A U.S. recession looks less likely this year. But we believe the risks are still elevated.

Executive summary:

- There will be a lot of firsts for the economic history books if this business cycle can survive a labour market slowdown, 525 basis points (bps) of rate hikes and an extremely inverted U.S. Treasury yield curve. But the dovish shift from the U.S. Federal Reserve (Fed) in December makes a soft-landing scenario more likely than a recession, in our view.

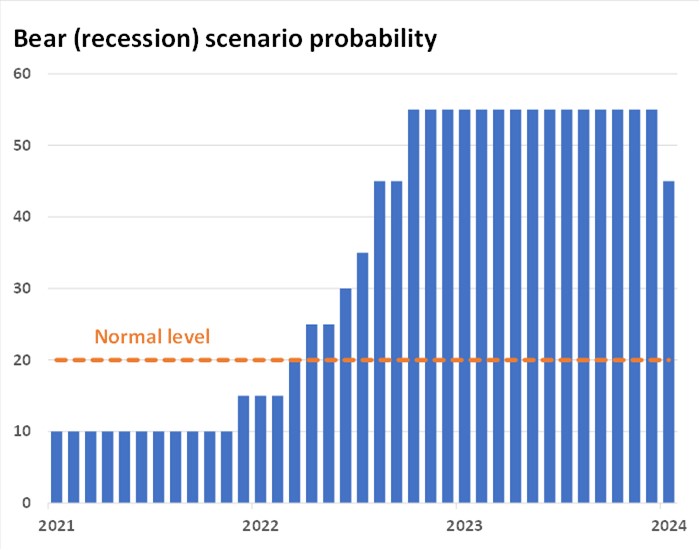

- We’ve lowered our U.S. recession probability from 55% to 45%. However, we still see recession risks as higher than normal, given that in a typical year, the normal probability for a recession is 15-20%.

- Sticking a soft landing remains difficult. If the Fed cuts rates too much, economic growth and inflation could reaccelerate. If the Fed cuts rates too little, the U.S. economy could still fall over into recession.

- We believe U.S. equities remain expensive and directionally overbought, and that consensus earnings expectations still look too optimistic. For U.S. rates, the combination of lower yields in Q4 and our new recession probabilities narrows the valuation opportunity in Treasuries somewhat.

Overview

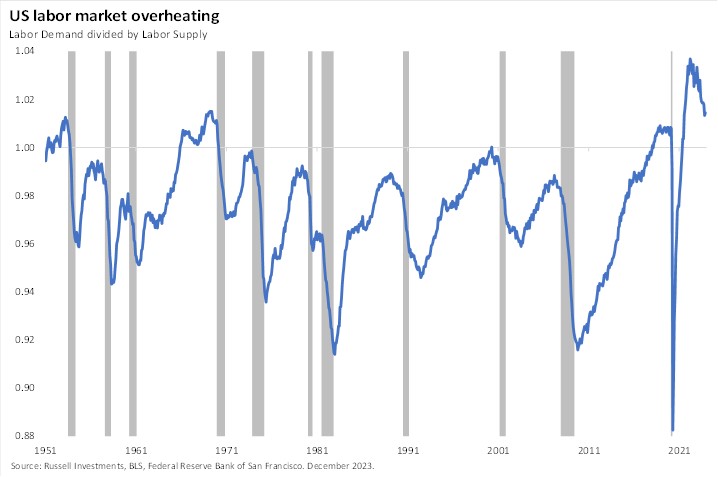

As a general principle, we tend to think an economy’s recession risk is lower when it has spare capacity and higher when it is overheated. The reasons for this are two-fold:

- 1. Overheated economies generate more inflation. Inflation forces authorities to implement restrictive policies to slow down aggregate demand. Recessions can be a desired or accidental result of this adjustment process.

- 2. Overheated economies tend to have more imbalances and vulnerabilities (e.g., overinvestment in 2000 created a capital overhang, consumer and banking system leverage in 2007 created well-known market failures and saddled the economy with years of deleveraging). Imbalances increase fragility and amplify the slowdown in economic growth.

As evidence of an overheated labour market and rapid Fed tightening cycle accumulated in the spring of 2022 we rapidly cut our U.S. cycle outlook and raised our recession probabilities to reflect these standard macro risk channels.

A recession has, of course, not yet materialised. The economy is no longer as overheated, inflation pressures have eased, and – with this progress – policymakers are pivoting to consider rate cuts. Collectively, these developments lower the recession risk from 55% to 45% in our view.

Source: Russell Investments. January 2024.

We continue to think that, should a recession materialise, it would be a mild or moderate downturn given the lack of major imbalances in the economy.

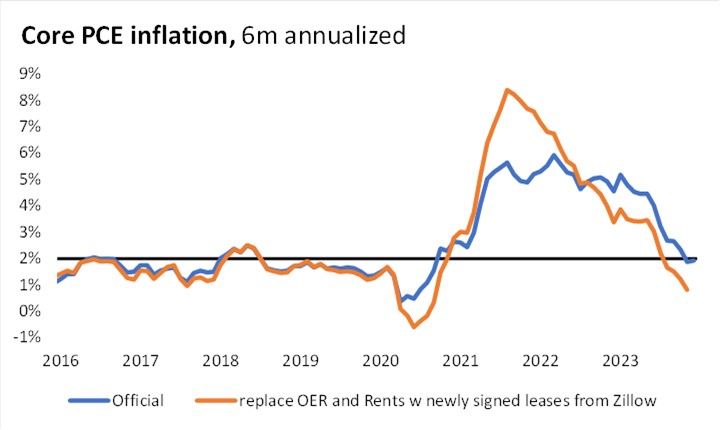

Inflation continues to decline

Inflation has come down rapidly in recent months. Core PCE (personal consumption expenditures) inflation on a six-month annualised basis was already running at 2% as of November and the CPI (consumer price index) data for December suggests that progress is likely to hold (see the blue line in the chart below). Furthermore, it is well known that the shelter component of U.S. inflation indices lags developments in home prices and rents. Timelier measures of rents have normalised back to pre-COVID levels and suggest further disinflationary progress is in the pipeline (orange).

Source: BEA, Zillow, Russell Investments. December 2023 is estimated.

Fed outlook

The Fed’s precondition for returning interest rates to a neutral setting (i.e., rate cuts back to a federal funds rate of 2.5% to 3%) is when inflation is “clearly moving down sustainably toward the Committee’s objective”. As flagged above we are already approaching that condition on some measures. This opens the door for a first cut as early as March.

Furthermore, the Fed’s risk management has pivoted in recent months. As recently as September 2023 the Fed and market had embraced a higher-for-longer narrative. But just three months later Powell said the central bank is focused on trying not to make the mistake of staying high for too long, stating that, “We’re aware of the risk that we would hang on too long. We know that’s a risk, and we’re very focused on not making that mistake … we’ve come back into a better balance between the risk of overdoing it and the risk of underdoing it.”

Labour market is cooling

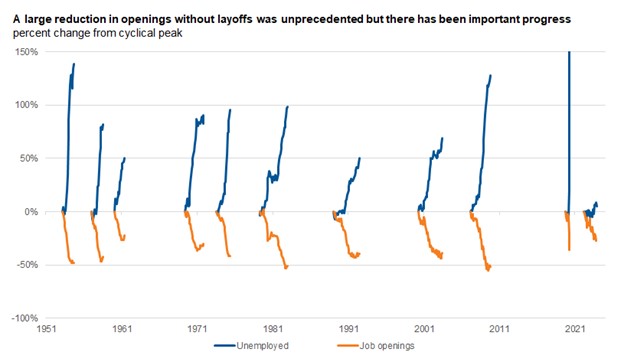

A year ago, famed economist Larry Summers said that “soft landings are like second marriages…they are the triumph of hope over experience”. The requisite labour market rebalancing he was concerned about and that I have been concerned about has turned out to be painless so far. Job openings have declined significantly without a commensurate rise in layoffs. This is unheard of in the post-war history of the United States and is welcome news. The chart below shows that about 60% of the overheating from 2022 has gone away.

The next chart decomposes the demand side of this labour market adjustment and shows how rare the current experience is in a historical context. At each labour market peak we track the subsequent moves in job openings and unemployment. There is no precedent for a large decline in job openings (orange) without a large rise in unemployment (blue). But so far, so good.

Source: BLS, Russell Investments. December 2023

Immigration and an increase in labour force participation have also supported the labour market adjustment from the supply side.

The risks of cutting too much and too little

Given the U.S. economy is still running at a sub-4% unemployment rate, there is a risk that too many rate cuts and an easing of financial conditions could improve economic growth at the expense of a stickier – or even reaccelerating – inflation problem.

There is also a risk that any Fed easing in 2024 could be too little, too late. Lags from monetary policy onto the economy, weak leading economic indicators, slower and narrowing employment growth, and a range of other factors suggest downside risks haven’t completely gone away.

Market implications

Equities

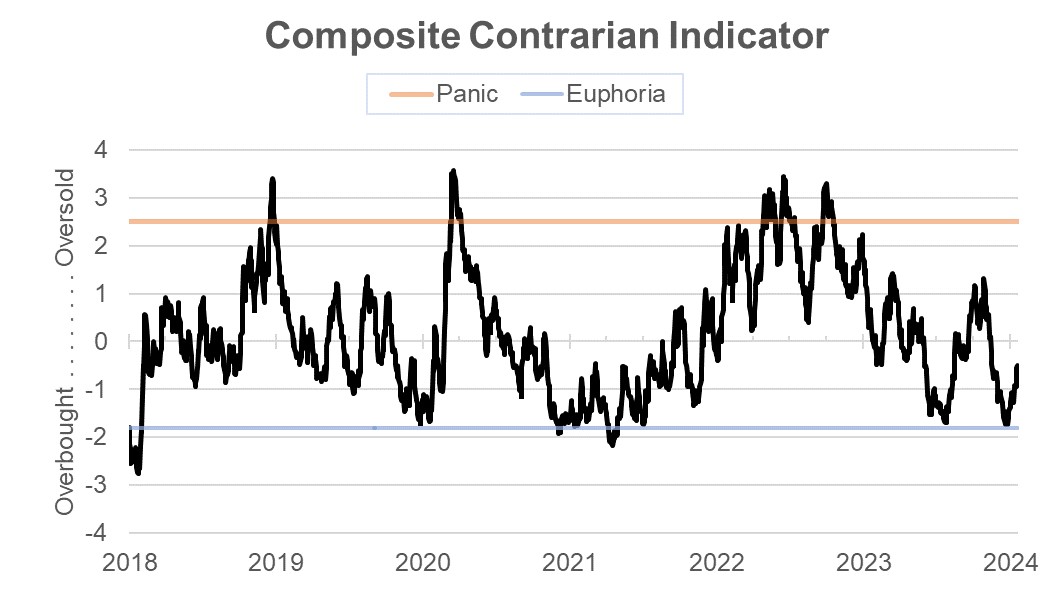

Equities already appear to be pricing in a sanguine outlook. Valuations look expensive, sentiment is directionally overbought (see chart below), and consensus earnings expectations appear very optimistic. At Russell Investments, we continue to advise clients to keep equity allocations near long-term strategic targets and don’t think it is prudent to change that based on this change in our economic scenarios.

Source: Russell Investments, as of Jan. 22, 2024.

Rates

The decline in Treasury yields in the fourth quarter, coupled with our lower recession probabilities, does suggest the value in Treasuries has narrowed somewhat. Valuations still appear cheap, but less so.

The bottom line

We believe that the painless labour market rebalancing, disinflation, and Fed pivot make it more likely the U.S. economy will avoid recession in 2024. In light of this, we have lowered our U.S. recession probability from 55% to 45%. However, it’s important to understand that recession risks remain higher than normal even after this change. From our vantage point, investors would be best-served sticking to their strategic asset allocations.