Russell Investments Corporate Class

Our corporate class solutions offer tax-efficient investing opportunities.

Corporate class funds are designed to eliminate or minimize taxable distributions.

Because they do not typically distribute interest income to shareholders, corporate class funds can provide more tax-efficient returns than comparable portfolios of mutual funds or individual securities. Annual distributions are generally eligible Canadian dividends and capital gains, which are taxed at a more favorable rate than interest income. Monthly distributions can also be provided as return of capital, which is not taxable until the original investment is depleted.

Why use corporate class?

Benefit from tax-deferred growth of your investments

Receive income as a return of capital, which is not immediately taxable

Choose when to realize capital gains, which could help you manage your taxable income

Russell Investments - Corporate Class Funds

Russell Investments Short Term Income Class (closed to new purchases)- Profile pages Series F | Series B | Series B USD Hedged | Series F USD Hedged

Russell Investments Canadian Equity Class

Russell Investments Tax-Managed US Equity Class

Russell Investments US Equity Class

Russell Investments International Equity Class***

Russell Investments Tax-Managed Global Equity Class

Russell Investments Global Equity Class

Russell Investments Global Infrastructure Class

Russell Investments - Corporate Class Portfolios

Income

Russell Investments Conservative Income Class

Russell Investments Income Essentials Class

Russell Investments Diversified Monthly Income Class

Accumulation

Russell Investments Balanced Class

Russell Investments Balanced Growth Class

Russell Investments Long-Term Growth Class

Multi-Asset Corporate Class Solutions

Multi-Asset Income Strategy Class

Multi-Asset Growth Strategy Class

Multi-Asset Growth & Income Strategy Class

All this, plus Russell Investments' renowned investment process and diversification across asset classes, investment styles, and money managers.

All taxable Canadian dividends (other than capital gains dividends) paid by Russell Investments Corporate Class are eligible dividends for federal tax purposes unless otherwise indicated.

Funds for tax-sensitive investors who want exposure to the U.S. Dollar

Capital Dividend Account

A tax-planning tool for small business owners

A Capital Dividend Account (“CDA”) combined with corporate class funds can be an effective way for shareholders of a Canadian business to generate tax-efficient income.

What is a CDA?

A CDA is a notional account that keeps track of various tax-free surpluses accumulated by a small business designated as a Canadian controlled private corporation, or CCPC. Those surpluses can be paid out as tax-free capital dividends to shareholders.

A corporation’s CDA balance can include:

- Capital gains and losses

- Dividends received from another company

- Proceeds from a life insurance policy in excess of the Adjusted Cost Base of the policy

- Gains and losses on the sale of some fixed assets1

Related content

From a tax perspective, it may be beneficial for a corporation to realize capital gains rather than interest income, to determine when those capital gains are recognized, and to have the gains flow through a CDA. Capital gains are a tax-efficient type of investment income for corporations (and individuals) as they are taxable at only 50%. Interest income does not qualify as an eligible addition to a CDA.

Tax rules that govern private corporations also make it more attractive to realize capital gains rather than interest income. Private corporations subject to the small business tax rate face a higher tax bill if their annual passive investment income exceeds $50,000. Any amount of passive income earned above that rate reduces access to the small business preferential tax rate, and the preferential rate is eliminated completely when passive investment income exceeds $150,000. Passive investment income is comprised of interest income and eligible dividends plus 50% of capital gains. Therefore, emphasizing capital gains over interest income can help reduce passive investment income (also known as Aggregate Investment Income).

Corporate class funds may provide private corporations with the potential to take advantage of the benefits of a CDA. Corporate class solutions are structured so that investors can realize income in the form of capital gains. When a company receives a capital gain, the non-taxable portion of the gain is added to the CDA, increasing its balance. This allows the CCPC to declare a tax-free capital dividend for its Canadian resident shareholders. As an extra benefit for the shareholder, this tax-free distribution doesn’t impact government benefits such as Old Age Security.

Corporate class funds can offer the following benefits to a shareholder of a CCPC:

- Minimize passive investment income and defer taxes payable

- Generate taxable distributions in the form of capital gains and Canadian eligible dividends

- Option to generate income in the form of Return of Capital

- Grow the CDA balance

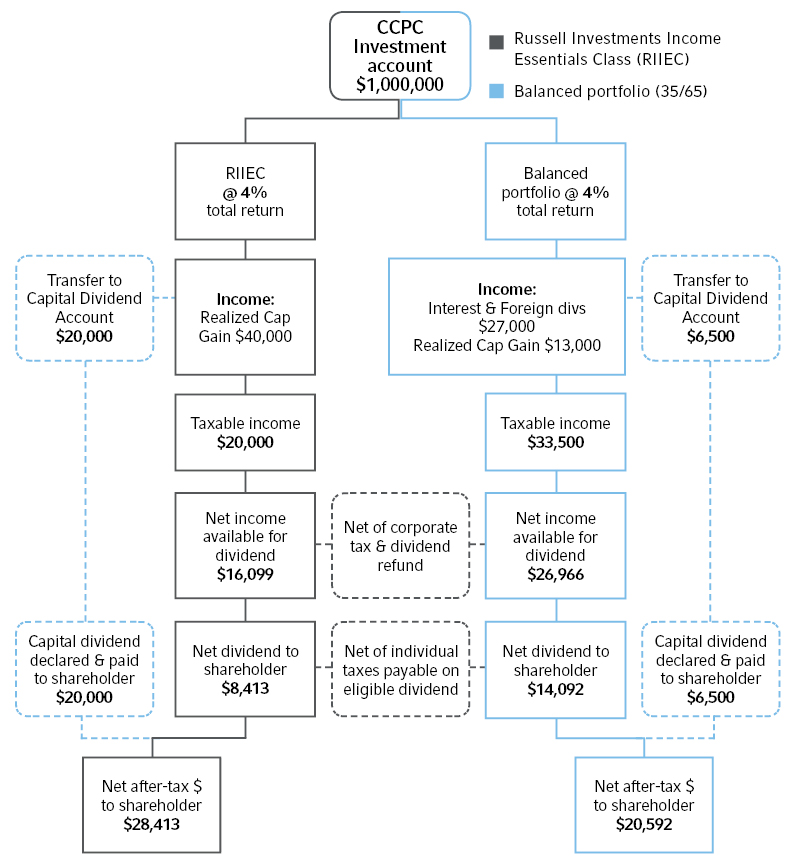

The following is a hypothetical example of the financial benefit Russell Investments Income Essentials Class (RIIEC) can provide to shareholders of a CCPC. We will assume the CCPC invests $1 million in each of two options:

1) Russell Investments Income Essentials Class and

2) a balanced portfolio of securities2 with the same equity / fixed income allocation as RIIEC.

In each case, the total portfolio rate of return is assumed to be 4%.

The chart depicts a detailed tax calculation for a CCPC investment account at a corporate account level and at an individual shareholder account level.

For illustrative purposes only and not a recommendation to purchase or sell any security.

Highest marginal tax rates => The following 2021 Ontario marginal tax rates are used for calculating the tax liabilities: interest income = 53.5%, Canadian eligible dividends = 39.3% and capital gains = 26.8%. Ontario 2021 corporate investment income tax rate is 50.17%.

Russell Investments does not provide legal or tax advice. Laws of a particular province or laws which may be applicable to a particular situation may have an impact on the applicability of such information. Federal and provincial laws and regulations are complex and are subject to change. Changes in such laws and regulations may have a material impact on pre- and/or after-tax investment results. Always consult a lawyer or tax professional regarding your specific legal or tax situation.