Know where you want to be: How a skilled OCIO provider can help investors navigate opportunities and threats

Executive summary:

- Working with a skilled OCIO provider can help you position your portfolio to benefit from investment opportunities and avoid uncompensated risks.

- We believe that a best-in-breed OCIO provider will always keep their tactical views anchored to their strategic beliefs.

- At Russell Investments, our tactical views are informed by a cycle, valuation and sentiment framework.

Editor's note: This is the second blog in a three-part series: Know what you own; Know where you want to be; Know how to get there.

Market dynamics shift every day, driven by cycles of greed and fear, presenting opportunities tempered by hidden risks. In hindsight, it seems easy to see what investment trends succeeded and what themes were nothing but a flash in the pan. Does your current OCIO (outsourced chief investment officer) position your portfolio to benefit from investment opportunities? Do they have a process for adjusting the portfolio away as uncompensated risks rise? To survive the journey in a rapidly changing world, having a clear view of where you want the portfolio to be positioned is critical for long-term portfolio success.

The preferred position: a process of determination

In the inaugural article in this three-part series, we discussed the importance of knowing what you own in your portfolio. As vital as that information is, it is a commentary without a counterpoint, if, as an investor, you don't know where you would like the portfolio to be. We believe portfolios must constantly adapt to succeed. They must adjust to shifts in fundamentals, market dynamics, and macro forces that impact the valuations of assets.

At Russell Investments, clearly knowing where we want to be allows us to take the data on our current portfolio position and match it against our preferred position—a constant testing effort—keeping in mind everything we know about capital markets. This begs the obvious question: How do we determine our preferred position?

The answer is two-fold.

- For long-term views, we adhere to a time-tested set of strategic beliefs. This serves as the anchor for portfolios, around which we more tactically adjust the portfolio.

- For more tactical views on a shorter horizon, we analyze current market conditions through our three lenses of cycle, valuation and sentiment (CVS).

You can think of the strategic beliefs as our anchor. You may find that some asset managers may use a benchmark as their anchor. But we believe strategic beliefs work better than a benchmark, as they incrementally lean the portfolio toward trends that we know work overtime to deliver better risk-adjusted returns.

Our tactical views shift, but are always tied to that anchor point, ensuring the long-term objectives are not compromised for shorter-term views, which by their nature are not certain. Because of this high level of uncertainty, for much of the time, our tactical views are right in line with our strategic beliefs. In fact, we operate with a first do no harm approach. If we don't have a strong tactical view, we stick with our long-term beliefs.

This is in stark contrast to "tactical" managers, or the GTAA (global tactical asset allocation) funds which garnered attention in decades past, who always need to have a position in the portfolio to show their worth. We believe in our other strategic and manager selection processes as key portfolio drivers, which affords a very high bar for taking a tactical view. Simply put, there are times when many attractive investment opportunities are present, and there are other times when high levels of uncertainty limit the menu options available. In those cases, we will bring the portfolio back to strategic positions.

Coiled spring

When it comes to value, one of our strategic beliefs states that stocks with lower valuation characteristics generate higher returns. This strategic belief gives us a long-term bias toward value stocks and a tendency to modestly overweight that style as part of our balanced multi-strategy, multi-style approach.

To remove confusion, let's separate value equity securities and valuation in our process. The valuation we refer to when analyzing market conditions through the CVS framework reflects the price assets are trading for and how it compares to the overall market and the asset's specific history. Value equity securities are stocks whose prices reflect cheaper characteristics relative to the broad market. This typically includes economically or cyclically sensitive companies such as banks or industrial companies. It can be thought of as the opposite of the style of equity investing that seeks to buy companies that exhibit high growth of sales or profits and tend to command higher valuation multiples.

There are certain times when our CVS analysis tells us that value stocks look much more attractive than they typically do. And that's when our tactical views kick in—like they did in 2020. March 2020 was a turbulent time, with sharp selloffs across asset classes and styles. Value companies, which tend to be more linked to the overall economy's health, underperformed the broad market, and investors were pricing in dire slowdown conditions. However, as governments around the world stepped in with support, we looked to our CVS signals to evaluate the potential opportunity.

When considering the cycle, we knew that value style tends to do best when coming out of recessions, with the typical exposure to companies in industries that benefit the most from the economic expansion acting like a coiled spring that was held back by prior contractions during a recession. Additionally, we saw valuation characteristics of value stocks far below what they normally are, acting as a predictor of outsized future returns. While sentiment continued to be very negative as recent momentum brought value stocks lower, we saw contrarian indicators point to overreaction that typically precedes a rebound. With such a skewed scorecard in favor of value, we increased our exposure to value style to a meaningful overweight.

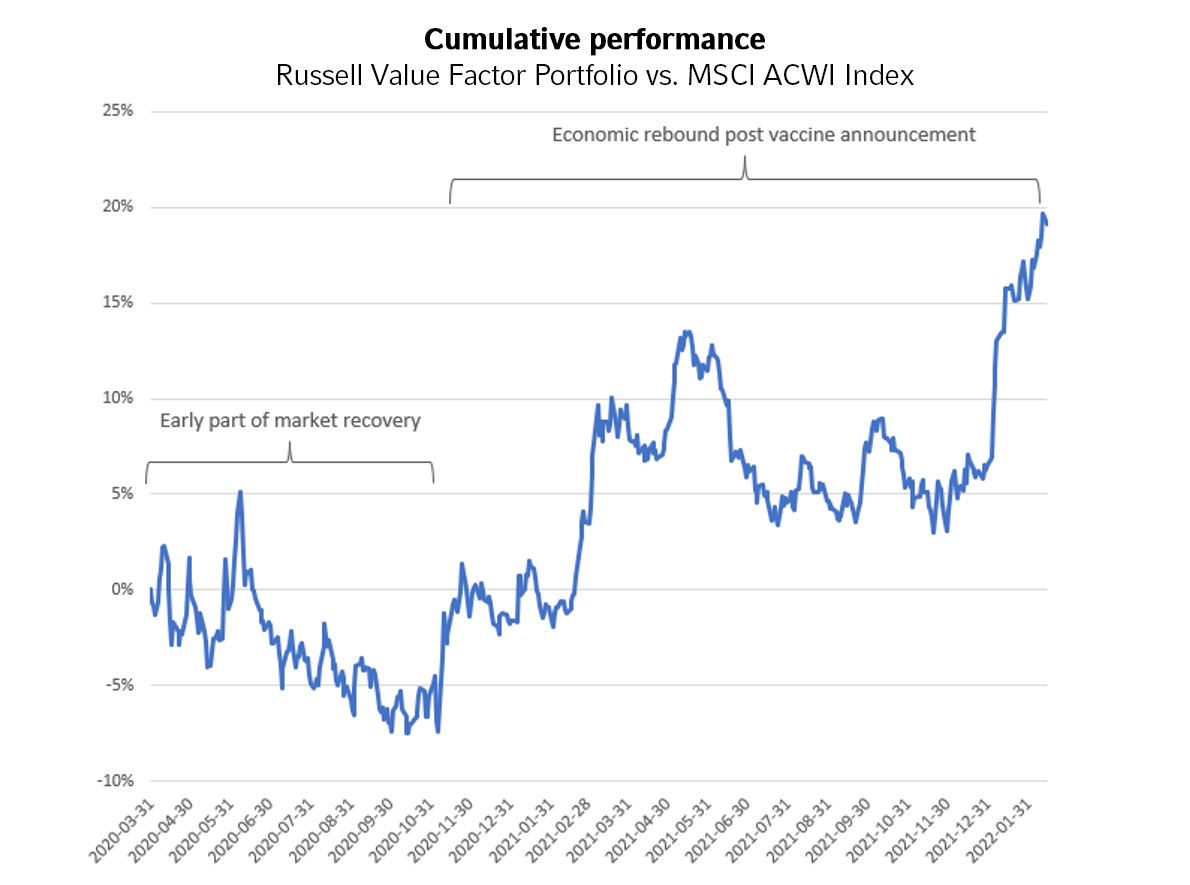

While early in the recovery value style continued to lag growth stocks, this came to a dramatic reversal in early November 2020 as COVID-19 vaccines were announced. Cyclically oriented companies that tend to have lower valuations rebounded sharply and continued to outperform the broad global equity index by over 20% until early 2022.

Click image to enlarge

Source: Russell Investments, MSCI ACWI Index

Back to home base

An important aspect of tactical positioning is knowing when to shift back to the anchor as circumstances change.

In early 2022, we saw signs that the market backdrop that was so positive for the value style was shifting in a more concerning direction. We saw high inflation become a significant concern, with central banks’ supportive monetary policy starting to turn restrictive, and our monitoring of earnings revisions indicated evaporating support for value stocks. In addition, rising geopolitical risks increased uncertainty around the cyclical outlook. Given what we saw as an environment with increasing risks, we took profits on a position that served us and our clients well and shifted back to our anchor. When the unsustainable extreme in our CVS process recedes, so does our willingness to take risks for clients—and we head back to our strategic positions, waiting for the next opportunity or risk to avoid.

In the final article in this series, we’ll talk about what we believe are the best practice processes for making moves like this happen with the least amount of portfolio inefficiency. But in the meantime, we’ll keep our tactical views anchored to our strategic beliefs, because we feel certain this is the best way to invest. We may not always get this right, but we believe a structured investment process will create discipline to add incremental value.