The UK didn't Brexit on 31 October, but no-deal risks collapsed

What happened in Brexit this month?

While the Brexit process seemed to have arrived at a dead-end in early October, a meeting between the UK and Irish prime ministers, Boris Johnson and Leo Varadkar, on 10 October gave it new momentum and paved the way to an agreement that was acceptable to both sides.

At the European Council summit on 17-18 October 2019, the UK settled on a modified withdrawal agreement with the European Union (EU). The new agreement removes the controversial backstop that could have retained the entire UK in a customs union with the EU after the end of the transition period. However, to ensure there is no physical border infrastructure and no customs checks between the Republic of Ireland and Northern Ireland, the new agreement keeps Northern Ireland in a de-facto customs union and in regulatory alignment with the EU on goods.

On 19 October, the UK House of Commons passed the second reading of Withdrawal Agreement Bill (WAB) with a majority of 329 to 299 votes, which shows support for Brexit in principle and allows the bill to proceed to parliamentary debate and a decisive third reading vote.

Shortly afterwards, however, parliament rejected the timetable set by the government (the so-called programme motion) to complete the debate in three days. The Democratic Unionist Party (DUP), who currently prop up the Conservative government, voted against the WAB and the programme motion because they believe the new deal could create divergences between Northern Ireland and the other nations of the UK.

The failure of the business motion to pass made it virtually impossible for the legislation to complete all necessary stages before the 31 October 2019 Brexit deadline. Also, the “Benn Act” compelled the Prime Minister to request a Brexit extension from the EU if no withdrawal bill had passed by 19 October. Boris Johnson (reluctantly) sent an extension request letter that same evening.

On 28 October, the EU signed off on a Brexit “flextension”, an extension to 31 January 2020 with an option for the UK to leave earlier if a deal is ratified.

With a Halloween no-deal now off the table, the House of Commons passed a bill to hold general elections on 12 December.

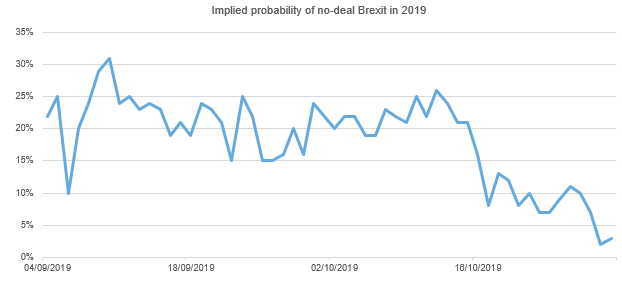

We agree with the political betting markets that the political gyrations have significantly lowered the risk of a no-deal Brexit in 2019 (see Figure 1).

Figure 1: Political betting markets think that the risk of disorderly Brexit has collapsed…

Source: predictit.org, as of 29 October 2019.

What could happen now? Short-term political paths to the end-state

- Conservative majority: Brexit by 31 January 2020 (40%)

- Hung parliament: Deal, no-deal and referendum all in play again (40%)

- General election with a shift towards Remain parties, a second referendum (10%)

- Other scenarios (10%)

- Sterling: Significantly up (10-15%) as UK’s currently favourable in terms of trade is secured for the future.

- Large cap (LC) UK Equities: Slighty positive, with the unwinding of the Brexit discount offset by heavy reliance on foreign earnings, which will be depressing by currency appreciation.

- Domestically Focused Equities: Should outperform LC UK Equities and FTSE 100.

- Gilts (10y): Meaningfully down as yields rise (30-40 bps) to accommodate a higher expected short rate path and a higher neutral rate.

- Sterling: Up (~5%) on relief that a Brexit deal that includes a transition has been reached. However, the gains are tempered by the fact that another cliff-edge still exists down the road.

- LC UK Equities: Flat or down slightly due to the negative correlation between sterling and LC equities.

- Domestically Focused Equities: A positive response as the UK’s economic outlook brightens somewhat.

- Gilts (10y): Down as yields rise (20-30 bps) as some negative risk premia is removed from the curve.

- Sterling: Down (15-20%) as the UK is economically locked out of all of its main trading partners as it falls back to World Trade Organisation terms.

- LC UK Equities: Up due to the negative correlation between sterling and LC equities, although this will be partly offset by No-Deal Brexit induced recession fears and uncertainty about medium term economic growth prospects.

- Domestically Focused Equities: Negative response as the domestic UK economic outlook materially darkens.

- Gilts (10y): Significantly up as yields fall (20-30 bps) to new lows on safe-haven demand and much reduced short-rate expectations.

As has been the case with the Brexit process all along, the three major outcomes are “Brexit with Deal”, “No Deal Brexit” and “Remain”. However, there are many potential short-term political paths to these three outcomes. We outline these below with our subjective probabilities in brackets.

If the general election delivers a stable majority for the Conservative party, it is likely that the WAB passes as it is and the UK leaves by 31 January 2020.

A hung parliament is a quite likely outcome, in which case we are back in the same situation as today. However, the EU could be more reluctant to agree on an extension, increasing the pressure to pass the deal, but a second referendum and even no-deal also coming back into play. A further extension cannot be ruled out.

If the Remain-leaning parties win more seats than the Brexit-supporting parties, a second referendum is likely (possibly attached to passage of the WAB).

Although we try our best, it is not possible to exhaustively cover all possible scenarios.

End-state Brexit outcomes and market implications

As a result of the short-term political paths outlined above, we also refreshed our end-state Brexit probabilities (previous probabilities are from end-August 2019) and calibrated the associated market movements*:

Remain (down from 25% to 20%)

'Deal' Brexit (up from 40% to 70%)

'No-Deal' Brexit (down from 35% to 10%)

Bottom line

A modified withdrawal agreement between the UK and the EU was thrashed out this month. However, the ratification of the agreement has hit severe roadblocks in UK parliament, delaying Brexit beyond Halloween. To break the logjam in the House of Commons, an election has been called for 12 December. Although the Conservative Party holds a lead in polls of voting intentions, the outcome of the election and its implications for Brexit are still highly uncertain. Stay tuned.* Direction and magnitude of expected market reaction is based on experience from the post-referendum (after 23 June 2016) period. The anticipated market reactions will not necessarily occur on the exit date (whether 31 January 2020, earlier or later). They may occur suddenly in the run-up to the exit, if unexpected but clear political outcomes materialise. Alternatively, market moves may play out gradually over an extended period of time, if the political process evolves towards the outcome slowly. Market moves calibrated using 23 October closing prices.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.