Sustainability pillar #2: Understanding your enterprise risk

In the first pillar we discussed the importance of managing the number of clients in your business. Now, in the second pillar of sustainability we focus on: understanding your enterprise risk.

Enterprise Risk a broad and diverse topic. From our experience in working with Advisers in Australia and globally, a key area of Enterprise Risk for an advice business is the level of ‘Product Inventory’. This simply means understanding the number of Funds, platforms, insurance solutions you may have used, inherited or have acquired over time across your full set of clients, and your associated obligations.

What's the problem with attempting to manage a lot of product solutions?

Compromised efficiency.

A significant variable in the quest for adviser scale is product inventory control. More funds require more time and resources to manage. This is especially true when you consider the amount of time required to effectively manage a product solution. Think about the amount of time and resources required for:

- Objective research: Independent research by the adviser focused on multiple variables, including selection, pricing, and performance.

- Subjective research: Quarterly meetings and updates to gain insight into the decision-making of the most recent quarter.

- Client education: The adviser must translate both the objective and subjective research into relevant information for client communications.

Increased liability

Many advisers are familiar with the 80/20 "rule" that describes the relationship between Revenues and clients in a typical adviser's book: often 80% of revenue is driven by 20% of clients. We have observed that in many cases the 80/20 "rule" also applies to the relationship between AUM and number of product solutions: 80% of a book's assets are concentrated within just 20% of the product solutions; and only 20% of assets are invested across 80% of the solutions. Sometimes there are solutions that are only used in a single client account with a very small amount of AUM.

This raises the question, if it requires so much dedicated time to manage so many product solutions, and there is little AUM/Revenue tied to that solution, then what incentive does the adviser have to dedicate the appropriate resources? Either the adviser is inefficiently spending their time by focusing on a solution with little client AUM representation in the book, or the adviser is exposing the business to a possible liability by neglecting to spend the proper time for oversight.

The impact

The hypothetical adviser following and researching product solutions would have to dedicate almost the same number of hours per year to effectively manage product inventory as they would the average number of work hours in a year. In theory, attempting to stay abreast of the number of products leaves little time for other business activities and potentially opens the adviser up to litigation if they can't dedicate the time required. Advisers who make the conscious decision to narrow their product lineup see a number of key benefits, including, but not limited to, increased scale of the ongoing research necessary to effectively manage the client portfolios, as well as a decrease in the business risk because of an effective reduction in the variability.

The solution

Review your product inventory to determine whether you have an 80/20 dynamic in your book. Are you maintaining any product solutions that are used by only a very small portion of your book? Is there opportunity to consolidate your smaller positions into more focused weightings that will then carry the AUM to justify the time spent on keeping them? Even better, the more concentrated inventory will allow for greater efficiency and scale in the portfolio management side of the business, thereby creating capacity for Centres of Influence relationships, prospecting, and deeper client relationships. Finally, consider the enterprise valuation benefits of consolidating your product inventory: a book with fewer solutions typically translates to a higher valuation.

The bottom line

Successfully managing the product inventory in your business is an important step toward building a sustainable practice. By conducting a product inventory audit, you're taking a crucial step to focus your time and resources while limiting your liability within our changing financial environment.

The Russell Investments Wealth and Super series gives you access and the ability to build a diversified investment portfolio using a range of Russell Investments' actively managed multi-asset, single sector and real return funds. Access multiple insurers, Term Deposits and cash, including bring your own cash account facilities. When you are accessing these funds, you're accessing a unique set of capabilities that we believe is essential to managing a total portfolio to meet your clients desired outcomes.

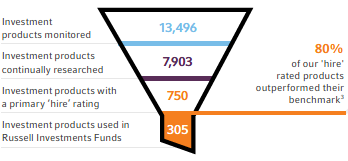

Manager research can help give you optimal combinations of managers inside your multi-asset portfolio. Because if you want access to the best active managers in any asset class, you need to research the universe. Russell Investments has been researching and hiring some of the world's leading third-party money managers for more than 45 years.

As at December 31, 2017 unless otherwise stated.

Important Information

Issued by Russell Investment Management Ltd ABN 53 068 338 974, AFS Licence 247185 (RIM). This document provides general information only and has not been prepared having regard to your objectives, financial situation or needs. Before making an investment decision, you need to consider whether this information is appropriate to your objectives, financial situation or needs. This information has been compiled from sources considered to be reliable, but is not guaranteed. This document is not intended to be a complete statement or summary.

Copyright © 2018 Russell Investments. All rights reserved. This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments.

About Russell Investments

Russell Investments is a global asset manager and one of only a few firms that offers actively managed multi-asset portfolios and services, which include advice, investments and implementation. Russell Investments stands with institutional investors, financial advisers and individuals working with their advisers—using our core capabilities that extend across capital market insights, manager research, asset allocation, portfolio implementation and factor exposures to help investors achieve their desired investment outcomes.