Effective liquidity management for non-profit investors

Executive summary:

- Private assets and alternative investments are usually illiquid in nature but can help an investor meet their long-term objectives in a more efficient manner.

- Allocating to illiquid investments necessitates managing liquidity risk in portfolios to ensure that sources of liquidity are sufficient to meet the various uses of liquidity.

- Effective liquidity management requires a holistic framework that considers the interplay between top-down asset allocation, bottom-up cash flow modeling, and liquidity scenario analysis.

Liquidity is a crucial consideration in the management of investment portfolios. The ability to meet all potential liquidity needs is of utmost importance to all investors. For institutional investors, periodic obligations necessitate careful asset allocation to mitigate the risk of failing to meet these obligations. However other investors may be so concerned about this risk that they miss the benefits provided by alternative investments, despite the ability to tolerate greater illiquidity in the portfolio. Detailed liquidity analysis can help the overly conservative investor gain confidence in building an appropriate allocation to illiquid investments while also deterring the aggressive investor from inappropriately allocating to illiquid investments. In this article, we'll review some key sources and uses of liquidity and then share what we see as a "best-practices" approach to determining the appropriate allocation to illiquid investments.

Sources and uses of liquidity in investment management

Liquidity management is the process of ensuring that the investment portfolio has enough cash and other liquid assets to meet its current and future cashflow needs. Investors must gain a comprehensive understanding of both the sources and uses of liquidity.

Sources of liquidity

The efficient management of liquidity relies on knowledge of the various sources from which capital can be obtained to meet financial commitments. Some key sources of liquidity include:

- Liquid assets: These include cash, cash equivalents, and highly liquid securities (e.g., public equity) that can be readily converted into cash with transparent daily pricing. The liquidity that can be assumed from the liquid assets will depend on both the total allocation to liquid assets, and the price volatility of the liquid assets.

- Inflows: Non-profit organizations may receive donations or gifts and affiliated-institution assets to manage or inflows from organizational operations, and pension plans may receive contributions. However, inflows cannot be relied upon to be maintained in a stressed market environment.

- Distributions from illiquid investments: If an investor has existing private investments the returns generated are paid back through distributions. The timing of distributions is uncertain, and distributions cannot be relied upon to provide consistent liquidity.

Understanding the sources of liquidity empowers investors to make informed decisions and allocate their assets effectively to meet various financial obligations and strategic goals. Detailed liquidity analysis can help the overly conservative investor gain confidence in building an appropriate allocation to illiquid investments while also deterring the aggressive investor from inappropriately allocating to illiquid investments.

Uses of liquidity

Just as diverse sources of liquidity exist, the available liquidity in an investment portfolio can be channeled toward several important uses, depending on the investor's specific needs and objectives. These uses encompass a spectrum of financial requirements:

- Organizational cashflow needs: The cashflow needs will vary by investor type. Endowments and foundations will have the annual spending payout and internal and external expenses, while other investment pools may be expected to support organizational cashflow needs, such as defined benefit plans funding benefit payments and expenses. All investors will need to assess the expected total outflows along with the maximum potential outflows.

- Capital calls from private investments: In the case of investments in private funds, capital calls will be made by the fund manager to meet investment commitments. These capital calls represent requests for additional investments to meet prior commitments.

- Rebalancing: Portfolio rebalancing involves adjusting asset allocations to maintain the desired risk and return characteristics. This is typically desired, but it is not a legal responsibility. However, it plays an essential role in optimizing the portfolio's performance and alignment with the investor's objectives.

Effective liquidity management: A two-test framework

Efficient liquidity management is a critical factor for investors, influencing their capacity to fulfill financial obligations. To address this challenge, we present an approach that merges top-down asset allocation and bottom-up cash flow modeling. This approach incorporates two essential tests: the maximum outflow coverage test and the expected outflow coverage test.

In the context of investors with a significant allocation to illiquid assets, we illustrate the application of these tests. Let's consider two investors, A and B, who initially conducted a top-down asset allocation based on capital market assumptions to align their investment portfolios with their objectives and constraints, as depicted in Exhibit 1. While this top-down portfolio may appear suitable for achieving both of their objectives, it lacks consideration of cash flow and liquidity factors, potentially leading to an excessive allocation to illiquid assets.

Exhibit 1: Illustrative top-down investment portfolio that meets investment goals

| Asset class | Allocation |

| Public equity and real assets | 32% |

| Private equity | 31% |

| Private real assets | 4% |

| Private debt | 8% |

| Hedge funds | 15% |

| Liquid IG fixed income | 10% |

For our example, let's assume that Investor A has an annual spending rate of 5%, and Investor B has an annual spending rate of 4% with a potential $10 million cash flow needed in case of a budget shortfall. Furthermore, both investors share a total asset base of $100 million, and the profiles of their private asset programs and illiquid funds are identical (as shown in Exhibit 2). These bottom-up assumptions play a pivotal role in shaping the cash flows and liquidity risks that investors must manage.

Exhibit 2: Illustrative private assets program

- Mature private assets program

- Illiquid investment funds liquidity profile:

- Private equity: Multi-year illiquid

- Private debt: Multi-year illiquid

- Private real assets and hedge funds: Conditionally liquid open-ended funds

- Uncalled capital as % of illiquids allocation:

- Private Equity: 50%

- Private Debt: 20%

- Private Real Assets and Hedge Funds: 0%

It's important to note that the assumptions in Exhibit 2 will vary based on specific investor circumstances, the chosen private asset investment program, and the profile of the private/illiquid funds within the investor's allocation.

Having established the top-down asset allocation and bottom-up cash flow modeling assumptions, we proceed to conduct liquidity stress tests within predefined shock scenarios, including a Global Financial Crisis (GFC) and a stagflation scenario. These scenarios are thoughtfully selected to demonstrate how different market conditions can impact the liquidity coverage for our illustrative portfolio.

Maximum outflow coverage test

Objective: Our first liquidity stress test rigorously evaluates the portfolio's capability to meet all potential financial obligations under the most dire of circumstances and maintain max potential outflow coverage greater than 1.

Calculation: Max Outflow Coverage = Daily liquid assets (after drawdown) / Max Cash Outflow

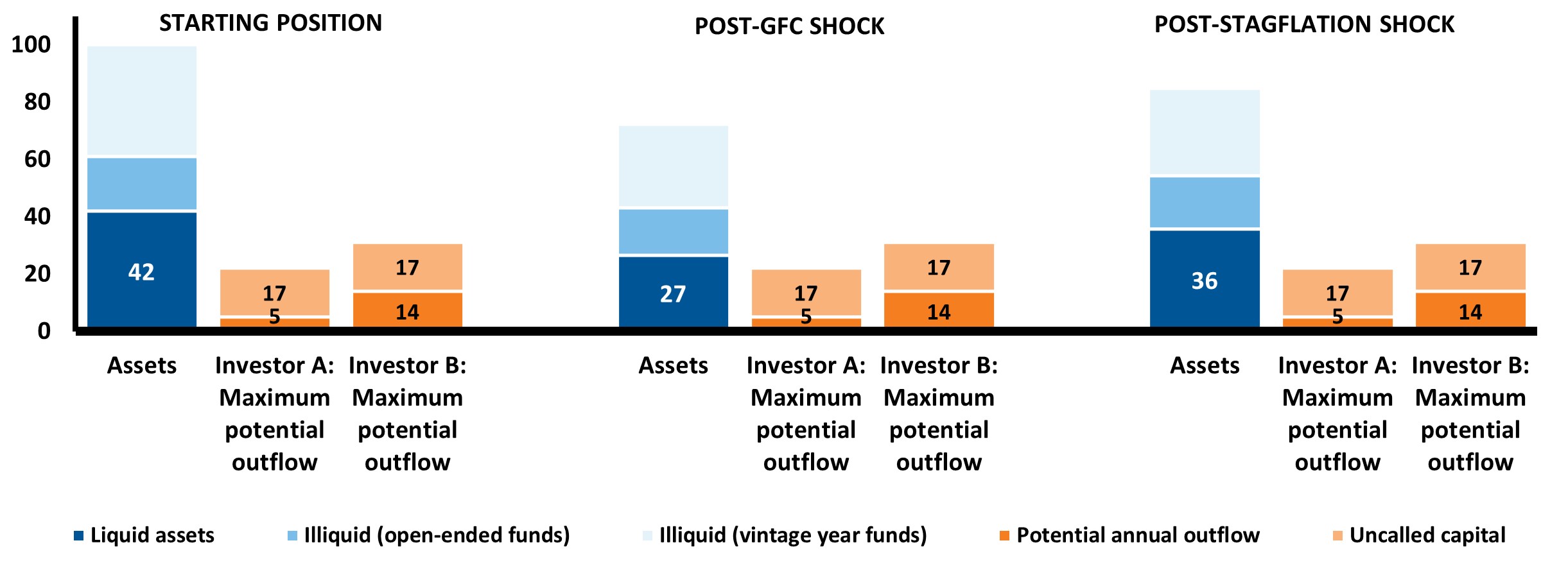

Exhibit 3 shows that while both investors have a total of $42 million in liquid assets prior to the shock events, that number is reduced to $27 million after a GFC shock and $36 million after a stagflation shock.

Exhibit 3: Stress-Testing the Maximum Outflow Coverage

The maximum outflow coverage for both investors in these scenarios is calculated as below.

Post GFC Shock

- Investor A Max Outflow Coverage = $27M / ($5M + $17M) = 1.2x

- Investor B Max Outflow Coverage = $27M / ($4M + $10M + $17M) = 0.9x

Post Stagflation Shock

- Investor A Max Outflow Coverage = $36M / ($5M + $17M) = 1.6x

- Investor B Max Outflow Coverage = $36M / ($4M + $10M + $17M) = 1.2x

We see that investor B has a Max outflow coverage of less than 1 in a GFC shock scenario and will therefore will not be able to meet his liquidity needs if capital is called for all of them in tandem after a GFC like shock. Although this portfolio is likely suitable to Investor A with its stable outflow pattern, it is unsuitable for Investor B given the uncertainty in its liquidity needs.

Expected Outflow Coverage

Objective: This test focuses on sustaining three years of expected outflows, maintaining expected outflow coverage greater than 3x. It assumes that liquidity will gradually be generated from conditionally liquid and distributions from illiquid investments within three years.

Calculation: Expected Outflow Coverage = Daily liquid assets (after drawdown) / Expected annual spending, expenses, other outflows and calls net of distributions (if a net outflow, ignored if a net inflow)

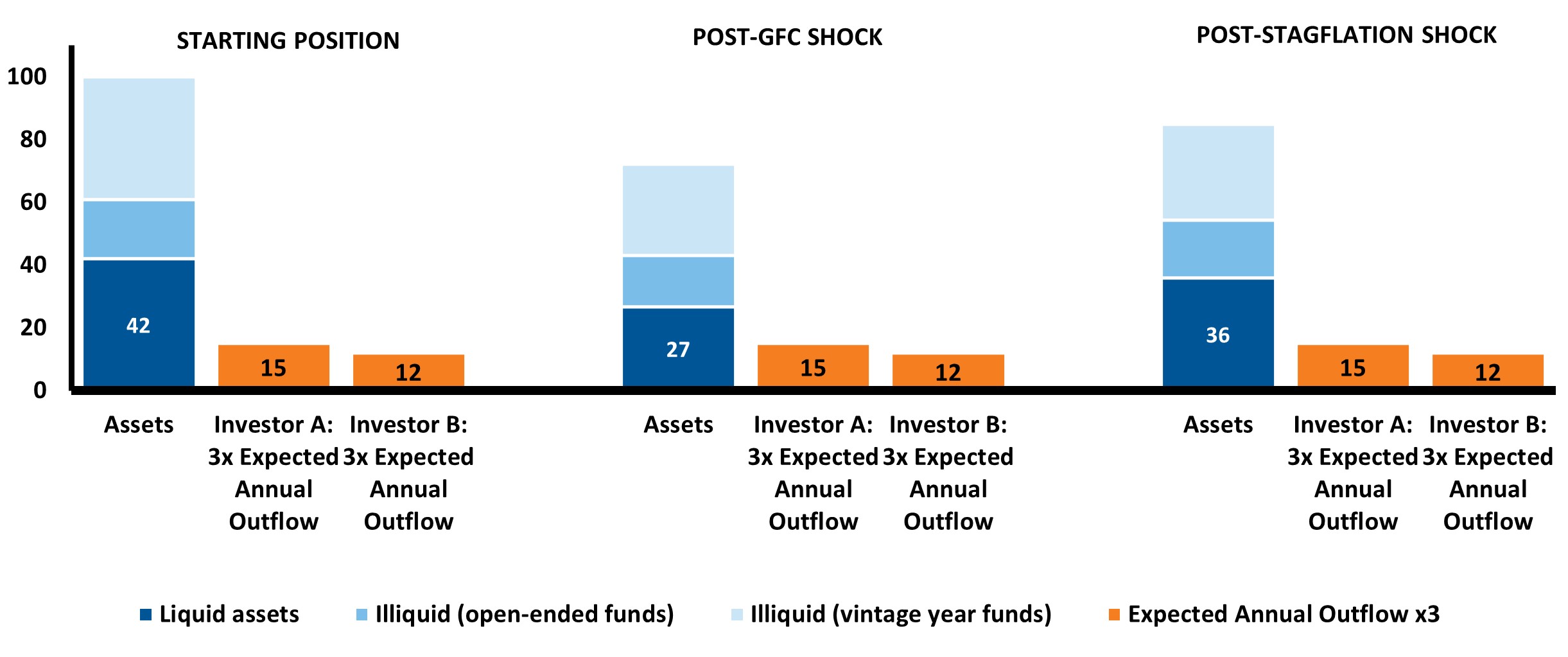

In Exhibit 4, we see that in the GFC and stagflation shock scenarios, there are enough liquid assets available post the drawdown event to cover 3x the expected annual cash flow for both investors A and B.

Exhibit 4: Stress-Testing the Expected Outflow Coverage

The expected outflow coverage for both investors is calculated below and exceeds our requirement of 3.

Post GFC Shock

- Investor A Expected Outflow Coverage = $27M / ($5M) = 5.3x

- Investor B Expected Outflow Coverage = $27M / ($4M) = 6.7x

Post Stagflation Shock

- Investor A Expected Outflow Coverage = $36M / ($5M) = 7.2x

- Investor B Expected Outflow Coverage = $36M / ($4M) = 9.0x

From the perspective of this test, the portfolio could be suitable for both investors A and B. In these examples, the more limiting stress is the Maximum Outflow coverage. However, this might not always be the case and will be impacted by the level of expected outflows relative to maximum potential outflow. If an investor’s maximum potential outflow is less than 3x larger than the expected outflow, it will be the expected outflow coverage that is the more limiting stress. We would expect this to occur for an investor whose illiquid exposure is solely or predominantly open-ended funds and has stable annual outflows.

Investor considerations

While the tests mentioned earlier are personalized to an investor's specific portfolio and liquidity requirements, additional investor-specific factors must be considered. Common considerations that should be accounted for in the determination of the appropriate allocation to illiquid investments are the following:

Tolerance for deviation from strategic allocation weights

Illiquid investments can hinder portfolio rebalancing to strategic targets, particularly as the allocation to illiquid assets and potential outflows increase. Two investors with identical profiles may differ in their comfort levels with extended periods of deviations from strategic targets, affecting their tolerance for illiquid investments in their strategies.

Desire to maintain flexibility to tilt the portfolio based on market environment

The investment landscape experiences significant shifts due to changing macroeconomic conditions through time. Some investors look to add value by dynamically adjusting portfolio allocations based on the market environment. A portfolio with adequate liquidity can efficiently adapt to such changes, aligning with an investor's unique risk tolerance and objectives. Excessive illiquid assets could limit the ability to adjust the portfolio as needed in response to changing macroeconomic conditions, potentially misaligning with investment goals.

Conclusion

Effective liquidity management requires a holistic framework that considers the interplay between top-down asset allocation, bottom-up cash flow modeling, and liquidity scenario analysis. By incorporating the client's liquidity preferences and specific private asset program details, investors can build portfolios that meet their liquidity needs while aligning with their risk preferences and performance objectives.