T is for tax-smart planning and investing: the value of considering the impact of taxes on investments

Would you willingly pay higher taxes on your income? Silly question, right? Nobody wants to pay more taxes than they have to. And yet, thousands of people do so every year.

Many are investors who aren’t aware of the different rates of taxation on different types of distributions. Others may not fully take advantage of the Tax-Free Savings Account (TFSA) or the Registered Retirement Savings Plan (RRSP). Or of plans designed to help them fund a child’s education, provide for a disabled relative, or save to purchase a home. And it’s likely that many investors don’t know the most tax-efficient way to withdraw from the various streams of income they may have once they enter retirement.

This is why T—for being a tax-smart advisor—is the fourth letter in our Annual Value of Advisor study. We believe advisors who can help their clients avoid unnecessary taxes can add substantial value.

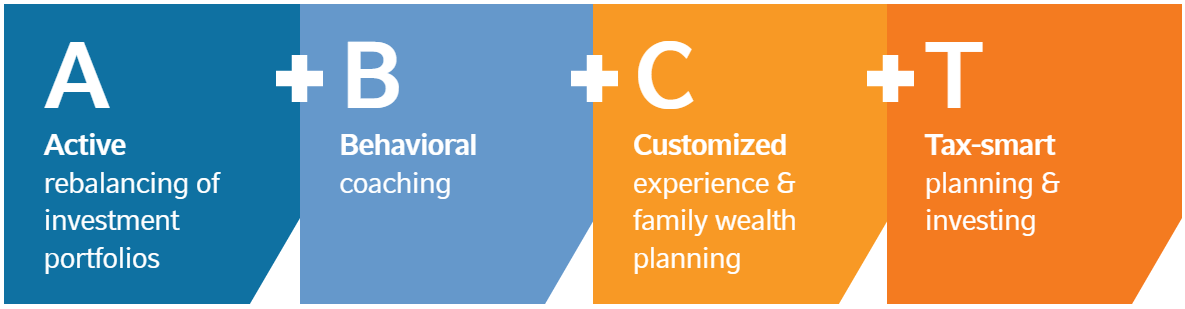

Value of an Advisor = A+B+C+T

This is the last blog doing a deeper dive into one of the letters in our easy-to-remember formula: A+B+C+T. Earlier we discussed the other components of an advisor's value: the active rebalancing to keep a client portfolio on track, the behavior coaching to help avoid knee-jerk reactions to market volatility and the customized wealth planning that families now require.

This blog will look at the value of being a tax-smart advisor. Advisors who consider the impact of taxes throughout the investment process can help their clients achieve potentially greater returns by reducing the bite that taxes take.

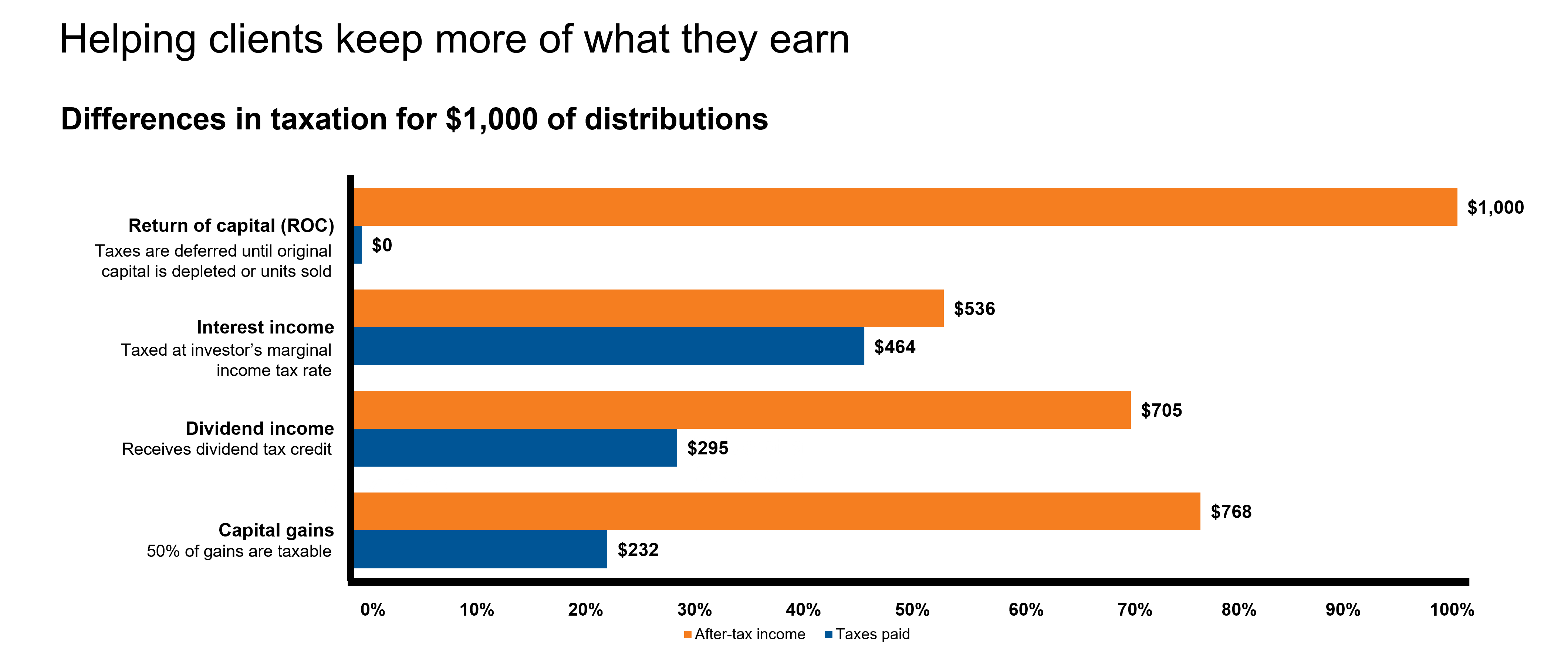

As a tax-aware advisor, you can help your clients understand the advantage of receiving distributions in the form of Return of Capital (ROC). Since ROC is not taxable in the year it’s received, taxes on those distributions can be deferred to a later time – perhaps when your client is in a lower tax bracket, such as when they enter retirement. ROC can be especially important for investors whose income from their investment portfolio could lead to a clawback of their Old Age Security (OAS) benefits.

For illustrative purposes only.

All examples shown are based on the following 2022 Ontario marginal tax rates for calculating the tax liabilities: interest income = 46.4%, Canadian eligible dividends = 29.5% and capital gains = 23.2%

Additionally, your advice in helping them decide when to begin drawing down their Canada or Quebec Pension Plan, and whether to purchase a Registered Retirement Income Fund (RRIF) or annuity can be instrumental to their ongoing financial security as well as helping them minimize the tax bite taken on their retirement income.

How would your clients react when they realize your advice helped them keep potentially thousands of dollars they would otherwise have paid to the government? Do you see why tax management is such an important component to an advisor’s value?

When to do tax loss harvesting?

Continually facing large taxable distributions, or paying the highest rate of taxes on their retirement income can have a material impact on the long-term wealth of investors. Therefore, we at Russell Investments believe taxes can be managed—through active tax-loss harvesting (not just once a year) to reduce capital gain distributions, minimizing wash sales, managing holding periods, and structuring a portfolio to distribute income in the most tax-efficient manner. These tools can help lower tax liabilities today and allow that money to remain in the portfolio to potentially grow in the future.

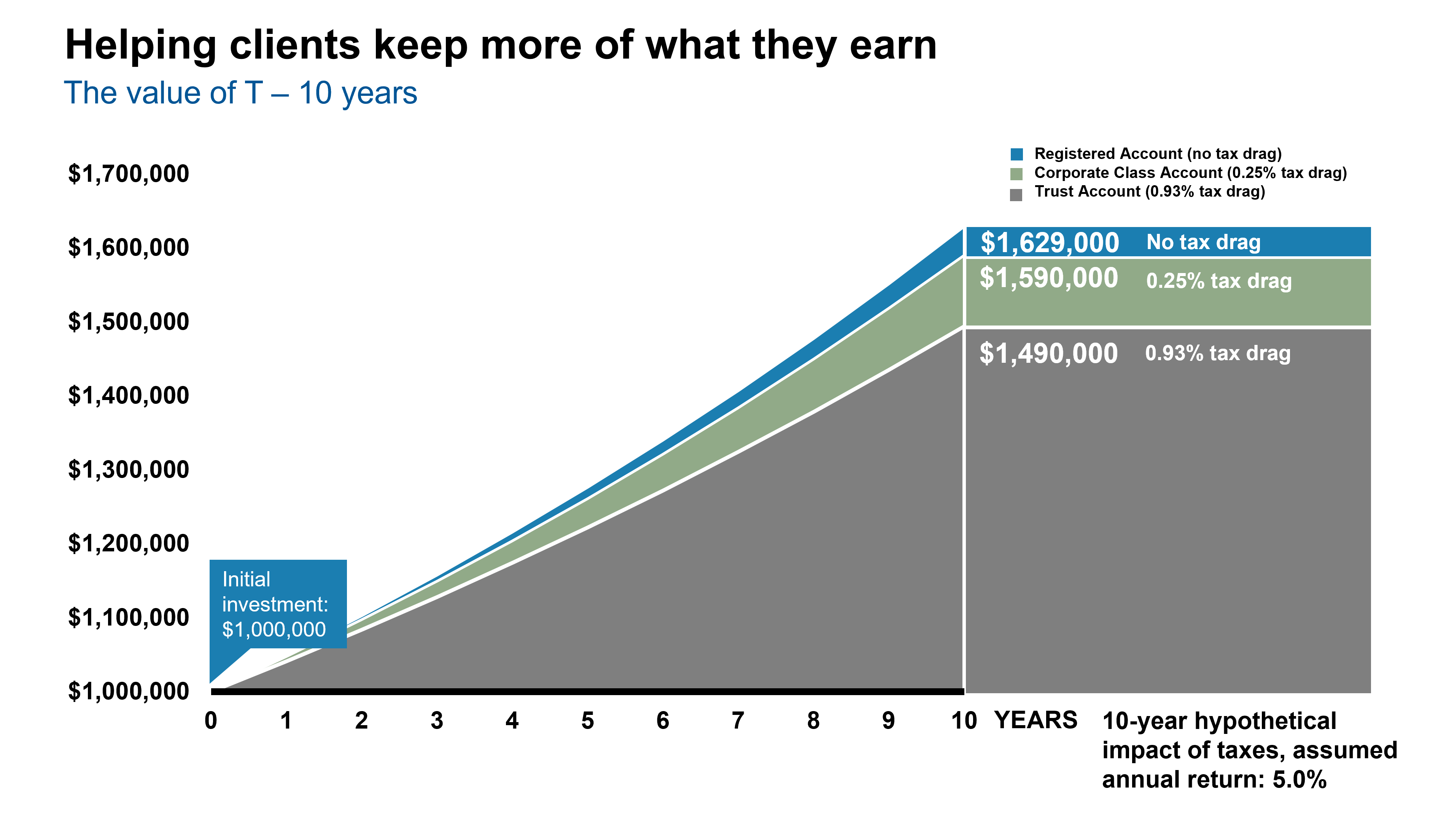

Tax drag: seeing is believing

We call the taxes on investment income that could have been avoided tax “drag”. The next chart shows the difference in portfolio growth when tax drag is removed. For many of your clients, investing in a registered account will eliminate tax drag. But other clients who have reached the allowable limit in their registered plans, may benefit from investing through a corporate class account. While many investors may be aware of the tax benefits of registered plans, they may not understand how corporate class could help them. This is where you, the advisor, can shine.

Source: Russell Investments

Assumptions: C$1 million investible amount 5% rate of return for “Registered Account”, 4.75% rate of return for “Corporate Class Account”, 4.07% rate of return for “Trust Account”

After-tax distributions are re-invested

Tax “drag” is the difference between the returns on the “Registered Account” versus “Corporate Class Account” or “Trust Account”.

For illustrative purposes only, Not intended to reflect any actual portfolio or Russell Investments Canada Limited product.

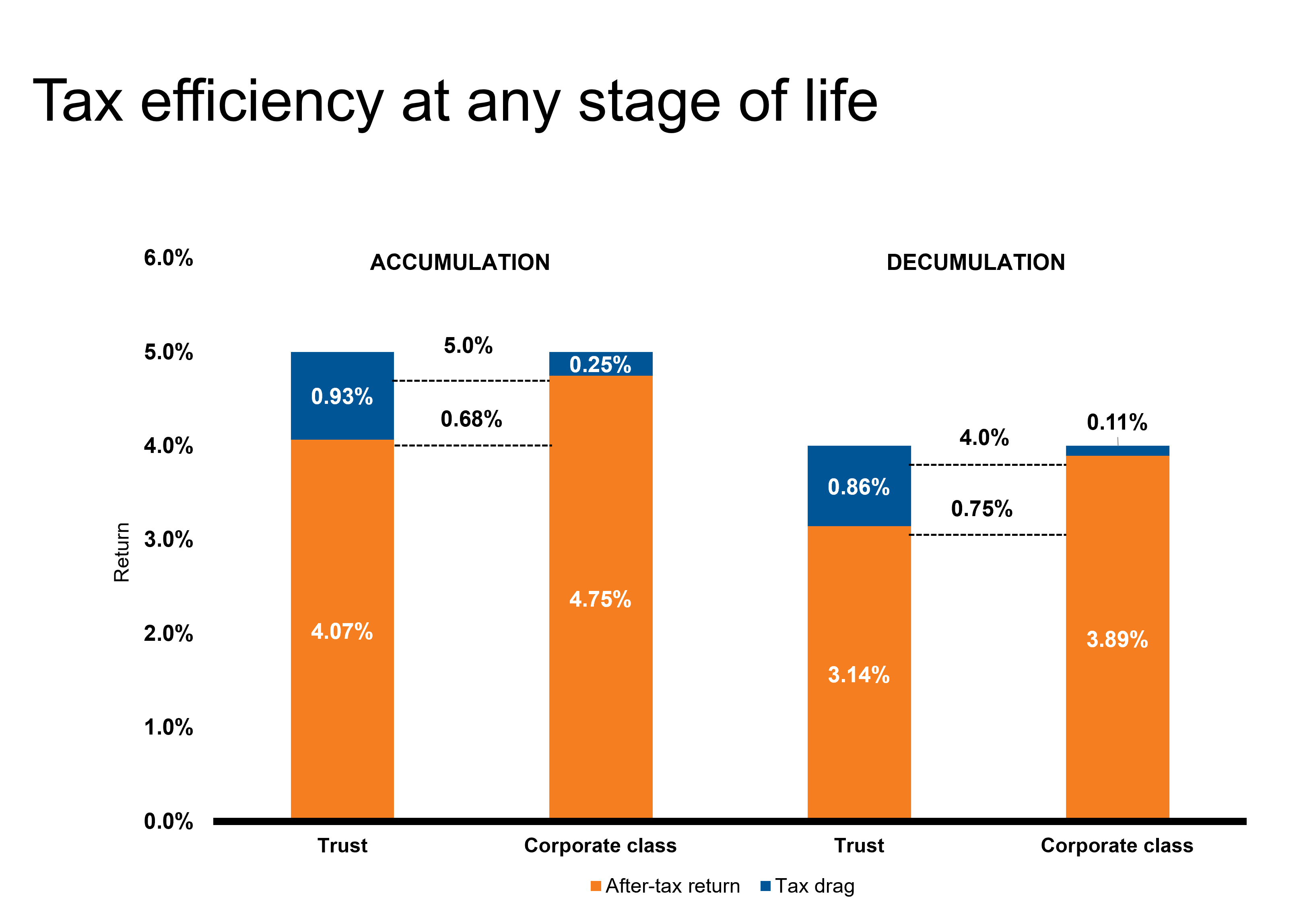

Percentages represent the difference in the gross return and after-tax return for trust and corporate-class mutual funds.

We work with and educate many advisors on how to demonstrate the magnitude of tax drag on a portfolio to both clients and prospects.

Advisors who work with business owners can combine corporate class solutions with a capital dividend account (CDA) to offer shareholders of a Canadian business the ability to generate tax efficient income. Using a tax efficient strategy like corporate class can offer business shareholders the ability to minimize passive investment income and defer taxes payable, or generate income in the form of ROC and potentially grow their CDA balance.

Tax management is important in both the accumulation stage and in the decumulation stage. In both cases, the more money that remains in the portfolio and not lost to taxes, the more potential the portfolio has to grow.

Click image to enlarge

Source: Russell Investments

Accumulation: 5% rate of return for “Registered Account”, 4.75% rate of return for “Corporate Class Account”, 4.07% rate of return for “Trust Account”.

Asset Mix: 60% Equity / 40% Bond. The following 2022 Ontario marginal tax rates are used for calculating the tax liabilities: interest income = 53.5%, Canadian eligible dividends = 39.3% and capital gains = 26.8%.

Decumulation: 4% rate of return for “Registered Account”, 3.89% rate of return for “Corporate Class Account”, 3.14% rate of return for “Trust Account”.

Asset Mix: 35% Equity / 65% Bond. The following 2022 Ontario marginal tax rates are used for calculating the tax liabilities: interest income = 37.9%, Canadian eligible dividends = 19.0% and capital gains = 17.8%.

After-tax distributions are re-invested

Tax “drag” is the difference between the returns on the “Registered Account” versus “Corporate Class Account” or “Trust Account”.

For illustrative purposes only, Not intended to reflect any actual portfolio or Russell Investments Canada Limited product.

Percentages represent the difference in the gross return and after-tax return for trust and corporate-class mutual funds.

The bottom line

Taxes can be a major headwind for investors. The good news is that the impact of taxes on investment portfolios can be managed intentionally, reaping potential benefits for investors and advisors alike. Helping your clients benefit from techniques like tax-loss harvesting or helping them mitigate the impact of taxable distributions can help set you apart from your peers.

Amid market volatility, an economic downturn, higher inflation and political uncertainty, today’s investing environment is one of the most challenging of our lifetimes. At Russell Investments, we believe the role advisors play has never been more vital. When else have investors had a greater need of a counselor and guide to help them navigate these issues? This annual Value of an Advisor study quantifies that dedication and the resulting benefit.