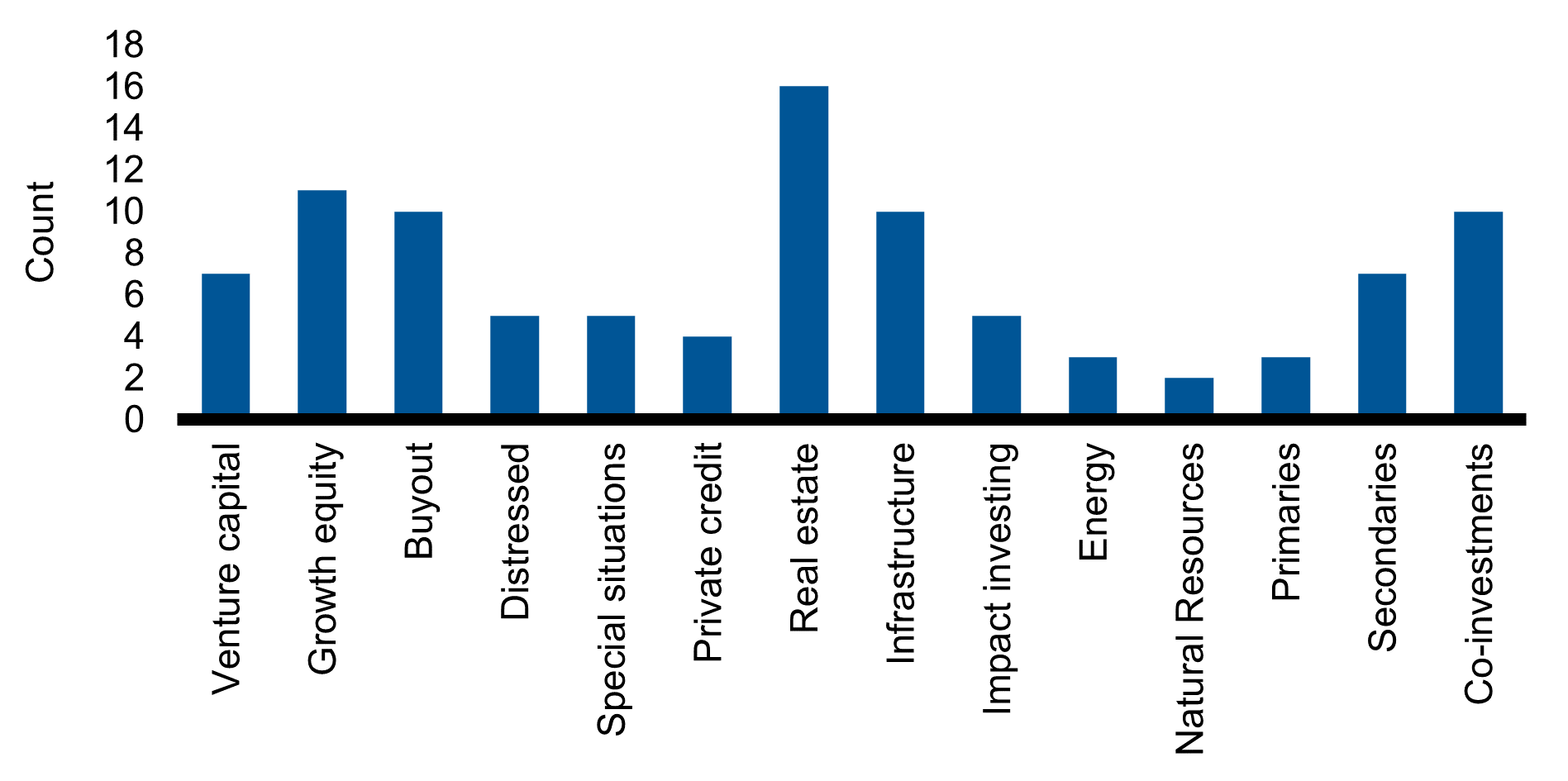

Breakdown of respondents

Where is your firm domiciled?

What is your firm’s total AUM in private markets in $Bn?

Which private markets strategies does your firm offer?

Survey details

Key investment themes

Considerable uncertainty remains about the global economic and financial market outlook. From geopolitics, inflation, interest rates and stock-market volatility to energy prices and central bank policies, there is a multitude of factors combining to make the range of potential investment outcomes much wider. Against this backdrop of an increasingly uncertain world, we wanted to gain a deeper understanding of the key themes that private markets managers expected to play out over the short term (1-3 years) and long term (5+ years).

"Specialised manufacturers and industrial service providers benefit from a combination of supply chain redesign and spending associated with government legislation."

Key themes highlighted include:

PRIVATE EQUITY

- Specialised manufacturers and industrial service providers benefit from a combination of supply chain redesign and spending associated with government legislation, such as the infrastructure bill, chips bill and Inflation Reduction Act (U.S.).

- The resurgence of LP (limited partner) secondaries as LPs seek to rebalance their portfolios due to reduced valuations in public markets.

- High quality secondary portfolios trading at discounts after a period of trading above par.

- More GP (general partner) led secondaries, including more continuation vehicles.

REAL ESTATE

- Despite a moderating economy, secular trends provide a path to resiliency. Technological advances, demographic trends and ESG (environmental, social and governance) requirements should create segments of growth that are less reliant on the economic cycle.

- An ageing population in need of greater amounts of healthcare driving senior housing and medical office demand.

- Home price and rental rate rises, driving multi-family and build-to-rent development.

INFRASTRUCTURE

- Investments in key areas that are supported by long-term structural tailwinds such as digital, renewables and social infrastructure.

- The benefit of inflation pass-through that infrastructure provides either through contracted / indexed revenue or regulated assets.

- Solutions to address climate change and decarbonisation efforts, particularly in EU markets to achieve energy security was a key focus point.

CREDIT

- Compelling return potential given the rapid increase through 2022 in the industry’s reference rate – Secured Overnight Financing Rate (SOFR)

- A focus on directly originated loans with middle-market companies where a private equity sponsor is:

- in control of the company,

- where the sponsors are specialised in certain industry sectors, and

- where management teams’ interests are aligned through significant equity ownership.

- More lender friendly terms including stronger covenants, origination and unused line fees and prepayment penalties.

- Upcoming maturities needing to be rolled over at significantly higher rates.

Opportunities and risks

OPPORTUNITIES

The responses show that managers are focusing on industries that are expected to survive and prosper in the future, including those that are supported by long-term secular trends, such as reshoring of supply chains, decarbonisation and increased digitisation.

Managers also noted the impact and resulting opportunities from the rapid increase in interest rates in 2022, and the potential for sustained periods of higher interest rates. These included:

- Interest rate stress which, when coupled with uncertainty around asset values, has led to a tightening of liquidity, creating attractive buying / rescue capital opportunities.

- Purchasing of high-quality assets underpinned by long-term thematics.

- Potential for buyout valuations to correct given higher interest rates and margin pressure from inflation and labour scarcity.

- Taking private opportunities where public markets have overacted to short-term dynamics.

- Rising recapitalisation requirements around the need to trim fund queues.

Within the secondary space, there is a confluence of factors contributing to the LP squeeze, creating conditions that allow more room to create acquisitions at a discount. There are numerous opportunities to provide liquidity to the market and create an attractive return profile for investors. One element that is affecting the secondary market is the denominator effect. Equity and bond valuations have fallen significantly, and this has impacted the strategic asset allocation of institutional investors, forcing them to create liquidity from various sections of their portfolios. Managers can then step in as liquidity solutions providers while delivering attractive investment opportunities to their investors. In addition, there is also continued growth in general partners continuation solutions – essentially, managers looking for sources of liquidity that may be attractive to buyers on the secondary market.

One social trend managers highlighted as an opportunity was the aging population and the associated real estate and infrastructure that will be required to support this demographic shift, e.g., more medical facilities and senior housing.

RISKS

73% of respondents identified the macroeconomic risks of high interest rates, inflationary pressure and recession risk as their biggest investment risks for 2023. For example, given that borrowing costs have nearly doubled from Q1 2022, capital availability and companies / assets with less ability to grow revenue have been impacted. Should policymakers keep rates higher for longer, the risk of a policy mistake and recession increases.

Other risks noted include:

- Labour shortage and supply chain risks.

- Extended geopolitical disruption.

- Rising costs, especially with respect to energy and broader commodity prices.

Considering these risks, managers are focusing on high quality assets, remaining defensive and capitalising businesses conservatively, as well as on businesses that are less sensitive to supply chain issues and have greater ability to pass on costs – through either contractual CPI escalators or strong competitive positioning.

Value creation

One of the key benefits of private investment is that general partners (GPs) have a much stronger direct involvement in creating portfolio company value over the medium to long term. GPs are able to draw on an additional level of tools to support portfolio businesses with direct engagement on personnel and business strategy.

"The focus is on operational excellence and the execution of business plans in the face of macroeconomic uncertainty, margin pressures, and rising borrowing costs."

As such, we wanted to glean insights into the actions being taken by private markets managers to determine how they are seeking to create value in the current market environment. At a high level, the focus is on operational excellence and the execution of business plans in the face of macroeconomic uncertainty, margin pressures and rising borrowing costs.

At the individual portfolio company and asset level, examples of the top initiatives that management teams are focused on to create value for investors are highlighted below:

PRIVATE EQUITY

- Improving the sales strategy to drive operational efficiency.

- Margin expansion through price increases, cost savings, and optimising operations.

- Investing in new product development through R&D investments and strategic acquisitions.

- Leadership and talent development including CEO / C-suite hires, and talent retention initiatives such as career growth and development.

- Developing and executing a strategy to expand into international markets.

REAL ESTATE

- Ensuring capital structure resilience in an environment of inflation and rising base rates.

- Net operating income growth through energy efficiency measures and reduced vacancies.

- Leveraging technology to capture growth opportunities such as developing smart homes, lowering maintenance costs, and machine learning / predictive AI to create market ranking models.

- Develop to core – creating new assets to ensure that the best possible space is available to meet the changing needs of tenants.

- As part of an asset owner’s annual business plan, setting ESG goals including LED lighting retrofits and green building certifications – such as LEED (U.S. certification) and water reduction strategies.

INFRASTRUCTURE

- Execution of asset management plans.

- Having clear sustainability strategies to meet investor and community expectations.

- Add-on acquisitions to expand platform businesses.

- Exit investments to realise value for investors.

- Advancing new renewable energy projects through permitting and supporting development partners in building out their renewables pipeline.

CREDIT

- A focus on investments in companies that have established competitive advantages.

- Sourcing transactions through a strong origination platform.

- Thorough portfolio monitoring through various mechanisms including board observer seats, access to reporting and ongoing communication with senior management.

- Negotiating robust and actionable positive (i.e., maintain certain interest coverage ratio) and negative (i.e., prohibited from selling assets) covenants to protect against potential downside.

- Ensuring strong capital structure with appropriate levels of equity and leverage.

ESG and impact

Given ESG and impact considerations are becoming increasingly important for investors globally, we wanted an understanding of which sustainability related organisations and initiatives firms are engaging with. While the UN PRI signatory had the greatest asset manager commitment at 24%, the survey also revealed that the Global Real Estate Sustainability Benchmark (GRESB) and the Task Force on Climate-related Financial Disclosures (TCFD) had notable commitment with 15% and 13% of participants respectively pursuing these initiatives.

This aligns with the results from our 2022 global ESG survey, where ESG integration was highlighted as the most used approach for incorporating responsible investment to product design.

We also asked participants which United Nations Sustainable Development Goals (SDGs) private asset firms could make the biggest difference in. The top 3 SDGs that managers felt private assets could contribute to were:

- Climate action.

- Affordable and clean energy.

- Sustainable cities and communities.

Product

As product development continues to evolve in private markets, we are witnessing greater democratisation of private investments. While the current average ratio of total private assets held was 90% institutional to 10% retail, we asked managers whether they were actively seeking to raise more capital from individual investors. 78% of those managers who responded confirmed they were looking to expand their offering to individual investors, as more high-net-worth individuals seek out the benefits of private markets that institutional investors have enjoyed for decades.

We also asked managers to describe the structure of the funds they anticipate bringing to market over the next 12-24 months. Surprisingly there was limited reference to evergreen fund offers, which have been popular in the media and have attracted attention from institutional investors, demonstrating the challenges involved in maintaining this structure of new product.

The bottom line

We believe the Russell Investments 2023 Private Markets Survey provides valuable perspectives around key trends, risks and opportunities across the private markets landscape.

Across the broad spectrum of private markets, we believe that managers and investors are well positioned in 2023 and beyond to exploit opportunities in private equity, real estate, infrastructure and credit. By working hand in hand with engaged and incentivised management teams, GPs are poised to create value for their investors over the medium-to-long term through actively managing businesses and assets, which in turn should serve investors well in a challenging and uncertain market environment.

As Russell Investments continues its commitment to help our clients achieve their desired investment outcomes, we encourage readers to get in touch to discuss any questions or comments they may have about the survey.

We wish to thank the many private markets investment professionals who contributed their time, effort and insights to the survey. It is our distinct relationship with underlying managers that earns us this unique access to insights and analysis, which we trust proves valuable to your organisation as you continue to develop your private market programmes moving forward.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.