Cryptocurrency and investor portfolios Is an allocation warranted

It was only a matter of time.

With the two leading cryptocurrencies (Bitcoin and Ethereum) posting annualised returns exceeding 90%1, investors have taken notice. Not surprisingly, for many, today's times feel like the dot-com boom days of the late 1990s. Of course, experienced investors (especially those who lived through the subsequent bursting of the tech bubble a few years later) realise such opportunities also come with significant risks. The first month of 2022 demonstrated just how quickly investor sentiment can change, with major cryptocurrencies falling more than 30%. Balancing these concerns, with perhaps a little FOMO (fear of missing out), investors today are trying to figure out how to position cryptocurrencies within a total portfolio.

Amid this backdrop, we've laid out some options for those seeking exposure to cryptocurrency, along with a set of guidelines we believe all cryptocurrency investors should consider. We've also identified some of the key risks that come with investing in this space.

But first, let's take a step back and review some of the basics surrounding cryptocurrency and the technology behind it. In other words, welcome to Crypto 101. Get your pencils ready

What are cryptocurrencies?

Cryptocurrencies are digital coins that are not backed by governments or metallic value. They are digital constructs that have agreed-upon value by their user base. As an example, as of 2/16/2022, those selling and buying Bitcoins agree that the price is near 43,000 USD per bitcoin2.

One of the major determinants of value, besides having a user base that adopts the medium of exchange, is the outstanding supply or scarcity of the currency. For example, it's common knowledge that increasing the money supply can cause inflation, or debasement of the currency. Given cryptocurrencies are digital constructs, a major concern is the production of additional coins or the copying of existing currencies that can dilute existing ones.

What is a blockchain? How does it power cryptocurrencies?

Cryptocurrencies, and their potential use in supporting decentralised applications, derive from the blockchain technology on which they are built. A blockchain is essentially a distributed database recording all digital transactions that have taken place in the currency.

When someone transacts in a cryptocurrency, the transaction is posted and then verified by independent agents who do work to validate that the transaction is legitimate. The transaction is then represented digitally in a block—which also includes the history of prior transactions for the coin and is ultimately appended to the chain—creating an indelible history of the transaction that anyone can inspect.

The future value of cryptocurrencies will depend on their adoption

The return that one achieves from investing in cryptocurrency will indirectly depend on its adoption, which will be linked to potential use cases and public trust. We view cryptocurrencies today as a speculative investment in the adoption of cryptocurrency rather than a functioning currency.

Before investing in cryptocurrencies, we think investors should consider the potential use cases of the coin or platform in which they are investing. The potential applications of cryptocurrencies have progressed beyond storage of value or a medium of exchange. Below are several use cases that investors might use to support investment in cryptocurrency:

- Broad adoption of cryptocurrency globally

- A hedge against debasement of fiat currencies

- Storage of value

- Facilitation of faster payments domestically and internationally

- Broad adoption of decentralised finance applications such as peer-to-peer lending, tokenisation of assets and other applications

- Other use cases that are currently unknown. Consider that someone in the 1980s with a strong command of the Commodore 64 might not have considered that one day she'd be ordering an Uber from a smartphone.

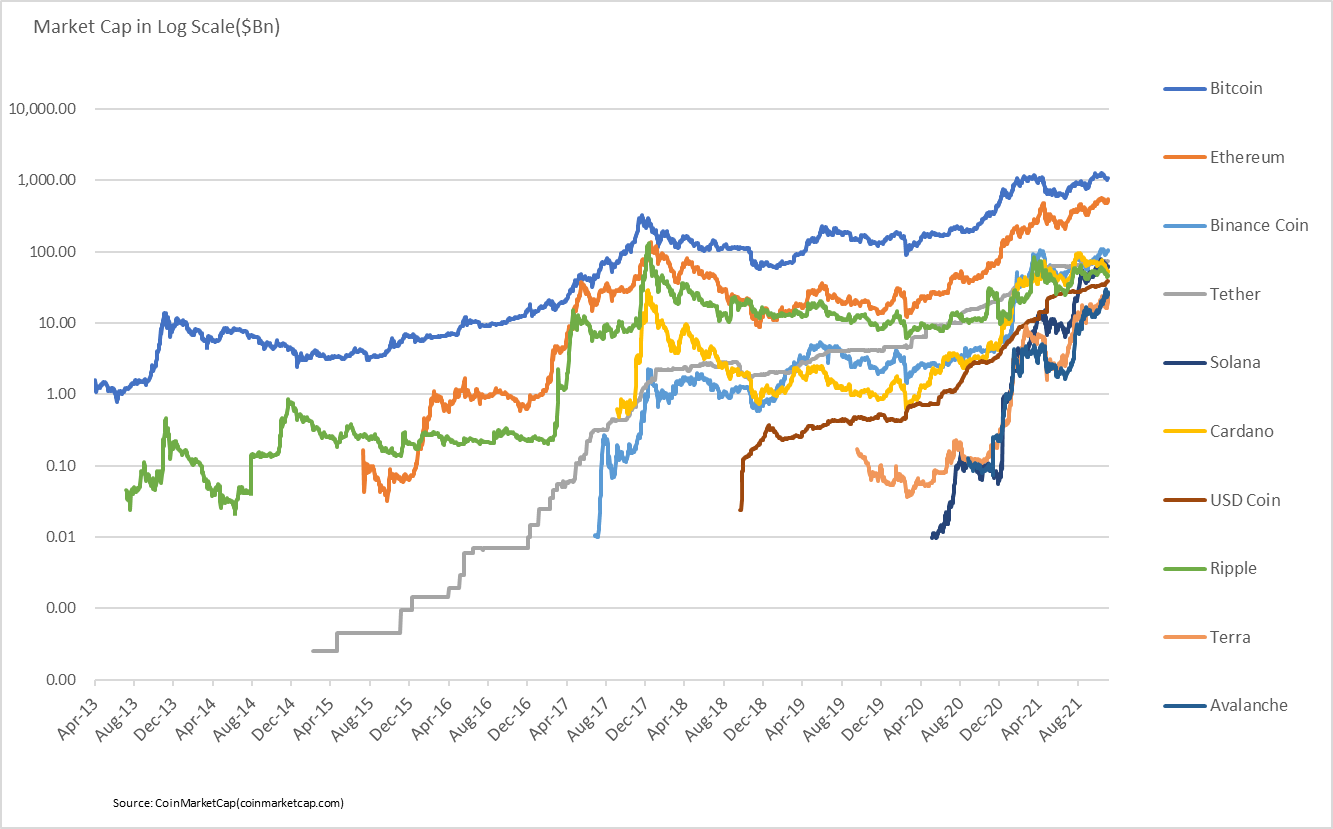

Cryptocurrencies now exceed 2 trillion USD in market capitalisation3. The chart below shows the top 10 cryptocurrencies by market capitalisation through time in log scale.

Chart: Top 10 cryptocurrencies by market capitalisation

Click to enlarge

Bitcoin leads the pack

Today, Bitcoin is the leading cryptocurrency by market value4. Bitcoin can be sent anywhere in the world with considerable speed. However, Bitcoin is unlikely to be adopted for everyday transactions for several reasons. The first is that energy consumption to validate transactions is an issue with Bitcoin5. Due to the proof of work method used to validate transactions, energy consumption is a concern for high volumes of transactions.

A second concern for United States citizens is that Bitcoin is treated as property. Each time Bitcoin is sold, the seller must report realised gains. Using Bitcoin for everyday transactions would create an exhausting tax return. This is why we, like others, see Bitcoin’s primary use case as large transactions like money wires and storage of value outside of a fiat currency. This is also why Bitcoin is sometimes referred to as digital gold.

What is Ethereum?

Ethereum is the second-largest cryptocurrency by market capitalisation6. Whereas Bitcoin’s blockchain platform is geared toward secure transactions, with limited other uses, Ethereum’s platform offers a range of decentralised exchange applications. The Ethereum platform allows assets, loans and contracts to be encapsulated into smart contracts that are executed on the platform using standardised protocols. As an example, digital art, loan covenants and even rules-based rebalancing investment strategies can be tokenised and managed on the platform.

What are Stablecoins? How can they help with price volatility?

A noted issue with cryptocurrencies as a medium of exchange is their price fluctuations relative to fiat currencies. As a potential solution, Stablecoins have been introduced to address price volatility. Stablecoins peg their value to a target fiat currency or asset such as gold. These coins allow users to transact on cryptocurrency platforms while mitigating the risk of price fluctuations between the coin and their base currency.

What are Central Bank Digital Currencies (CBDCs)?

Central banks are also experimenting with digital currencies, known as Central Bank Digital Currencies (CBDCs). CBDCs have the potential to disintermediate the banking system, which central banks would prefer not to do. This is why central banks are proceeding with caution. Ultimately, the use of CBDCs may be limited to a specific set of users, such as banks.

What are some risks of investing in cryptocurrency?

While there are many potential and emerging use cases that may improve adoption of cryptocurrencies, investors would be wise to consider systemic and coin-specific risks. Some of the key risks we see include:

-

Regulatory risks

Cryptocurrencies face major legal and regulatory risks. While many countries with unstable currencies could meaningfully benefit from cryptocurrency, there are other governments that do not want competing currencies in circulation. Additionally, governments are concerned about cryptocurrencies facilitating money laundering. As of September 2021, China has banned the use of cryptocurrency. -

Fraud

With lack of regulatory oversight in digit asset markets, fraudulent activity is more likely. This is evidenced by a recent U.S. Federal Trade Commission report, which notes an increase in scammers luring people into bogus investment opportunities. Losses of around USD 80 million related to scamming activity in digital asset markets were reported between October 2020 and May 20217. -

Theft from hacking

Bitcoin and other cryptocurrencies accounted for 80% of total attempted digital thefts during 2011-20208. Investors who keep their currency on digital currency exchanges that don’t provide cold storage wallets (storage that is not connected to the internet, such as a USB drive) are the most susceptible to hacks. However, more and more financial intuitions now provide cold storage custody services for clients. -

Transaction processing speed and electricity consumption

Each Bitcoin transaction requires 500,000 times more energy than that needed to process a digital transaction on the Visa network9. While technological innovations such as using proof of stake rather than proof of work may alleviate this issue, environmentally conscious investors may shun the idea of currencies that compete with essential energy requirements. Moreover, central banks are working to improve transaction speed in fiat currency10. -

Cryptocurrency-specific risks

Research indicates that around one-third of newly launched crypto coins don’t survive beyond the first year, with additional data demonstrating that a newly launched cryptocurrency has only a 30% chance of surviving five years11. Most investors would consider a 70% chance of total loss over a period of five years as quite high. -

Enhancements to centralised systems

Fast payment systems are being developed that will speed up centralised banking transaction speeds. While this wouldn’t invalidate the anti-fiat currency wealth storage use case, it would remove the transaction speed advantage of cryptocurrencies.

Investing in cryptocurrencies: Diversified options

We believe investors seeking cryptocurrency exposure have several diversified options, including:

-

Broad diversified long exposure

Holding a diversified basket of cryptocurrency provides exposure to an emerging payment system. We believe investors seeking broad cryptocurrency exposure should hold a diversified basket of currencies that mimics some sort of market capitalisation weighting, as opposed to a single cryptocurrency. Investors can gain this exposure by buying cryptocurrencies directly. Importantly, however, we expect to see more and more cryptocurrency-wrapped products. -

Specific cryptocurrency exposures that align with use cases the investor sees as most prolific or disruptive

Investors can either choose cryptocurrencies that align with use cases they see as most promising or hire active cryptocurrency managers with the expertise to size specific cryptocurrency exposures. Investors can also gain specific exposures through listed companies and private capital investments. Notably, venture capital and angel investors are experts in screening nascent technologies, where large potential returns and risks exist. -

Exploitation of mispricing in cryptocurrencies

Though the market cap of cryptocurrencies has grown exponentially over the last decade, several researchers note that cryptocurrency markets remain inefficient. We believe these inefficiencies create opportunity for investors with the right skills.

In particular, hedge funds with access to leverage are well-suited to exploit market inefficiencies, such as the one referenced here12, where profits could be made by going long Bitcoin and short futures contracts. Exposure to cryptocurrency hedge fund strategies should have the benefit of low correlation to long cryptocurrency positions.

What to consider when investing in cryptocurrency: Our guidelines

Cryptocurrencies are in such an early stage of adoption that it’s difficult to assess them as a prospective investment. At present, we don’t have capital market assumptions that can be used for portfolio construction. Given this, we believe it’s prudent to avoid typical quantitative portfolio construction techniques, as they are likely to provide a false sense of security. Instead, we believe investors will have to bootstrap their approach to sizing allocations to cryptocurrencies.

We believe that investors would be wise to consider the following guidelines when investing in cryptocurrency:

- Investors should put no more money in cryptocurrency than what they are willing to lose.

- We view a position in cryptocurrency as a speculative investment in greater adoption of decentralised finance applications and anti-fiat money wealth storage.

- Investors should diversify their exposure across various cryptocurrencies.

- Investors should extend their exposure to holding listed companies, private companies and hedge funds operating in the crypto space, in addition to coins.

The bottom line

Cryptocurrencies are a nascent investment opportunity, where there are still large risks to broader adoption. However, this doesn’t mean investors should completely avoid cryptocurrencies. Rather, we believe an investor should size the allocation to what they are willing to lose. Moreover, investors can ameliorate some risk by diversifying across different currencies, investing in companies that are developing technologies that extend use cases, and by seeking exposure to crypto hedge fund strategies.

1 Source: Bitcoin, the largest coin by market share has gone from $250 per coin to $64000 per coin over the period of 2015 to 2021. Source: CoinMarketCap(coinmarketcap.com).

2 Source: CoinMarketCap(coinmarketcap.com).

3 Source: CoinMarketCap(coinmarketcap.com).

4 Source: CoinMarketCap(coinmarketcap.com).

5 Source: https://www.nytimes.com/interactive/2021/09/03/climate/bitcoin-carbon-footprint-electricity.html

6 Source: CoinMarketCap(coinmarketcap.com).

7 Source: https://www.ftc.gov/news-events/data-visualizations/data-spotlight/2021/05/cryptocurrency-buzz-drives-record-investment-scam-losses.

8 Source: https://fortune.com/2021/04/06/cyber-thefts-bitcoin/.

9 Source: https://www.forbes.com/advisor/investing/bitcoins-energy-usage-explained/.

10 Source: https://www.federalreserve.gov/paymentsystems/fednow_about.htm.

11 Source: Lansky, J., 2019. Cryptocurrency Survival Analysis. The Journal of Alternative Investments, 22(3), pp.55-64.

12 Source: https://www.bloomberg.com/news/articles/2021-10-18/crypto-s-money-printing-machine-has-turned-back-on-for-now.