Executive summary:

- U.S. small cap stocks have soared due to falling yields and expectations for Fed easing

- A Fed rate cut in September looks increasingly likely

- The disinflation trend in the UK and Canada is continuing

On the latest edition of Market Week in Review, Director of Investment Strategies, Shailesh Kshatriya, discussed the recent strength in U.S. small cap stocks and the likelihood of a September rate cut from the U.S. Federal Reserve (Fed). He also provided an update on the latest inflation numbers from Canada and the UK.

Two key factors powering the rise in U.S. small cap stocks

Kshatriya began by unpacking the recent outperformance of U.S. small cap equities over their large cap counterparts. Characterizing the comeback in small cap stocks as remarkable, he said that from July 11-18, U.S. small cap stocks—as measured by the Russell 2000® Index—outperformed the S&P 500® Index by around 6.5% and the Nasdaq 100 Index by nearly 10%. Prior to that, small caps had struggled mightily in comparison to their larger peers, he said.

“The catalyst for small cap's strong performance dates back to July 11’s softer-than-expected U.S. inflation report, which added confidence to the market that Fed rate cuts are nearing,” Kshatriya stated, noting that at one point, the U.S. 10-year Treasury yield was down over 10 basis points (bps) from its peak earlier in July. Lower yields help small cap stocks, which are generally more interest-rate sensitive, he said. “Smaller companies tend to have a higher cost of borrowing, so falling yields are a tailwind,” Kshatriya explained.

In addition, he said the rotation into small cap stocks has been supported by recent U.S. political developments, which have increased market expectations for potential tax cuts and a looser regulatory backdrop.

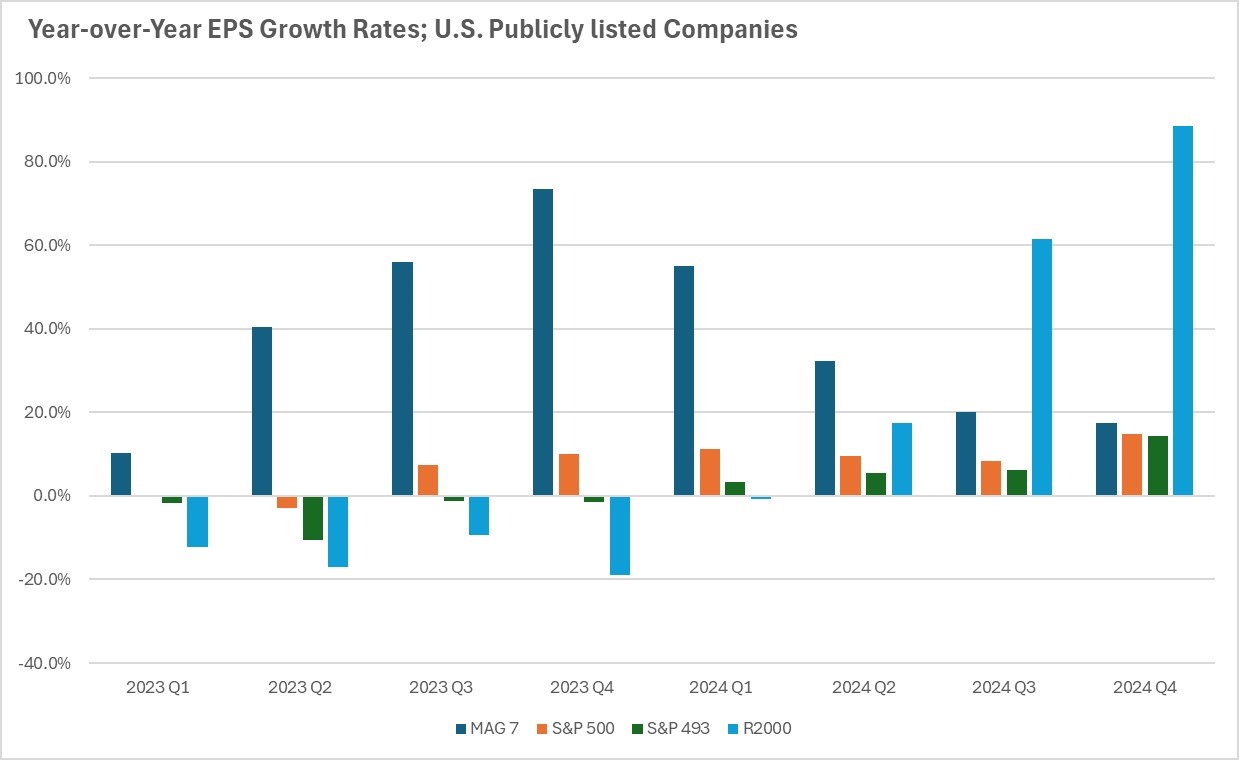

Kshatriya cautioned that a few days or a week doesn’t make a trend, but noted that U.S. earnings growth expectations are starting to broaden out. For instance, earnings-per-share (EPS) growth expectations for U.S. small cap companies are rising, with analysts anticipating that Russell 2000 companies will grow at a convincingly faster rate than the Magnificent Seven group of stocks and the S&P 500 in the third and fourth quarters of 2024, he said.

Source: Russell Investments, LSEG I/B/E/S, July 2024

“These expectations for U.S. small caps look lofty, as the sustainability in the small cap rally remains to be seen, but the impressive shift in the consensus outlook is worth noting,” Kshatriya observed. He added that, from his vantage point, small cap valuations remain attractive relative to those of large cap equities while also providing compelling opportunities for diversification in multi-asset portfolios.

Fed appears likely to start cutting rates in September

Shifting to U.S. monetary policy, Kshatriya noted that a few Fed officials gave speeches recently, including Chair Jerome Powell and Governor Chirstopher Waller. Waller’s remarks that the time to lower the policy rate is “getting closer” drew particular attention, he noted.

“Bear in mind that closer does not mean imminent—we’re not expecting a rate cut at the Fed’s July 30-31 meeting—but a September cut is looking increasingly likely,” Kshatriya remarked. He said that if the U.S. central bank does begin easing later this year, that could provide additional strength for small caps, especially if the U.S. economy is able to achieve a soft landing.

Is another rate cut on the way in Canada?

Kshatriya concluded with a look at the June inflation reports from Canada and the UK. He said that in both countries, the broader disinflation story remains on track.

In Canada, the average of the Bank of Canada’s (BoC) preferred core inflation gauge eased to 2.6% from 2.7%, Kshatriya said, while the simplified version that excludes food and energy came in at 1.9%—slightly below the BoC’s target.

“This inflation report shouldn't change the outcome for the BoC at its upcoming meeting. Markets expect a 25-bps rate cut, and we concur,” he stated, noting this would be the bank’s second cut of the year.

Meanwhile, in the UK, headline inflation for June came in right on target at 2%, Kshatriya said, although core inflation remained elevated at 3.5%. Due to the stickiness in core inflation, markets believe the Bank of England (BoE) will probably wait until September to lower borrowing costs, he said.

“Although there will be some deviations in the inflation numbers on a month-to-month basis, the overall trend in both the UK and Canada is one of disinflation, which should allow central bank officials to either initiate or continue cutting rates as the year lengthens,” Kshatriya concluded.