Private markets and liquidity needs for DB plans – do you really need to worry?

One of the first items for a defined benefit (DB) plan sponsor that comes to mind when considering private market assets is the impact on liquidity. Of course, this could be a large problem for some DB plans, but usually it is not, especially if the allocation is properly sized to account for future liquidity needs. Here are a few common concerns and alternative ways to think about them when contemplating adding private assets to the plan’s portfolio.

Don’t we need liquidity to pay our benefit payments each year?

Every DB plan, regardless of how mature, will be paying benefits out each year. However, even a very mature plan doesn’t necessarily have outsized liquidity needs. By reviewing the ratio of benefit payments to benefit obligation you can determine at a high level how extreme the plan’s liquidity needs really are. Typically, plans will pay out about 5-6% of the PBO (projected benefit obligation) on an annual basis. For more mature plans, or plans that pay lump sums, the ratio could be as high as 11-12% of PBO. For plans paying out less, liquidity can be managed quite reasonably through liquid return-seeking and fixed income assets.

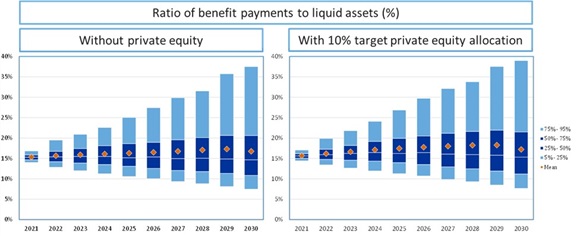

Exhibit 1 below illustrates a case study of the liquid assets’ ability to cover benefit payments. In this example the plan’s annual benefit payments were 9% of the PBO and had a 75% allocation to return-seeking assets. The addition of even 10% private assets had little impact on the ratio of benefit payments to liquid assets.

Exhibit 1: Case study of impact of private assets on ratio of benefit payments to liquid assets

Click image to enlarge

Absent large fluctuations in benefit payments, sourcing liquidity only from liquid assets can be more than adequate to meet the needs of the plan, and that’s before considering that a mature private asset portfolio will also begin to generate cash flows for the plan.

Won’t private assets limit our ability to complete risk transfers?

Nothing says outflows like a risk transfer transaction. A simple way of thinking of these transactions is a very large benefit payment—and like benefit payments, the scale of the transaction matters. The risk transfer activity may lead to a high concentration of illiquid assets, which could create issues in both the short and long term.

However, there’s more to the equation than may meet the eye. Demographics and funded status before and after a risk transfer play a large role in what the strategic asset allocation should look like when the dust has settled. Both lump sum offers and annuity purchases almost exclusively target inactive participants (i.e., terminated vested participants for lump sum offers and retirees for annuity purchases), meaning the plan will have a larger share of active participants after the risk transfer event. The larger share of active participants will extend the duration and time horizon of the plan and lead to lower near-term benefit payment needs.

Along with reducing the size of the plan, the risk transfer is likely to reduce the funded status of the plan (due to associated fees and premiums) and especially so if the plan is already underfunded. With that longer timeframe, lower liquidity needs and lower funded status (in relative terms), a higher allocation to private assets after the risk transfer can be a part of the solution to bridge the funding gap more smoothly if the liquidity needs of the plan allow. However, it will be important to consider the extent of risk transfer activity and to size the private commitments based on the future state of the plan rather than the current state of the plan.

Our plan is closed/frozen, doesn’t that preclude the use of private assets?

Conventional wisdom may leave you thinking that only open plans should have private assets. However, being a closed or frozen plan does not immediately make private markets a wrong or bad decision. In the right circumstances, privates can provide both higher return and diversification that many plan sponsors are looking for. Closing or freezing the plan shortens the time horizon, but there is usually still a very long path to plan termination.

We often discuss with our clients the opportunities available through hibernationand privates definitely have their place in those discussions. It is most important that sponsors consider the plan’s time horizon to termination and potentially marrying the length of the illiquidity to that. This can be accomplished through a one-and-one allocation, or choosing private credit to private equity if the time horizon is shorter. And while it may not be preferred, private assets can always be sold on the secondary market or possibly included in the buy-out if termination comes sooner than expected. A private market allocation, even a one-and-done commitment, can provide a strong ballast to the plan’s funded status and, when reasonably sized, not have a noticeable impact on the liquidity needs of the plan.

What’s the takeaway?

All DB plans need to be thinking about their liquidity needs. But it’s a complex issue intertwined with other concerns within the plan. It is worth visiting the topic within the specifics of your plan to determine whether those liquidity concerns hold any weight, especially within the broader context and concerns the plan faces. Perhaps those initial liquidity concerns aren’t as large as you first thought.