A is for Annual Rebalancing. Do your investors know why this matters?

Russell Investments believes in the value of an advisor. It is part of our corporate DNA. Delivering, communicating and elevating your value so your investors have a better chance at meeting their financial goals has never been more important. That’s why we’ll be sharing a deeper dive into our own study on this topic. This is the first of five blog posts on the subject.

Over the five years that we’ve conducted this study, we’ve found that it continues to grow in popularity because advisors tend to understand what we call the value struggle. Many advisors struggle to quantify their value, even though we see many industry studies like ours that do just that. These studies work to quantify the value an advisor brings in helping investors reach their long-term goals. We like many of these studies, because they all work to elevate the conversation around the value of advisors. Over that same period, it feels like there has been an almost constant increase in investor demands. When it comes to hiring an advisor, investors want to know what they are getting for their money.

In our 2019 study, we see that planning, managing investor behavior, and managing taxes are the key values that advisors provide to investors. Investors want a plan, they want a process that helps them stay disciplined, and they want a partner that helps them maximize their after-tax returns.

The value communication gap

Let’s assume that you do valuable things for your clients. Do your clients recognize the value of what you do? Establishing the value of all the good things that advisors do is completely dependent on good communication. This communication should cross styles. It should not just include what we write—via email, online, or via traditional mail—but should also include what we say when we are face-to-face or phone-to-phone with investor clients.

Despite those efforts toward establishing advisor value, there continues to be a disconnect between what advisors do and what their clients think they do. In other words, there is a value communication gap between advisors and clients. Advisors don’t always know what their clients really value. They don’t always know what their reference clients say about them. And they don’t always understand what they should do less of and what they should do more of.

Communication is the most deceptive of all the academic disciplines. We each think that we’re good at communication. But in our decades of working with advisors, we’ve found it’s an area that all of us need to continuously work at.

With great communication in mind, here’s the question: Do your existing client communications clearly and consistently define the value you provide? If not, consider using our simple formula.

A = Annual rebalancing of investment portfolios

A is for the annual rebalancing of investment portfolios. But the value of it is often downplayed. And when it comes to devaluing this vital service, advisors may be the main culprit. Why? Because it’s something they do every single day. It’s like breathing for advisors, and most of their clients don’t think about the impact of doing it or not doing it.

Unless you clearly communicate the value of rebalancing, don’t expect your clients to appreciate it. They should, because we think clients practice reverse rebalancing much of the time. We believe that without the help of advisors, clients are more likely to buy high and sell low. They wait to see what’s doing well in the markets and then buy more of that.

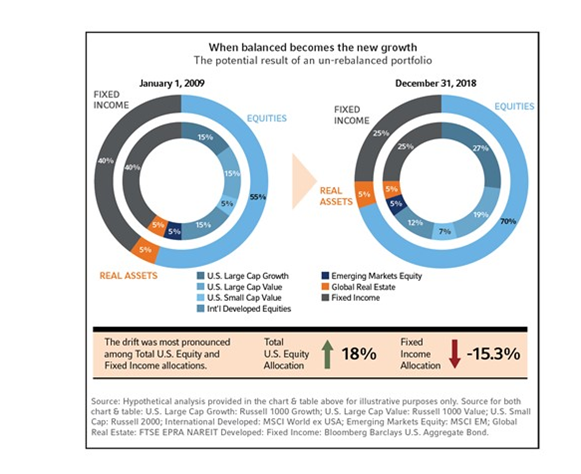

The good news is that with technology, rebalancing is easy to turn on. The bad news is the same: With technology, rebalancing is easy to turn off. Investors who don’t rebalance can end up with a very different portfolio than even they might realize. In other words, unbalanced portfolios can look very different over time versus their initial goal.

In the chart below, on the left, we see a theoretical buy-and-hold 60/40 portfolio as of January 1, 2009. On the right is the same buy-and-hold portfolio after a decade in the market, as of December 31, 2018. During that time, U.S. equities were up 18% and U.S. fixed income was down 15.3%. Growth of U.S. equities and a downward trend in fixed-income markets transformed this portfolio into a 75/25 portfolio with no action by the investor. Because no action is, in and of itself, an active choice.

Do you think most investors even realize that this sort of thing occurs? Do they recognize the value of annual rebalancing and how it’s a vital part of wealth management? If advisors don’t talk about rebalancing, don’t name it, and don’t have conversations about it, then we can’t expect investors to understand its importance.

A case for model strategies

The good news is that many advisors are increasingly using model strategies and communicating the model’s strategic philosophy and policies. And that’s great. Especially since we see that annual rebalancing is important, but we also recognize that advisors have only so much time. There are increasing demands on that time. Adding models to your inventory helps take care of both the rebalancing policy and helps to free up your time for efforts that may deliver even more value.

How to tell the rebalancing story

Are you sharing your rebalancing strategy consistently with your clients? Are you letting them know how frequently their portfolios are rebalanced, whether you are doing it manually or whether it’s the rebalancing policy of the model-strategy partner you’re working with? We recommend four simple touchpoints to make the communication both easy for you and meaningful for your investor clients.

- The benefits of a systematic rebalancing policy—Explain what can happen if rebalancing doesn’t happen and how annual rebalancing helps keep their portfolios on track with their goals and their risk profiles.

- What the strategic rebalancing policy is—Let your clients know the basics of the policy, how it works to be both efficient and oriented toward their desired outcomes.

- How frequently the portfolios are rebalanced—Explain how often strategic rebalancing happens and why you believe that frequency makes sense for them.

- The approach to strategic rebalancing policy during periods of market volatility—Let your clients know how sticking to a long-term, disciplined rebalancing policy can help them avoid costly mistakes, such as following the herd, buying high and selling low, and leaving the market at worst times.

The bottom line

In the formula of advisor value, A is for the annual rebalancing of investment portfolios. But for your investor clients to understand the value of strategic rebalancing, you need to talk about it. This doesn’t have to be a complicated conversation. But we believe it needs to happen, because rebalancing is a key part of helping your investors reach their desired outcomes. And that’s what matters most.

To learn more about the 2019 Value of an Advisor Study, click here.