C is for customized experience and family wealth planning

Executive summary:

- The trend of customization is showing up in the financial services world too

- Many advisors are now providing customized wealth management services to their clients and their families, often across multiple generations

- This personalized treatment holds value for investors as it can help them achieve a smoother investment journey and an orderly transition of wealth

Everyone likes to feel special. We like it when we get things our way – be it the toppings on our hamburger, the features on our new car, or the a-la-carte service at the salon.

But even though we enjoy the choices that customization provides, that isn’t enough anymore. There’s a reason why the barista writes your name on the coffee cup, rather than the order itself (even if it was an iced half-caff, 4-pump skinny latte): personalization is where it’s at these days.

Just as we all love the personal touch at the hairdresser or sporting goods store, we appreciate the personal touch when it comes to our investments. After all, that is what each of us has worked hard to build and is what will sustain us in our retirement, help us build our legacy, and be passed on to our heirs.

This is clear in the growing demand from investors for a more personalized client experience and an investment portfolio that reflects their unique goals, circumstances, and preferences.

The thing is, personalization means something different to everyone, and different generations of clients have different expectations for personalized services. Advisors today need to contend with how to cater to the preferences and needs of each of those demographic groups. Amid a huge generational wealth transfer, the growing financial power of women, and the wave of baby boomer retirements, many advisors are now providing holistic wealth management services to clients and their families, across multiple generations.

Indeed, many advisors are now offering a multitude of services that can encompass everything from insurance needs, legacy planning, charitable planning, to setting up trusts, tax management and more.

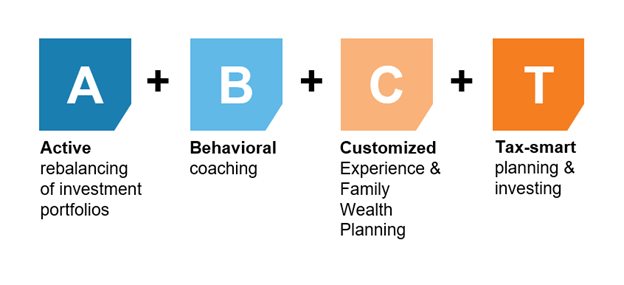

That’s why C – the third letter in our annual Value of Advisor formula – has evolved so much over the years. It has been transformed over time to reflect the changing needs & expectations of investors and the changing role of advisors.

Our annual Value of Advisor study quantifies the value that advisors bring to their clients through the myriad of services they provide. The formula is simple:

Every year we produce a series of blogs providing greater detail into how we determine our formula. We’ve already discussed the value that advisors provide by actively rebalancing portfolios – the A in the formula above – through all market environments in order to keep their investors’ risk and reward profiles on track. And we’ve written about the B in the formula – the behavioral coaching financial advisors provide that is intended to keep their clients from making emotional decisions when markets are volatile.

In this blog post, our focus turns to the “C” in the formula – the personalized custom client experience that advisors now provide as part of the wealth management experience to investors, and often their entire family.

Let’s be clear: our conviction remains steadfast that services such as asset allocation, security selection and portfolio construction are the building blocks of any successful investment strategy. All three elements are indispensable for reaching a client’s financial goals.

But choosing investments is only one component of a comprehensive financial strategy. Advisors do much more. They can and do gather a copious amount of information about their clients, including their personalities, the life events they have faced (and should prepare for), their dreams and ambitions and so much more about their investment journey. A skilled wealth manager can then craft a comprehensive, real-world financial plan that addresses the unique needs that every individual client faces.

Often this holistic wealth management encompasses a broad range of services through the accumulation, preservation, and distribution phase of an investor’s financial life. Some of these services require specialized skills. And that means many advisors are drawing in other resources such as accountants and lawyers to assist. They’re like the project manager on a construction site, ensuring the right specialist is in the right place at the right time.

Depending on an individual’s personal circumstances, preferences and considerations—there are a broad mix of these complex factors that require expert knowledge and advice to evaluate the choices and trade-offs at play, and what is right for their specific goals and needs.

Including other family members has become a lot more important amid the great wealth transfer as baby boomers age. Research suggests that nearly 70% of investible assets will be in the hands of the next generation by the start of the next decade1. And to ensure they can keep that next generation as a client, many advisors are engaging the spouses in the planning. Studies have found that most widows will switch financial advisors within a year of losing her husband2—unless she already has a good relationship with that advisor. And often, where mom goes, the children follow.

This brings us to the vital role of communication between advisors and their clients. When an advisor is dealing with several members in a family, it’s important to maintain clear and consistent communication so that everyone knows what’s at stake and everyone has the opportunity to voice their concerns and state their needs.

Doing so can often mean the difference between a smooth transition of assets or a tangled web of legal issues, a big tax bill, and a divided family. It’s probably fair to assume that the former will do a better job of preserving a legacy than the latter. This means that the work you do to guide your clients through the defining moments of their lives, to ensure their investments align with their goals, to provide expertise on taxes, insurance, careers and major purchases, to plan their retirement, long-term care needs, and legacy—among a myriad other services—has significant value.

Research has shown that investors prefer to work with an advisor who has a deep understanding of their individual situation and what they are trying to achieve. The same study also found that investors are far more likely to refer an advisor to family and friends if they felt the advisor provided regular and valuable information3. Communication is important for your client relationships, and for your opportunities for growing your business.

To help articulate the value of your conversation, consider using our client engagement roadmap to demonstrate next steps and mutual commitments. This also helps to give structure to your meeting cadence, a vital supportive point to your communication strategy and ongoing service model. With respect to focus and time, outsourcing some of your investment strategy often becomes a valuable part of the solution. Consider model strategies for clients who only need core investment management. And you could consider Personalized Managed Accounts —a Separately Managed Account solution that can be individually customized for high net-worth clients. With each of these points of consideration, the goal is to intentionally shift focus and resources to what your clients may expect and value from your relationship. We are here to help.

The bottom line

In the equation of advisor value, the “C” signifies the pivotal role of the customized client experience you deliver. This has become crucially important as investors’ needs become more complex and as the wealth held by baby boomers is passed on to younger generations accustomed to personalized services. You stand poised to be their guiding light through the multifaceted stages of their wealth journey.

1 Source: https://info.cerulli.com/HNW-Transfer-of-Wealth-Cerulli.html

3 in “How can advisors better communicate with their clients”, December 2019 by YCharts. Total sample size represented 650 individuals across the U.S. https://go.ycharts.com/hubfs/YCharts_Client_Communications_Survey.pdf, Accessed Feb 3, 2021, While the data shown is from the U.S., trends in Canada are believed to be quite similar.