ESG considerations in fixed income: Rapid expansion trend continues

While ESG was initially a hot topic for equity investors, fixed income market investors are taking notice and practitioners are quickly catching up. At Russell Investments, we have observed the rapid expansion in ESG integration practice among fixed income asset managers in recent years.

Since 2014, we have been formally incorporating environmental, social and governance (ESG) factors into our investment process, including fixed income research. As a component of our manager research process, manager research analysts assign an ESG rank to individual strategies. Our observations of market trends assist us in identifying leading market practitioners around ESG considerations and implementations in their investment processes.

In this blog, we aim to share some key ESG integration trends we see among the fixed income market practitioners. Our observations are derived from the findings from our 2020 ESG Manager Survey and discussions with a number of fixed income market practitioners.

ESG for fixed income investing

Before diving into our observations, we believe it’s helpful to compare the history of ESG considerations in fixed income investing to equity investing. The primary difference is the fiduciary duty associated with proxy voting and shareholder engagement (proxy and engagement) for equity investment managers.

The role of proxy and engagement has emerged as a major part of responsible investment practices. The idea that investors can influence the activity of their holdings had a slower uptake among many bond investors, where proxy voting isn’t an option. Fixed income investment managers distanced themselves from the notion of engagement at first, while focusing more on integration. However, we have seen rapid shifts where fixed income managers are embracing an engagement practice that leverages some of the unique features of fixed income investing in a more implicit manner. We review this recent development later in this blog post.

Fixed income investing is primarily focused on diversifying from and moderating the risks associated with equity investing - and this is true even for riskier securities such as high yield bonds and emerging market bonds. Downside protection is key to a successful bond investment programme. It is not surprising, then, that ESG considerations are mainly considered a risk mitigation exercise in fixed income investing. Furthermore, ESG issues and opportunities tend to have long-term effects that bode well for fixed income investing where the investment horizon is likely to be long-term.

ESG data coverage availability

In the fixed income market, we have observed that the corporate credit market has been the first to broadly adopt ESG integration. This is understandable, given that corporate bonds are the closest to equities, allowing equity coverage in ESG considerations to be transferred over to the corporate credit market. Many credit market practitioners try to incorporate ESG considerations into their companies’ credit analysis.

Third-party ESG data providers such as MSCI and Sustainalytics also have greater ESG coverage for corporate bonds than for other debt markets. It is important to note that within the corporate bond world, investment-grade-rated corporate bonds have wider ESG data coverage than high yield bonds. The reason for this is that there are more privately held companies that are rated below investment grade, where the disclosure requirements are less than those that are publicly traded. That is even more true in the leveraged loan market where privately held companies account for greater market share.

We have observed increased efforts to analyse ESG aspects of sovereign debt, followed by municipal and securitised markets over the past year. ESG considerations in corporate credit differ from sovereign bonds - the first is associated with companies, while the second is associated with governments that are more complex. The source of ESG-related information in sovereign debt is typically different from corporate credit. Furthermore, the consideration of ESG criteria to analyse countries is often different for developed market countries than emerging market countries.

Engagement

We have now observed a rapidly growing trend of many fixed income market practitioners utilising the engagement terminology as a part of their ESG integration efforts.

While bondholders do not have voting rights per se, as capital providers to corporations, they do have a direct line of access and communication to company management. For example, the global bond market consists of over $70 trillion1 of issuance. Therefore, bond investors are substantial capital providers. Furthermore, many bond issuers are repeat issuers, meaning they come back to the capital market regularly - an incentive for companies to engage with bond investors. In our 2020 Annual ESG Manager Survey, we asked market practitioners to state how often they engage with underlying companies in relation to ESG issues2. Our findings show that 92% of market practitioners who invest in bond offerings claim that they often or always discuss ESG topics, when they interface with companies they are invested in3.

While the explicit limitation exists for bondholders who are without proxy voting, the influential power of bondholders appears to be expanding. Bond investors often report their engagement activities with case studies. Successful bondholder engagement case studies include encouraging label bond issuance, greater transparency and disclosure, especially among privately held companies, pressuring board membership composition for privately held companies and/or encouraging net zero initiatives.

We have observed that those investors who also have equity offerings leverage their equity counterparts to increase influence when engaging with the underlying companies. Some bond managers who have limited or no equity offering try to partner with other bond managers to increase influence. Climate Action 100+, an investor-led climate engagement coalition launched in 2017, helps facilitate such bond managers to coordinate the engagement activities with other investors4 - referred to as collaborative engagement. As the importance of active ownership continues to increase, so will the consensus among investors to incorporate active management across all asset classes.

Growing regulation

Regulators around the globe are playing a vital role in how the investment industry is incorporating ESG practices. European regulators have introduced the Sustainable Finance Disclosure Regulation (SFDR) in an attempt to increase the transparency and accountability of investments that claim to have ESG or sustainability objectives. The SFDR requires asset managers in Europe to disclose how sustainability risks are incorporated into their investment decision-making process. Additionally, the European regulator has established a classification framework - EU Taxonomy - to determine whether economic activity is an Environmentally Sustainable Investment. In order to be deemed an Environmentally Sustainable Investment, economic activity must meet four criteria. Find out more about SFDR and Taxonomy here.

There is ever-growing global support to tackle climate risk and while Europe has led the way in regulations to tackle ESG measures, there are signs that other regions, like the U.S., are following a similar path towards developing taxonomies and standards. Increased regulations which focus on transparency, disclosure and use of common language in sustainable investing assist in global standardisation of the ever-evolving ESG practices. At the same time, reportable data gaps exist in the fixed income market around ESG considerations. Bond investors are trying to comply with regulations, despite the data not being readily available for certain fixed income segments.

The increased pressure to tackle climate risk through climate risk disclosures is resulting in the climate-related reporting format generating a lot of attention. Third-party data providers continue to expand their reporting capabilities around the measurement of greenhouse gas (GHG) emissions – specifically where it connects to the global transition pathway required to limit global warming to below two degrees Celsius (signed under the Paris Agreement). Climate risk can be segregated into physical risk – referring to climate-related damage that impacts asset prices - and transition risk – referring to those arising from the shift toward a low-carbon economy. The Task Force on Climate-Related Financial Disclosures (TCFD) guidelines detail how to disaggregate the transition and physical risks, yet some of these risks are challenging to quantify.

At Russell Investments, we have committed to the Net Zero Initiative to support the goal of net zero greenhouse gas emissions by 2050. The net zero initiative encourages all financial market participants to evaluate the current status of their existing portfolio offerings, their engagement activities toward net zero, and forward-looking climate transition plans. Asset owners are increasingly interested in the transparency of how the portfolios they invest in are aligned with the Paris Agreement to address climate risk. Climate risk measures continue to expand and evolve. This is expected to be the key evolution in sustainable investing.

Responsible investing product offerings

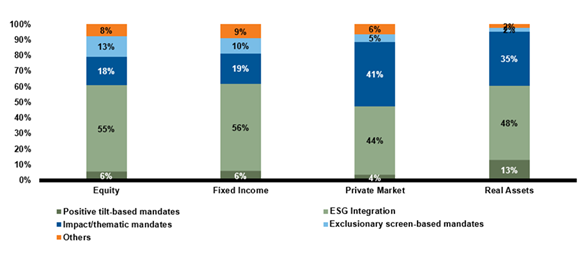

Our 2020 ESG Manager Survey results show ESG-related product expansion across asset classes, with an increased number of assets being deployed into ESG and responsible investing specific strategy offerings. In order to gain a deeper understanding of these strategy offerings, we asked asset managers to identify the types of ESG or sustainability-labelled strategies they currently offer (including exclusionary screen-based, ESG integration, best-in-class/positive tilt-based and impact/thematic strategies) in our annual ESG survey across asset classes. We also asked which type of strategies asset managers are seeing the most interest and asset growth in over the past 12 months. The results show proportionally more demand in ESG integration strategies, which are often mainstream strategies that are benchmarked against traditional indices, such as the Bloomberg Global Aggregate and U.S. Aggregate Indices. This suggests investors are looking to substitute existing core allocations with ESG approachable strategies.

Additionally, the interest for impact/thematic strategies in fixed income offerings also increased, as shown in the below chart. Among impact strategies, green bonds, United Nations Sustainable Developments Goals (SDGs) and low carbon solutions are the most popular impact strategies that we have seen in the fixed income strategy expansion. We expect to see this growth trend for products with sustainable goals continue.

Types of ESG / responsible investing products with the most interest and/or asset growth over the past 12 months

Click image to enlarge

Source: Russell Investments 2020 Annual ESG Manager Survey.

A surge of labelled bond issuance

Bonds with specific environmental and/or social objectives are referred to as impact bonds or labelled bonds. The labelled bond market has seen explosive growth in issuance over the past two years. In the first four months of 2021, labelled bond issuance reached over $340 billion, compared to roughly $500 billion in the 2020 full year issuance volume. The labelled bond market has four primary categories: green bonds, social bonds, sustainability bonds and sustainability-linked bonds.

The valuation of the labelled bond is also worth highlighting. The surge in labelled bond issuance was driven by strong demand. In fact, the demand has been so strong that the spreads between labelled and unlabelled bonds for the same company are showing a clear trend. Labelled bonds are often slightly more expensive than unlabelled bonds – referred to in the market as the ‘greenium’. This is likely due to the proliferation of ESG product offerings that prefer to invest in labelled bonds, creating a supply/demand imbalance that influences price. Therefore, the labelled bond market is expected to continue to grow.

The bottom line

The incorporation of ESG into investment practice continues to expand, and many fixed income market practitioners are embracing the ESG journey as a key initiative. While the starting point varies, engagement is becoming a key information source to analyse investment opportunities. We believe that regulation is driving much of the adoption of ESG practices, with Europe leading.

Since 2014, Russell Investments has formally been covering ESG considerations as a part of our strategy evaluation process. Our 2020 Annual ESG Manager Survey found a high level of ESG awareness and an increase of ESG factor integration among the respondents. The concept of ESG integration is to provide a more comprehensive picture in analysing underlying companies, as a part of enhanced security analyses. The 2020 ESG Manager Survey results provide a more in-depth understanding of asset managers’ ESG integration framework for our manager strategy evaluation.

To conclude, the incorporation of ESG factors has now reached a stage of universal recognition in terms of its importance to asset owners and the investment management community. The role of engagement is gaining ground among bondholders in an attempt to seek outcomes with sustainable goals. The methods of implementation continue to vary, a clear best practice is dependent upon the asset type and practitioner, whilst identifying a common reporting mechanism has a long way to go. As we move forward, standout approaches will be able to demonstrate leading implementation methodologies, articulate a best practice and define useful and informative metrics that are broadly recognised by investors as effective implementations of ESG considerations.

Download the full paper

1 Bloomberg Multiverse as of 30 April 2021.

2 Phillips, Y. (2020). “2020 Annual ESG Manager Survey”, Russell Investments Research. Available at: https://russellinvestments.com/uk/insights/esg-survey

3 See above source 2.

4 Russell Investments is a Climate Action 100+ signatory since 2020. https://www.climateaction100.org

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.