Prospecting your own book for revenue wealth

For just a minute, set prospecting aside. Because your greatest growth opportunity may exist within your own book of business.

We’ve been working with financial advisers to build more valuable, efficient, and faster growing businesses for over 20 years. Over this time, we’ve collected practice data from thousands of advisers and gathered numerous insights into what drives adviser success.

There are two critical metrics that correlate with firm revenue production: return on assets (ROA) and revenue per households (REV/HH). We believe the key to unlocking growth and creating efficiency lies in improving those two metrics.

These metrics show that the most optimal path to growth does not involve increasing your assets under management—your AUM. Instead, it involves increasing the productivity of assets you already have under management, for your existing clients. In other words, the best opportunity to grow revenue and increase practice efficiency may be by prospecting your own existing book.

Revenue optimisation: Transition to advisory

You probably already know that the Pareto principle, better known as the 80/20 rule, applies to many adviser practices. For most advisers we work with, on average, we find that the top 20% of clients generate nearly 80% of the firm’s total revenue. Our adviser data also shows that for an average adviser we work with, the bottom 50% of clients typically generate less than 5% of the firm’s total revenue.1

We believe this means that in an average adviser’s book, about half of the client relationships are unprofitable and may not generate enough revenue to justify the time an adviser spends servicing them. But this challenge also presents a tremendous opportunity for growth by changing the nature of the relationship with these unprofitable clients.

Organising for growth in three steps

We’re not necessarily suggesting that you get rid of clients. After all, you’re in this business to help people. And you’ve already put in the time to build relationships with your clients, even the ones on the bottom end of your book. Instead, we’ve found that these relationships may represent the greatest opportunity for growth. We believe that the most efficient growth strategy is to identify unprofitable client relationships and adopt a turnkey, fee-based, advisery solution—one designed to give all your clients the investment guidance they need and potentially grow your revenue at the same time.

In three steps, here is our strategy for improving the productivity of existing assets and clients.

1. Identify the opportunity: The Client Prioritisation Lens

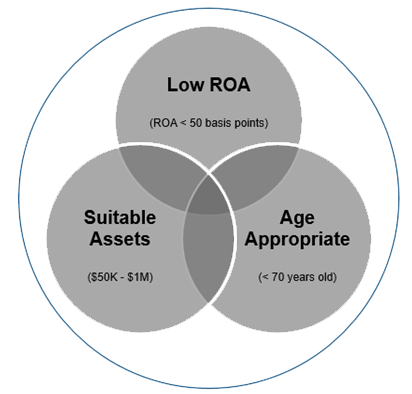

How can you be sure which of your clients deserve more of your time and which should be assigned to a robust-but-efficient turnkey solution? If you’re moving from a commission-based practice toward a fee-based service, which clients should be prioritised in that transition? We’ve identified three criteria to filter advisers’ books for growth opportunities.

- Low ROA – Return on assets (ROA) is a simple, powerful indicator. We believe clients generating less than 50 basis points of ROA are likely unprofitable for your business. They are candidates for a fee-based advisery relationship.

- Suitable AUM – Keep it simple and think of $1 million in AUM as a dividing line. Clients with less than $1 million investable assets may be the best candidates for turnkey, model-based strategies. Clients with more than $1 million may require a more customized investment approach.

- Age – Based on our decades of practice management, the age of 70 is also a simple and effective categorisation line. Clients age 70 and younger may have time horizons that are sufficiently long to consider transitioning to a fee-based advisery solution.

Client Prioritisation Lens

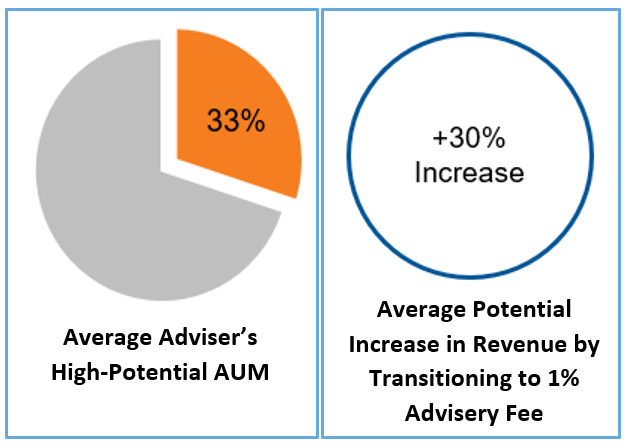

2. Quantify the opportunity: High potential AUM

The next step is to quantify the opportunity. We’ve done some of this work for you. When we applied the above three criteria to advisers’ books, we learned that, on average, 33% of AUM on the typical adviser’s book can be considered high-potential AUM. In other words, 33% of the average adviser’s book is filled with relationships that could generate significantly more revenue than they are currently generating.

We found that if these advisers were able to convert their high-potential opportunity into advisery relationships and charge a 1% fee, they could increase their revenue by 30%, on average.2

Unprofitable clients may be a servicing liability to the business, but they also represent a tremendous opportunity. Especially if advisers have never undertaken an exercise to clean up the book.

3. Capitalise on the opportunity: Execution and accountability

The final step is all about action. The opportunity for growth is there, but change is hard. Most advisers recognise that there’s an opportunity to improve the efficiency of their books. And many advisers understand that there are a lot of unprofitable smaller accounts in their books as well. But most haven’t dedicated the time to identify clients who could benefit from a transition, quantify the opportunity, and devise a strategy to prioritise and execute a plan.

You don’t have to do this alone. Make sure you’re partnering with a skilled fund company who understands this process can make it much easier to get across the finish line. Ask them for a custom book analysis. Ask for help identifying the revenue-optimisation opportunity unique to your practice. And ask for help building an action plan. If your fund company can’t provide this, well, you probably know what I’d recommend.

The bottom line

As an adviser, you hear a lot about change management. The only constant is change. Change is an ongoing process. Yada yada yada. Wouldn’t it be nice if change wasn’t always a burden? In this case, we believe that change can mean increased profitability for your practice and right-sized solutions for your investor clients. By creating a prioritised plan to identify, quantify and capitalise on the opportunity, this may truly be a change for the better.

1 Data collected from advisers who attended Russell Investments Business Solutions workshops between 2015 – 2017. Non-bank advisers (sample size: 477). Clients sorted by revenue descending.

2 Average high potential AUM and Average potential increase in revenue from advisers who attended Russell Investments Business Solutions workshops between 2015 -2017. All advisers (sample size: 1110).