Three keys to navigating

volatile markets

When the news cycle looks alarming and markets fluctuate wildly, sometimes the best thing to do is nothing.

There are a variety of events that can, and have, caused share market volatility over the years—from recessions and tech bubbles, the 9/11 terrorist attack in the US, natural disasters like tsunamis, the Global Financial Crisis (GFC), and in 2020 it’s a global health event. History has shown us that each of these events have resulted in market falls and periods of volatility, but without fail there has been a corresponding bounce-back and a continued trend of increased investment value and returns over the longer-term.

On days where headlines and market fluctuations are alarming it’s common to think about what’s happening to your savings, and at that point it’s more crucial than ever to avoid emotional, panic driven decisions and focus on the bigger picture of your long-term goals.

Overcoming emotion-driven decision making

Investing can be an emotion-driven game, especially when markets are volatile. To overcome our emotional biases, we need to learn to identify when we are about to make a decision based on feelings rather than facts. The cycle of market emotions helps us recognise what’s fuelling our emotions and what to expect next.

1. No one (really) can time the market

Even the most sophisticated investors will tell you that it is virtually impossible to accurately predict the market’s short-term moves. In fact, mistiming can be disastrous to investment returns. In a lower return environment, it’s more important than ever not to miss out on any gains.

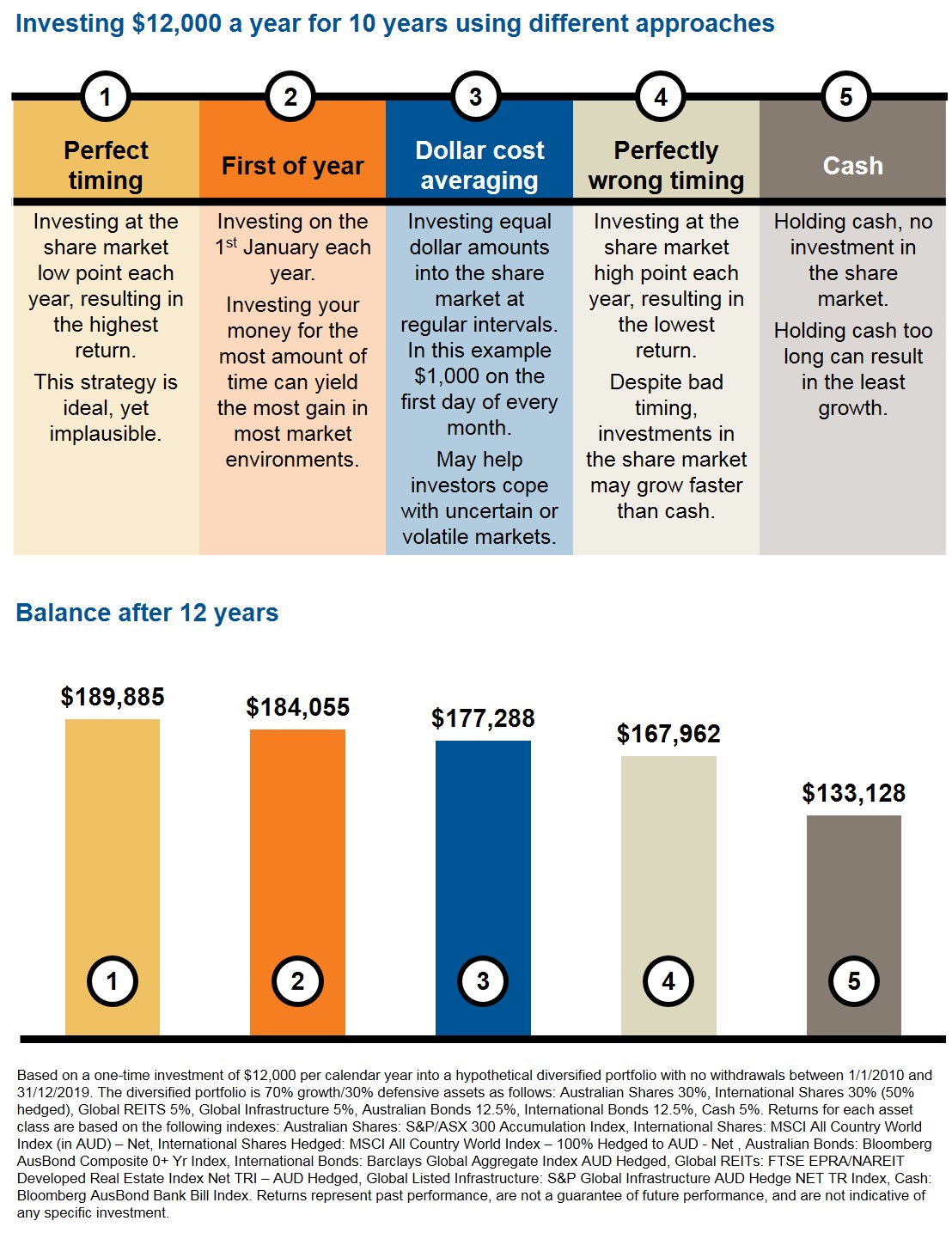

The old adage ‘time in the market’ not ‘timing the market’ still holds true. In the chart below we compare the results of investing $12,000 a year for 10 years using different approaches. Simply leaving money in a cash option (#5), yields by far the worst result of any of the approaches. Even investing your money in the share market with the very worst timing so you get the poorest return (#4) is still more favourable than investing just in cash.

2. Nothing, especially volatility, lasts forever

There have been many times throughout history when share markets have declined — but these relatively short periods are most often followed by the most favourable returns. Unfortunately, people tend to remember the bad twice as much as the good*. This means that despite having experienced the longest bull run in history, even a few bad days in the markets can cause investors to rethink their long-term investment strategy.

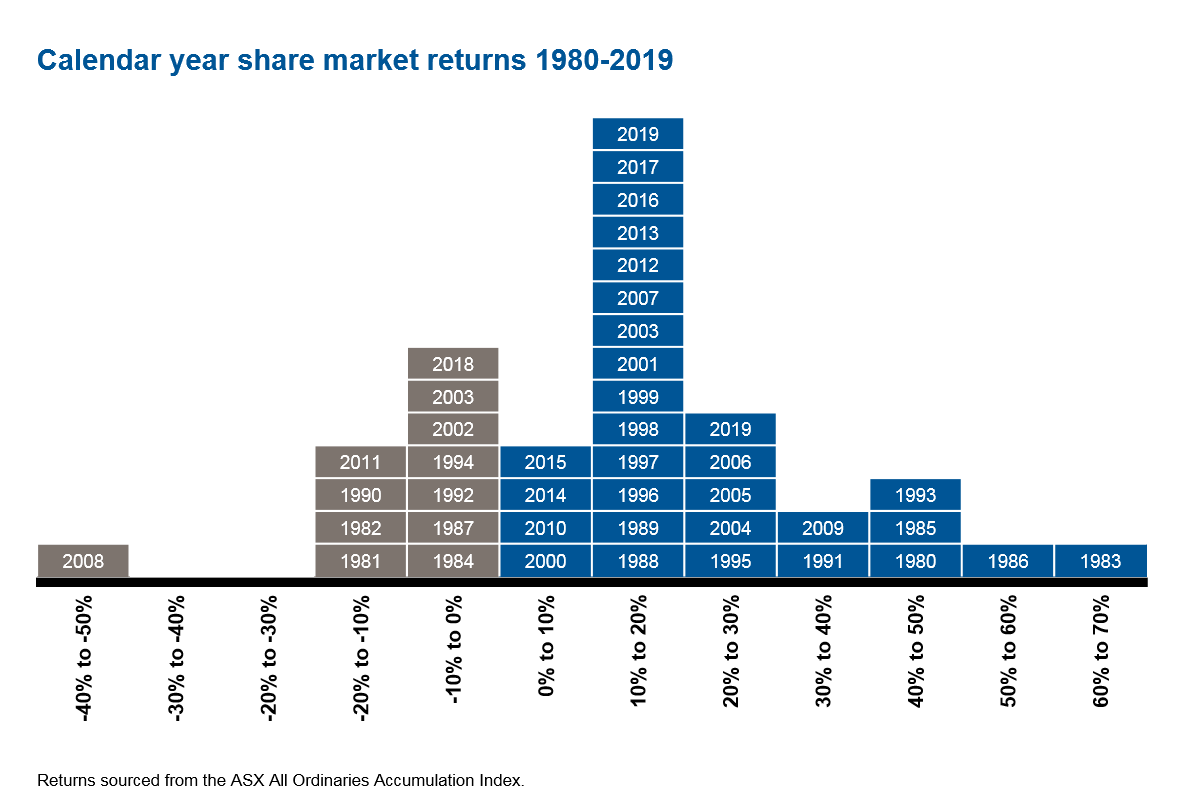

Since 1926, shares have more often finished the calendar year in positive rather than in negative territory, as shown in the chart below. It’s extremely challenging to predict whether a calendar year return will be positive or negative.

3. Diversification matters

‘Past performance is not a reliable indicator of future performance’—wise words for the savvy investor to live by. Diversification works because the future is uncertain, and no one can predict with certainty which asset class will win or lose over the upcoming cycles. A strategy that diversifies across multiple asset classes and relies on different types of return drivers is more likely to result in a smoother investment journey to achieving your long-term goals.

If you haven’t made an investment choice, we automatically invest your super based on the information we know about you, in GoalTracker - a diversified multi-asset strategy (unless you are a defined benefit member). If you do want to choose your own investments, you have access to a range of over 20 investment options across diversified, outcome-oriented, sector, responsible and third-party categories.

The bottom line

While navigating uncertainty and extreme market volatility is difficult, it’s important to keep the big picture in mind and stay focused on your long-term goals. Historically, over the long term, markets have been positive more often than negative and staying invested has generally been a better option. Our global investment strategists provide regular research updates and insights that we use to make investment decisions, and that you can also access too. If you need a little extra help, we also have a variety of financial advice options to meet your needs – call us on 1800 555 to get started.

*Source: Seeking Alpha: The Persistence of Aversion: Why Investor Pain Hurts Twice. https://seekingalpha.com/article/4240745-persistence-of-aversion-why-investor-pain-hurts-twice