Q2 Fixed Income Survey – the U.S. growth domino effect

Throughout the year we ask leading bond and currency managers to consider valuations, expectations and outlooks for the coming months. Today, we’ve put the spotlight on U.S. rates and inflation expectations, credit markets and casualties from rising U.S. interest rates.

The domino effect

Over 2017, we highlighted the dichotomy between interest rate managers’ bearish views on U.S. growth relative to credit managers, who have been more bullish. However, over the last two surveys, we have seen a significant change in the direction of travel. It appears as though the impact of U.S. growth is having a domino effect which is seeing market participants come towards a more general consensus. However, as we will see, some areas have suffered.

Today, we’ve put the spotlight on:

- U.S. interest rates and inflation expectations

- Credit markets: cracks starting to appear?

- Casualties from rising U.S. interest rates

In May, we received answers from 62 investment managers from across the world. View the Q2 2018 Fixed Income Survey - a closer look for the key takeaways from all eight areas (global interest rates, global investment grade and leveraged credit, emerging market local and hard currency debt, municipal bonds, securitised bonds and currencies).

U.S. growth – interest rates and inflation

Where are we in the cycle?

Overall, managers are recognising that the U.S. Federal Reserve (Fed) is determined to act. This is particularly clear from the expected increase in the Fed terminal rate, or ‘the peak’ – i.e. the interest rate that is consistent with full employment and capacity and therefore the interest rate at which the Fed stops hiking.

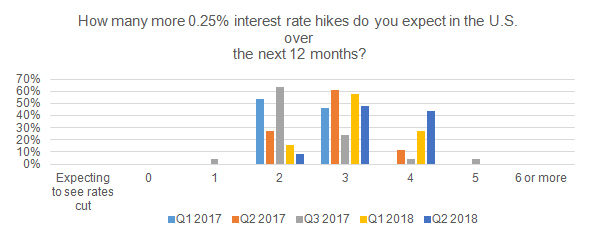

Managers are expecting more U.S. rate hikes compared to last quarter. The majority anticipate there will be between three and four 0.25% interest rate hikes over the next year, whereas last quarter the majority expected three hikes. Managers expect the peak in this hiking cycle to reach 3%, up from 2.65% last quarter This level is still low relative to long run nominal growth, but confirms a multi-quarter trend of rising rate expectations.

Source: Russell Investments Q2 2018 Fixed Income Survey

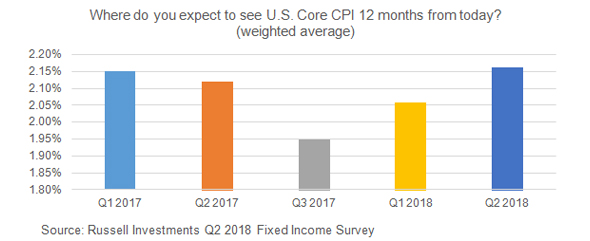

However, this has not been mirrored by rising inflation expectations. While we have seen an increasing trend since the Q1 2018 survey, core CPI expectations have only increased from 2.06% to 2.16% this quarter on a 12-month horizon. This result somewhat implies that the FED will be successful at controlling inflation.

Source: Russell Investments Q2 2018 Fixed Income Survey

Is a recession on the cards?

As the U.S. Federal Reserve (the Fed) continues down the path of hiking interest rates, we’ve also seen a rise in interest rate expectations for 10-year Treasuries – now expected to rise to 3.28%, up from 2.92% last quarter.

Managers also expect to see a flattening of the U.S. Treasury yield curve. As history tells us, if this goes far enough, it usually signals a recession.1 With this in mind, we can infer that the majority of managers feel that the U.S Federal Reserve is likely to over-tighten interest rates throughout the next 12 months. A flattening of the U.S. Treasury curve could have bad implications for credit; however, we can see below that many credit managers are shrugging this off and remain broadly positive.

Credit markets: cracks starting to appear?

Global leveraged credit fundamentals - the bullish view weakens

An aligning of views by market participants is also evident in the bullish view of leveraged credit, which has now come down relative to the previous quarter. When asked to describe the overall corporate fundamental picture for global leveraged credit, we received a mixed bag of results:

- managers expecting an improvement fell from 89% down to 55%

- 35% see corporate fundamentals remaining the same

- 10% see modest deterioration (versus 5% last quarter)

Although we’ve seen a deterioration of the level of bullishness towards improving fundamentals, the large majority (70%) continue to maintain current portfolio positioning, similar to last quarter’s 68%.

Credit spreads

The majority of managers feel that spreads in most credit sectors will remain range bound. However, the remainder had previously generally felt that spreads could see moderate tightening. This quarter, we’ve seen a flip – the remainder now see some risk of moderate credit spread widening for global investment grade (IG) credit, leveraged credit, and securitised non-agency assets. That being said, more global IG credit managers feel current spreads are high enough to compensate for the risks of deteriorating credit fundamentals over the next 6-18 months. Previously, more than half felt they weren’t.

When looking at specific regions, the U.S. finally lost its top spot as the favourite within global IG credit. Europe ex-UK is now number one while the UK is least favourite.

U.S. high yield no longer number one – managers are seeking expertise in multiple sectors

When looking at specific asset classes, U.S. high yield has fallen from consistently being the most favoured leveraged credit sector. The consensus is now much more diversified including U.S. high yield, U.S. leveraged loans, European high yield, European leveraged loans, Emerging Market high yield, and collateralised loan obligations (CLO) mezzanine tranche. On the whole, this implies that the expertise in multiple sectors has become quite valuable.

Casualties from rising interest rates - currencies

Emerging market local currencies

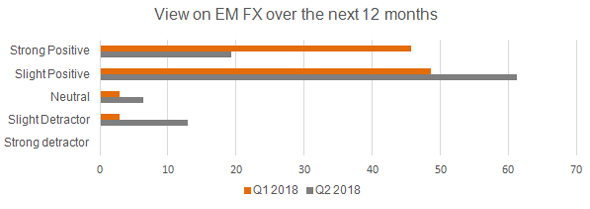

Last quarter, the bullish sentiment towards Emerging Market foreign exchange (EM FX) was as strong as we had seen in any of our previous surveys since July 2016. 95% of managers had a positive view overall for expected EM FX contribution to performance over the next 12 months and only 3% anticipated EM detracting from performance.2 However, market performance indicated that manager bullishness proved to be ill timed.3 Rising U.S. yields and quantitative tightening knocked local currencies and exposed notable weaknesses in currencies such as Argentina and Turkey.

Despite recent hiccups, managers remain positive for the EM FX outlook on the whole, only marginally less so than last quarter. More managers believe that EM local currencies will be a slight performance detractor (13%) while 80% of managers have a positive view overall.

Source: Russell Investments Q2 2018 Fixed Income Survey

The euro – some upside remains but all eyes are on political developments in Italy

Another casualty of rising U.S. rates has been the euro. A year ago, survey respondents expected the EUR/USD exchange rate to push into the 1.30 to 1.35 range on a 12-month view. However, today’s actual exchange rate is instead languishing at 1.17. Indeed, managers this quarter still see an upside for the euro. Although, as the political situation in Italy unfolds over the coming weeks and months, the outlook for the euro may very likely change. Since the closing of our survey, we have seen the coalition of 5-Star and Northern League, who at one point even speculated about getting the Italian central bank to write off its government debt. Perhaps the euro has more tough times ahead, and the playbook for dealing with an Italian populist government is not going to be the same as the one for Greece.

Volatility is to be expected

Broadly, this survey has indicated that global managers have accepted – and made room for – some market volatility. As interest rates begin to rise in the U.S. and more globally, there does seem to be a consensus that we may begin to see some market dislocation, particularly around valuations and spreads on an absolute and relative basis. One thing that remains clear is that managers across all eight specialities are a lot less bullish overall than they were last quarter. From our perspective, we believe that the survey respondents this quarter may have understated the volatility potential in a variety of places.

As always, we will be keeping a close eye on market developments. Savvy investors should remain vigilant, stay nimble and consider adding some portfolio diversifiers that perform well in rising rate environments.

1 A flattening of the curve can eventually lead to an inverted curve, where shorter-dated securities yield more than longer-term bonds. This event has predicted all nine U.S. recessions since 1955.

2 46% of managers expected strong contributions and 49% expected slightly positive contributions

3 EM FX has sold off by 7% since the February survey, which serves as a major headwind to strong EM FX performance predicted 12 months forward from that survey.