Private market secondaries: Shifting up a gear

As the global economy faces a heightened risk of a recession and financial markets continue to deal with uncertainty, where can investors turn for attractive opportunities to deploy capital? In today’s market environment, private equity secondaries are looking increasingly appealing, largely thanks to a shift in the balance of supply and demand.

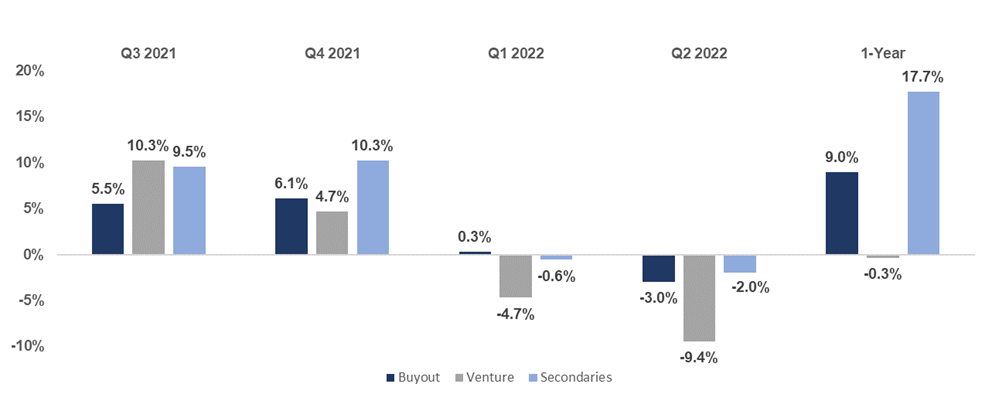

With public equity markets declining 15-20% since the start of the year, many investors are finding themselves overallocated to private capital, forcing them to utilise secondary markets to manage exposures. The effects of higher supply began to show up in pricing and performance during the first half of 2022. During this time, discounts on secondary deals expanded to some of their highest levels in the last decade. Meanwhile, private equity secondary funds significantly outperformed other private market strategies, delivering a 1-year return of 17.7% during a period where public equities exhibited negative performance1 . We expect this trend to continue in the coming months, creating a strong buying opportunity for secondary investors.

Click image to enlarge

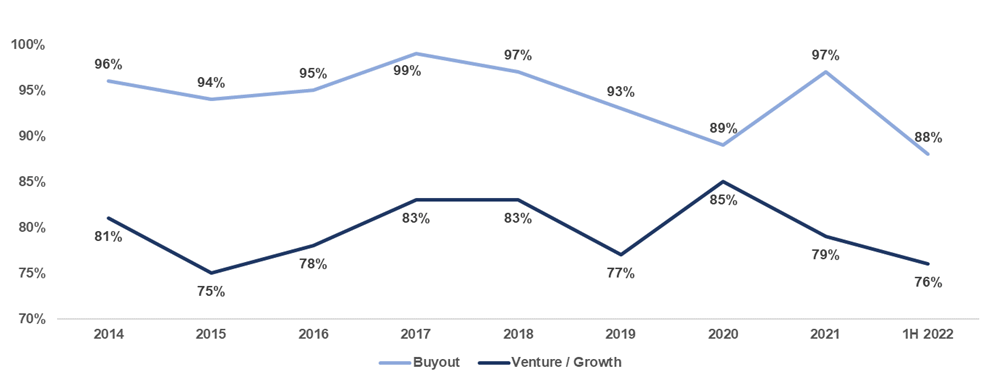

Historical Secondary Pricing (% of NAV)

Source: Greenhill Global Secondary Market Review; August 2022

Click image to enlarge

Quarterly Returns by Strategy

Source: Hamilton Lane. As at 30 June 2022.

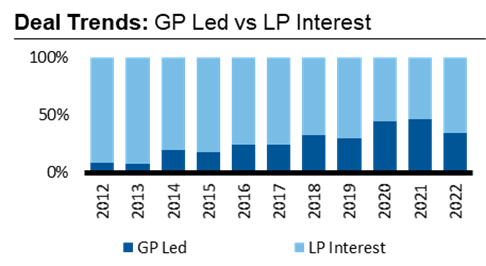

This heightened supply of capital has been augmented by a gradual increase in the occurrence of GP-led secondary transactions. Over the last several years, a growing number of investment managers have adopted the secondary market as a key tool to provide limited partners with liquidity. These transactions have become increasingly important in today’s market environment, as they create an avenue for managers to return capital to investors, even as M&A and IPO activity slows.

Sources: Pitchbook and Greenhill.

Private equity secondaries provide several benefits to investors even in more neutral market environments, particularly for investors looking to build up an allocation to private markets. By deploying capital more quickly than traditional private equity funds, secondaries can reduce cash drag, help mitigate the J-curve, and return capital to investors more quickly. However, many of the same risks that apply to traditional private equity investments must also be considered when evaluating secondaries. Despite their tendency to return cash to investors more quickly, secondary transactions still represent investments in illiquid vehicles, which typically do not allow investors to redeem. Many of these investments also utilise significant amounts of leverage, which can enhance returns, but also magnify losses. Further, when evaluating GP-led secondaries, investors should consider potential conflicts of interest and ensure that the incentives of the managers are properly aligned with their limited partners.

The bottom line

Current market conditions have led to most asset classes posting negative returns this year, but for specialised investors this has given rise to new opportunities including in the private secondaries market. However, given the complexity and breadth of private markets, it is crucial that investors work with an experienced partner with global market coverage and access to high-quality investment managers in order to identify the most attractive investment opportunities.

1 Source: Hamilton Lane. As at 30 June 2022.