What is a tax managed mutual fund?

Executive summary:

- Tax-managed investing can help reduce the bite that taxes take out of a portfolio

- Investment taxes are triggered by different types of gains, income and distributions

- Tax-managed mutual funds are designed to minimize taxable distributions

At Russell Investments we strongly believe that no one should pay more taxes than they need to. And we also strongly believe that a major component of an advisor's value comes from their efforts to help their clients minimize the taxes they pay on their investments.

After all: It's not what you make, it's what you get to keep. Managing for taxes throughout the investment process can help reduce the taxes payable on a portfolio, thereby theoretically leaving more money available to grow and compound. You can probably intuitively understand the concept of "tax managed." But what does it really mean?

Read on as we dig into the nuts and bolts of tax-managed investing, define a tax-managed mutual fund, and describe how Russell Investments approaches tax-managed investing.

How are mutual funds taxed?

Taxes have a nasty habit of eating away at investment portfolios. If you aren't careful, a meaningful amount of return can be lost just due to the impact of taxes. But, by investing in a tax-efficient manner, you can reduce the tax bill on a portfolio and keep more of the investment returns earned.

When it comes to mutual funds, taxes can be triggered in three ways. This is particularly important for investors with non-registered assets (i.e. assets not in an RRSP, TFSA, RRIF or other registered vehicles).

INTEREST INCOME

Investments which pay income as interest, such as Money Market funds or Guaranteed Investment Certificates (GICs), are taxed at an investor’s marginal tax rate. Out of the various types of distributions, interest is taxed the highest.

Dividend Distributions

Mutual fund unitholders can be taxed on a fund's dividends, whether they are received as cash or reinvested in additional shares. Eligible Canadian dividends are taxed favourably (through dividend tax-credits), whereas US and foreign dividend income are taxed as other income (at an investor’s full marginal rate).

CAPITAL GAINS DISTRIBUTIONS

Inside of the mutual fund, when the fund sells stocks or bonds that have a gain, that gain must be passed along to all unitholders of the fund (unless it can be offset by a realized loss in the portfolio).

Most funds distribute capital gains near the end of the year. This means with most mutual funds, there are some capital gains to report each year even if no units of the fund were sold.

Mutual funds are similar to stocks in that the investor is a unitholder. Normally, when an investor sells units of a mutual fund, they will be taxed on any gains made during the holding period. When units of a mutual fund are sold for more than was paid for them, that will result in a capital gain. Selling your mutual fund units is in your control.

Helping clients keep more of what they earn

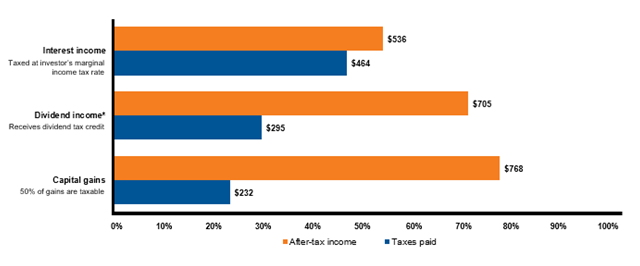

Differences in taxation for $1,000 of distributions

Click image to enlarge

For illustrative purposes only. All examples shown are based on the following 2023 Ontario marginal tax rates for calculating the tax liabilities: interest income = 53.5%, Canadian eligible dividends = 39.3% and capital gains = 26.8% *Eligible Canadian dividends are taxed favourably, US and foreign dividend income are taxed as other income (at an investor’s full marginal rate).

The chart above shows how different types of distributions have different taxation levels for Canadian investors. As an example, on $1,000 of interest income earned, an investor would keep $536 with $464 to be paid in taxes. Contrast this to $1,000 of capital gains, an investor would keep $768 with $232 to be paid in taxes.

What can be done to minimize these taxes?

This is an easy one to answer! Consider investing in tax-managed mutual funds. Tax-managed mutual funds can make a lot of sense for investors in taxable non-registered accounts--provided they live up to their promise of being tax-efficient.

While most traditional mutual funds are not managed with the impact of these capital gain distributions in mind, a tax-managed mutual fund can take steps to significantly reduce – or even eliminate – these unwanted distributions. By eliminating the prospect of unexpected distributions, unitholders of tax-managed mutual funds have control over the tax year in which capital gains are reported. For example, they can choose to sell their shares of the fund in a year when they may have less income from other sources.

Tax-managed mutual funds are designed to generate returns via fund price increases, while minimizing annual capital gain distributions.

They not only have investment objectives to provide returns similar to non-tax managed funds, but tax-managed mutual funds also have an obligation to minimize taxable transactions within the fund itself. They do this in several ways, whether by selling some stocks at a loss to offset other gains, eliminating wash sales or through other techniques.

How does Russell Investments approach tax-managed investing?

Russell Investments employs all the principles of tax-managed investing such as year-round tax loss harvesting, paying attention to holding periods to minimize superficial losses, implementing tax-smart portfolio turnover, minimizing realized gains, and strategically managing a fund’s yield.

Our centralized trading desk then enhances tax efficiency by employing an internal overlay management team to coordinate trading activity across all the underlying money managers within each tax-managed mutual fund.1 With total portfolio management ("TPM"), all the securities within each Fund are held in a single custody account, where they are fully monitored and solely transacted by the overlay management team. Considerable tax benefits can be derived using this TPM approach. For example, when one money manager is buying a position and another is selling the same position, the total transaction can be lessened because all or part of the buyer's purchase can be fulfilled by the seller, with potentially no actual transaction required within the overall fund.

This additional layer of coordination and centralized oversight eliminates the overlap common to multi-manager funds. This gives us greater potential to reduce administration and trading costs, as well as the potential to minimize capital gains distributions.

We're not only leaders in active tax management, we're also pioneers, having spent more than 35 years in the U.S. sharpening an approach tailored to remove complexity, solve problems and save time. We are excited to bring our tax-managed capabilities to serve Canadian advisors looking to unlock true return by helping their tax-sensitive clients keep more of what they earn.

1 Centralized trading and overlay services provided Russell Investments Implementation Services, LLC. As a sub-adviser to Russell Investments Canada Limited, Russell Investments Implementation Services, LLC is a Securities Exchange Commission (SEC) Registered investment adviser and broker-dealer, member Financial Industry Regulatory Authority (FINRA), Securities Investor Protection Corporation (SIPC). Russell Investments Implementation Services, LLC is a wholly owned subsidiary of Russell Investments US Institutional HoldCo.