2019 Fixed Income Survey: Is a change in market dynamics afoot?

Throughout the year we ask leading bond and currency managers to consider valuations, expectations and outlooks for the coming months. Today, we ask: Is the Fed providing markets with false comfort?

Over 2018, it was clear that our fixed income manager survey respondents were anticipating ongoing market volatility. During that period, we continued to highlight the incongruous views of bearish interest rate managers versus credit managers, who have been more bullish. We also saw broad optimism for emerging markets foreign currencies overall, with particular favour for the Mexican peso.

In 2019 however, there has been a clear shift in sentiment and the results from our survey suggest that our respondents have a very different outlook for the next 12 months. As we will see, the abrupt change in direction by the U.S. Federal Reserve (the Fed) in January has had an effect on many of our managers' views versus last year.

Today, we put the spotlight on:

- Market status quo: December versus now

- The 'Fed put'

- The outlook for emerging markets

In January, we received answers from 60 investment managers from across the world. A closer look at the findings from all eight areas will be available soon (global interest rates, global investment grade and leveraged credit1, emerging markets local and hard currency debt, municipal bonds, securitized bonds and currencies).

The market status quo: December vs now

The U.S. Federal Reserve (the Fed)

Having witnessed a material market sell–off in December, the U.S. Federal Reserve (the Fed) met on January 30 and indicated that they intend to slow down the pace of rate hikes over 2019.

Market dynamics have shifted

This announcement changed the market completely—participants immediately stopped pricing in rate hikes and, as such, we saw a lift in U.S. equities within minutes following the announcement. As of February 15, 2019, equity markets globally are up 10%+ over December lows (according to the FTSE All–World Index), interest rate markets have repriced, credit markets have rallied substantially and overall, market sentiment has shifted positively.

Unsurprisingly, this shift in market dynamics has also had strong implications on the views of the managers and the outcome of the survey more broadly.

The 'Fed put': Genuine comfort, or mistake?

Against the backdrop of the strong rally we have experienced since the turn of the year, market sentiment has been buoyant, and participants are very much risk–on. As such, many are recalling Fed action from the 1990s and are hailing this market environment as a resurgence of the 'Fed put'—i.e. an expectation by the market that the Fed will pause rate hikes (or even lower rates) if we experience a downturn of any sort. And typically, we see elevated market confidence buoyed by the comfort of this expectation.

However, critics are concerned that

- Markets may be relying too heavily on the prospect of a Fed bail–out

- The Fed and markets may be discounting fundamentals such as wage inflation and unemployment or risks such as Trump's increased U.S. fiscal spending.

10–year Treasury demand and supply: Overall lack of concern

In line with markets, our survey respondents do not appear worried about these fundamentals, nor the demand required to meet the increased supply of 10–year Treasuries (issued to fund the U.S. government's spending). Our survey respondents are predicting the 10-year Treasury rate to be only 2.92% in 12 months. This is considerably muted relative to the amount of issuance that is expected from the U.S. Treasury.

Given that today's 10–year rate is at 2.66%, our survey respondents are clearly not concerned about Treasury demand or supply, or the threat of rates rising at an uncomfortable pace. And as such, it seems as though our interest–rate manager respondents do indeed feel genuine comfort from the Fed put, but are growing cautious on their outlook for global growth.

Market versus managers: Fed hikes—where to now?

Survey projections for the Fed funds rate however, are at odds with the market. As a result of the Fed's January announcement, the market is currently no longer pricing in any more rate hikes. While we have also seen a drop in the expected number of hikes from our survey respondents, the weighted average is still higher than the current market view.

Survey respondents have moved from anticipating an average of 3.5 hikes over the next 12 months down to now only 1.5 times. This does beg the question: If active fixed income managers are not fully responsible for the current market pricing of zero hikes, who is?

Source: Russell Investments Q1 2019 Fixed Income Survey

Momentum shift for credit managers?

Overall, the momentum for corporate credit, including high yield and investment grade, has deteriorated in contrast to credit managers' bullish outlook throughout 2018. While sentiment has shifted somewhat, 50% of credit managers still expect 5% or greater returns in U.S. high yield overall for 12 months—which suggests they are not overly concerned about spreads more broadly. Only 5% of survey respondents expect a negative return. If they were truly bearish, we would expect that return expectation to be much lower.

Interestingly, the momentum shift has moved from corporate credit to securitized credit2— with 33% planning to add risk here, which is the most since the survey has started. Emerging markets debt has also grown in favour, which is somewhat at odds with the declining outlook for corporate credit, given that these two risk assets are typically correlated. 51% of managers expect a total return of 6% or more over the next 12 months in emerging markets debt, up from 18% a year ago—and not one manager expects a return of less than 2%.

Managers are bullish on local currency emerging markets

Global currencies

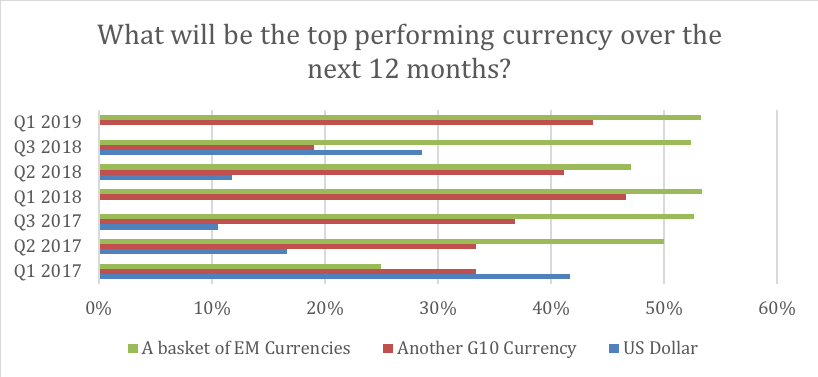

One of the biggest shifts that we have seen in this survey is the complete reversion of favour for the U.S. dollar. When we asked dedicated G10 foreign exchange managers to predict the best performing currency over the next 12 months, none of our survey respondents selected the U.S. dollar (for the first time since Q1 2018). Given that the outlook for the U.S. dollar is highly linked to Fed action, this shift in favour is likely due to the change in direction from the Fed.

44% of managers now predict it to be another G10 currency, while we continue to see the majority of managers (56%) expect a basket of emerging markets (EM) currencies to perform best.

Overall, the Japanese yen and sterling are the most favoured currencies in the G10.

Source: Russell Investments Q1 2019 Fixed Income Survey

Local currency emerging markets debt

Overall, managers are bullish towards local currency emerging markets debt. 73% of managers expect a 6% or better return over the next 12 months, versus 47% in the last survey and 64% previous to that. The only time they were more bullish was in February 2018... when they turned out to be incorrect.

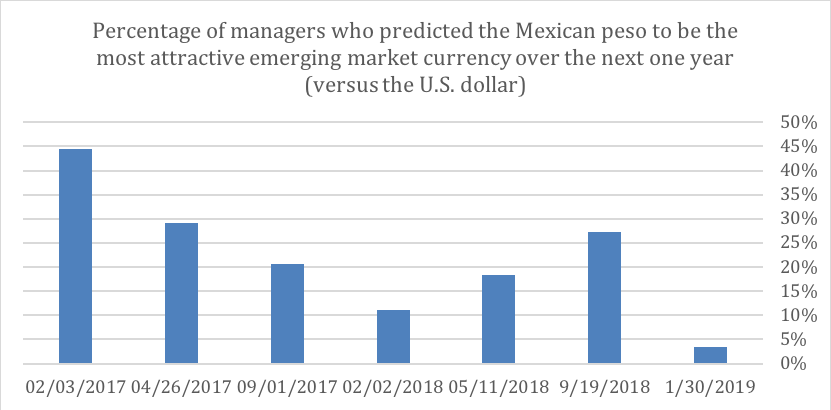

Peso is no longer the favourite

The Mexican peso spent the vast part of 2018 and 2017 as the most favoured local emerging markets debt currency against the U.S. dollar. In this latest survey however, only 3% of managers predicted it to be the most attractive over the next year—the lowest number since the peso was first highlighted as one to watch in March 2017.

Attention has shifted to the Brazilian real, with 28% of managers selecting it as the most attractive currency. This top spot was closely contended by the Argentinian peso, which, despite experiencing a significant drawdown in 2018, has 24% of managers selecting it as their favourite currency for 2019. This is a big shift from our end–of–year survey, which saw only 5% and 14% favour the Argentinian peso and the Brazilian real, respectively.

Source: Russell Investments Q1 2019 Fixed Income Survey

Navigating today's market environment will be critical for bond managers

The main takeaway from this survey has been the clear change in views on interest rates and the U.S. dollar, impacted by recent guidance from the Fed that they would be more accommodative in the face of slowing economic data. While a notable change, the government bond market has priced in a weaker economy than the survey would imply.

On the other hand, there has been only marginal deterioration in the credit outlook. Credit spreads3 have retraced much of their weak performance from the fourth quarter of 2018, and thus are more in alignment with survey views.

The dichotomy of opinion between credit and interest rate managers that we have highlighted for some time now, started to show signs of unwinding last year in the third quarter, with rate managers adjusting their views progressively higher to align better with the benign views of credit managers. This survey has once again shown that the opposing views of credit and interest rate managers is set to continue.

Three questions to ask yourself

- Are market participants now relying on monetary policy once again to support credit spreads?

- If so, how will credit markets react if recession becomes a reality, given policy makers have not made significant progress towards rate normalization?

- Or will rates shift gears and trend higher again?

Only time will tell, but navigating this market environment will certainly be critical for bond managers.

Watch out for our 2019 Fixed Income Survey report: Deep dive, coming soon.

1 Leveraged credit is debt from companies that have a credit rating below investment grade, and are typically secured with a lien on the company's assets. Investment grade credit has a high credit rating, indicating low risk of default.

2 A group of debt obligations or assets that are packaged together and sold as a tradable security.

3 The difference in yield between two bonds of similar maturity but different credit quality.