Feeling rattled by the markets? Consider yourself normal!

The markets so far this year have left many feeling rattled. In this guest blog Tim Noonan provide some insights to help calm worried clients.

The main thing to remember is that everyone feels rattled by the markets so far this year – so consider yourself normal! When the markets get messy, as they are currently, it’s generally because investors lose confidence in their ability to clearly see the future.

Loss of confidence in the markets has been catalysed by a general distrust of both the durability of economic growth in China (plus, frankly, a low level prejudice that the Chinese government isn’t the most objective and trustworthy source of information about the Chinese economy!). This has been compounded by investor confusion on how to interpret dramatic reductions in oil prices (optimists see in it a discount at the pump and therefore a buoyed consumer; pessimists see in it slumping revenues from the energy sector and higher junk bond defaults from idealistic entrepreneurs washing out. Can they both be right?

Finally – and most meaningfully, there is a legitimate concern that the long run of record corporate profits might be nearing its apex.

Typically, what we expect to see from this is an overreaction (look: the market is already coming back to its senses…). The key is to remember that investing for any one market environment successfully requires a crystal ball. If you haven’t got one, spread your bets. The diversified client is a smart client – one who knows that winning is a balance of getting it right and not get getting it all wrong over a long period of time. And that is exactly how we invest for our clients.

Our message today

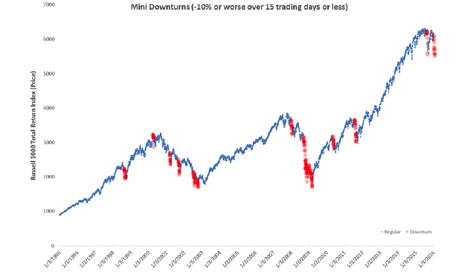

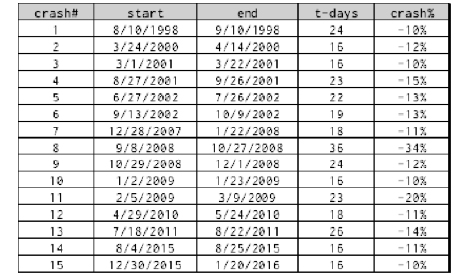

We should all bear in mind that market cycles are normal, even helpful, but you need to view them in their totality, not one at a time, you can see that they are not only frequent but also idiosyncratic and unforecastable.

See image….

Source: Bloomberg

Take-aways

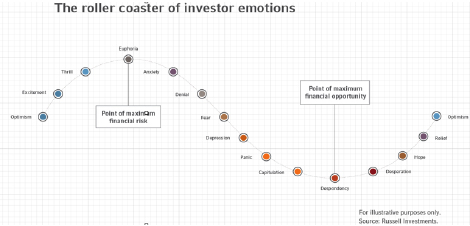

Russell Investments’ ‘Cycle of market emotions’ is one way to help investors understand how market cycles influence their emotions.

Help investors remember that although these market changes feel exceptional, they are in fact fairly ordinary. ‘Corrections’ invariably are amplified, messy and indiscriminate. Therefore investment strategies that work across cycles rather than within cycles are to be preferred, if the investor would like balance and relative calm.

Conclusion

This is why sophisticated forms of diversification are desirable: not to maximise return in any one cycle, but to maximise the opportunity for success across many cycles. The only way investors could avoid this cyclicality is very, very unappealing – they would have to accept very short life spans! The typical investor is going to live through 9 or 10 cycles. Furthermore his or her adviser will advise clients through an average of nearly 6 cycles (5.8 to be exact). So neither advisers nor their clients should try to bet the farm on any one of them, including this one!