Q1 2021 Fixed Income Survey: The inflation beast has awoken. How big will its bite be?

In this latest survey, 50 leading bond and currency managers considered valuations, expectations and outlooks for the coming months.

In the previous 4Q20 survey, a second wave of coronavirus cases towards the end of the year, forced countries to go back into lockdowns. Brexit uncertainties and volatility to the run-up to U.S. presidential elections, moderated investors’ risk sentiment. G4 central banks remained accommodative, but hesitancy for further fiscal support, notably in the U.S., raised concerns about the speed of any potential recovery. Indeed, the speed of the recovery remained a top concern for managers. However, there was more robust consensus in regard to rates, U.S. inflation expectations and the direction of both developed market and emerging market currencies.

Since then, a Brexit deal (albeit with teething issues), the continued rollout of COVID-19 vaccines (lifting hopes of an end to the pandemic) and Joe Biden’s U.S. election win with his major $1.9 trillion fiscal stimulus plan, boosted global growth prospects. Investors soaked up all these variables and markets have climbed ever since the year began. Concurrently, this optimism in growth engendered increased inflation expectations. Higher inflation will increase interest rates and this caused a significant sell-off in sovereign bonds late in February.

For the latest survey therefore and considering the major jump in volatility at the end of February, we sought an updated consensus over the managers’ thoughts on the speed of economic recovery. Additionally, what are the inflation expectations going forward and will higher rates in the developed world dent the previous optimism for emerging market debt?

Is inflation finally here?

Views from interest rate managers

-

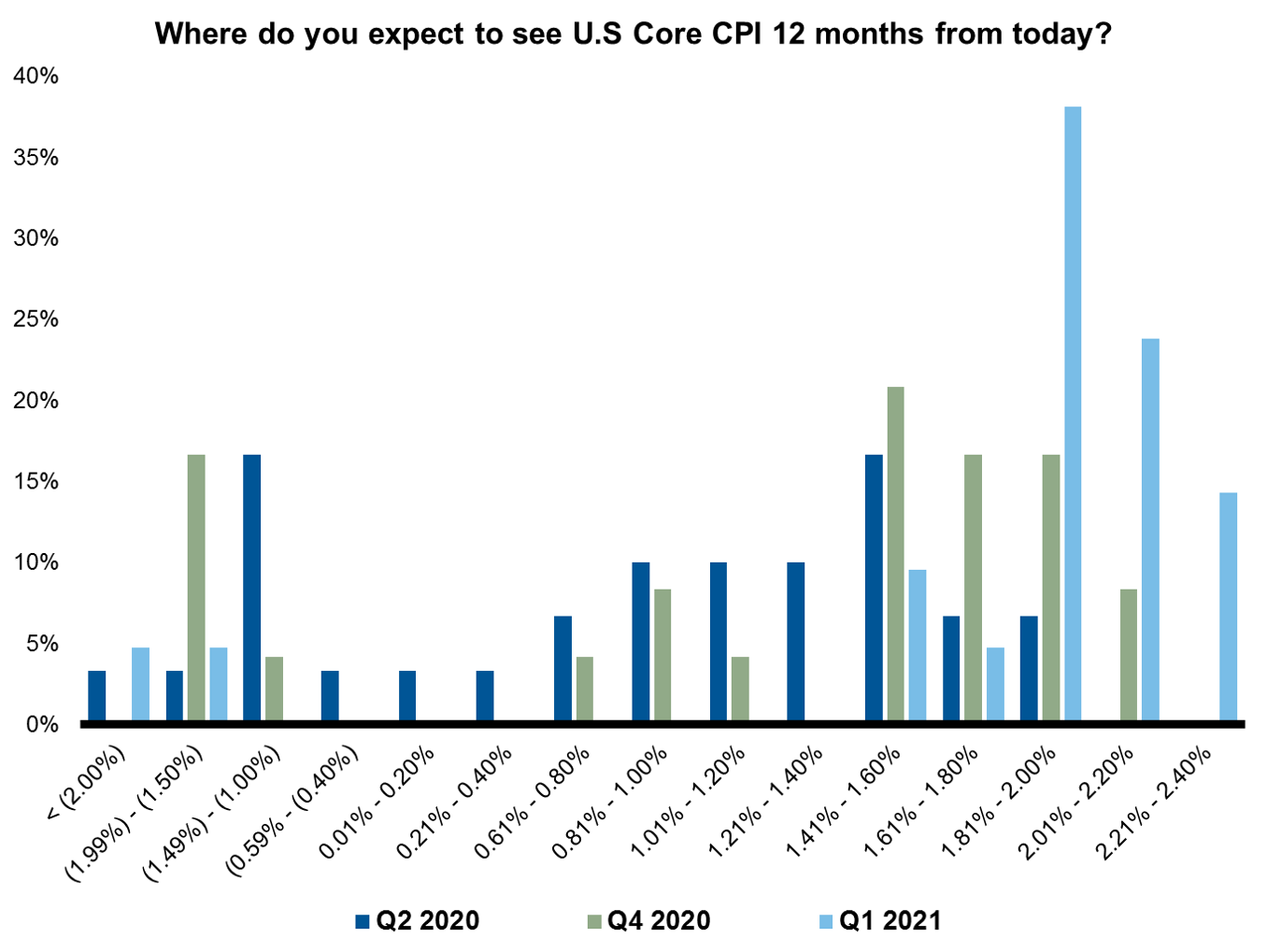

Consensus is building up in regard to U.S. inflation versus our previous surveys. 76% of managers are expecting U.S. Inflation to hover near Federal Reserve’s (FED) target rate - somewhere between 1.80% - 2.40% in the next 12 months. Only 10% expect to see a deflationary environment in the next 12 months versus 21% that expressed such a view in our previous survey.

-

60% of managers expect the Fed to deliver its inflation promise. However, 30% are still skeptical about the Fed's ability to achieve its target.

-

62% of respondents expect the U.S. 10-year Treasury to trade between 1.20-1.60% in the next 12 months. Managers expect the current steepening of the U.S. Treasury curves to continue during the next 12 months.

-

Managers perceive that the Fed will consider the 1.90% level in the U.S. 10-year Treasury yield as potentially disruptive.

-

When asked if the Fed would implement a yield curve control before a rise in rates derails risk assets, only 20% agreed with such a statement, while 37% don’t expect this curve control to happen.

-

Lower for longer: 36% of managers expect the next hike from the Fed won't occur before 2023, and 40% expect it not to happen until 2024.

Views from investment-grade (IG) credit managers (bullishness moderates)

-

Almost 60% of respondents expect spreads to be range-bound between +/- 10 basis points (bps), while 38% expect a moderate tightening (10-30 bps) in spreads in the next 12 months. Recall that in our previous Q4 2020 survey, 67% of respondents expected spreads to tighten in the next 12 months.

-

Panic signs evaporate: Expectation of managers about increasing leverage in investment-grade (IG) companies declined to ~10%, versus 50% in our previous survey. Most of the managers consider that leverage in IG corporates will decline or at least remain stable in the next six to 18 months. When asked if current spreads compensate for current risks, ~35% of managers mentioned caution is warranted—up 14% versus our previous survey.

-

Most of the managers still favor the U.S. as the region with the most attractive returns, now closely followed by emerging markets (EM). Regarding sectors, financials are still expected to post the best returns on a 12-month basis, while expectations about performance of cyclicals materially improved versus the Q4 2020 survey.

Global leveraged credit (views becoming more conservative)

-

50% of managers expect range-bound of spreads over the next 12 months versus 33% in our previous survey. 39% of managers still expect a moderate tightening of spreads—15% lower than in the Q4 2020 survey.

-

Positivism around fundamentals: Almost 80% of managers are expecting a moderate improvement in corporate fundamentals, which is 40% more than in our previous survey.

-

A steady decline in interest from managers in U.S. high yield (HY) bonds since Q2 2020, while U.S. leveraged loans are where managers expect to see the most compelling opportunities in the market, followed by EM HY bonds.

-

Return expectations keep declining: 61% of managers expect the total return of the U.S. HY market to be in the 4%-5% range, down from the 5-6% total return expectation managers expressed in our Q4 2020 survey.

-

60% of managers see a slow vaccination rollout as the biggest risk for the HY market, while 30% mentioned rising interest rates as the most concerning point for this segment.

-

More balanced views in terms of defaults: in the Q4 2020 survey, 67% of managers expected default rates to be in the 5%-8% range over the next 12 months. Now, 38% of respondents consider defaults to remain in the low end, between 3%-5% in the next 12 months.

Risk across the globe

Emerging markets

-

In regard to local currency emerging market debt (LC EMD), managers expressed a more constructive view regarding the performance of developing currencies versus the Q4 2020 survey, with almost 89% expecting a positive performance of EM currencies in the next 12 months. Almost 40% of managers expect developing currencies to post strong positive returns in the next 12 months. Only 4% of managers expected developing currencies to be a detractor in the next 12 months.

-

Managers expressed their preference for the Brazilian real as the most attractive currency in the next 12 months, followed by the Turkish lira. Recall that in our previous survey, the Turkish lira was expected to post the worst performance in the next 12 months. The change in the Turkish lira sentiment is most likely attributed to the more positively perceived monetary policy developments in the country.

-

68% consider positive returns will come from EM FX, while only 4% consider rates will see the most positive return potential over the next 12 months. Roughly 30% expect a combination of currencies and rates to contribute to positive returns, down from 61% in our Q4 2020 survey.

-

Managers remain bullish but less aggressive within the hard currency emerging market debt (HC EMD) space. 74% of the managers expect spreads in the HC EMD index to tighten in the next 12 months. The weighted average expected return stands at 4.7% over the next 12 months—1% down compared to our Q4 2020 survey.

-

There is a more balanced view in terms of growth differential between EMs and developed markets: 42% of managers expect the growth differential to remain between 2-3% versus the 60% that expressed such a view in our previous survey. 38% now expect the growth differential to be between 1-2% over the next 12 months.

-

Managers continued their preference for Mexico, Ukraine and Brazil as the countries with the highest expected returns over the next 12 months within the hard currency space. China and the Philippines remain the top two underweight countries.

-

For managers, the change in U.S. Treasury levels presents the most significant risk factor for the HC EMD performance in the next 12 months. Meanwhile, 36% of the managers expressed having more than 15% exposure in HC EMD corporates—the second highest percentage since the start of the survey.

Europe and UK

-

Narrower expectations for the euro: 61% of managers expect the euro to trade in the 1.21-1.25 range. In our Q4 2020 survey, 73% of managers expected the euro to be in the 1.21-1.30 range.

-

More consensus with a modest tilt toward appreciation of the British pound: Approximately 77% of managers expect the British pound to be in the 1.36-1.50 range in the next 12 months.

Securitized sectors

-

There is a more balanced view in the securitized segment: 31% of managers expressed they will be adding risks in the return-oriented securitized portfolios in the next 12 months, down from the 38% registered in our Q4 2020 survey. 63% will maintain risks.

-

When asked about taking a meaningful beta position, 64% of managers expressed already having a long basis in their portfolios, a 20% drop from our Q4 2020 survey. 21% of managers expect to add a short position while none expressed such a view in the Q4 2020 survey.

-

Are managers less concerned about the impact of COVID-19 on CMBS? 50% of managers consider the BBB-tranche as the highest rank where to expect losses into the structure of the CMBS 2.0 securities as a result of COVID-19. During our Q20 survey, 30% of managers considered even the single-A tranche to see significant losses into the structure of CMBS 2.0 securities.

Conclusion

Market sentiment is significantly different from one year ago, when COVID-19 caused widespread selling of risky assets. This survey’s responses demonstrate that managers have truly embraced the confluence of vaccines, fiscal spending and easy money supply supporting asset prices.

Managers expressed more optimism about the speed of the economic recovery. Expectations for growth recovery to pre-COVID-19 levels were pushed into the latter stages of 2022—backed by 57% of respondents. Meanwhile, 42% of them expect this to happen during the first half of 2022.

Additionally, when asked about the segments with the most attractive risk-adjusted returns, managers continue to reduce preference towards IG assets, tilting toward HY assets and, more recently, toward EMD in local and hard currency in the endless pursuit for yield.

In regard to higher inflation, managers seem to be comfortable with predicting levels hovering around the Fed's target rate of 2%. The consensus of managers seems in line with recent Federal Open Market Committee minutes suggesting that the threat of subdued inflation is greater than that of higher inflation.

However, U.S. Treasury yields have tested these expectations quickly as Congress approved its $1.9 trillion stimulus package at a time when monetary policy is very accommodative, with low interest rates and continued increases in the money supply. Could the combination of decisive fiscal spending and expanding money supply awaken market fears regarding inflation?

Survey participants do not think so and current market levels merely imply a return to normal economic activity. However, this will be a paramount issue moving forward, as the easy market conditions are critical to current market valuations.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.