Executive summary:

- Potential benefits of investing in private real estate include diversification, competitive returns, relatively low volatility and income-generating capabilities.

- We believe that private real estate is currently near the bottom of a market cycle, presenting a potentially compelling buying opportunity for some investors today.

- Specifically, we think that the positive growth trends in some sectors of private real estate—including industrials, apartments and specialty sectors such as data storage and healthcare—when combined with the right active management approach, could allow for potential outperformance.

When it comes to the private real estate sector, the mention of the U.S. commercial office sector scares many investors away. While the office sector may give some investors pause, it's also prudent to look at the bigger picture, especially when that picture may conclude that private real estate is near the end of a market cycle and may hold significant investment opportunities.

No matter where we may be in a market cycle, we believe private real estate has a role to play. Let's examine the potential benefits it can bring to a portfolio.

- Diversification – Diversification remains the fundamental reason for including private real estate. This is truer now than ever before, as the property types within the real estate sector are also more diversified. More on that later. Unlike stocks and bonds, private real estate also tends to lag the economy.

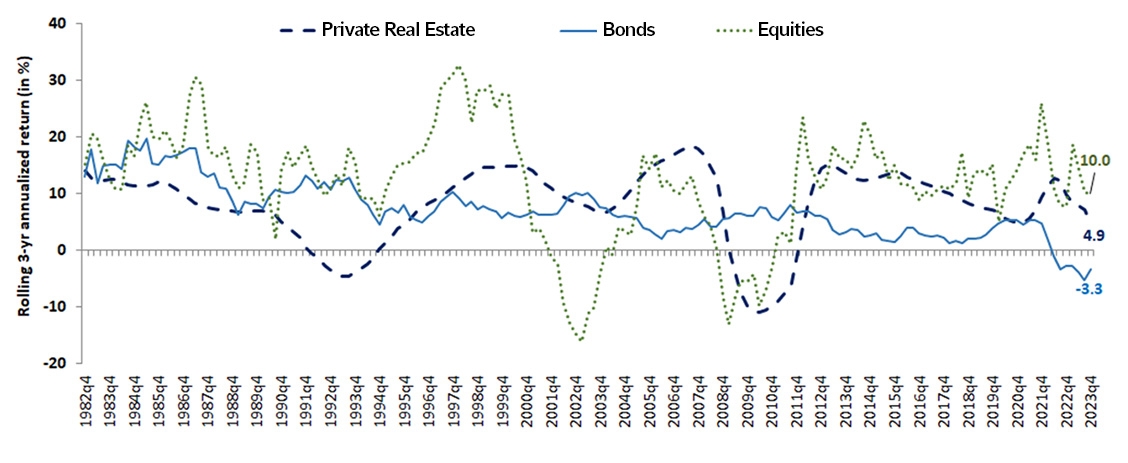

- Competitive returns – Returns on private real estate tend to fall between the returns of stocks and bonds. Over the last 25 years, private real estate has had an average annualized return within the 7-9% range (Source: Russell Investments; Real Estate is measured by the NFI-ODCE Value-weighted Index, using total returns).

- Relatively low volatility – Private core real estate's quarterly appraisal process reduces volatility, which tends to settle out somewhere between that of stocks and bonds, at least over the last two decades. Returns are comprised mainly of income and some capital appreciation driven by income growth. In addition, leverage levels for core private real estate (defined as fully leased multi-tenant properties) tend to be lower than the average U.S. REIT (real estate investment trust).

- Income-generating capability – Private real estate's contractual lease obligations–binding contracts that ensure tenants pay rent, even if the space is vacant–help stabilize returns.

Private (unlisted) real estate versus equities and bonds

Source: Russell Investments

Is private real estate a good investment right now?

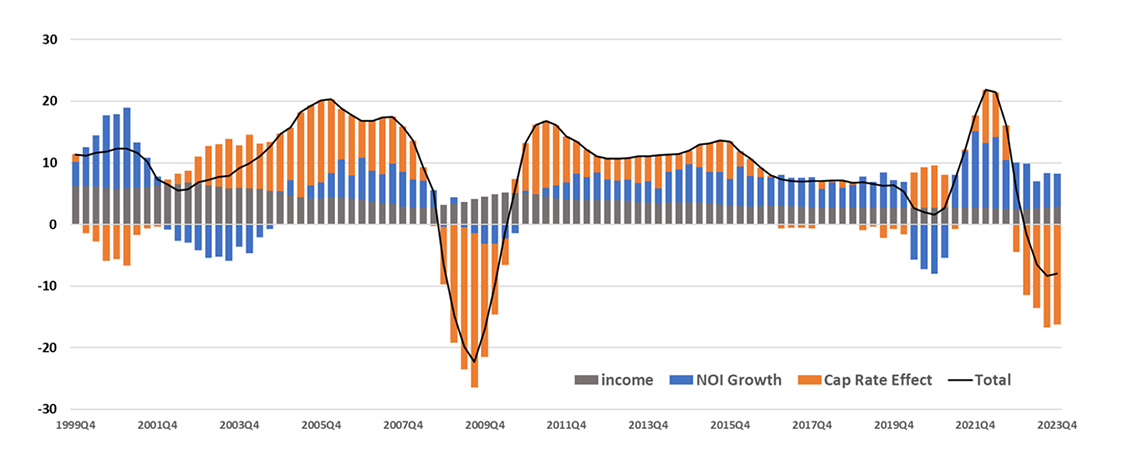

It's not a secret that real estate has struggled in recent history. According to GreenStreet Advisors, the private real estate sector has seen a 20% decline over the last six quarters. But let's look at the NOI. Net Operating Income (NOI) is the commonly used figure to assess a property's profitability. We've seen strong NOI growth during that same six-quarter period, helping sustain total returns.

Unlevered real estate returns (trailing 4 quarters) through December 31, 2023

Source: NCREIF Property Index Trends Report, PGIM and Russell Investments

Another positive indicator for this sector comes from the listed real estate market. Private real estate tends to lag listed REITs by about a year. Share prices on REITs have returned, which is a strong indicator that private real estate should also return. (Another positive note worth mentioning: Because private real estate tends to lag, in theory, it comes with a bit of built-in predictability.)

We expect some additional modest write-downs in the coming quarters. However, because it is very difficult to time market swings, many savvy investors buy the trough instead of trying to time the precise bottom of the market. We believe that private real estate is in that trough right now. For some investors, the timing may be right.

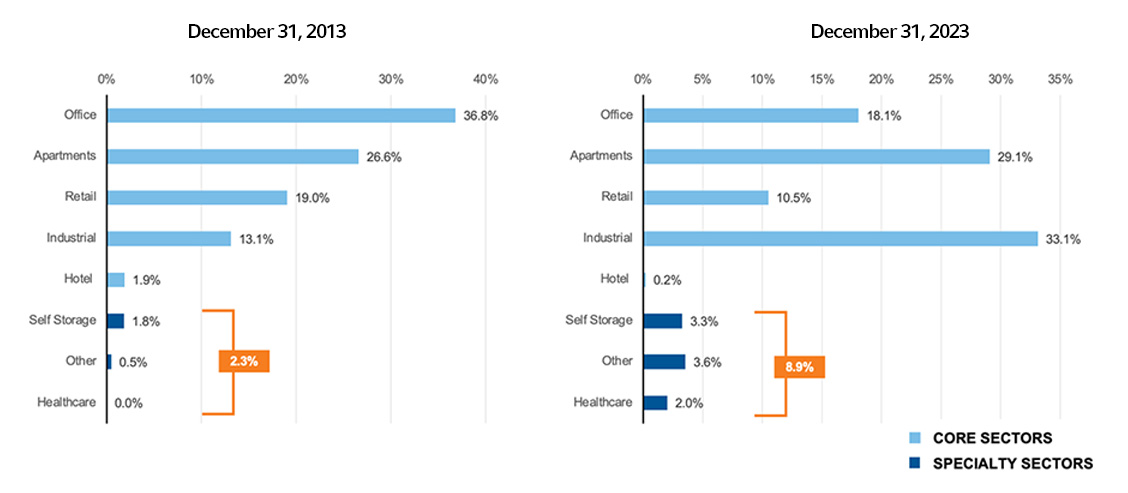

An expanded opportunity set

Another key factor that makes us bullish on private real estate is that the sector has expanded, allowing for more diversification and specific return opportunities within the sector. In 2013, the office subsector used to dominate the space, at 36.8% of the assets. In 2023, that sector dropped into third place, trailing industrial and apartments. The office category still gets all the headlines but is no longer the dominant force.

Another subsector trend that has us particularly excited is the growth of specialty sectors, such as data storage and healthcare, among others. In 2013, these subsectors held just 2.3% of the assets, but that number grew to nearly 9% in 2023.

The 21st century real estate market

Specialty sector exposures

Source: NCREIF ODCE (National Council of Real Estate Investment Fiduciaries) as of December 31, 2023.

Why active management matters in private real estate

We believe many managers and funds do not pay enough attention to these specialty sectors. However, a growing number of private funds focus on this market segment. We believe it may be possible to outpace the index by overweighting these sectors. Of course, this depends on choosing the right managers who understand asset management's role in creating value for investors.

In conversations with our clients and prospects, many are surprised to learn that even in this relatively bleak environment, the office sector is at an approximately 90% occupancy rate (Source: NCREIF Property Index Trends Report). On the negative side, we are only at a 50% office utilization rate (Source: Kastle Systems), meaning that while the space is leased, it may not be in use. The conclusion is that this will be bad news for those funds and managers who are heavily loaded with lower-quality assets but may benefit managers who specialize in compelling, class-A space. This is another reason that active management is a key factor when it comes to success in this sector.

The uncertainty of office vs. the relative certainty of supply and demand

The natural question is: What will happen with all the unused office stock? The honest answer isL No one really knows yet. We believe this uncertainty about this single subsector has caused too many investors to shy away from the entire private real estate sector. Remember that office is only 18% of the sector, and that number will likely decrease.

If we right-size the impact of office, the holistic picture is quite positive due to the fundamental supply/demand picture. For the real estate sector as a whole, construction essentially dropped off a cliff when the Fed began tightening in 2022.

We've seen this, especially in the senior housing sector.

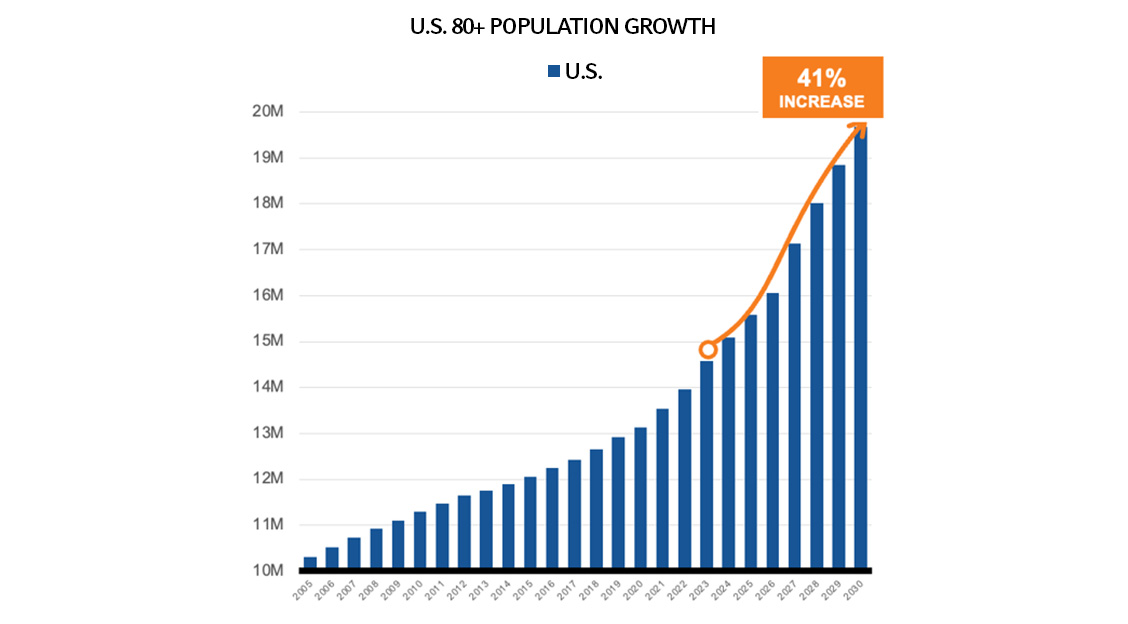

Senior housing: Accelerating 80+ population growth

Source: U.S. Census Bureau

The U.S. Census Bureau predicts a 41% increase in the 80+ population between 2023 and 2030—a staggering number. At the same time, senior housing starts fell off during COVID, when the idea of group living situations seemed untenable. Post-COVID, we have rapidly accelerating demand and insufficient supply, supporting the landlords' abilities to push rents within the sector.

We see a similar situation in technology; the infrastructure needed to support the digitization of the economy across industries is contained in data centers. The roll-out of AI (artificial intelligence) more broadly represents a new and, perhaps, dominant source of leasing demand going forward. Public cloud computing companies and AI are some of the largest data center tenants and account for a growing share of overall leasing activity. Vacancy remains tight due to lack of supply and power constraints, once again leaving pricing power in the hands of the landlords with existing stock.

The bottom line

The case for private real estate is compelling. We are not necessarily recommending that investors try to time the market, but we do believe we are at or near the end of the current market cycle in this sector. The broader set of real estate subsectors provides an additional layer of diversification if the right managers are brought to bear. With the proper guidance and the right active-management approach, we believe it is a reasonable time for investors to rescind redemption requestions and add to their allocations within the private real estate space.