Fed September meeting: The job’s not done

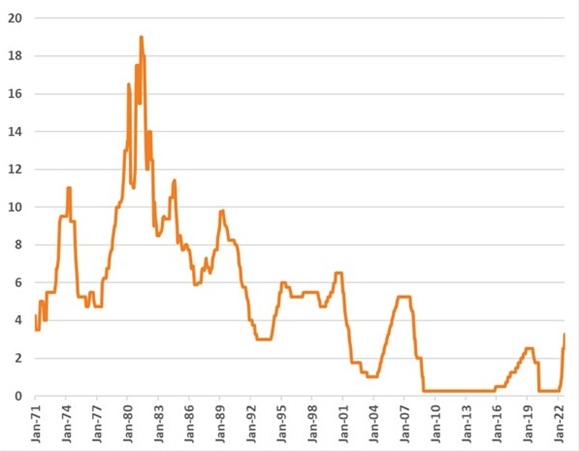

Despite a minority view for a 100-basis-point (bps) rate hike, on Wednesday the U.S. Federal Reserve (Fed) stuck with the consensus and delivered its third straight 75-bps rate hike instead, raising the federal funds target rate to 3.0% to 3.25%—the highest since 2008—and signaling more super-sized hikes ahead.

Rates move into restrictive territory

The target rate is now in restrictive territory, rising above the Fed's estimated neutral rate of 2.5% The higher the target rate drifts above neutral, the more restrictive it becomes to the economy. In other words, the target rate is now at a level intended to limit the economy. This is likely the central bank’s intention—to slow the U.S. economy enough to cool the labor market and, in turn, bring down inflation. Based on the Fed's updated economic projections, the growth outlook is for a weaker economy over its projection horizon versus its June update. However, for a central bank committed to bringing inflation back to the 2% target, the September projections indicate that it isn't likely to occur until 2025. This, in turn, keeps the pressure on the Fed.

Chart: Federal funds target rate

Source: Refinitiv DataStream, as of September 21, 2022.

As rates rise, how is the U.S. economy reacting?

The troubling bit is that the most rate-sensitive sectors of the economy are already showing signs of stress. For instance, the 30-year mortgage rate has doubled from year-ago levels, contributing to mortgage applications tumbling by about 56% since the start of the year. However, despite driving rates into the danger zone, the Fed doesn't seem ready to make a U-turn. FOMC (Federal Open Market Committee) officials remains troubled by a strong labor market placing upward pressure on wages and inflation.

In the press conference following the FOMC meeting, Chairman Jerome Powell mentioned that there is "only modest evidence" that the labor market is cooling off. In other words, the Fed likely won’t consider the job done until the labor market slows enough to bring down core inflation within striking distance of its 2% target. The August CPI (consumer price index) report was a step in the wrong direction, with core inflation rising to 6.3% from 5.9%—too distant from its target level.

Fed members see rates rising to 4.4% by year-end

The hotter inflation has resulted in a more hawkish rate path relative to the June projections. The Fed now expects the year-end 2022 target rate to rise to 4.4%. Although that's roughly in line with market pricing heading into the September meeting, it implies an additional 125 bps tightening over the remaining two meetings in 2022. This suggests that November could see another 75 bps rate hike, followed by a 50-bps increase at the final meeting this year and another 25-bps hike in early 2023. The terminal rate, or the level at which the target rate peaks, is now expected to be 4.6% by 2023 versus 3.8% in June.

Too early to pivot

Those who had been hoping for a Fed pivot will likely be disappointed. While Chairman Powell mentioned at the press conference that "there isn't a painless way" to get inflation under control, he also underscored that price stability is paramount and therefore, a slowing economy or a mild recession may not be enough to enable the Fed to pivot if inflation still remains above the Fed’s target.

We take the chairman at his word and do not expect a policy reversal to occur as quickly as markets may be anticipating unless core inflation sufficiently declines to the point that the Fed no longer considers inflation expectations at risk of becoming unanchored. That said, we are concerned with the speed at which rates are rising. The Fed has cumulatively raised rates by 300 bps in about seven months, and is forecasting another 150 bps in rate increases, making this the most aggressive rate hiking cycle since the 1980s. Importantly, we know policy works with a lag, and inflation is a lagging indicator. And, as previously discussed, the most interest-rate sensitive parts of the economy, like housing, are flashing a warning signal. Ultimately, there is a clear risk that the Fed becomes too restrictive and stays there for too long—especially if it waits for confirming signals from a lagging indicator.

Market reaction and key takeaways

U.S. equity markets (represented by the S&P 500 Index) were up on the day but were noticeably volatile after the statement's release and Chairman Powell's press conference, gyrating between gains and losses before finishing lower. Bonds were similarly whipsawed, though the U.S. 2-year Treasury yield trended higher on the hawkish outcome.

We remain cautious about the outlook for the business cycle as a consequence of the Fed's aggressive rate hiking campaign and expect market turbulence to persist. Maintaining a diversified asset allocation and investment discipline will be crucial.