Passive investing could be very costly. What’s your plan if a market correction strikes?

Executive summary:

- The price-to-earnings ratio of the Magnificent Seven is not yet at levels seen during the 1999 tech bubble, but historical observations can elude forecast accuracy.

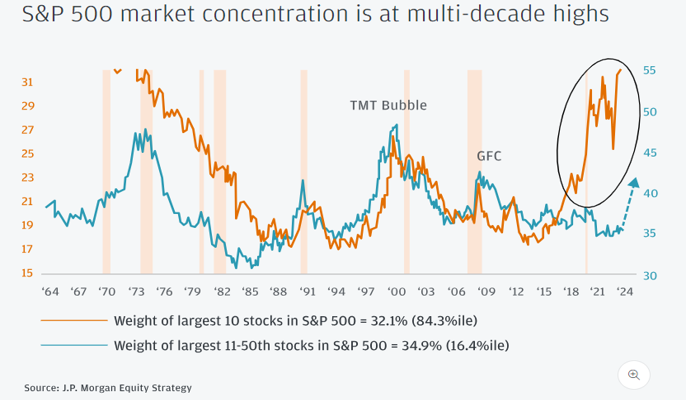

- The S&P 500 Index today is the most concentrated it's been since the 1950s. Amid this backdrop, taking a passive approach increasingly exposes investors to a few high-flying securities—and may lead to significant portfolio drag if these stocks begin to fizzle.

- We believe a diversified, multi-manager approach can best help manage the risks of investing in today's highly concentrated markets.

Material tail risk appears for passive investing in the current landscape

How long will the Magnificent Seven group of stocks stay magnificent? Are cracks starting to appear in its armor?

The consensus outlook among analysts today is that tech innovation will rewrite the global productivity index, with AI (artificial intelligence) and automation expected to bring a new wave of industry efficiencies. Because each of the companies in the Magnificent Seven are tech innovators, some have speculated that this group could dominate the stock market for years to come. And while this may or may not prove to be the case, it's important for investors to understand that the fundamentals of investing will remain the same regardless. Simply put, price points still matter and valuations ultimately will determine the magnitude of investment returns—and inform the margin of safety behind a decision.

Party like it's 1999? How today's market concentration compares to the dot-com boom of the 1990s

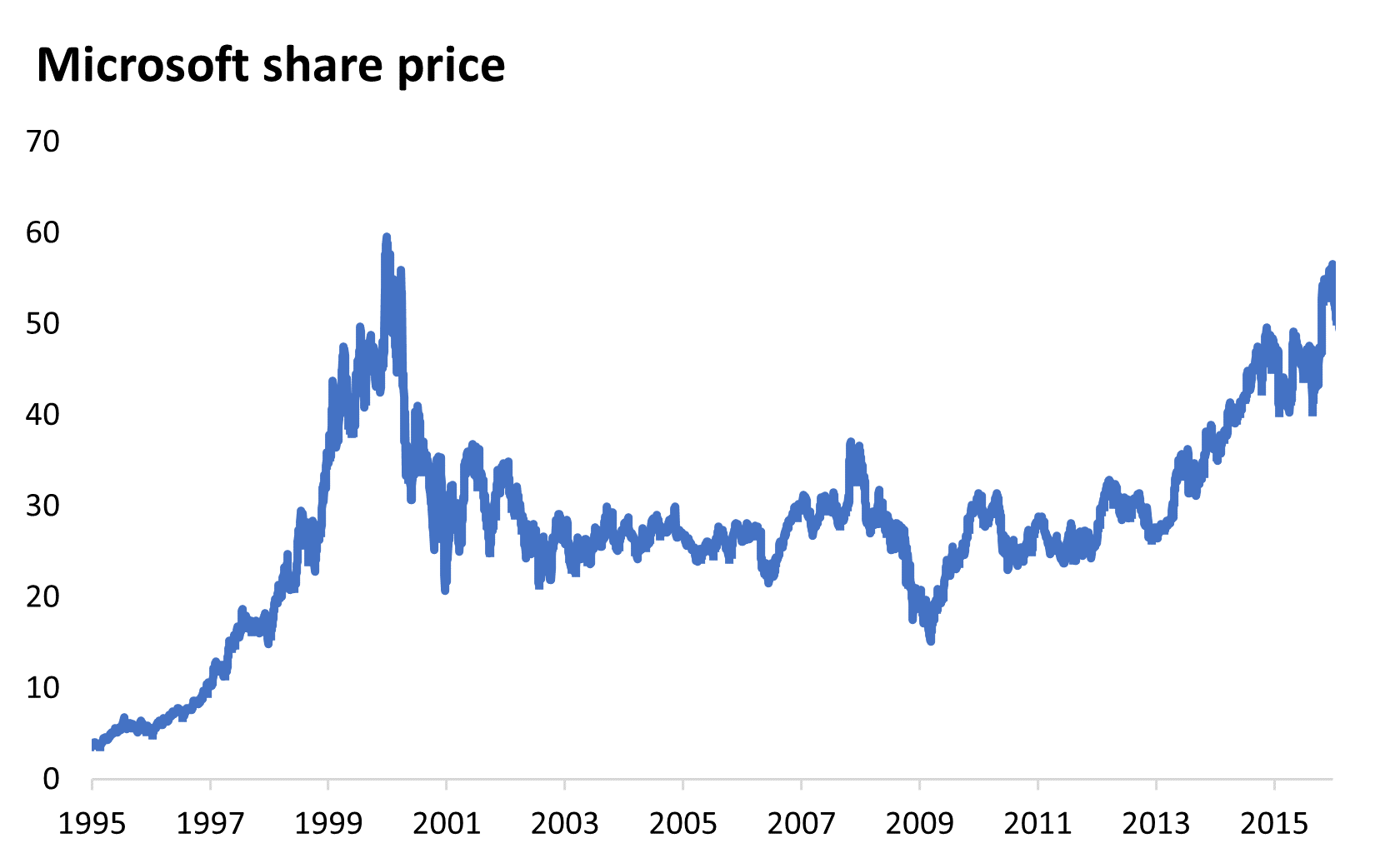

The market dominance of the Magnificent Seven today is reminiscent of Cisco and Microsoft in 1999, which was the last time similar extreme levels of concentration occurred among the biggest index members of the S&P 500. Microsoft, for example, peaked at US$60 per share in 1999 before the dot-com bubble burst. The company would not reclaim this price point for 16 years, as the chart below shows.

Source: LSEG Datastream

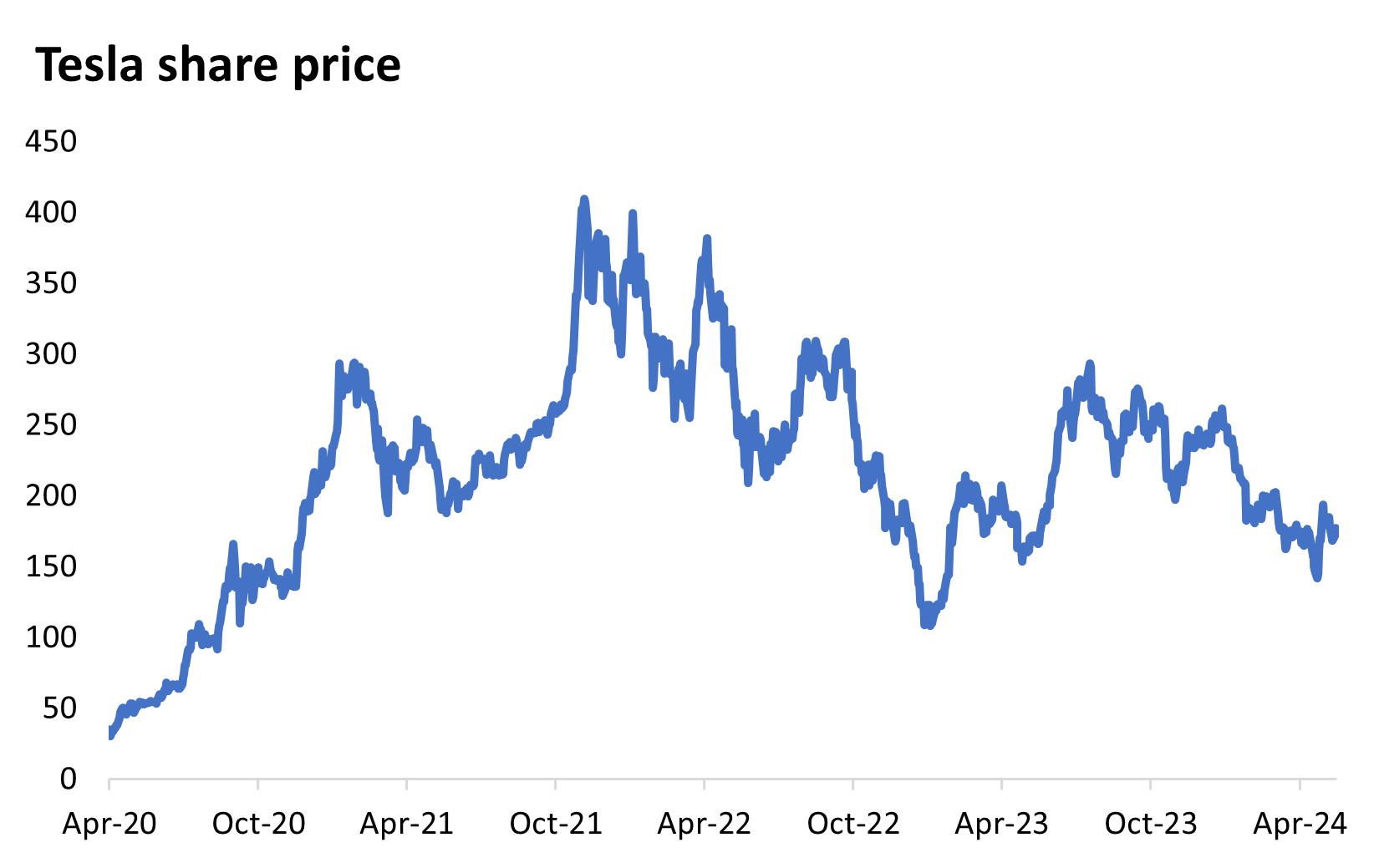

While there are some notable differences in today's market environment versus that of the late 1990s, it is interesting to note that Magnificent Seven member Tesla's stock price today is approximately half of what it was in late 2021, when it reached US$400 per share. Today's stock price sits below US$200 per share as Tesla encounters growing competition (cheap Chinese substitutes) and internal production challenges.

Source: LSEG Datastream

Under the hood: Price-to-earnings ratio of the Magnificent Seven

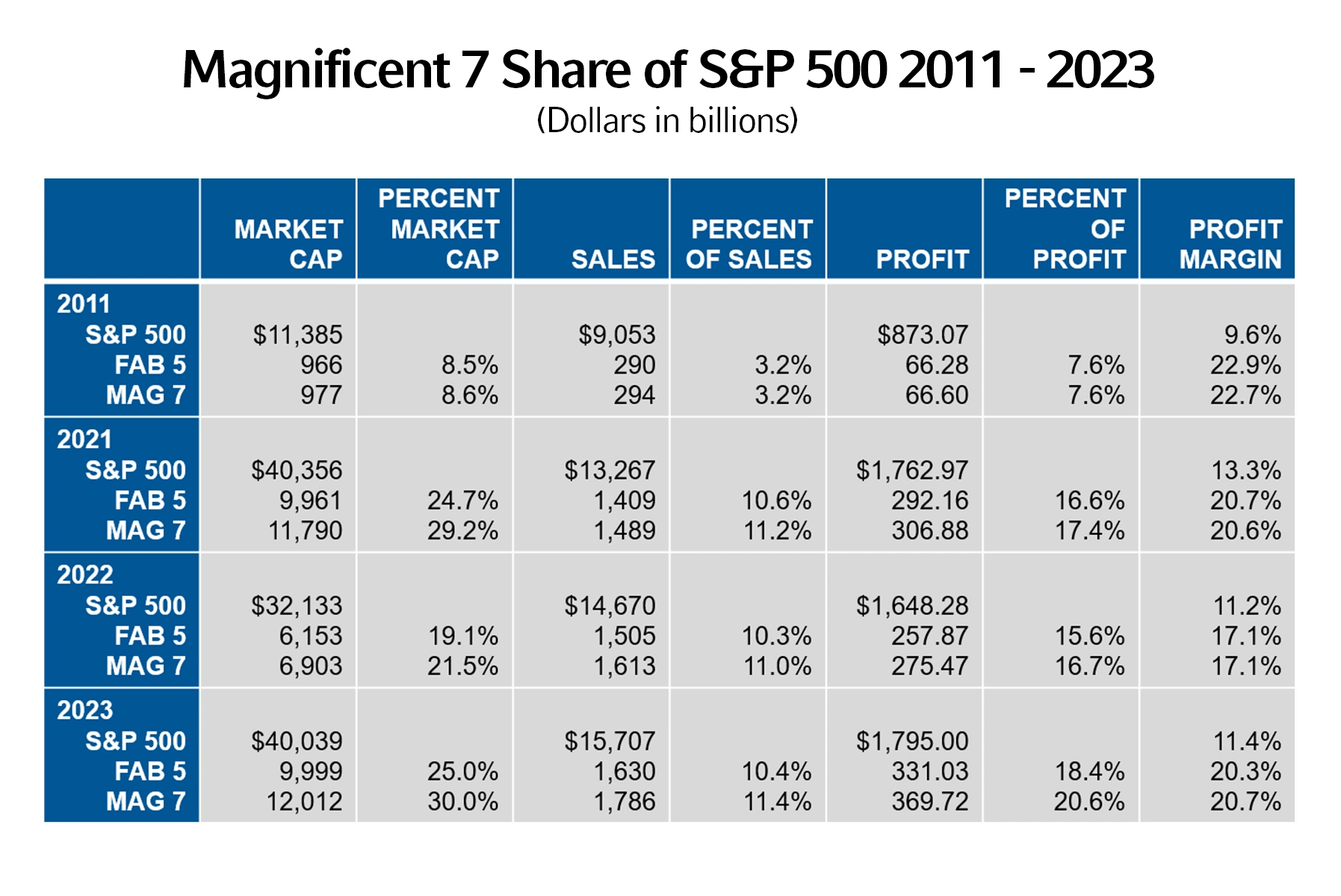

Without a doubt, the Magnificent Seven are remarkable businesses. Back in 2011, they accounted for 3% of S&P 500 companies' revenue sales. By 2023 this number had shot up to 11%. Although profit margins dipped slightly during this time period, levels among the seven companies remain healthy—with profit margins above 20%. In addition, the Magnificent Seven's percentage of S&P companies' profits increased from 8% to 20%, indicating a huge share of the economic pie. As of 2024, the Magnificent Seven now account for an aggregate U.S. $13 trillion in market cap. That's quite simply an astounding number.

Source: Semper Augustus

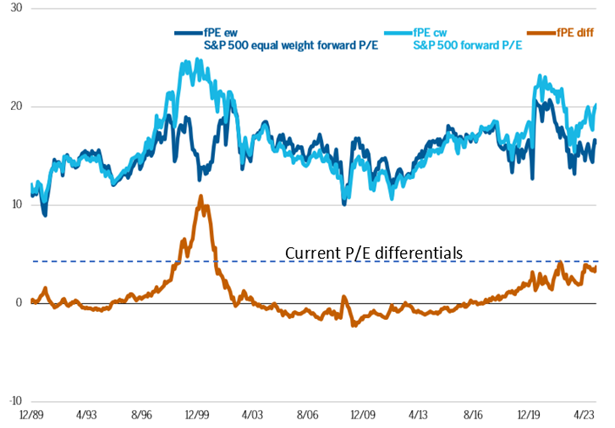

This begs the question: How does the price-to-earnings (P/E) ratio of the Magnificent Seven compared to what was seen during the halcyon days of the dot-com era?

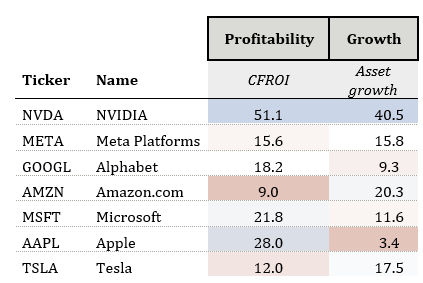

We can find out by measuring P/E valuation differentials of top market constituents with the rest of the index. This is done by comparing market-weighted P/E with equal-weighted P/E. When doing this for the S&P, we note that the P/E valuation stretch is not yet at levels of the 1999 tech bubble—and it can be agreed that the Magnificent Seven have exhibited remarkable sales and margin growth, as the chart below shows.

Source for both charts: Wellington Asset Management

However, it's important to understand that historical observations can elude forecast accuracy. In order to fully ascertain what may lie ahead for the Magnificent Seven, there a few critical questions that should be asked:

- Will P/E differentials further widen? Or could they begin to tighten? Recall that it's been 30 years since we last saw such large valuation gaps.

- Can names such as Nvidia and Apple foreseeably sustain CFROIs (cash flow return on investments) of 51% and 28% over the investment horizon—numbers that their valuation multiples would suggest?

- Are we cognisant whether (if not already) we will soon see peak earnings growth?

These questions force us to think about the risks for the Magnificent Seven companies whenever we reach the next trough of the business cycle—whether that's in six months or six years. To see how things could potentially play out if the economy goes south, let's take another look back to the late 1990s and early 2000s.

What happened when the dot-com bubble burst?

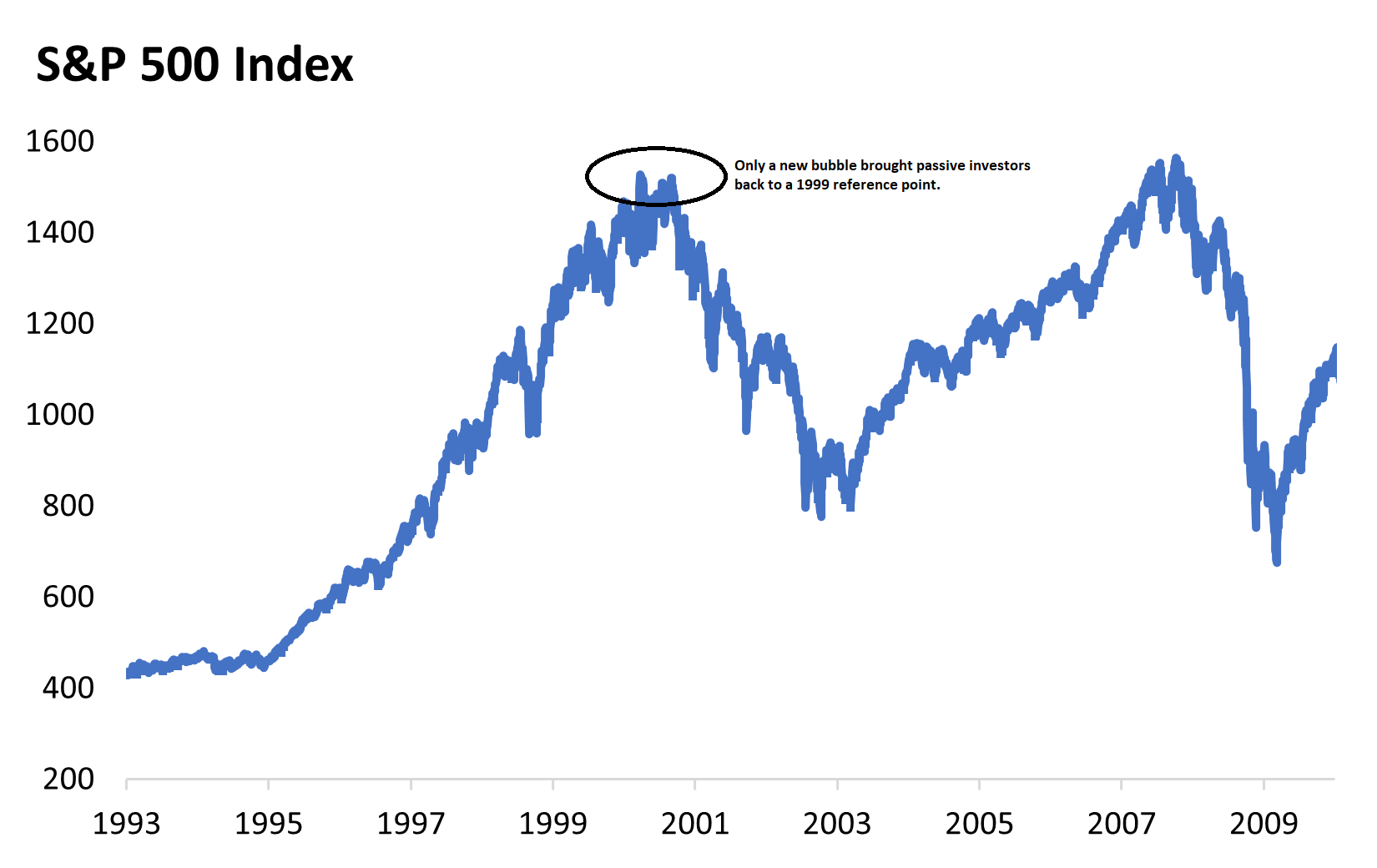

While market concentration peaked in 1999 in the U.S., the market rally continued on into the early 2000s (as shown in the chart below). After that, however, there was a considerable downward correction and derating in stock prices. Could such a scenario play out this time around, whenever the next recession strikes?

History tells us it's a possibility. A correction from here on out may potentially wreck investor returns—particularly among passive investors who now have material index exposure to the Magnificent Seven—perhaps similar to what was observed during the so-called lost decade from 1999 to 2009. During this stretch, the stock market only briefly returned to 1999 levels at one stage—but this proved to be a second moment of exuberance, realizing the peak of the subsequent credit bubble.

Is the stock market in an AI bubble? That's beside the point.

Going by the Herfindahl-Hirschman Index (HHI)—one of the most common gauges of market concentration—today's S&P 500 Index is the most concentrated in over 50 years. Not since the days of the Nifty Fifty have markets been as heavily concentrated. Amid this backdrop, some investors have speculated we might be in an AI bubble today. From our vantage point, whether we are in a bubble or not is beside the point, as there can be no argument that taking a passive approach today increasingly exposes investors to a few high-flying securities. At some point, those stocks will come back down to earth, and the impacts to passively managed portfolios could be significant—if not painful.

The bottom line

Today's investors should think not only about how they want their portfolios positioned in the here-and-now, but also about how they want their portfolios positioned if the excitement around AI subsides. While we highlight our concerns on index concentration, it is naive to completely avoid all Magnificent Seven companies. This would result in pronounced levels of active risk coming from these non-held names that could overwhelm the intended risks coming from selection.

Russell Investments' approach is to diversify investment processes across different decision-makers, building around the collective wisdom of various investment specialists. This results in varying levels of exposure and selection of individual Magnificent Seven companies by embedding different manager insights.

On occasion, abnormal market concentration may still drive disproportionate risk levels and create a drag on performance. Russell Investments further combines alpha-seeking strategies with internal positioning strategies and risk solutions to smooth out the journey faced by clients. This helps navigate occasional periods of unusually high concentration while seamlessly integrating active investing to help ensure that investors are capturing alpha opportunities while effectively managing risk.