Stay the course. This, too, shall pass.

Diversification still matters

An integral part of financial planning is helping clients determine what proportion of household savings and investments should be invested in short, medium- or longer-term growth-oriented investments like stocks. An investor’s time horizon matters for different types of accounts and managing the complexity of achieving both short term and longer-term goals is a large component of the value you add as a financial advisor.

The recent market volatility after a decade-long bull market, as evidenced by the S&P 500, serves as a reminder to clients that investing in stocks can have an important impact on long-term investment plans for life events such as retirement or education savings. Investing in growth-oriented assets in order to outpace inflation or longer lifespans also means that investors must be able to weather the market ups and downs over shorter time horizons.

We have been experiencing extreme fluctuations in stock prices as global markets try to determine what the full impact of the coronavirus will be and how long it will take to get back on track.

Bonds – the brakes in the portfolio

Most investors are likely holding diversified portfolios that are made up of a mix of different asset classes including stocks, bonds, cash and even real assets. Remember that each asset class plays an important role in the portfolio’s risk and return. The mix of assets also determines the ability of the portfolio to provide some measure of stability and potentially smooth out the ride when things get bumpy. Different asset classes generally react to different events in different ways.

Tim Halverson, a fellow colleague puts it this way: Not having bonds is akin to driving a car that only has a gas pedal. Such a car would be fine—and even lots of fun—when nobody else is on the road, the road is smooth, the weather is good and you know where you are going. But let's be honest: that rarely happens in real life.

It is common for some investors to get frustrated when markets are on the way up and their portfolios do not capture all of the upside. However, investor behavior patterns remind us that most investors are motivated to avoid losses when things are trending down, and this is exactly when being diversified wins the day. When the stock market is volatile, it’s often the allocation to bonds that provides some measure of stability and a stream of income. Bond performance is typically negatively co-related or moves in a different direction to stock or equities.

Equities typically act as the gas pedal in a portfolio and bonds serve as the brakes. In the same way that no one would ever drive a car with only a gas pedal, why would you have a portfolio with only stocks?

The chart below shows that having a diversified mix of stocks and bonds has resulted in much smaller declines than portfolios that are 100% allocated to global stocks, as of late March 2020.

Click image to enlarge

Source: Russell Investments, Confluence. As of March 27, 2020. In US dollar. Global Equity = MSCI World Net Dividend Index; Global Bond = Bloomberg Global Aggregate Bond Index USD Hedged. Indexes are unmanaged and cannot be invested in directly. Past performance is not indicative of future results.

Focus on your client’s goals and how your portfolios are allocated

We’ve previously written that while the cause of the current correction is unusual, extreme periods of market volatility are not. Historically, we’ve observed the length of bear markets have been declining. Specifically, as measured by the S&P 500, the stock market crash of 1929 and resulting bear market lasted 34 months, the dotcom bubble was 25 months and the global financial crisis lasted 16 months. Over the past 94 years, the average bear market has been 15 months in duration, while the average bull market has sustained for almost 72 months, using the S&P 500 Index as a measure.

Market volatility can and does present opportunities for active portfolio managers, such as harvesting capital losses in order to shift toward increased tax-efficiency, as well as portfolio rebalancing, with a lens on the global opportunity set. Advisors, too, may use volatility as a means to remind clients to possibly accelerate their savings strategies by buying low and to put their portfolio accumulation on autopilot using dollar-cost averaging.

We believe behavioral coaching is a significant contributor to the value of your advice. We believe one of the biggest risks to a client's return is their own behavior during periods of volatility. As their trusted advisor, you can help guide clients toward a portfolio mix that is focused on helping them achieve their outcomes. Keeping your clients invested, on track and ready for the market turnaround will leave your clients grateful they have you.

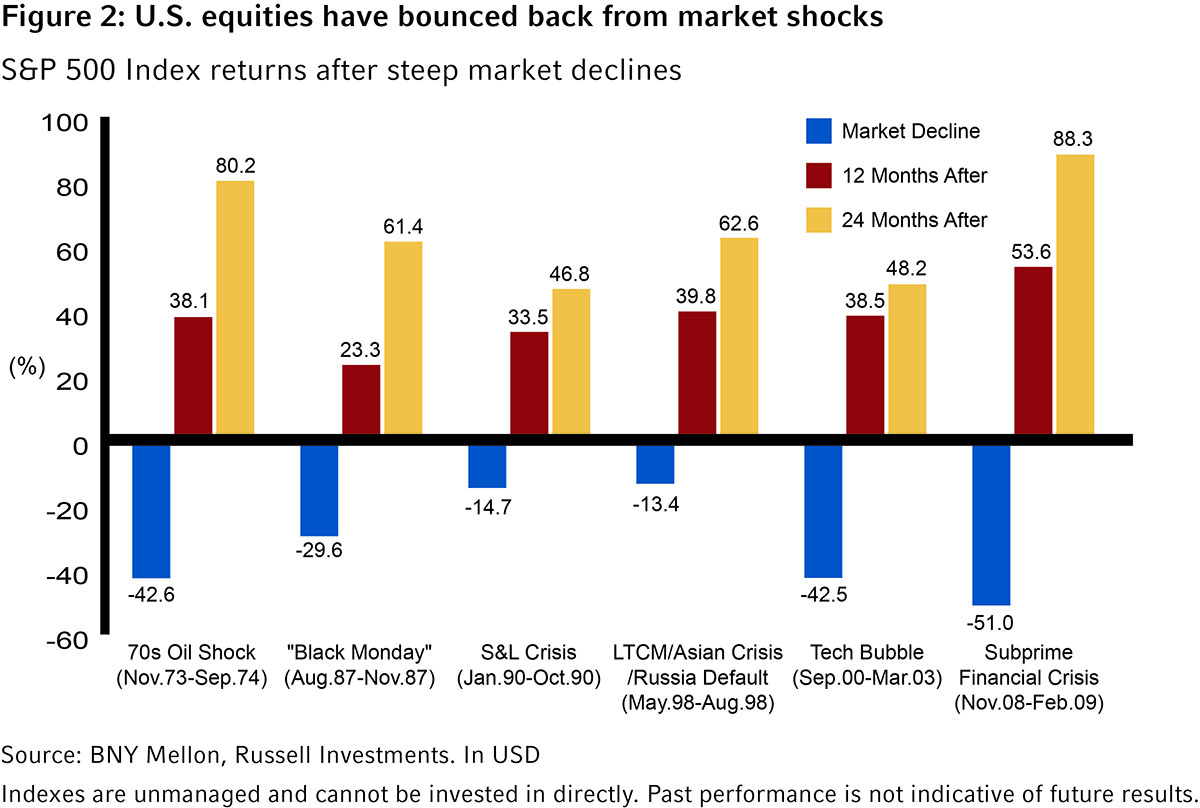

The chart below shows how markets have historically bounced back after steep market declines. This is where the payback for the work that is being done now behind the scenes typically pays off.

Click image to enlarge

Bottom line

Your clients need you now more than ever to have a disciplined investing and asset allocation strategy, to be proactive in your client conversations with them and for your voice to be the calm in the storm through this most recent market turmoil. Your clients need you to help them stay focused on their outcomes, keep their long-term objectives at the forefront and to remind them that while we do not know when, this too shall pass.