What is the Task Force on Climate-related Financial Disclosures (TCFD)? And why is it important for investors?

The Task Force on Climate-related Financial Disclosures (TCFD) was created by the Financial Stability Board in 2015, in recognition that without reliable climate-related financial information, markets cannot accurately price climate risks and opportunities. In the lead-up to the 2021 United Nations Climate Change Conference (COP26), the TCFD released several important updates. Before jumping into some of the new guidance, let’s first take a step back to recap exactly what the TCFD is, and why the TCFD’s recommendations are becoming an increasingly important reference for investors and financial regulators.

The recommendations

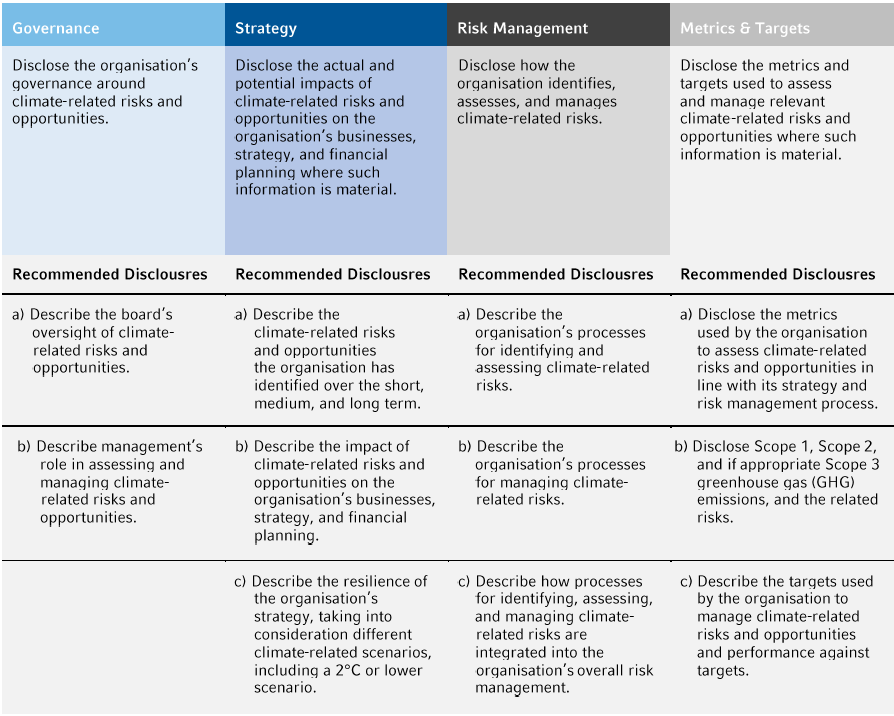

A core output of the task force are the recommendations – a set of 11 recommended disclosures spanning four thematic areas: governance, strategy, risk management, and metrics and targets. The recommendations were released in June 2017 and are designed to be adoptable by companies of any sector and size.

Click image to enlarge

Source: TCFD, Final Report: Recommendations of the Task Force on Climate-related Financial Disclosures (2017).

Investors leverage the TCFD recommendations in at least two ways. First, it is a disclosure framework for the companies they invest in. Where companies are disclosing, the information can be an input to the investment process or, if disclosure is lacking, the TCFD provides a reference point during engagement. The second use case is that the TCFD recommendation can also be a framework for the investor’s own disclosures. This is where we are seeing increased interest from asset owners, who face mounting requirements for mandatory TCFD-aligned reporting.

Growing regulatory pressure

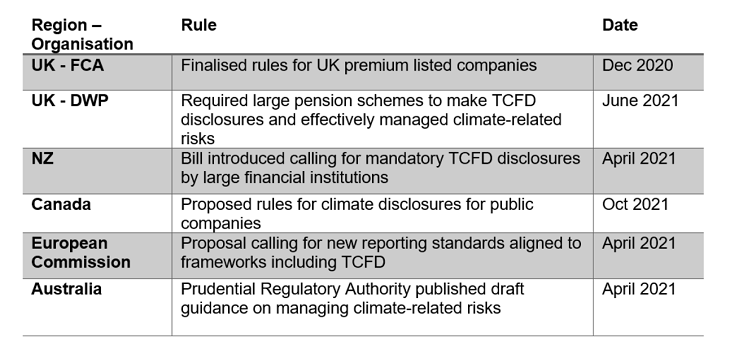

An increasing number of regulators are introducing, or considering introducing, mandatory TCFD-aligned disclosures for financial institutions. This growing regulatory pressure has spurred considerable interest from investors to better understand the recommendations and what they need to do to be ready.

Here is just a snapshot of related regulatory developments:

Click image to enlarge

What are the reporting requirements for pension schemes in the UK?

Amid global momentum, the UK leads in making TCFD-aligned reporting mandatory for asset owners. UK pension schemes with more than £5 billion AUM (assets under management) need to comply with TCFD disclosures mandated by the Department for Work and Pensions (DWP) from 1 October 2021. Schemes with more than £1 billion AUM will be in scope starting from 1 October 2022.

Under this new regulation, pension schemes need to comply with different requirements under the four core pillars mentioned previously and outlined below. It is important to note that the suggested disclosures described below do not cover every requirement of the DWP regulation, and our goal here is to a provide high-level overview only.

- Governance: Pension schemes need to establish robust processes to oversee identification, assessment and management of climate-related risks and opportunities.

- Strategy: Pensions schemes need to define time horizons and preferred climate scenarios, including at least a 3° C and a 1.5-2° C scenario. They then need to run climate scenario analysis on their portfolio and assess the potential impact on the scheme’s assets and liabilities, as well as the resilience of the scheme’s investment strategy in these scenarios.

- Risk management: Pension schemes need to establish and define the process to identify, assess and manage climate-related risks and the integration into the scheme’s overall risk management framework.

- Metrics: Pension schemes need to select, calculate and disclose at least three types of climate metrics in relation to the scheme’s assets: one absolute emissions metric, one emissions intensity metric and one additional climate change metric. Moreover, they will be responsible for setting and measuring targets against these metrics.

What’s changed: Key takeaways from the TCFD updates

Just as investors had started to absorb the implications of upcoming reporting requirements, a new set of TCFD documents have been released. What, exactly, has changed? First, it is important to note that it is the TCFD documents themselves that have been updated, which is not the same as the regulations that are generally aligned to TCFD. Below, we assess a few of the key takeaways from the TCFD updates.

Snapshot of what’s changed:

- The 11 recommended disclosures (see figure above) remain intact and unchanged

- The annex (or implementing guidance) document has been superseded. This is the detailed guidance that sits underneath the recommendations, and includes sector-specific recommendations, including for asset owners

- New guidance document on metrics, targets and transition plans

A few key elements of the new implementation guidance (the annex):

- In recognition of the push for more disclosure around transition plans, transition plan disclosures were added to facilitate measuring progress along the way to 2050

- Added disclosure on asset alignment to a well-below 2oC scenario

- Disclosure of owned greenhouse gas emissions for asset owners

- Added new appendix on cross-industry, climate-related metric categories

The bottom line

A natural question for asset owners is whether the updated recommendations will flow through to related regulations, including those from the DWP. While the timing and final rules are still very uncertain, it is noteworthy that there is already a consultation underway from the DWP on precisely one of the revisions mentioned above, the incorporation of portfolio alignment metrics. If passed, this would mean that instead of the three metrics listed above, a fourth metric would be added for portfolio alignment. While there is still much unknown, it does appear these updates are likely to eventually trickle down in some cases.

Climate risk is a new and complex beast for pension schemes to grapple, a task made even more difficult by a lack of consensus around methodologies and robust data. At Russell Investments, we have conducted our own extensive due diligence of climate risk experts over the past year and a half to understand what climate risk modelling capabilities are available today. After extensive review, we have selected Planetrics as our climate risk partner. While there are undoubtedly major challenges for investors in incorporating this area into their investment process, we look forward to the opportunity to assist our clients in meeting the challenges of this new frontier in investing.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.