Unlisted infrastructure – Highway to diversification

Executive summary:

- Private infrastructure offers unique investment characteristics and potential diversification benefits for portfolio construction.

- Implementing an unlisted infrastructure portfolio comes with inherent challenges, but adopting a multi-manager strategy can help counter these vulnerabilities.

- Having a holistic and robust framework to guide the building of an infrastructure portfolio, selecting managers, and evaluating investments is key to successful investing.

Infrastructure is the backbone of our society. It provides the essential services that we rely on every day, such as transportation, connectivity, energy, water, and sanitation. Infrastructure also plays a vital role in economic growth and development.

However, unlisted infrastructure remains underutilised as a diversifier. Traditional asset classes like equities and fixed income play crucial roles but are more susceptible to broader market volatilities and may be supplemented to meet the long-term return objectives of investors.

While infrastructure investment has emerged as an alternative, there's a notable dichotomy between listed and unlisted infrastructure assets. The former, while easily accessible, is publicly traded, hence is limited in its potential as a true diversification instrument. Unlisted infrastructure assets in contrast are valued on a quarterly basis, thereby offering more diversification benefit, but with challenges that may lead to suboptimal implementation. Understanding unlisted infrastructure's implementation challenges provides investors more tools to harness its potential in a portfolio.

What is unlisted infrastructure?

The global infrastructure landscape is multifaceted and expansive. Infrastructure as an asset class is diverse, ranging from transportation (e.g., toll roads, airports) and utilities (e.g., water, electricity) to social infrastructure (e.g., hospitals, schools). Among its various segments, unlisted and private markets boast a valuation exceeding $10 trillion.

This segment is poised for robust growth, propelled by factors including the imperative for heightened energy efficiency, surging data demands spurred by technological evolution, increasing strains on digital communications from shifting work and lifestyle dynamics, and evolving demographic patterns.

Yet, while unlisted infrastructure is a prominent component of the broader infrastructure ecosystem, investors need to recognise it as one of several distinct facets within the vast sector.

Please see Appendix for types of unlisted infrastructure.

Benefits of unlisted infrastructure

Diversification

Unlisted infrastructure has consistently demonstrated distinctive investment behaviours, especially when compared to its counterparts in public markets. One key differentiator is the low historical correlation of unlisted infrastructure with publicly listed infrastructure, equities, and fixed income instruments.

The table below highlights that the lowest correlations are between global unlisted infrastructure (as represented by the EDHEC infra300 Index) and all other assets:

- Global Equities: Represented by MSCI ACWI which spans both developed and emerging market public equities.

- Global Fixed Income: Represented using the Bloomberg Global-Aggregate Index which captures global investment grade debt including treasury, government-related, corporate and securitised fixed-rate bonds from both developed and emerging markets issuers.

- Listed Infrastructure: For a more nuanced comparison, three different benchmarks have been considered to represent the listed infrastructure space. These benchmarks provide varied perspectives on how publicly traded infrastructure assets perform in the market. Interestingly, the low correlation of all three to unlisted infrastructure highlights the different risk factors and characteristics driving returns of unlisted versus listed infrastructure.

By juxtaposing unlisted infrastructure with these asset classes, it becomes clear that private infrastructure offers unique investment characteristics and potential diversification benefits for portfolio construction.

Source: Bloomberg, EDHEC Infra & Private Assets Research Institute and Russell Investments. Data as of June 30, 2023.

Stable cash flows

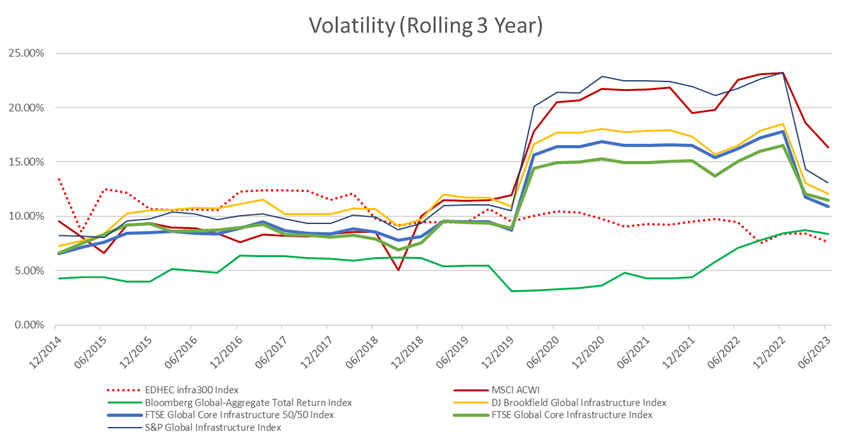

Robust, forecastable cashflows enable unlisted infrastructure to reliably deliver income distributions. The stable nature of the unlisted infrastructure universe is evident from the lower historical volatility of unlisted infrastructure per the exhibit below. In contrast, public markets experienced record low volatility in 2018, and sharply higher volatility triggered by the pandemic in 2020.

Unlisted infrastructure (dotted line as represented by the EDHEC infra300 Index) had consistently lower volatility while the volatility of global fixed income, global equities, and listed infrastructure varied significantly.

(Click image to enlarge)

Source: Bloomberg, EDHEC Infra & Private Assets Research Institute and Russell Investments. Data as of June 30, 2023.

The diminished volatility of unlisted infrastructure underscores its relative insulation from macroeconomic fluctuations. The past decade, marked by events such as a global pandemic, unparalleled economic recovery, and historically low interest rates, provides a rare assessment framework.

Within this context, unlisted infrastructure has consistently demonstrated stable returns with downturns being limited in magnitude and duration. Conversely, listed infrastructure encountered its most pronounced reductions, coinciding with the pandemic's onset.

| Based on quarterly returns (12/31/2010 to 6/30/2023) | Maximum drawdown amount | Beginning of drawdown period | End of drawdown period | Length of recovery to new high |

| EDHEC Infra 300 Index | -12.2% | 30/03/2012 | 28/09/2012 | 6 months |

| MSCI ACWI | -25/6% | 30/09/2022 | ongoing | n/a |

| Bloomberg Global Aggregate Total Return Index | -23.7% | 30/09/2022 | ongoing | n/a |

| DJ Brookfield Global Infrastructure Index | -20.9% | 31/03/2020 | 03/06/2021 | 15 months |

| FTSE Global Core Infrastructure 50/50 Index | -21.2% | 31/03/2020 | 30/06/2021 | 15 months |

| FTSE Global Core Infrastructure Index | -17.9% | 31/03/2020 | 30/06/2021 | 15 months |

| S&P Global Infrastructure Index | -29.2% | 31/03/2020 | 30/09/2021 | 18 months |

Source: Bloomberg, EDHEC Infra & Private Assets Research Institute and Russell Investments. Data as of June 30, 2023.

The pronounced drawdown in global equities and fixed income can be traced to the market's abrupt realisation of impending interest rate hikes, instituted to curb inflation. This inflation-induced upheaval was especially grievous for the most vulnerable segments of society — those already grappling for limited resources and basic necessities like food and energy.

Amidst such challenges, both listed and unlisted infrastructure assets served as safeguards against inflationary pressure with unlisted offering a particularly fortified buffer. This heightened protection in unlisted infrastructure can be attributed to the asset holders' privileged access to proprietary and granular financial and operational insights. Such exclusive and confidential information provides an in-depth comprehension of the asset's intricacies, thereby bolstering confidence in its inflation-resistant cash flows. Consequently, unlisted infrastructure exhibited strong resilience amidst inflation-induced economic uncertainty.

Challenges of building an unlisted infrastructure portfolio

Implementing an unlisted infrastructure portfolio comes with inherent challenges such as the limitations of relying solely on a single General Partner (GP) fund. Such a singular approach can dangerously concentrate risks and potentially expose investors to drastic underperformance or significant losses due to lack of diversification.

Consequently, adopting a multi-manager strategy emerges as a more prudent alternative. It not only counters the vulnerabilities of a single GP fund but broadens exposure across specialist managers and sectors. Infrastructure stretches across a diversity of sectors including energy, utilities, health, education and housing. Different sub-sectors within infrastructure have their own economic drivers and risk factors, providing another layer of diversification.

A multi-manager approach also allows investors, particularly resource conscious ones, exposure to a wider range of specialist managers. A robustly constructed multi-manager infrastructure solution encompasses a significantly larger number of underlying businesses than the typical 10-15 found in an average single fund. These 10-15 assets may have exposure to a limited number of sectors, and often, only one or two investments within each sector.

Source: Russell Investments. Strategies, portfolio allocations and return targets are illustrative and subject to change and to variation in implementation. Illustrated allocations reflect intended allocation range midpoints. Return targets are uncertain, not guaranteed and presented gross of Russell Investments fees and expenses.

Thoughtful portfolio construction is paramount as it offers the potential to enhance returns and mitigate inherent risks, particularly considering that assets within a singular sector can be driven by divergent return mechanisms and carry disparate risks.

For example, compare a midstream pipeline with fixed, contractually-bound revenue to an independent merchant powerplant selling electricity at market-driven rates. Both are part of the energy sector but have different risk and return profiles due to their cash flow predictability. Therefore, it is essential for portfolio construction to recognise and utilise the diversification potential of such sub-sector differences.

Risk management – managing risk across vintages and profiles

Once an unlisted infrastructure portfolio is established, investors bear the onus of maintaining the designated exposure - both regarding the overall capital deployed and the specific strategic allocations within the asset class.

Closed-end funds, though prevalent for accessing unlisted infrastructure, present notable challenges due to their defined legal duration. These funds draw capital during their active investment phase and subsequently distribute capital upon asset liquidation.

To retain the intended exposure, investors find themselves in the constant cycle of initiating new commitments and attempting to accurately predict the timing of capital calls and distributions. Within standard business scenarios, such predictions are considerably challenging; and for blind pool commitments (investors that don't know the eventual contents of their investment i.e., they are blind to what will be in their pool of investments), such predictions are impossible.

Furthermore, as closed-end funds continuously engage in asset acquisition and disposition, the portfolio's adherence to crucial diversification metrics is in flux. To maintain these strategic allocations, there's a requisite for continuous and rigorous oversight of the underlying funds, coupled with perpetual market analysis to ascertain forthcoming market introductions to replenish exposures. Conversely, an open-end fund structure offers a more streamlined and less cumbersome approach, alleviating many of these complexities.

Source: Russell Investments. Strategies, portfolio allocations and return targets are illustrative and subject to change and to variation in implementation. Illustrated allocations reflect intended allocation range midpoints. Return targets are uncertain, not guaranteed and presented gross of Russell Investments fees and expenses

Maintaining discipline and flexibility

The long-term nature of unlisted infrastructure assets can magnify investment mistakes, such as overestimating growth or underestimating obsolescence. We believe successful investing in this asset class requires a delicate balance between the discipline of avoiding bad investment ideas while having flexibility to adapt to a changing world. We believe in the importance of having a holistic and robust framework to guide the building of an infrastructure portfolio, selecting managers, and evaluating investments.

What does this mean in practice?

Investors who follow this approach could invest in assets that may not look like traditional infrastructure but have robust barriers to entry – whether granted by government or through market structure.

For example, we recognise that data storage has become an essential service to modern economies in recent years. The challenge with accessing this trend is that the typical data centre has unattractive investment features: low barriers to entry, short contracts, high obsolescence risk, and high unrecoverable capital expenditures.

As we researched the space, we found an access point that worked and solved the key issues. The data centre we uncovered was exclusively used by a government agency in the Asia-Pacific region that was fully contracted, including revenues and capital expenditures. The centre had very high security requirements that, in our analysis, served as a robust barrier to competition.

As a result, from our experience, we believe the unlisted infrastructure segment offers investors substantial opportunities for diversification, income and growth. While investing in this asset class requires navigating challenges, including complexities in portfolio construction, risk management, and operational challenges, adopting a multi-manager strategy can help mitigate these risks.

With informed guidance and a more comprehensive understanding of its benefits and challenges, investors may significantly enhance their broader investment portfolios through the integration of unlisted infrastructure.

Appendix

Types of unlisted infrastructure assets

(Click image to enlarge)

The above illustrates the different types of infrastructure assets and their relative position with respect to expected risk and expected return.

Super-Core

Super-core infrastructure is characterised by fully contracted, amortising assets. This means that the assets have long-term contracts that guarantee a steady stream of income, and they will eventually be fully paid off. As a result, super-core infrastructure is considered a low-risk investment, with the potential for high returns.

Some examples of super-core infrastructure assets include:

Regulated utilities: These assets have regulated tariffs that are set by government agencies. This provides a high degree of certainty about future cash flows.

Availability-based public-private partnerships (PPPs): These assets are financed through a combination of public and private funding. The private sector is responsible for building and operating the asset, and the public entity e.g., university system, municipality, or central government, guarantees a minimum level of revenue.

Core

Core assets are already generating returns and have a low risk of operational disruption as they are typically in transparent regulatory environments. These assets are typically characterised by the following features:

- Monopoly position: Core infrastructure assets often have a monopoly position as the only provider of a vital service in a particular area. This gives them a degree of pricing power and insulates them from competition.

- Demonstrable demand as there is a critical need for the services that they provide. This demand is typically stable over time, which provides investors with a predictable source of income over a long time horizon.

Core Plus

These assets offer the potential for both stable cash flow and growth, and are typically less risky than other growth assets as they are already generating income and therefore have more predictable cash flows. They also have the potential for growth through expansion or acquisition, for example:

- Fibre infrastructure is the network of fibre optic cables that are used to transmit data. It is a critical part of the telecommunications infrastructure and is essential for the delivery of high-speed internet, and communication with data centres which power growing technology such as AI.

- Smart grids are digital infrastructure assets that are used to improve the efficiency and reliability of the power grid. They offer the potential for both stable cash flow and growth.

Value-Add

These are moderate-to-higher-risk assets that may be undergoing upgrades, for example to change capacity, operational methods, or intended use to increase market value. The assets may even be greenfield (versus brownfield). Greenfield assets are assets that are being developed on land that has not been previously developed. Brownfield assets are assets that are being developed on land that has been previously developed. Examples of value-add assets may include:

- A toll road that is being expanded to handle more vehicles.

- A power plant that is being upgraded to use cleaner fuel sources.

- A port that is being modernized to handle larger ships.

- A data centre that is expanding data storage and increasing processing power

Opportunistic

Opportunistic infrastructure is a type of infrastructure investment that offers the potential for high returns but also carries high risks. Typically, there are no cash flows as the assets are not operating. Furthermore, the timeline to cash flow generation may be uncertain.

Examples include:

- Newly constructed infrastructure. Such assets may be acquired at a discount, however, they may require much more investment before revenue generation.

- New technologies. Infrastructure assets that are employing emerging technology such as hydrogen fuel cells, ocean wave energy, or direct air capture.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.